Summary:

- Broadcom Inc.’s acquisition of VMware enhances its AI software capabilities, crucial for capitalizing on the projected $13 trillion AI software demand by 2030.

- Broadcom’s robust position in high-performance computing hardware and data center components aligns it to benefit from aggressive data center investments by tech giants.

- Institutional investors are increasingly bullish on AVGO, with significant share accumulation and positive EPS revisions indicating strong future performance.

G0d4ather

Introduction

I shared a “Strong buy” call for Broadcom Inc. (NASDAQ:AVGO) (NEOE:AVGO:CA) in July. The stock was flat over the last three months, which is slightly worse than the S&P 500 (SP500). Despite flat performance, my fundamental analysis update suggests that there are no reasons to worry about the company’s long-term prospects. AVGO remains uniquely positioned to benefit from strong AI tailwinds, as the company boasts a strong mix of offerings, which makes it a crucial player in the AI revolution. Institutional investors are set to continue expanding their ownership stakes in AVGO, and the valuation remains very attractive. I think that all these positive factors are strong enough to let me reiterate a “Strong buy” rating for AVGO.

Fundamental analysis

Brett Winton, Chief Futurist at ARK Invest, recently shared his insights about the potential of AI software. According to him, the total AI software demand can hit $13 trillion by the end of this decade. This is a massive tailwind for Broadcom, as the company is gaining traction in AI software after acquiring VMware. Let me remind you that VMware has a partnership with NVIDIA (NVDA) to deliver generative AI for enterprises.

Overall, there is a great potential in delivering AI capabilities to enterprises, as IDC projects edge computing investments will reach $232 billion in 2024. I think Broadcom is further optimizing the real-time data processing of Edge AI workloads through enabling innovative connectivity devices such as VMware VeloCloud Edge appliances that provide Fixed Wireless Access and satellite connections. My opinion is that this strategic integration of VeloCloud SD-WAN with Symantec’s network points further accelerates cloud connectivity for better bandwidth, availability, and security for organizations.

These changes, in addition to VMware Edge Compute Stack enhancements like zero-touch orchestration and pull architecture, help to simplify the deployment and administration of Edge AI applications in multiple locations. This will highly likely allow Broadcom to leverage the growing appetite for edge solutions – particularly AI-centric ones – with a secure, scalable, and robust platform.

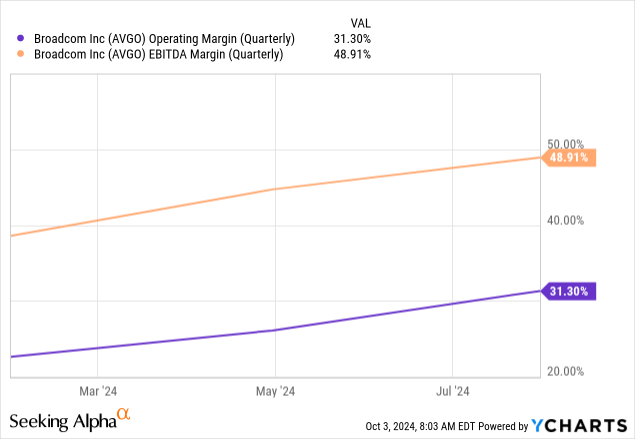

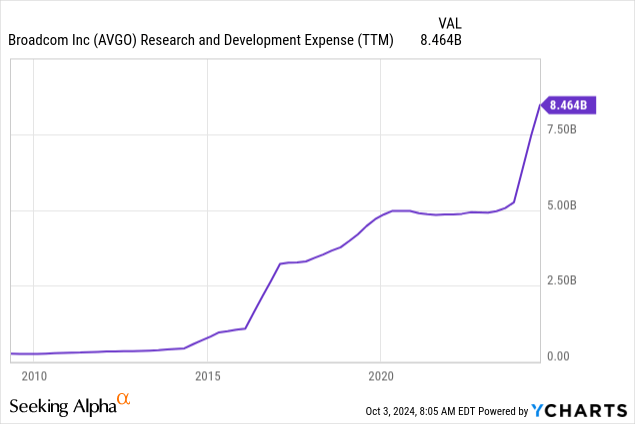

I think that synergies from the acquisition of VMware are already apparent if we look at how the operating margin and the EBITDA margin grew so far this year. Broadcom started consolidating VMware’s financials starting from Q1 2024, and profitability improvements are apparent. During several earnings calls since VMware was acquired, the management mentioned its commitment to innovate VMware’s offerings, and the robust R&D spending is a clear indication that we can expect more synergies from the acquisition.

