Summary:

- Broadcom’s AI segment is expected to generate 25% of its revenue in 2024, benefiting from partnerships with OpenAI and diversification efforts.

- Despite risks from Apple’s in-house chip development, Broadcom’s VMware acquisition has reduced reliance on hardware, expanding its software footprint to 46% of revenue.

- Trading at a Forward P/E of 26.6x for FY25, Broadcom offers an attractive valuation compared to Nvidia and in line with AMD.

- Broadcom’s disciplined capital allocation, operational efficiency, and AI adoption are expected to drive organic growth and deliver attractive annual returns of around 12%.

Jonathan Kitchen

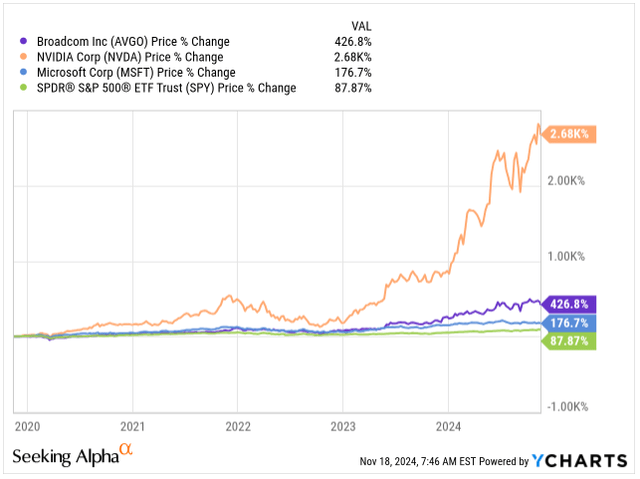

When I think of the AI investment theme, a few companies immediately come to mind: NVIDIA (NVDA), Microsoft (MSFT), and OpenAI.

However, the lesser-known custom chipmaker Broadcom Inc. (NASDAQ:AVGO) (NEOE:AVGO:CA) has also been one of the key beneficiaries ever since generative AI was first introduced to the general public via ChatGPT.

Previously, Broadcom was seen as the finest dividend compounder with its 13-year 37% compound dividend growth rate, but due to its stellar 427% price appreciation within a span of 5 years, the yield has fallen to 1.29%, and the company’s dividend yield is now relatively unattractive 1.29%.

The company has a very healthy balance sheet with a “BBB” rating from S&P Global, and the parabolic stock rise shouldn’t automatically scare you. Instead, the opposite, as with the acquisition of VMware, the company diversified its business model, reducing reliance on a few key customers, benefited from increased operational efficiency by cutting excess expenses and delivering excellent margins, and now benefits from the AI tailwinds in part of its business.

In my previous coverage, I praised Broadcom’s 50/50 exposure to software and hardware and its unique position in the market with its custom chips. These chips set Broadcom apart from Nvidia, Intel (INTC), and Advanced Micro Devices (AMD), which market one-size-fits-all solutions chips.

Since my last coverage of the company in July, several key developments have taken place, such as OpenAI announcing a partnership with Broadcom to develop an AI inferencing processor to reduce reliance on Nvidia and Apple announcing its aim to reduce its dependence on Broadcom’s Wi-Fi chips next year by introducing its own customer processor.

Having said that, let’s revisit my previous thesis and see whether Broadcom is still a good investment today.

