Summary:

- Broadcom is poised for a strong Q4 earnings report driven by AI tailwinds, with expected revenue and free cash flow surges, and higher gross margins.

- Favorable EPS estimate revisions and strong AI product demand justify a speculative buy, despite high valuation.

- Broadcom’s AI-optimized products, like Jericho3-AI, capitalize on the growing AI market, expected to double to $632B by FY 2028.

- Despite high valuation, Broadcom’s consistent growth in revenue, free cash flow, and dividends make it a compelling investment ahead of Q4 earnings.

JHVEPhoto

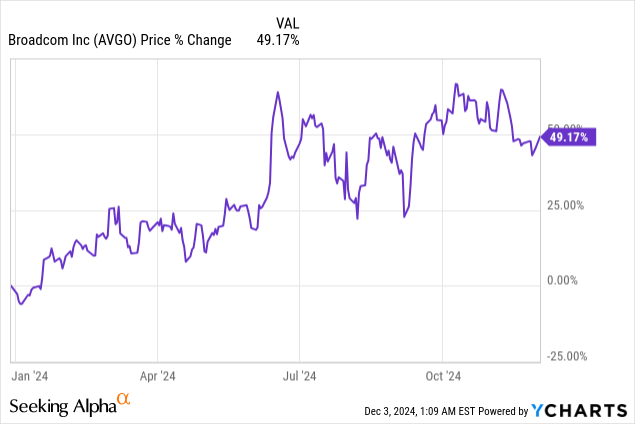

Broadcom (NASDAQ:AVGO) is expected to release its fourth fiscal quarter earnings scorecard on December 12, 2024 and with current momentum in the IT business, which is driven by considerable AI tailwinds, I believe the hardware company is set for a very strong earnings report. Broadcom is mostly likely set for a revenue and free cash flow surge, and could report higher gross margins as well. Further, the EPS estimate revision trend is favorable and justifies long exposure ahead of the earnings release. Shares of Broadcom are not cheap, given that the market has had plenty of time to price in bullish AI tailwinds, but the company is critical to the AI revolution, which justifies a higher valuation multiplier.

Previous rating

I rated shares of Broadcom a buy in my last work on the AI hardware company — A Golden Buying Opportunity — due to favorable trends in the market for artificial intelligence adoption and a general expansion of the generative AI market opportunity. Broadcom executed its growth strategy well in the fourth fiscal quarter and generated consisted growth in its key financial metrics, especially revenue and free cash flow. I see a speculative buying opportunity for Broadcom given the most recent consolidation and expect the company to return more cash to shareholders in the future.

Broadcom is chiefly a capital return play

Broadcom benefits greatly from growing adoption of the AI theme with companies, especially Data Centers, spending a ton of money on the latest AI-optimized products. Broadcom benefits from this trend specifically as the company has launched a unique suite of AI-optimized hardware products that are now in high demand, such as Jericho3-AI, which provides the fabric for artificial intelligence networks. Jericho3-AI helps companies handle more demanding AI workloads and in the context of a ramp in AI-related spending, Broadcom has considerable revenue growth potential.

According to the IDC’s report ‘Worldwide AI and Generative AI Spending Guide’, global spending on AI, which includes AI-enabled applications and infrastructure investments, is expected to double to $632B by the end of FY 2028, showing an estimated compound annual growth rate of 29%.

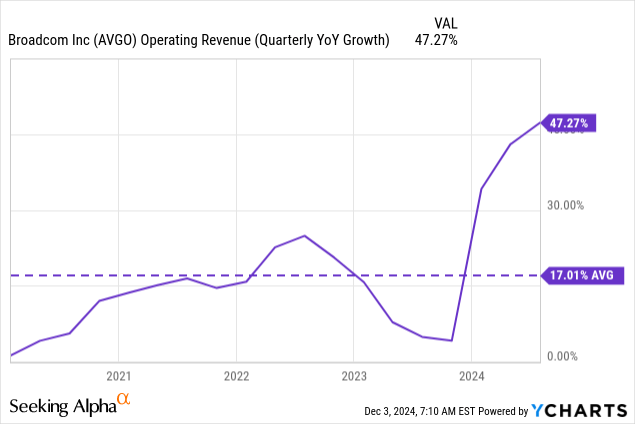

Because of this strong market-driven growth, Broadcom is likely to remain a serious contender for accelerating top line, free cash flow and gross profit growth. Broadcom’s top line growth has accelerated way above the 5-year average, and the company will likely have seen strong revenues in the fourth fiscal quarter as well.