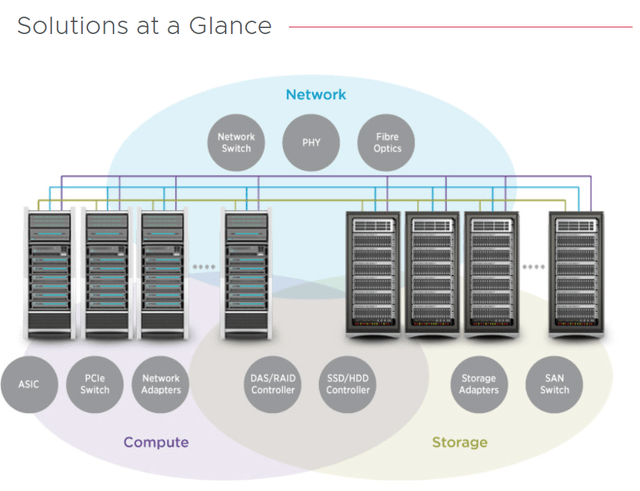

In addition to having strong potential to capitalize on favorable trends in AI software, Broadcom is also a prominent player in hardware for high-performance computing. Datacentermagazine.com listed Broadcom among the top 10 chip providers for the data center industry. It’s important to note that Broadcom is not just a “chip provider;” it supplies crucial components for data center networks, with a comprehensive portfolio that includes network, server, and storage connectivity solutions.

Therefore, Broadcom is also well-positioned to benefit from the aggressive data center spending from the largest tech players. It was announced recently that Microsoft (MSFT) will invest $4.8 billion in Italy’s AI infrastructure. Oracle (ORCL) plans to invest $6.5 billion in data centers in Malaysia. Google (GOOGL) is ready to invest $1 billion in data centers in Thailand. All these announcements are related just to a few past days, and we see such news emerging every week. Therefore, the data center race is still fierce as giants continue pouring billions into AI infrastructure, which is beneficial for AVGO.

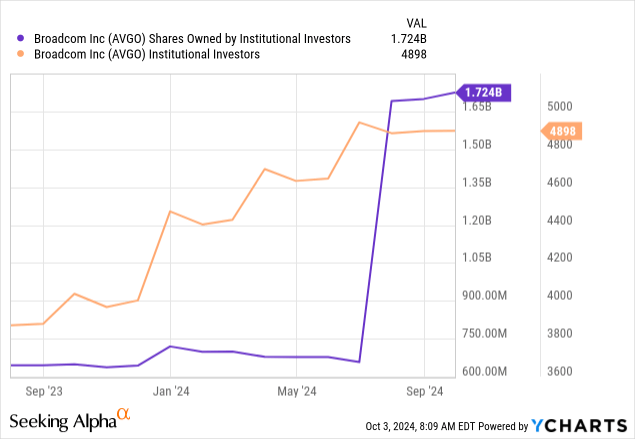

With such a solid potential to benefit from massive AI tailwinds, I am not surprised that institutional investors are loading up AVGO. The number of shares held by institutional investors and the number of institutional investors has increased significantly over the past twelve months, which is also a strong bullish indicator. Moreover, BofA’s analysts believe that AVGO is one of the top-stocks to see ‘greatest expansion’ by fund managers.