Diversifying Beyond Apple

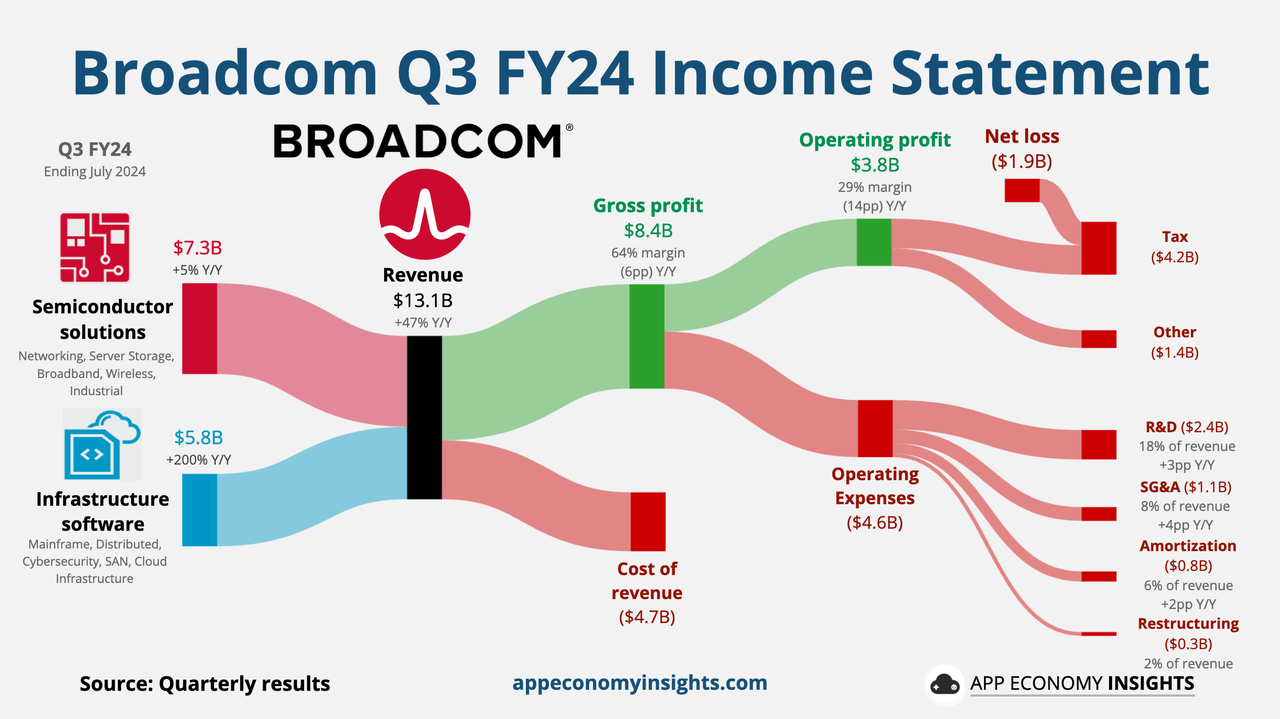

For better or worse, Broadcom’s custom semiconductor chips remain the cornerstone of its market-leading positions, bringing in $7.3B in sales out of the total $13.1B revenue during Q3 FY24, which represents 56% of the company’s total sales, underscoring the continuous dominance of this business unit.

Unlike Nvidia and AMD, which make “one-size-fits-all” chips for data centers, Broadcom specializes in so-called application-specific integrated circuits (ASICs) or custom chips to address specific application-tailored needs of its customers. This niche focus allows the company to differentiate itself from other chipmakers, and that’s why I own both Nvidia and Broadcom in my portfolio, even though I generally steer clear of duplicating my holdings in a similar field.

AVGO Q3 Earnings (App Economy Insights)

I started this section with “for better or worse” for a compounder like Broadcom because the business of custom-tailored chips very often leads to overdependence on a few customers. This was the case for Broadcom for most of its history, as in 2022 and 2023, thin-film bulk acoustic resonators, which the company sells exclusively to Apple (AAPL) for use in iPhones, made up as much as 20% of total revenue.

On the one hand, Broadcom’s success is closely intertwined with the success of the iPhone, but on the other hand, 20% sales dependency on a single customer is quite a risk. That’s why I steered clear of owning Broadcom for a long time until the company’s announced acquisition of VMware, which helped diversify the revenue stream.

The risk of customer-overdependency becomes evident right away when we look at the recent report from Internation Securities analyst Ming-Chi Kuo, who reported that Apple plans to move away from Broadcom’s Wi-Fi chips starting next year:

With new products in 2H25 (e.g., iPhone 17), Apple plans to use its own Wi-Fi chips, which will be made by TSMC’s N7 process and support the latest Wi-Fi 7 spec. Apple expects to move nearly all products to in-house Wi-Fi chips within about three years. This move will reduce costs and enhance Apple’s ecosystem integration advantages.”

