Summary:

- Broadcom’s Q1 2024 results exceeded expectations, with strong growth in the Infrastructure Software segments.

- The company’s free cash flow increased significantly. I expect that AVGO’s cyclical trough in terms of gross margin will soon be over, and we’ll see growth back to the peaks.

- According to my DCF model, Broadcom’s shares could be undervalued by as much as 25.5% – that’s a significant upside potential amid AI tailwinds.

- Despite the many existing risks, I’m pleased to have found an explanation for the somewhat high and frightening valuation of the AVGO stock. I’m upgrading AVGO to “Buy”

G0d4ather

Intro & Thesis

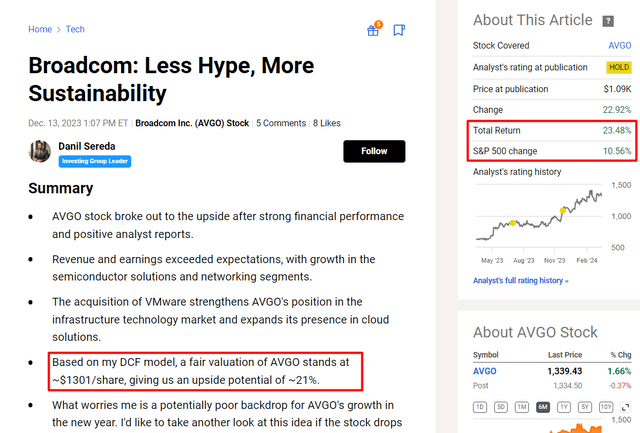

I initiated coverage of Broadcom Inc. (NASDAQ:AVGO) stock last July. Although I was relatively positive, I did not dare to assign a “Buy” rating at the time, fearing that there was no explicit margin of safety. In my last update, my DCF model showed AVGO’s fair valuation at ~$1301/share, giving us ~21% upside potential (as of December 13, 2023). And as time has shown, AVGO only needed 1 quarter to reach that target:

Today I decided to update the results of my earlier DCF model again and look at AVGO from a slightly different angle. As a result of my research today, I came to the conclusion that what had previously confused me may not exist – I mean that my earlier finding that AVGO is overvalued may be wrong. Perhaps we should not only look at the seemingly inflated valuation multiple, but also consider the reason for the existing premium and its sustainability in the future. I’ve therefore decided to upgrade Broadcom to “Buy”, but would still like to warn against the existing risk of a meaningful correction ahead.

Why Do I Think So?

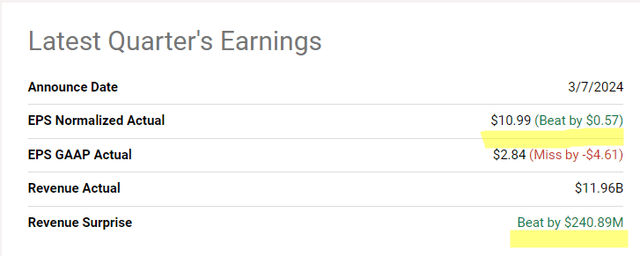

First of all, I would like to update my financial analysis of Broadcom because 4 months have passed since my last update and the company has managed to present a report for fiscal Q1 2024, easily topping the consensus expectations in terms of revenue and earnings per share:

Seeking Alpha, AVGO, the author’s notes

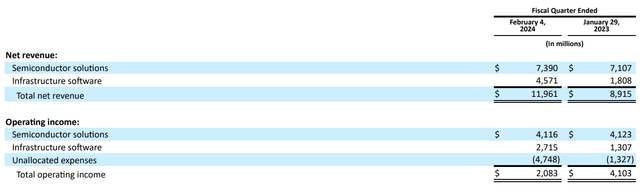

Based on description provided by Argus Research [proprietary source], AVGO is a top-5 global fabless semiconductor company with “leading franchises in wired and wireless communications, enterprise data center and storage, and other end markets.” According to the latest 10-Q filing, AVGO reports under 2 segments: Semiconductor Solutions and Infrastructure Software.