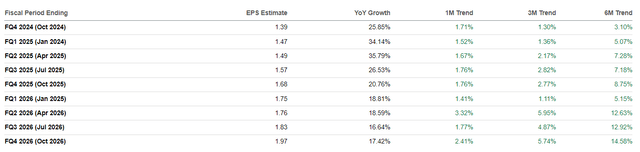

Favorable sentiment from Wall Street analysts is evident from positive developments around EPS revisions for the next nine quarters. This trend can be seen in the below screenshot. I also want to emphasize that the EPS is expected to sustain double-digit quarterly YoY EPS growth at least by FQ 2026, which is a massive fundamental strength.

I think that Broadcom remains on a solid growth trajectory, which is backed by its unique positioning in the AI trend by being both a hardware and software player. As a result, the company can exercise strong pricing power, which helps in improving profitability.

Valuation analysis

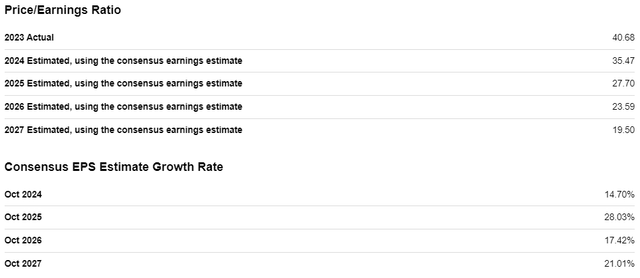

In the below chart, we can see that despite the currently elevated 41 P/E ratio, it is justified by the company’s growth prospects. Since AVGO’s EPS is expected to demonstrate aggressive growth over the next five years, the P/E ratio is likely to fall below 20 by FY2027.

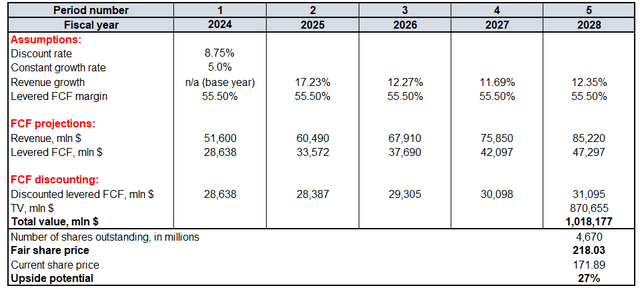

The discounted cash flow (“DCF”) approach will likely add more understanding. Broadcom’s cost of equity is 8.75%. This is slightly softer compared to a 9% discount rate, which I used last time as the Fed started cutting interest rates in September. Due to AVGO’s strong potential to capitalize on the rapidly expanding AI industry, I reiterate the same 5% constant growth rate for the terminal value (‘TV’) calculation.

Revenue forecast for the next five years is from consensus. A 55.5% levered FCF margin (TTM level) is already sky-high, so I do not expect expansion of the metric. According to Seeking Alpha, there are currently 4.67 billion AVGO shares outstanding after the split.

Broadcom is worth $1 trillion, according to the DCF. This means that the target price is $218, and there is a solid 27% upside potential.

Mitigating factors

The price rally of the past 12 months among the largest semiconductor names has been jaw-dropping. So, investors have expectations for encouraging earnings beats and guidance revisions. However, I think the big names such as AVGO, NVDA, and AMD are all reacting similarly to the same market sentiment and one of them releasing poor results or outlook could drag all three stocks down.

I have to mention geopolitical risks as well as Broadcom’s presence in China is significant. According to the 10-K, net revenue from China (including Hong Kong) for fiscal years 2023, 2022, and 2021 was $11.5 billion, $11.6 billion, and $9.7 billion, respectively. These are significant parts of AVGO’s sales, and I perceive risks associated with them. It’s well-known that U.S.-China relations are complex, and AVGO has already faced negative impacts on its financial performance in 2019 because of the Huawei export ban.

Conclusion

AVGO still deserves an extremely bullish outlook. With its diversified set of offerings for the AI revolution, Broadcom Inc. is uniquely positioned to support its revenue growth trajectory together with sky-high profitability. The valuation is very attractive, according to my valuation analysis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.