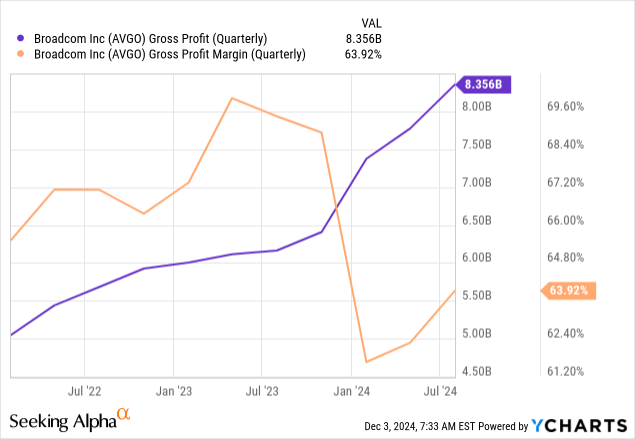

Broadcom, due to strong demand for its AI products, is set to report a sequential gross margin expansion as well, which, I believe, could be a catalyst for an upside share price revaluation. In the most recent quarter, Broadcom’s gross margin improved due to the sale of higher-margin AI products, which is a trend that I expect to continue in the fourth fiscal quarter. With a positive trend reversal happening in the last quarter, I project that we could see a gross margin in the neighborhood of 65-66%.

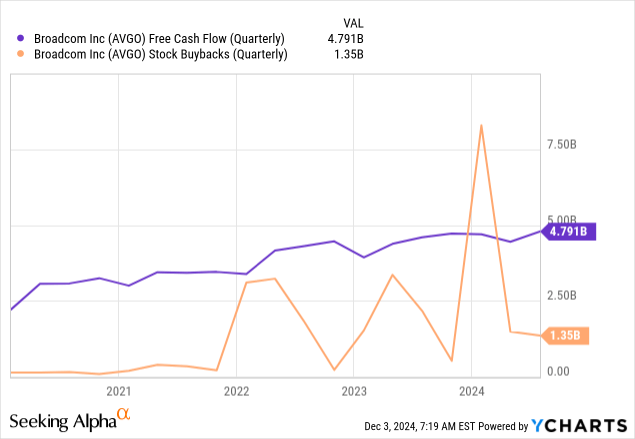

Free cash flow is a measure I am specifically interested in for Broadcom because it gives the company the firepower to grow its distribution while also retaining cash for new investments or even stock buybacks. In the third fiscal quarter, Broadcom generated $4.8B in free cash flow, representing a free cash flow margin of 37%. For the fourth quarter, I project at least $4.0B in free cash flow, a significant portion of which I expect will be returned to investors through stock buybacks. In the July quarter, Broadcom returned $1.35B of its free cash to shareholders through buybacks, with more likely to follow.

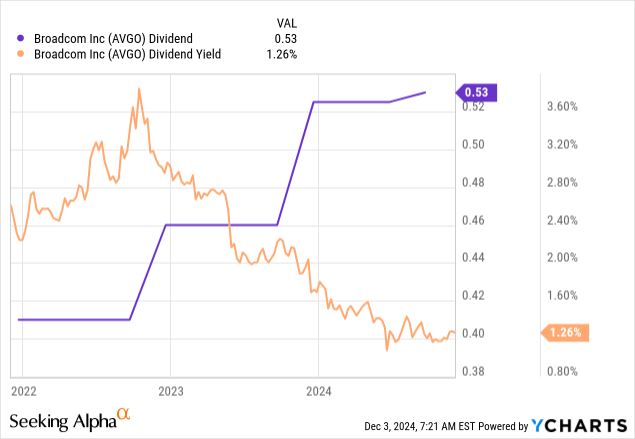

The main reason to invest in Broadcom is that the company is growing its dividend, which makes the hardware company chiefly a capital return play for investors. The dividend yield currently sits at 1.3%, but since Broadcom has consistently increased its dividend in the last several years, investors can look forward to get many more dividend raises.

