Summary:

- Broadcom’s Q3 earnings forecast shows a 15% year-over-year EPS increase and 46% year-over-year revenue growth, driven mainly by its infrastructure software segment.

- The software segment, bolstered by VMware, is expected to double sales to $5.5 billion, overshadowing modest growth in semiconductor and AI segments.

- Despite impressive growth, Broadcom’s valuation is high at 26 times earnings, raising concerns about the sustainability of its premium valuation.

JHVEPhoto

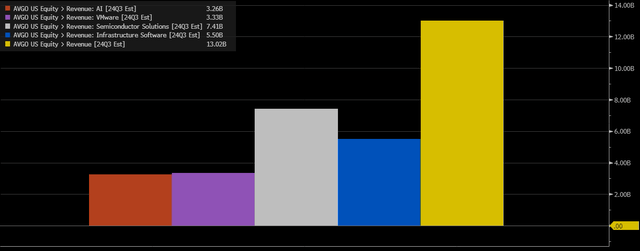

Broadcom (NASDAQ:AVGO) will report its fiscal third quarter earnings after the market closes on Sept. 5. Analysts are forecasting a 15% y/y increase in earnings per share to $1.22, alongside a significant 46% y/y growth in revenue, bringing the total to approximately $13 billion. However, it’s important to note that the growth in Broadcom’s Semiconductor Solutions segment is expected to be relatively modest, with an anticipated increase of just 7% y/y, reaching $7.4 billion. The company’s AI segment is projected to see only a slight uptick, growing by 5% q/q to $3.3 billion.

AI or Not AI

In contrast, Broadcom’s infrastructure software segment drives much of the company’s overall growth. This unit is expected to see its sales more than double, reaching $5.5 billion, with VMware contributing $3.3 billion. This shift highlights Broadcom’s growth, which is increasingly coming from its software side, mainly through acquiring VMware, rather than from its traditional semiconductor business. This dynamic may surprise those who view Broadcom primarily as an AI-driven company, which makes up a relatively small amount of total revenue.

Bloomberg

Despite the company’s impressive growth figures, Broadcom no longer provides quarterly guidance, having shifted to offering only annual forecasts. For the current year, the company is targeting $51 billion in revenue, a figure that was reiterated last quarter. Analysts expect it to slightly exceed that at $51.7 billion.

Bloomberg

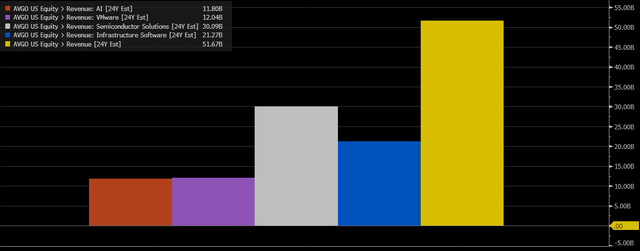

No Surprises

Broadcom has a history of reporting in line with revenue estimates, with last quarter marking its most significant beat in recent times at 3.5%. Regarding adjusted earnings, the company also tends to beat expectations by a small margin, typically around 1%. Market expectations for Broadcom’s stock movement post earnings are modest, with a projected move of around 6.7%.

Bloomberg

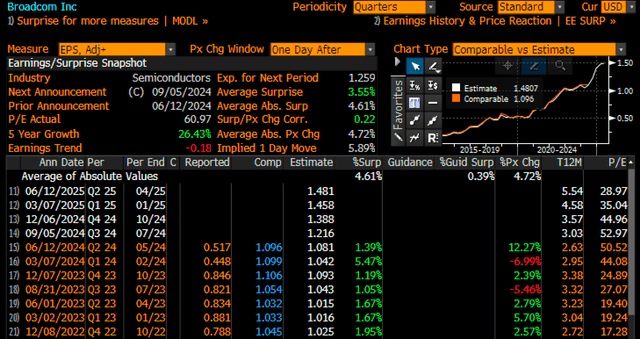

Options Betting on Further Upside

Looking at options positioning for the week of Sept. 6, implied volatility [IV] is relatively modest at 77%, though it should continue to rise heading into the earnings release as event risk builds. The options market is very bullish on Broadcom, as noted by the solid positive call gamma and delta values, particularly around the $160 strike price, with resistance at $170 and support near $150.

It’s important to note that once the event risk passes, the implied volatility will drop, and both the calls and the puts will see their premiums fall dramatically. As of Sept. 3, a buyer of the $160 calls needs the stock to rise above $166 following the results, or the options will lose value by 6.5%. This is similar to what happened with Nvidia, and if the stock cannot clear $160, option holders could sell their positions. That may be hard to do, considering the implied move being priced in by the market is just 6.75%, as already noted.

Bloomberg

Already At Support

From a technical perspective, Broadcom’s stock is currently trading around $155, a level that had previously served as support. The $170 area appears to be a key resistance point, while the $136 region has recently been a support zone.

TradingView

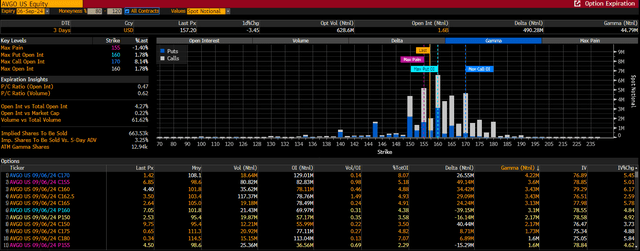

Not Cheap

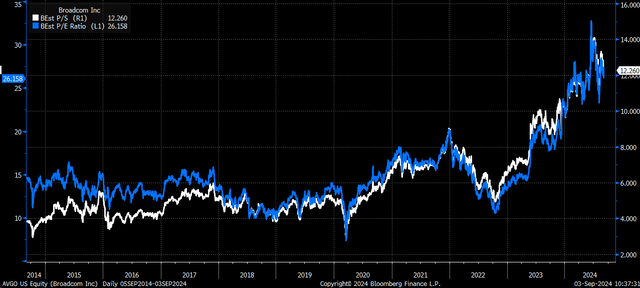

Valuation wise, Broadcom is trading at 26 times earnings, significantly higher than its historical average of around 13 to 14 times. On a price-to-sales basis, the stock is currently valued at 12 to 13 times sales, well above historical norms. This elevated valuation suggests that much of the optimism around Broadcom is tied to its AI prospects, despite the bulk of its growth coming from the VMware acquisition.

Bloomberg

While Broadcom’s AI business is expected to contribute significantly to its revenue in the coming years, its current valuation appears stretched, particularly when compared to its historical trends. Investors seem to be betting on further upside, but the steep valuation raises questions about whether Broadcom can continue to justify its premium valuation.

Additionally, the big risk here is that Broadcom does what it normally does when it reports results, delivering as expected. If that should happen, the overly bullish options market is likely to bring a lot of stock for sale, pushing shares lower, and making the call options a losing bet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Reading The Markets

Reading the Markets helps readers cut through all the noise, delivering daily video and written market commentaries to prepare you for upcoming events.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.