In Q1, the Semiconductor Solutions segment (~62% of consolidated sales) recorded a YoY growth of almost 4% – the AI-driven demand was offset by the current cyclical slowdown in the enterprise and telecom sectors, according to the management commentary. Within semiconductor solutions, however, networking sales stood out, up a remarkable 46% YoY to $3.3 billion. As I mentioned in my last article, Broadcom’s established leadership in Ethernet solutions for enterprise and cloud data centers is playing a critical role in the growth of this segment and to date, management continues to see strong demand for its networking products, particularly as hyperscalers deploy Ethernet networks for AI clusters.

Following the acquisition of VMware, Infrastructure Software emerged as a substantial revenue contributor, representing 38% of total consolidated revenue (as of Q1). The revenue figure in this segment soared to $4.57 billion – that’s +153% and +132% YoY and QoQ, respectively. The integration of VMware’s offerings into Broadcom’s portfolio has unlocked new revenue streams and positioned the company for further growth in cloud and hybrid cloud environments, according to the management. Looking at the level of growth in Q1 FY2024, I have no doubt that AVGO really has an additional, fast-growing revenue stream that will have an impact on margins in addition to growth (in the future, the transaction costs of calendar 2023 should go away and give a slight boost to EBIT).

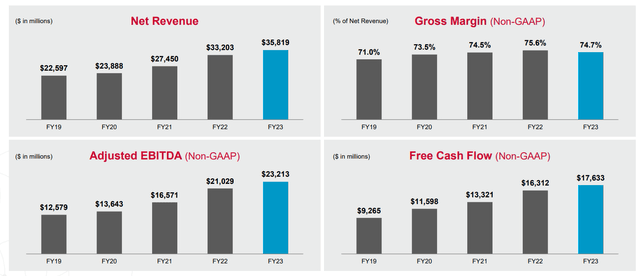

As a result of the segments’ strong performance, AVGO’s free cash flow soared to $4.7 billion in Q1. If we extrapolate this value to the end of the 2024 financial year, we get $18.8 (my own calculations), which is 6.6% more than what we saw for FY2023. The long-term trend in FCF growth looks impressive indeed: Broadcom manages to show growth in the form of cash generation even against the backdrop of a slight decline in gross margin.

AVGO’s IR materials, March 2024

They also continued their commitment to shareholders by paying out $2.4 billion in dividends and completing its share buyback program. Looking ahead, the company reaffirmed its guidance for the fiscal year, emphasizing its strategic decisions regarding divestitures and mergers within its business units to further optimize operations and drive growth. Over the past 5 years, AVGO’s total R&D amounted to ~$15 billion, so I believe Broadcom has accumulated enough skills to make the most of its current AI-centric realignment.

Therefore, I expect that AVGO’s cyclical trough in terms of gross margin will soon be over, and we’ll see growth back to the peaks. The same should apply to other margin key figures, such as the operating income or EBITDA.

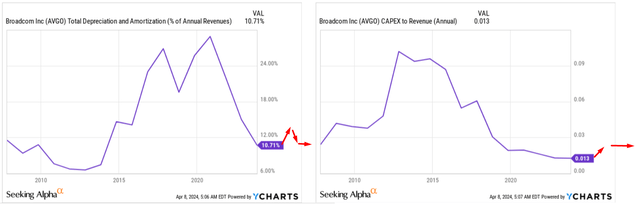

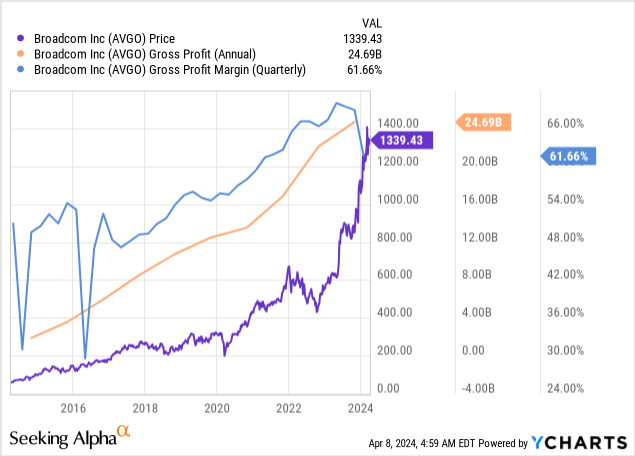

In the last 2 years, AVGO has never missed the market’s revenue expectations, but I will nevertheless assume that the current revenue consensus for the next 5 years is correct. I also assume that the ratio of D&A to sales and CAPEX to sales will normalize shortly.

