Summary:

- Broadcom’s Q4 earnings report showed a bottom line beat, 51% revenue growth, and strong free cash flow, driven by AI spending.

- The company announced a partnership with Apple to develop custom AI server chips, enhancing its position in the growing AI hardware market.

- Broadcom raised its dividend by 11% and provided strong revenue guidance for Q1 FY 2025, indicating continued growth potential.

- Despite a high valuation, Broadcom’s expanding free cash flow margins and top line momentum suggest significant long-term upside in the AI sector.

BlackJack3D

Broadcom (NASDAQ:AVGO) submitted a strong Q4 earnings scorecard on Thursday that resulted in a 14% stock surge in extended trading. The hardware company revealed a bottom line beat, saw an acceleration of revenue growth and benefited from higher free cash flow margins… which were driven once again by the AI spending boom that is playing out in the Data Center market. Broadcom also announced a partnership with Apple (AAPL) that will see these two companies develop their own server chips. Broadcom raised its dividend 11% quarter-over-quarter and submitted strong revenue guidance for the first fiscal quarter of FY 2025. I believe Broadcom offers investors one of the best risk-reward ratios in the AI sector and while shares are not cheap, they certainly have considerable long term growth potential.

Previous rating

I rated shares of Broadcom a strong buy in my last work on the AI hardware company, at the beginning of December, just before earnings — The More It Drops, The More I’ll Buy — due to favorable trends in the market for artificial intelligence adoption, growth in AI workloads and strong revenue growth. Broadcom generated consisted growth in its key financial metrics, especially revenue and free cash flow, in the last quarter. The guidance for Q1’25 is robust and the partnership with Apple could boost the company’s revenue growth in the future.

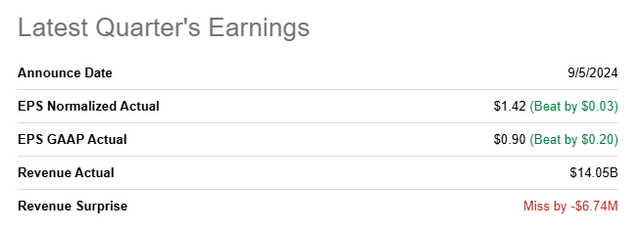

Broadcom beats earnings

The AI hardware company beat bottom line expectations for the fourth-quarter while missing slightly on the top line: Broadcom reported adjusted earnings of $1.42 per-share compared to the consensus expectation of $1.39 per-share while revenues came in at $14.05B, missing the average prediction by the small amount of $7M.

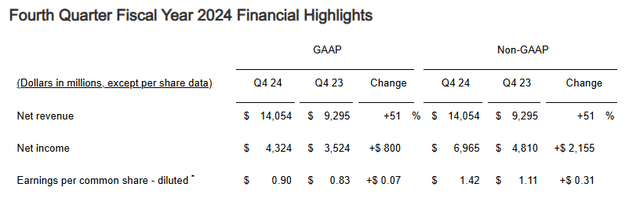

Broadcom had a very successful and a very profitable fourth-quarter that concluded the company’s 2024 fiscal year. The AI hardware company generated a massive 51% revenue growth in Q4’24, showing a 4 PP revenue growth acceleration compared to the previous quarter. Broadcom saw momentum in both of its core businesses, but especially in Infrastructure Software which is where revenues surged 196% year-over-year. Semiconductor Solutions, which is the company’s largest segment, saw 12% year-over-year revenue growth. Broadcom also remained widely profitable and reeled in earnings of $4.3B in Q4’24.

What I like about Broadcom are two things, especially: the hardware and networking specialist has stable gross margins and is growing its free cash flow (margins)… which creates attractive long-term capital return potential. In the most recent quarter, Q4’24, Broadcom generated a gross margin of $9.0B, showing a margin of 64% (stable Q/Q).