While Broadcom does not disclose the total sales impact this will have on the business, Apple’s move poses a risk to a certain degree to Broadcom’s future revenue from Apple, notably as Apple previously announced the replacement of Broadcom’s 5G Chips. Apple is expected to keep sourcing thin-film bulk acoustic resonators and 5G radio frequency components, but in the future, I expect to move all chip production in-house eventually.

Broadcom has been preparing for this for years, diversifying its customer base and expanding its strategic partnerships with major industry players such as Arista Networks (ANET) and Cisco Systems (CSCO). Likewise, now that Broadcom is expected to benefit from the growing demand for AI chips, the non-AI segment will present a lesser part of the business.

Recently, OpenAI has partnered with Broadcom and Taiwan Semiconductor Manufacturing Company (TSM) to develop a custom inference chip. Inference is widely expected to play a crucial role, potentially exceeding demand for training chips (Nvidia’s Hopper and Blackwell Architecture) as AI applications widen. I view this development as high-value accretive for Broadcom, as AI companies are trying to diversify beyond Nvidia and AMD.

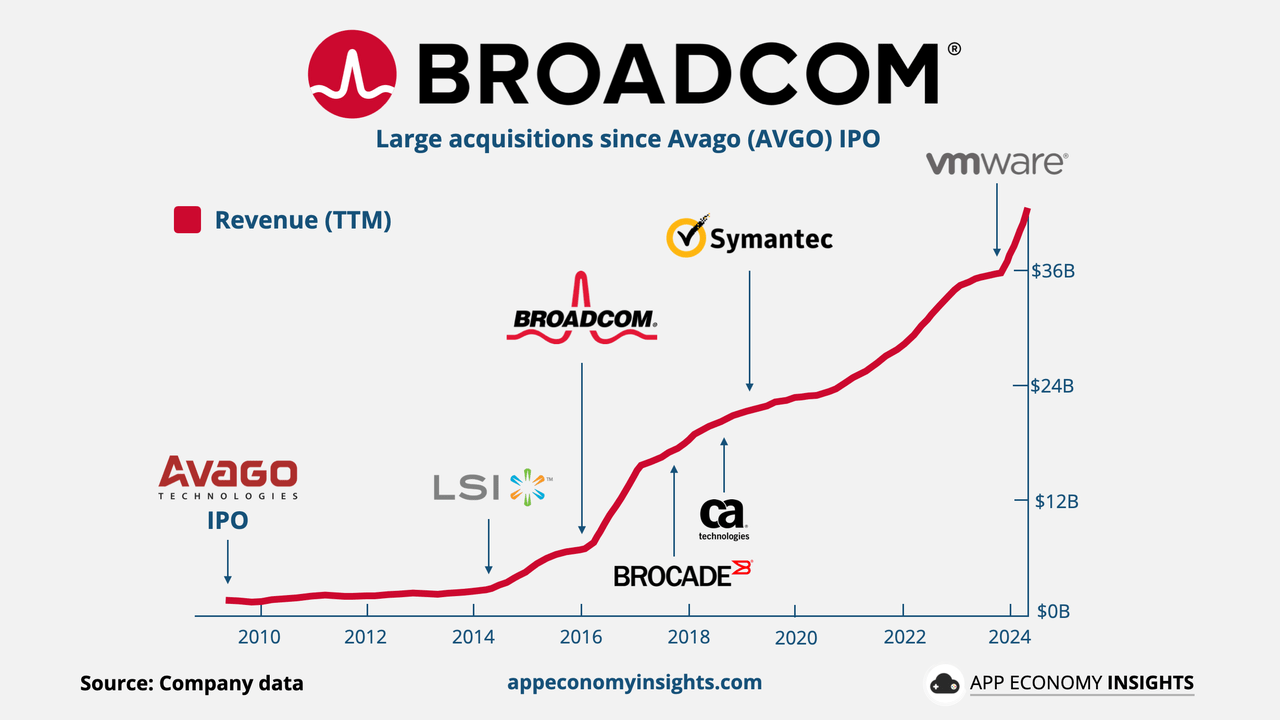

While Broadcom’s historical organic growth has been strong, the company is predominantly growing via acquisitions, excelling in capital allocation and trimming excess expenses, which in turn drive excellent operating margins.