These assumptions led me to the following conclusion: AVGO’s undiscounted FCFF will grow at a CAGR of 11.5%, which is quite realistic in my opinion.

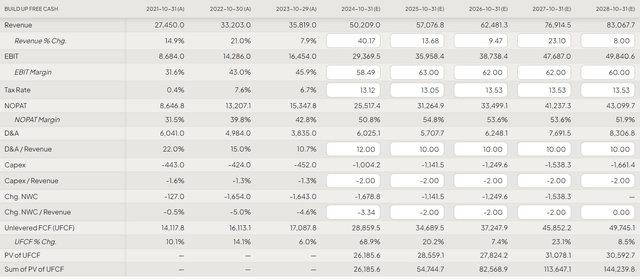

FinChat’s DCF model template, author’s inputs

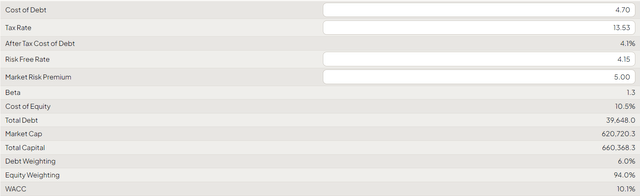

If we assume a cost of debt of 4.7% and a risk-free rate of 4.15%, with a market risk premium of 5% (the long-term rate commonly used in DCF models), we get a WACC of 10.1%, which is much higher than I previously thought. On the other hand, I’m assuming much more optimistic margins this time, so a higher WACC should theoretically bring my model closer to reality (it seems to me).

FinChat’s DCF model template, author’s inputs

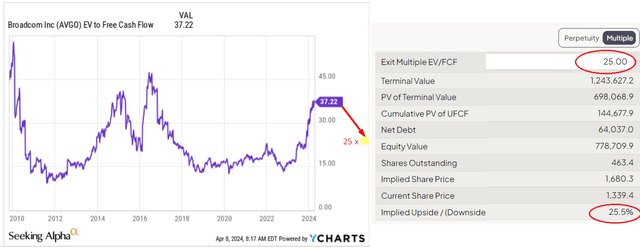

I will use EV/FCF as an exit multiple. Given the rate at which Broadcom’s FCF has grown in recent years -and given the long-term growth in my forecast – I think that the market will be willing to pay at least 25x EV/FCF for AVGO. That would be 49% lower than today’s TTM multiple. In this case, the AVGO stock currently appears to be 25.5% undervalued today.

YCharts, FinChat, the author’s notes

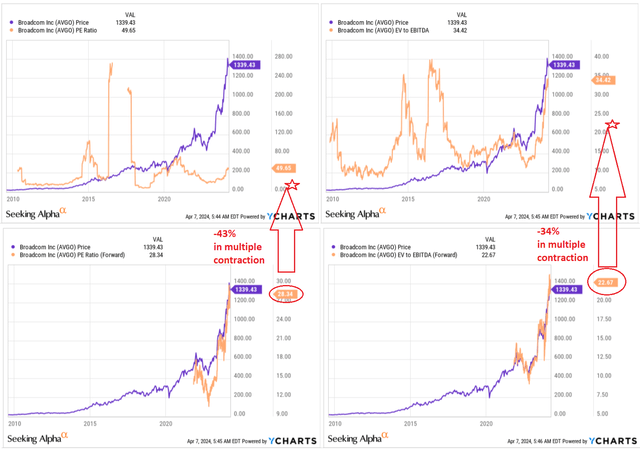

These results may contradict what the company’s current multiples suggest – as they are close to local highs, I don’t think they indicate undervaluation. What is notable, however, is that the FWD multiples show a sharp multiple contraction to at least the midpoint of the historical range. This means that if AVGO manages to maintain its existing valuation premium while delivering EBITDA and EPS growth roughly in line with what the market expects from it, then my conclusions about a 25.5% undervaluation have a good chance of coming true.