Broadcom also generated $5.5B in free cash flow in the fourth fiscal quarter on revenues of $14.1B, which calculates to an impressive free cash flow margin of 39%. Compared to the year-earlier period, Broadcom generated 16% free cash flow growth and the firm successfully expanded its free cash flow margin 2 PP Q/Q. Broadcom’s high free cash flow sets the basis for attractive capital returns. The hardware enterprise is already returning a lot of cash to shareholders through its dividend, which was increased by 11% Q/Q to $0.59 per-share.

|

$millions |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

Q4’24 |

Y/Y Growth |

|

Revenue |

$9,295 |

$11,961 |

$12,487 |

$13,072 |

$14,054 |

51% |

|

Net Cash Provided By Operating Activities |

$4,828 |

$4,815 |

$4,580 |

$4,963 |

$5,604 |

16% |

|

Purchases of PPE |

($105) |

($122) |

($132) |

($172) |

($122) |

16% |

|

Free Cash Flow |

$4,723 |

$4,693 |

$4,448 |

$4,791 |

$5,482 |

16% |

|

Free Cash Flow Margin |

51% |

39% |

36% |

37% |

39% |

-23% |

(Source: Author)

Partnership with Apple

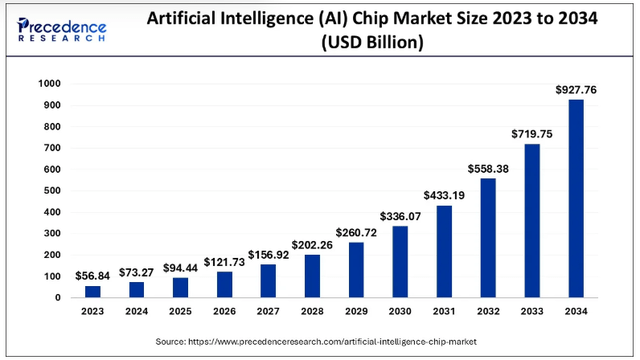

Broadcom entered into a partnership with Apple that will see these two companies develop custom server chips together that are specifically designed for AI applications. These server chips, which are dubbed Baltra, are set to go into production in FY 2026. Partnering with Apple gives Broadcom the opportunity to secure a cashed up anchor customer while expanding its product portfolio. The market for AI-capable chips is set to expand rapidly due to advancement in AI technology, which stipulates an attractive growth opportunity for Broadcom as well as Apple which is going full in on the AI opportunity.

According to Precedence Research, the AI chip market is set for sustained, secular growth in the next decade, and it is expected to expand to a size just shy of $1T by the end of FY 2034. As a leading AI hardware provider, and with the partnership with Apple, Broadcom is in a unique position to tap into this potential.

Outlook for Q4

Broadcom’s guidance for the first fiscal quarter of FY 2025 calls for $14.6B in revenue, implying a revenue growth rate of 22% year-over-year. The guidance slightly exceeded the consensus expectation ahead of earnings of $14.57B.