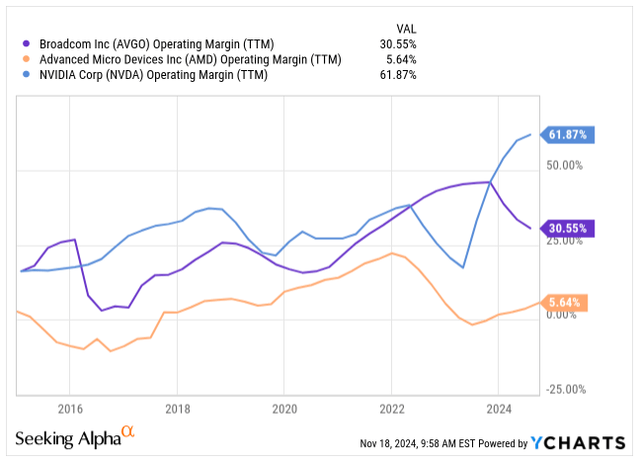

Operating Margin (Seeking Alpha)

Acquisitions were a key strategy for Broadcom to reduce its reliance on semiconductor business and customer-specific dependency, pushing into software. By acquiring VMware in 2023 for $61B, Broadcom de-risked its portfolio, and now, following successful integration, software makes up 46% of the total sales.

In the near term, as AI chips drive growth, the software may hover around 40-45% of total sales, but on the bright side, as Broadcom finds synergies, the company is guiding for 64% non-GAAP EBITDA margin in VMware, similar to previous acquisitions.

AVGO M&A (App Economy Insights)

Now, let me turn to the latest Q3 2024 earnings report, to look closer underneath the hood of the business.

For Q3, Broadcom reported strong earnings, with revenue topping $13.1B, marking a 47% increase compared to the year prior. This growth, however, includes the contribution from VMware. Without the acquisition, the organic growth of the business was mild, 4% year over year, due to continuous weakness in the broadband and industrial chips (non-AI segment), greatly offset by strong organic growth in the AI chips segment.

The legacy chip business is expected to start growing again in the current quarter, as guided by the management, and eventually meaningfully rebound in 2025.

However, the most important thing is that Broadcom’s AI chip segment continues to grow at a fast pace as the adoption of its accelerators and networking chips continues, with the AI revenue expected to reach $12B in 2024, representing around 25% of the company’s revenue.

If the growth continues at a similar pace of around 25-35% the following year, the AI chip sale contribution could reach around 30-32% of the company’s total sales.

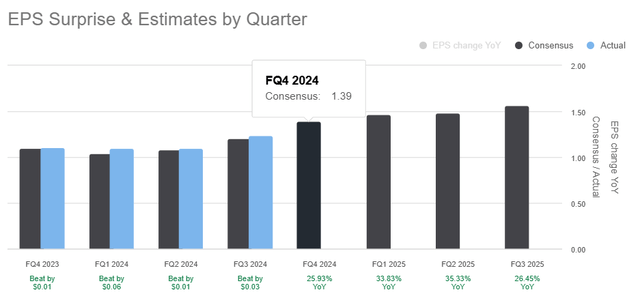

Nonetheless, the company’s guidance of $14B for Q4 has fallen short of analysts’ expectations of $14.13B, which pushed the stock lower following the report, but I still view their guidance rather on the cautious side and likely to overdeliver, similar to the development of the past four quarters.

EPS Projection (Seeking Alpha)

Valuation

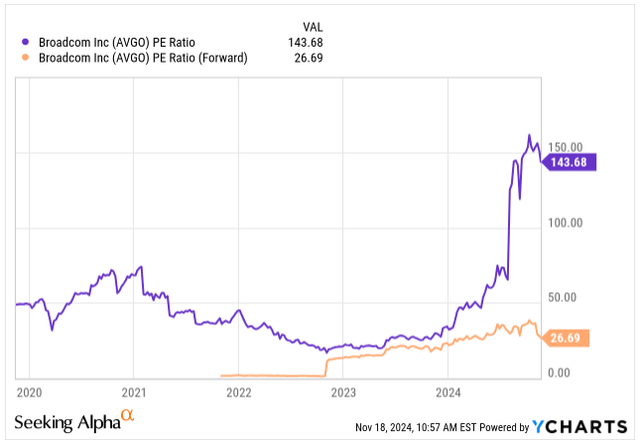

Following close to 50% stock appreciation on a year-to-date basis, we can assume Broadcom’s stock won’t be trading at a cheap valuation.