YCharts, Broadcom’s valuation multiples, the author’s notes

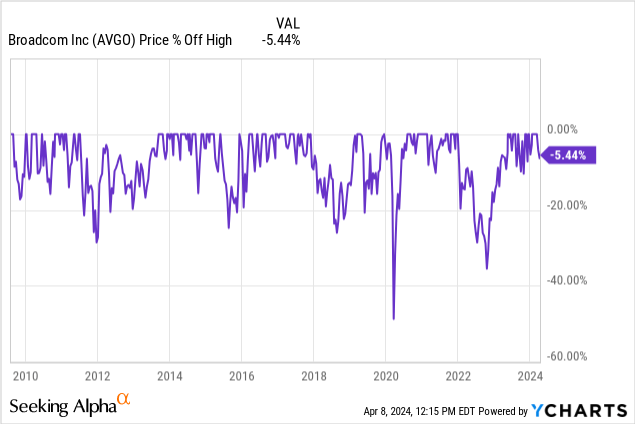

This means that what I feared initially – the lack of a margin of safety – may not exist at all. It all depends on which angle you look at the stock’s valuation from. After looking at AVGO’s valuation through the prism of the company’s future potential free cash flow, I began to better understand why the market is willing to pay so much. Given the DCF undervaluation of 25.5%, I feel compelled to upgrade AVGO stock to “Buy, even considering the current stock price, which is close to the all-time high:

Where Can I Be Wrong?

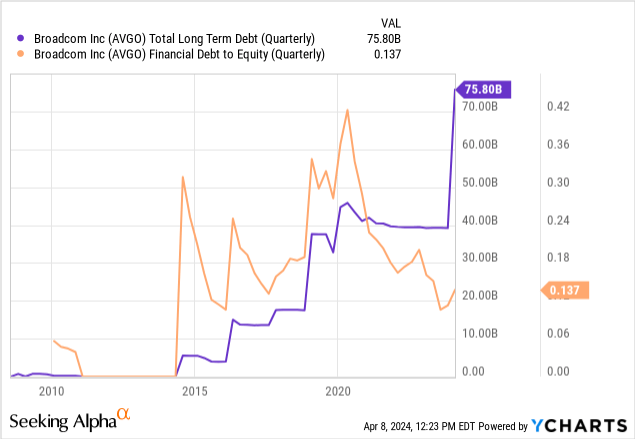

Investing in Broadcom stock, like anything else on the stock market, comes with risks. It’s essential for investors to consider the company’s recent acquisition spree, which has significantly increased the company’s debt load.

Currently, the debt on AVGO’s balance sheet surpasses cash, but this isn’t unusual for companies aiming for acquisition-driven growth. Sometimes, taking on low-cost debt is necessary to fuel expansion. The key is to manage this debt efficiently through operational growth, ensuring that interest payments are covered. From what I see today, AVGO’s debt is manageable, but if the company fails to sustain its growth momentum over an extended period, the burden of debt could negatively impact its financial performance and, subsequently, its stock price.

Another risk factor to consider is the fair valuation of Broadcom stock. There is a possibility that I’m leaning towards too optimistic scenarios regarding future margin growth, which is a key element of my DCF calculations. If the company’s gross profit doesn’t reach the level I expect over the next 5 years, the validity of my projections could be called into question. Although I apply a significant discount to free cash flows, I use a relatively high exit EV/FCF multiple [25x] to calculate the terminal value. If this assumption fails – say AVGO’s EV/FCF will be 20x instead of 20x in FY2028 – it could indicate that Broadcom’s current stock price is reasonably valued, suggesting limited growth potential based on fundamental value analysis.

FinChat’s DCF model template, author’s inputs [EV/FCF = 20x]![FinChat's DCF model template, author's inputs [EV/FCF = 20x]](https://static.seekingalpha.com/uploads/2024/4/8/49513514-17125989544643927.png)

The Bottom Line

Despite the many existing risks, I’m pleased to have found an explanation for the somewhat high and frightening valuation of the AVGO stock. In my opinion, Broadcom deserves its premium due to its strategic approach and the multitude of market opportunities arising from artificial intelligence. In addition, the generous shareholder return (dividends plus buybacks) attracts the attention of investors noticeably so that the premium looks sustainable. According to my DCF model, Broadcom’s shares could be undervalued by as much as 25.5% – that’s a significant upside potential. I don’t want to repeat my past mistake to rate AVGO a “Hold” after finding an undervaluation but fearing the risks – I am taking a different approach this time. Therefore, I’ve decided to upgrade Broadcom stock, giving it a well-deserved “Buy” rating.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!