Summary:

- Broadcom Inc.’s integration of VMware has been accretive, reducing operating expenses by 50% and boosting gross margins to 70%, despite initial public criticism.

- Q4 2024 results showed 51% YoY revenue growth, with EPS beating estimates, and robust Q1 2025 guidance forecasting 22% organic sales growth.

- Broadcom’s AI accelerator market entry, leveraging its networking expertise, positions it as a key player against Nvidia, with AI-related sales up 220% in Q4.

- Strong cash flow and shareholder-friendly capital allocation, despite high debt from the VMware acquisition, support a favorable risk/reward balance at a forward P/E ratio of 36x.

G0d4ather

Investment Thesis

The past two years have been extraordinary for Broadcom Inc. (NASDAQ:AVGO), with shares soaring 101% in 2024, following a 100% rise in 2023.

A major milestone this year was the integration of VMware into Broadcom’s portfolio. The process has been challenging, with controversial price hikes and discontinuation of certain freemium services, sparking public criticism. But these moves have been accretive to shareholders. VMware’s operating expenses are now half what they used to be before the acquisition, while the gross margin is up to 70%.

Going into 2025, there’s much to be optimistic about. Broadcom is clashing with some big tech incumbents for their market share, and collaborating with others to leverage its tech prowess and enhance its strategic position in a fierce, highly competitive market. This makes Broadcom a highly interesting play in the semiconductor market.

Impressive Q4 2024 Results and Promising Q1 2025 Outlook

Broadcom reported its Q4 2024 (three months ended November) results last week, with revenue reaching $14 billion, up 51% year-over-year (“YoY”). This performance was in line with expectations, reflecting the impact of the $68 billion VMWare acquisition completed last year. On an organic basis, revenue growth was a more modest 9%.

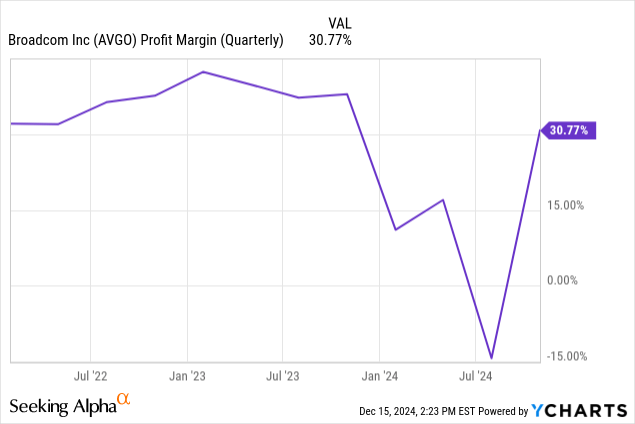

Profitability is starting to return to normal levels, after substantial integration expenses incurred during the first half of FY 2024 weighing on profit margins, as shown in the chart below. Earnings per share “EPS” stood at $1.42, up 8.3% YoY, beating consensus estimates by 3 cents.

The real highlight of the earnings call was Broadcom’s robust guidance for Q1 2025. Management forecasts 22% YoY sales growth, mostly organic, given that VMware acquisition closed in November 2023, no longer distorting YoY comparison starting Q1 2025, covering the three months ended January 2025.

This brings us to the next point; what’s driving sales going into 2025

Broadcom’s Foray into XPU AI Accelerators

Broadcom’s entry into the world of high-performance computing ‘HPC’ logic microchips was sudden, unexpected, and somewhat by chance. Unlike companies such as Nvidia (NVDA), Advanced Micro Devices (AMD), and Intel (INTC), who had technology roadmaps targeting the Logic AI data center microchip market, Broadcom’s entry into the market was a result of large public cloud providers’ desire to enter the market. They seek to leverage Broadcom’s expertise in networking chips in the hopes that this integration would give their AI accelerators an edge over market incumbents such as Nvidia, AMD, Intel, and other logic microchip providers. Google (GOOGL) (GOOG), Meta (META), Apple (AAPL), OpenAI, ByteDance (BDNCE), and Amazon (AMZN), are the new entrants in the logic AI accelerator microchip market, and Broadcom is helping them all develop their own AI chips, except Amazon, which, from my understanding, is partnering with Marvel.

So, where does Broadcom fit within the AI accelerator supply chain? Consider this analogy: if microchips were cars, Broadcom would be the chassis supplier, providing networking systems, memory access, and interconnects. Meanwhile, its customers are the engine suppliers, contributing the core neural processing units “NPUs,” and logic central processing units “CPUs.” When Broadcom talks about custom-made AI accelerators, they mean customers design the “engine” to meet their specific needs, while Broadcom integrates its components around it.

Broadcom’s strength has always been, and still is, networking. Its cutting-edge technology, and perhaps its clash with Nvidia’s networking portfolio, drew interest from new chipmakers seeking to integrate Broadcom’s expertise to differentiate their product offering in the AI accelerator market that is currently dominated by Nvidia’s GPUs.

Broadcom vs. Nvidia

Connecting logic microchips, whether that be GPUs, CPUs, or XPUs together to operate as a synchronous unit is a cornerstone of AI supercomputing cluster design. While a single GPU, CPU, or XPU can’t handle large AI and Machine Learning workloads, connecting many together to function as a unified system allows AI data center clusters to take the most demanding tasks.

