Summary:

- I’ve been too cautious on Broadcom recently. I’ve failed to recognize the AI growth drivers in its bullish thesis.

- AVGO’s growth prospects in AI networking and custom AI chips could spur a multi-year revenue opportunity.

- Broadcom’s solid profitability and robust momentum justify the market’s confidence.

- Non-AI revenue cyclicality could be less significant as the AI revenue increases further.

- I argue why I was so wrong about my caution in AVGO and would rather be late than totally miss the ride. Read on.

JHVEPhoto

I Was Too Cautious On Broadcom’s Thesis

Broadcom Inc. (NASDAQ:AVGO) (NEOE:AVGO:CA) investors will likely point to my previous AVGO ratings as too cautious, even though I’ve never been bearish on the stock. While I’ve had two bullish ratings in 2022, the recent ones are mostly Hold ratings. Given the stock’s outperformance against the S&P 500 (SPX) (SPY) and its semiconductor peers (SMH) (SOXX), I believe it’s suffice to say that I’ve been wrong on Broadcom’s thesis.

In my last AVGO article in May 2024, I urged investors to be cautious about chasing its optimism, as I highlighted that Broadcom isn’t a “pure-play AI” company. However, buyers have continued to prove me wrong, as the stock outperformed the market significantly. Therefore, I decided to review my thesis and reassess whether a Hold rating is still apt, given the sustainability of the semiconductor leader’s AI thesis.

Broadcom is a semiconductor bellwether with exposure across several industries and growth vectors. AVGO is highly profitable, with margins well above its tech sector (XLK) median. Coupled with its leading position in AI networking and custom AI chips, I have reviewed my caution on AVGO and realized it doesn’t seem justified.

Broadcom’s FQ2 earnings release in June corroborated the market’s confidence. Management raised its full-year guidance, although VMware is still expected to dilute corporate adjusted EBITDA margins. Despite that, the company expects to optimize the acquisition while lifting its quarterly revenue run rate to $4B. The company has implemented substantial changes to VMware’s product SKUs, go-to-market motion, and “transitioning all VMware products to a subscription licensing model.”

Broadcom delivered a 12% YoY organic revenue growth in FQ2, excluding VMware’s contribution. AI-related revenue was the highlight of the quarter, rising 280% YoY to $3.1B. It also represented a sequential increase of 35% QoQ, underscoring the significant growth opportunities from the AI gold rush.

As a result, I’ve understated Broadcom’s ability to partake in AI growth drivers, as I was too concerned with the non-AI semiconductor momentum. Broadcom’s exposure across the enterprise, networking, storage, data center/hyperscaler, industrial, and consumer space provides substantial revenue diversification.

However, the company’s diversification could also impact its ability to benefit markedly from AI-growth inflection if the other segments are not expected to perform as well. Broadcom’s guidance suggests that non-AI businesses are still facing headwinds. Notwithstanding the caution, management also anticipates non-AI semiconductor revenue to “have bottomed out in Q2 and is likely to recover modestly in the second half of fiscal 2024.”

Therefore, the cyclicality in the semiconductor business might hamper the secular growth momentum in AI-related opportunities. Furthermore, BofA’s (BAC) Vivek Arya cautioned that visibility “outside of AI is less clear.” As a result, one of the assessed drawbacks of Broadcom’s revenue diversification is exposure to a higher revenue cyclicality level across its business segments.

Broadcom’s AI Revenue Expected To Grow Further

Notwithstanding my caution, Wall Street is optimistic about Broadcom’s “cumulative $150B AI revenue opportunity” over the next five years. As a result, AI is estimated to become increasingly critical, even though AI-related revenue guidance for FY2024 is anticipated to be only above $11B. Significant opportunities relating to AI networking are linked to the scalability of its Ethernet solutions in backend AI clusters.

Management emphasized the scale and dominance of its leadership, as its “Ethernet solutions are used in seven of the largest eight AI clusters currently in deployment.” I also addressed the growing opportunities in AI networking for Arista Networks (ANET). The company estimates “AI-related revenue rising to $750M by 2025.” Broadcom is a critical partner for the ANET in the networking space. Moreover, AVGO is also working closely with other key AI players such as Dell (DELL), Juniper (JNPR), and Super Micro (SMCI), broadening its networking opportunities.

Of particular interest to me is Broadcom’s leadership in custom AI accelerators. The company has worked closely with Google (GOOGL) (GOOG) and Meta Platforms (META) in the custom ASIC AI chips. ByteDance’s collaboration with AVGO is assessed to be a critical upgrade to the Chinese leader’s AI capabilities.

Given the intensified AI chips restrictions by the US government on China, Broadcom’s ability to design high-performance and compliant customized AI chips could be increasingly important. OpenAI reportedly partners with Broadcom to develop custom AI accelerators, corroborating the semiconductor leader’s expertise and capabilities. Big tech and leading AI companies are expected to leverage their scale into custom AI chips to stretch their leadership further.

It also allows them to diversify from relying on merchant AI chips from Nvidia, potentially lowering execution risks from inadequate chip supply and exposure to a dominant chip designer. Therefore, these opportunities are expected to benefit AVGO, helping to raise the contribution of AI-related revenue over time and reducing the anticipated semiconductor cyclicality through the business cycle.

Is AVGO Stock A Buy, Sell, Or Hold?

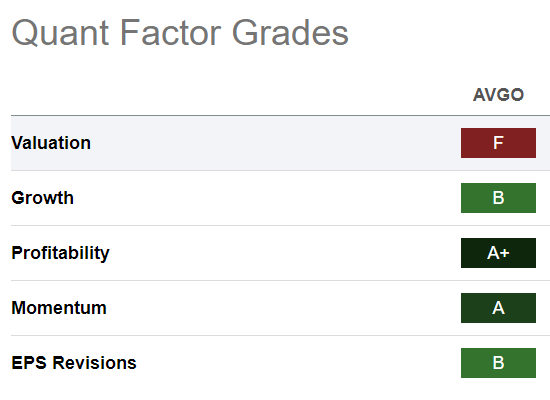

AVGO Quant Grades (Seeking Alpha)

AVGO isn’t assessed to be cheap (“F” valuation grade). However, with the increasing importance of AI-related revenue, I encourage investors to consider its growth-adjusted valuation to assess buying opportunities.

Moreover, the stock’s “A” momentum grade underpins the market’s conviction in its secular growth drivers, bolstering dip-buying opportunities. AVGO’s adjusted PEG ratio of 1.96 is aligned with the tech sector median. Therefore, the stock’s valuation doesn’t seem excessive when adjusted for its growth potential. Upgraded Wall Street estimates on Broadcom corroborate my optimism, underscoring the robustness of its prospects and solid execution (“B” earnings revisions grade).

As a result, I urge investors to consider capitalizing on the recent rotation out of tech stocks to consider buying the dips on AVGO. While I have not assessed an optimal entry point, the stock’s solid long-term uptrend bias has remained intact. Therefore, further near-term downside volatility could present potentially more aggressive dip-buying setups, helping to improve the entry levels.

With that in mind, I acknowledge that my previous Hold ratings on AVGO are no longer appropriate, as AVGO is still in the earlier stages of benefiting from the AI gold rush.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, SMH, SMCI, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!