Summary:

- Broadcom’s stock has rebounded and may continue rising due to strong AI segment growth and potential earnings beat next week.

- Broadcom’s AI revenues, driven by the VMWare acquisition, are expected to significantly increase, making it a solid buy for the intermediate and long term.

- Analysts predict substantial revenue and EPS growth, with a 12-month price target of $215, and potential stock appreciation to $450-500 by 2030.

- Risks include high client concentration, geopolitical, regulatory, and macroeconomic factors, which should be monitored before investing in Broadcom’s stock.

BlackJack3D/E+ via Getty Images

The last time we discussed Broadcom (NASDAQ:AVGO) in a public article, the stock began rebounding from a post-earnings pullback after hitting the $135-140 support level. Following the sell-the-news earnings announcement, Broadcom seemed inexpensive. Broadcom is approximately 25% higher now and could announce a better-than-anticipated quarter when it reports earnings next week. Therefore, Broadcom’s stock could continue heading higher in the near term.

Moreover, through its comprehensive hardware and software solutions, strategic partnerships, and innovative product offerings, Broadcom has established a significant presence in the AI segment. Furthermore, Broadcom may be the best-positioned AI company, second only to Nvidia (NVDA).

While Broadcom’s AI revenues are only about 25% of total sales, the percentage should continue increasing in future years, leading to substantial sales and profitability increases. Broadcom is a central player in the AI race, and its growing AI revenues should continue rising at a considerable pace, making it a solid buy for the intermediate and long term.

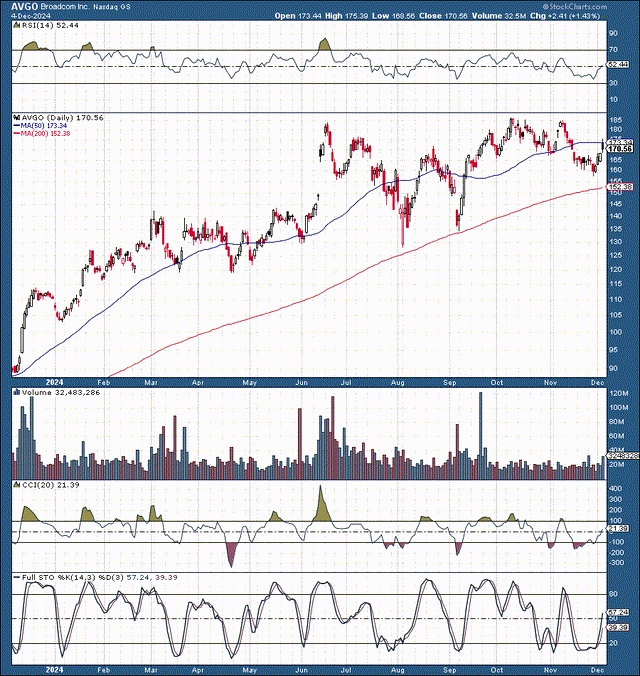

Broadcom Stock: Looking For A Breakout

AVGO has flirted with $175-185 resistance for a long time. AVGO has moved sideways for about six months, consolidating between the $130-185 levels. More recently, the trend has narrowed to about $160-185, and we may see a breakout soon. Broadcom has consolidated, potentially growing into its valuation. Whereas its stock was not ready to reach $200 earlier this year because of the massive run-up, it’s possible that after this consolidation, AVGO could attempt breaking out above $200, potentially melting up to the $210-220 zone in early or mid-2025.

Broadcom Is A Very Unique Company

Due to its dominant, market-leading position in semiconductors and infrastructure software, Broadcom was a powerhouse before acquiring VMWare last year. Broadcom specializes in designing custom application-specific integrated circuits (ASICs) for AI workloads. Moreover, Broadcom offers high-performance networking solutions, software, and security enhancers and has formed strategic partnerships to help cement its position as a cornerstone in AI.

However, Broadcom’s acquisition of VMWare elevated the company to another level. For $69B, it may have been one of the best deals in corporate history. VMWare had $13.35B in sales in 2023, equating to a P/S valuation of only about 5.17 at the time of the transaction. Given VMWare’s highly favorable AI position, arguably, the stock could trade around 10 times sales (or higher), exemplifying the remarkable deal Broadcom got in the VMWare acquisition.

Now, VMWare is an AI juggernaut, driving much of Broadcom’s growth. VMWare segment revenues were around $3.8B last quarter, a 41% QoQ surge from the $2.7B in Q2 2024. The $3.8 billion accounted for 29% of Broadcom’s total revenue and 65.5% of its Infrastructure Software segment sales. Given that VMWare’s sales will likely eclipse $15B next year, this segment alone could be valued around $150-200 billion, in my view.

Broadcom’s Staggering AI Growth Ahead

Bank of America (BAC) and other analysts believe Broadcom’s advantageous AI position sets the company up for substantial revenue increases in future years. BofA analysts expect an AI segment CAGR of 30-35% in the coming years, elevating AI revenues to about 30% of total sales over the current 23-24% range. They also predict Broadcom’s EPS of $7.31 by 2026, roughly in line with the consensus estimate of $7.29 for 2026. The bank also has a $215 12-month price target, approximately 27% above Broadcom’s current stock price.

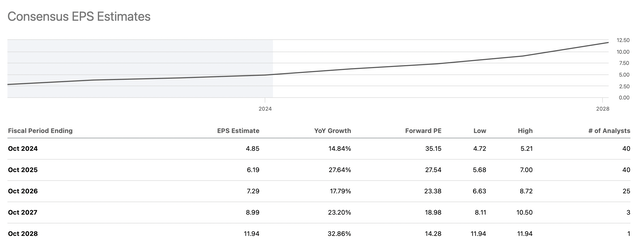

I concur with this bullish assessment, and Broadcom likely has considerable growth ahead. Moreover, Broadcom’s growth may be better than expected, and it could earn more than $7.30 in EPS in fiscal 2026. Broadcom’s AI sales expectations were $11 billion, but the company increased the forecast to $12 billion more recently. Therefore, the positive earnings trend should persist, and Broadcom could continue surpassing the consensus estimates.