Similar to other companies that enjoy momentum and popularity, conventional valuation metrics such as trailing twelve-month P/E offer us limited insights. As we can see below, Broadcom is valued at 144x its earnings, yet that does not provide us with the complete picture.

On a 12M forward basis, given the company’s expected meaningful bottom-line expansion, we see the company trades at a forward valuation of 26.7x its earnings, which is a significantly lesser premium.

PE & Forward PE (Seeking Alpha)

As per FactSet, analysts are projecting the following EPS growth:

- FY25: $6.18E (28% YoY growth)

- FY26: $7.23E (17% YoY growth)

- FY27: $8.23E (14% YoY growth)

This gives us a good understanding of the compounding expected to take place over the next three years and the optimistic outlook of analysts. At the midpoint, this represents a growth of 20% annually.

Over the past 15 years, Broadcom has delivered EPS growth of around 25% annually, but again, most of it has been fueled via inorganic growth. In contrast, the company is now expected to grow organically.

If we look instead at the forward valuation, we get more promising picture:

- FY25 Forward P/E: 26.6x

- FY26 Forward P/E: 22.7x

- FY27 Forward P/E: 20.0x

For instance, if we take the forward 12M valuation and compare it to other AI plays, such as Nvidia and AMD (adjusted for the FY difference), we can see that Broadcom is priced at a similar price point as AMD, but Nvidia is far ahead:

- Nvidia: Forward P/E FY26: 34.5x

- AMD: Forward P/E FY25: 26.5x

In my opinion, a 12M forward valuation of 26.6x its earnings is still relatively attractive, given the AI theme has a long runway to play out as CAPEX among the mega-cap firms is booming, trying to stay at the forefront of innovation.

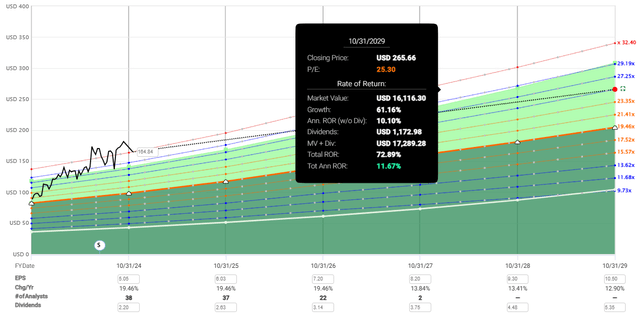

Moving forward, I expect Broadcom’s valuation to remain around 25x its earnings, and if the growth materializes as expected over the following three years, followed by another 12-14% annual growth (excl. M&A) for the remainder of the decade, investors could earn relatively attractive annual returns of around 12%, with Broadcom’s more defensive portfolio, balanced by both hardware and software.

Potential Returns (FAST Graphs)

Investor’s Takeaway

In summary, Broadcom offers a compelling investment opportunity to gain some exposure to the AI theme, as in 2024, 25% of its revenue is expected to be generated by its AI segment.

One risk element that still remains with Broadcom is its legacy dependency on key customers like Apple, which in my opinion, still pose risk, particularly as Apple is switching to in-house chip development, but Broadcom has effectively diversified away with the acquisition of VMware, also reducing the reliance on hardware and expanding its software footprint to 46% of its revenue.

The company is currently trading at a Forward P/E valuation of 26.6x for its expected FY25 earnings, which is cheaper than Nvidia and in line with AMD.

I expect Broadcom to continue to allocate capital in a disciplined manner, drive operational efficiency, mainly through synergies via VMware, and benefit from the accelerating adoption of AI that will drive organic growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, MSFT, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.