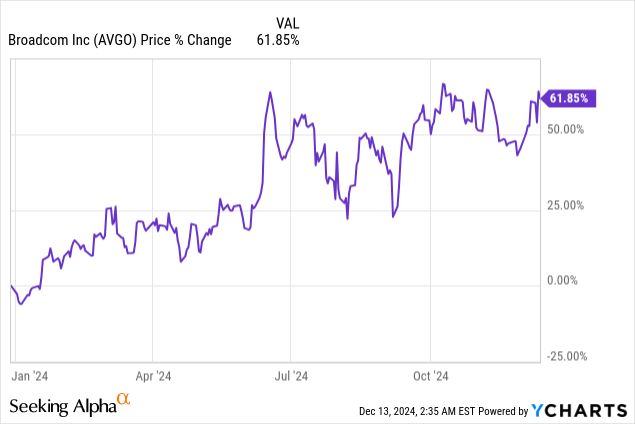

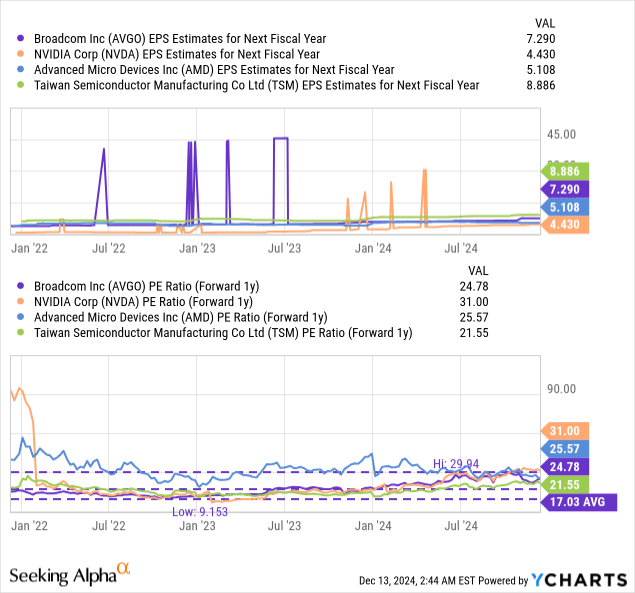

Broadcom’s valuation

Broadcom is currently valued at a forward (FY 2025) price-to-earnings ratio of 24.8X, which makes the hardware company one of the most expensive hardware enterprises focused on AI chips that investors can buy. Only Nvidia (NVDA) and AMD (AMD) are more expensive on a forward price-to-earnings basis, with P/E ratio of 31.0X and 25.6X. Broadcom has had a very strong run in recent years and shares increased 62% in value just in FY 2024 (year-to-date). However, with Broadcom having considerable top line momentum, expanding its free cash flow margins and issuing a strong revenues guidance for Q1’25, I believe Broadcom retains considerable long term upside potential. Nvidia, from a growth perspective, remains my top bet in FY 2025 as the chipmaker is just about to start ramping up its Blackwell shipments… and I believe that Nvidia is going to crush estimates in this regard: Nvidia’s Blackwell Is Set To Crush Expectations.

In my last work on Broadcom, I stated that I saw a fair value in the neighborhood of up to $198 per-share (based off of an industry group average P/E ratio of 27X). In my opinion, Broadcom, assuming that it can continue to expand its free cash flow margins and capitalize on its unique opportunity to work with Apple developing custom server chips, may have a considerably higher fair value. If Broadcom were to achieve a valuation similar to Nvidia, which has traded for a long time at a P/E ratio in excess of 31X, the hardware company may actually be considered cheap. A 31X earnings multiplier implies fair value of approximately ~$230 per-share. Since AVGO is also a dividend growth play for me, I would likely not sell shares even if my price target was reached.

Risks with Broadcom

Broadcom is exposed to a wave of accelerating spending on its AI products which has been key driving a significant share price revaluation in the last year. The networking specialist is still growing quickly and expanding its FCF margins, which still makes Broadcom a growth play. What would change my mind about Broadcom is if the enterprise were to see a deceleration in its top line growth or a drop-off in its free cash flow margins.

Final thoughts

Broadcom continues to have a lot of momentum in its core businesses, which is why I see the current stock rally to continue in FY 2025. Broadcom submitted a very solid earnings scorecard for the fourth-quarter on Thursday that showed a revenue acceleration Q/Q, a bottom line beat, and a Q/Q improvement in terms of free cash flow margins. Broadcom is widely profitable based off of net income and is now focused on improving its capital returns… by raising its dividend. The guidance for Q1’25 is robust, and the partnership with Apple could result in a revenue acceleration for Broadcom in the longer term. Shares of Broadcom are not a bargain, but the company has considerable growth potential in its core AI hardware market and the risk profile is still skewed to the upside for long-term investors, in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, NVDA, AMD, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.