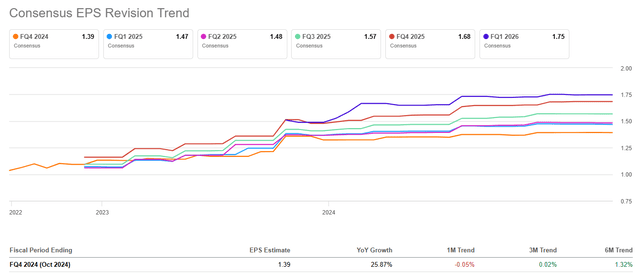

Favorable EPS estimate revision trend

Ahead of the fourth quarter earnings release, a look at the EPS estimate revision trend shows that analysts expect a strong earnings scorecard. In the last 90 days, analysts have submitted 19 EPS estimate upside revisions, compared to just 8 downside revisions. The upside-to-down estimate revision ratio is therefore 2.4:1.0, meaning the EPS trend is widely in favor of Broadcom reporting better than expected earnings next year. Analysts currently expect the IT hardware company to report $1.39 per-share in earnings for the fourth fiscal quarter, which implies a year-over-year EPS growth rate of 26%.

Broadcom’s valuation

Broadcom’s shares are highly priced and have been so for quite a while. The reasons behind Broadcom’s surge can be found in consistent execution and a growing dividend. The growth in the distribution is what has made Broadcom a dividend powerhouse, and I am looking forward to higher capital returns in the future.

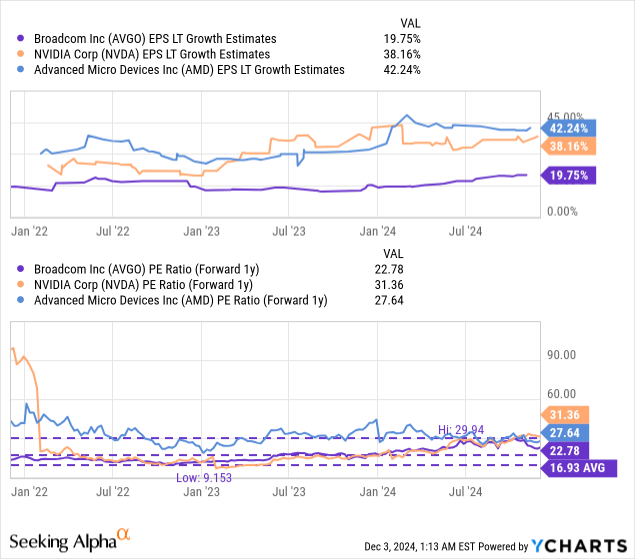

Broadcom is currently valued at a price-to-earnings ratio of 22.8X, which is about 35% above its longer term, 3-year average P/E ratio. However, rivals in the AI market, like Nvidia (NVDA) or AMD (AMD) trade at considerably higher earnings multipliers. Nvidia is valued at a price-to-earnings ratio of 31.4X, by far the highest in the AI industry group, while AMD is trading at a P/E ratio of 27.6X. The industry group average price-to-earnings ratio is 27.0X.

In the longer term, I believe Broadcom could trade at a forward P/E ratio of 25X, if not at the industry group average of 27X, given its strong growth across key metrics, improving free cash flow and higher capital returns. A fair value P/E ratio of 25X implies at least 10% upside revaluation potential and a fair value of $184 per-share. If Broadcom is valued at a price-to-earnings ratio of 27X, the industry group average P/E, then the hardware company could be valued as high as $198 per-share.

Risks with Broadcom

The biggest risk with Broadcom, as I see it, relates to the industry’s willingness to spend lavishly on AI technology. As a mission-critical hardware company, Broadcom provides the equipment that companies in the Data Center market need in order to participate in the growth of the AI economy. What would change my mind about Broadcom is if the company were to see a decline in its free cash flows, or if the enterprise were to see falling gross profit margins.

Final thoughts

Broadcom has delivered excellent financial results throughout 2024 as the AI revolution kicked into gear and led to a considerable acceleration in the company’s growth. Revenues, gross profits and especially free cash flow advanced significantly, indicating that the company’s fourth quarter also is set for strong results. I expect Broadcom to deliver ~$4.0B in free cash flow in the fourth quarter and given the favorable EPS trend in the last ninety days, I believe the odds are also in favor of Broadcom delivering a decent earnings beat. Shares are not a bargain, and trade at a forward price-to-earnings ratio of 22.8X, but AI market expansion and a strong product portfolio translate into considerable revaluation potential. I like the drop ahead of the Q4’24 earnings report, and I am upgrading shares of Broadcom to strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.