As logic microchips became faster, the need for fast, reliable, and power-efficient networking became paramount. For many quarters, I listened to Nvidia’s CEO touting the importance of their Infiniband technology, which Nvidia inherited from the Mellanox acquisition in 2020. Broadcom disputed Nvidia’s networking narrative, rolling out Jericho3-AI as an alternative to the Infiniband platform.

When Nvidia eventually embraced Ethernet technology with its Spectrum-X platform, the company marketed it as the best thing since sliced bread. Broadcom was quick to point that the features touted by Spectrum-X were far from novel, having been embedded in Broadcom’s Jericho3-AI and Tomahawk switches for several quarters.

More importantly, Spectrum-X suffers from a major drawback. It is vertically integrated with Nvidia’s proprietary systems, lacking the vendor-agnostic flexibility of Broadcom’s solutions. Nvidia’s closed ecosystem is an important aspect in its approach to market, creating a technology moat against competition. But these kinds of networks create rigid systems, as compared to Broadcom’s solutions, which offer more flexibility, an attractive proposition to public cloud providers with a diverse set of clients with different networking requirements and ecosystems.

Balance Sheet, Cash Flows, and Capital Allocation

Broadcom ended FY2024 on a high note. It delivered $5.5 billion in free cash flow in Q4, nearly double what it brought in the same period of last year, especially considering $500 million in cash expenses related to the restructuring and integration of VMware.

As a fabless operator, Broadcom’s capital expenditures are remarkably low. They stand at $122 million in Q4, and $550 million in FY2024, giving leeway for the company’s shareholder-friendly capital allocation policy, which say Broadcom allocating $22 billion in dividends ($9.8 billion) and share buybacks ($12.4 billion) in FY 2024, representing 70% of its $31 billion unleveled FCF for the year.

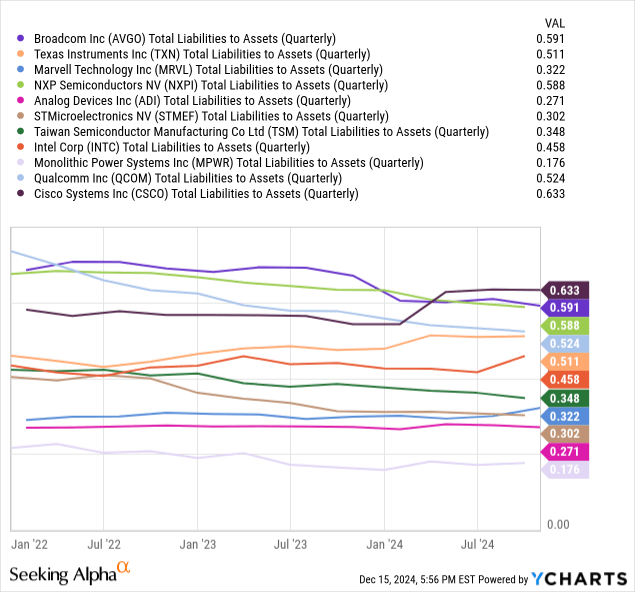

Lowering debt tied to the VMware acquisition is now a top priority for Broadcom, whose management is known for their appetite for M&A. Total debt stood at $70 billion as of November 2024, with total debt to assets falling at the upper bound of the industry range, as shown below.

Valuation

I believe that Broadcom’s valuation mirrors a justified growth premium, but nonetheless, it leaves an opportunity for those willing to bet on the sustainability of the AI tailwinds supporting its ticker. Public cloud providers entering the semiconductor market have the scale to market their products, especially for the many millions of enterprises who aren’t really concerned about what’s under the hood. For many, as long as the applications are running, it doesn’t matter what type of silicon is running it. This, combined with the cost reductions that cloud providers are promising those who chose their in-house microchips over third-party microchips, is a reason to believe that Broadcom’s rally has wings.

The computational needs are increasing exponentially, and while I believe NVDA has a pretty strong position in the market, the market is big enough to accommodate more than one player, and Broadcom is powering these new market entrants. In Q4 2024, its AI-related sales, which from my understanding include both custom AI chips and networking products, rose 220%, mirroring the immense market opportunity. While how sustainable this is, may be debatable, I think at a forward P/E ratio of 36x, the risk/reward balance is favorable. This is especially for a newcomer to the AI logic chip scene with ample room for growth, assuaging the fact that this forward P/E ratio falls at the upper bound of the industry range.

Final Thoughts and How I Might Be Wrong

Broadcom’s success in positioning itself at the heart of the burgeoning AI accelerator market, coupled with its shareholder-friendly capital allocation policy, strong product portfolio and solid tech platforms, offer a compelling investment opportunity. Valuation might be above average, but nonetheless leaves room for further growth if Public Cloud providers succeed in marketing their in-house AI accelerators.

The risk is clear and well-defined, allowing for easy monitoring of market dynamics as Public Cloud providers update investors on their semiconductor programs. Concentration risk is also an important factor. A rating downgrade is possible if Broadcom loses its supply contracts with one of its major three customers. Beyond AI, Apple (AAPL), who recently replaced Broadcom’s Wi-Fi and Bluetooth chips with their own in-house designs, could extend its silicon initiatives and replace Broadcom’s RF microchips it currently uses in its iPhone product line. Previously, Apple bought RF microchips from Qualcomm until it shifted supply to Broadcom.

Given the size of these supply contracts, any change in market dynamics could have a material impact on Broadcom, necessitating constant monitoring of market supply relations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.