Constructive Earnings Trend Should Persist

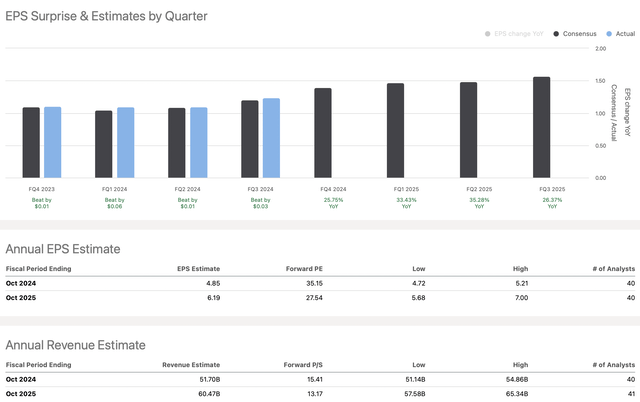

EPS vs. estimates (seekingalpha.com)

Broadcom has consistently surpassed earnings estimates, having only missed one report in its last twenty quarters (five years). Moreover, we should see a substantial rise in sales and EPS in 2025. Also, given that it’s nearly 2025, we should look forward to 2026 estimates and consider what Broadcom can earn as we advance.

EPS Likely To Exceed Estimates

EPS estimates (seekingalpha.com)

While the consensus EPS estimate for fiscal 2026 is around $7.30, Broadcom could easily outperform. The high-end estimates go up to about $8.70, but in a mildly more bullish scenario, Broadcom can achieve around $8 in EPS in 2026. Given that Broadcom is still around $170, it’s now trading at approximately 21 times forward earnings estimates. This valuation is cheap, considering Broadcom is an AI dominator on the hardware, software, and services side.

AI Growth Shows No Signs Of Slowing

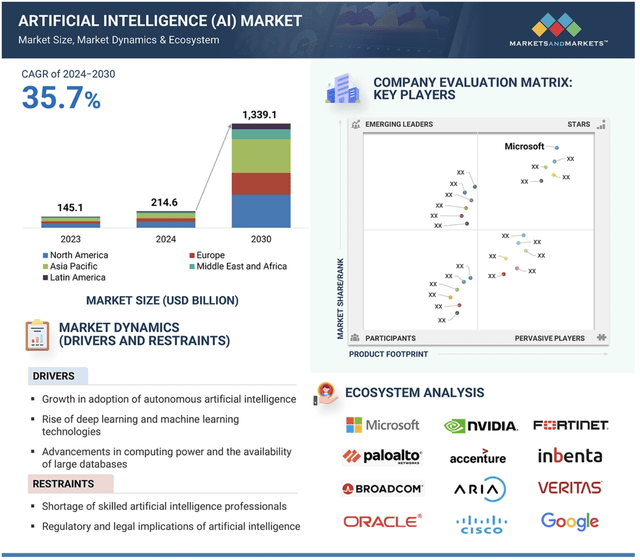

AI growth (marketsandmarkets.com )

AI segment CAGR is expected to be nearly 36% through 2030, and Broadcom plays an instrumental role in this burgeoning space. Therefore, Broadcom may have a longer growth runway than previously anticipated, and its AI segment could increase by 30-40% for several years as we advance.

If we implement a 33-35% CAGR relative to Broadcom’s $12 billion in 2024 AI revenues, Broadcom’s AI-related sales could surge to approximately $35-40B by 2028 and roughly $65-70B by 2030. Implementing a 5-7% CAGR to Broadcom’s approximate $40B in 2024 hardware/non-AI space sales suggests these revenues could be around $50B in 2028 and about $56-58B by 2030.

Where Broadcom’s stock could be in the future

| Year | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue (in billions) | $62 | $71 | $81 | $93 | $105 | $118 |

|

Revenue growth |

19% | 15% | 14% | 15% | 13% | 12% |

| EPS | $6.60 | $8 | $9.30 | $11.20 | $13.30 | $15.80 |

| EPS growth | 35% | 21% | 20% | 20% | 19% | 18% |

| Forward P/E | 27 | 28 | 29 | 29 | 28 | 27 |

| Stock price | $215 | $260 | $325 | $387 | $444 | $480 |

Source: The Financial Prophet

VMWare and its enterprise AI offerings could substantially increase Broadcom’s sales in future years. Moreover, because of its dominant, market-leading position, Broadcom could sustain a high level of profitability, increasing EPS considerably by double digits as we advance. Due to significant sales and profitability growth prospects, Broadcom could experience multiple expansion to 25-30 forward P/E or higher in future quarters.

Broadcom is a strong intermediate and longer-term buy, as its stock is highly likely to move notably higher in the coming years. Despite being around $170 now, Broadcom’s stock could appreciate to approximately $350 by 2027/2028, potentially reaching around $450-500 by 2030.

Risks to Broadcom

Broadcom has a high concentration of sales coming from several huge clients like Apple (AAPL) and others. While there are positive factors to this dynamic, Broadcom’s high concentration in sales coming from several massive firms comes with risks due to potential changes in customer decisions and market dynamics.

Geopolitical, regulatory, macroeconomic, and other broad risk factors exist and should be monitored carefully. Market cyclicality, technological competition, supply chain dependencies, acquisition integration, debt servicing, and other risks exist and should be considered before investing in Broadcom’s stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!