Summary:

- Broadcom is nearing a $1 trillion valuation, driven by strong earnings growth and the acquisition of VMware, with a P/E ratio of ~30.

- The company’s AI segment is booming, with 220% YoY growth and partnerships with three large customers, aiming for a $75 billion market opportunity by 2027.

- Broadcom’s semiconductor segment saw 12% YoY growth, and infrastructure software revenue nearly tripled, indicating strong demand and future growth potential.

- Despite initial reservations about its valuation, Broadcom’s innovative AI chips and customer shift from Nvidia position it for substantial future revenue and shareholder returns.

JHVEPhoto

Broadcom (NASDAQ:AVGO) is approaching the $1 trillion threshold after hours, making it potentially the first semiconductor company to do so. We last recommended against investing in the company here, discussing the threats faced by the company’s acquisition focused strategy. However, as we’ll see in this article, the company’s ability to take the customers from existing dedicated GPU providers (NASDAQ:NVDA) (NASDAQ:AMD) could be the strength that justifies investing.

Broadcom Earnings

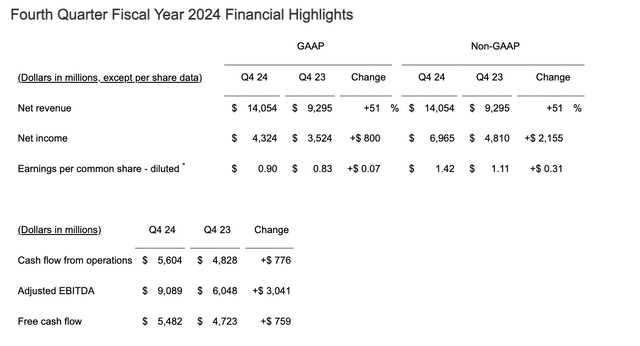

Broadcom announced strong YoY earnings growth primarily buoyed by the acquisition of VMware.

The company announced a 51% increase in revenue and a strong increase in non-GAAP net income. Earnings per share came in at roughly $6 annualized, with substantial YoY growth, putting the company at a P/E of ~30. It’s a lofty-er valuation that indicates that the company will need continued growth to justify its valuation.

The company’s annualized FCF came in at $22 billion, with adjusted EBITDA at more than $36 billion. The company’s FCF yield, at roughly 2.5%, is also a yield that requires continued growth. For 2024 overall, the company saw more than $12 billion in AI revenue with 220% YoY growth, and we expect the company’s portfolio here to give it strong growth.

Broadcom Segment Performance

Broadcom has continued to perform well segment by segment.

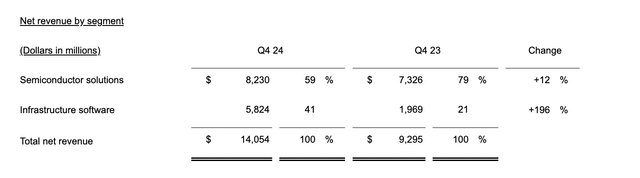

The company’s semiconductor segment saw 12% YoY revenue growth, driven by the continued strength of artificial intelligence. Based on the company’s earnings, artificial intelligence makes up 40% of the company’s semiconductor revenue and has continued its substantial growth. Despite that, the acquisition of VMware means semiconductor solutions are now 59% of the company.

The company’s infrastructure software revenue almost tripled YoY to almost $6 billion per quarter.

The company’s 1Q 2025 guidance is for $14.6 billion in revenue with an adjusted EBITDA margin of 66% ($9.6 billion adjusted EBITDA). That would imply 7% QoQ adjusted EBITDA growth, showing continued demand for the company’s products and strong growth. That will enable the company to grow into tis valuation.

Broadcom Artificial Intelligence

Here’s the key segment from the earnings discussion on artificial intelligence.

“We see an opportunity over the next three years in AI,” Tan told investors on the earnings call. “Massive specific hyperscalers have begun their respective journeys to develop their own custom AI accelerators.”

Tan said Broadcom is currently developing AI chips with three very large customers, and he expects each of them to deploy 1 million AI chips in networked clusters by 2027. Tan said the total market opportunity for its AI chips, which it calls XPUs, as well as parts for AI networking could be between $60 billion and $90 billion by 2027.

– CNBC

We’ve discussed in our prior articles on Nvidia, the issue of Nvidia’s massive customer concentration. For Nvidia, the company is reliant on massive sales to a handful of companies, and it needs those sales to continue increasing. Forecasts for 2025 Blackwell sales are 800K units for the first quarter ramping up to a total of ~5 million units for the year.

While the exact sales remain to be seen, almost half of the company’s revenue comes from just 4 customers. So when Broadcom says they’re currently developing AI chips with “three very large customers”, initial data indicating Apple is one of them, there’s very likely to be some overlap between these 3 large customers and Nvidia’s largest customers.

The same is true for AMD given that the largest customers are the same sets of companies. Broadcom is saying, likely with strong internal data, that he expects each of these customers to deploy 1 million AI chips in networked clusters by 2027 with a total market opportunity of ~$75 billion by 2027. For perspective, the largest AI cluster in the world today is “Colossus” owned by xAI, with 100K Nvidia GPUs.

So in just a few years, these customers, working with Broadcom, will be developing clusters 10x the size of the largest today. That’s not surprising to us. These “large customers” are massive, with deep pocket books, like in the realm of companies like Google, Amazon, Microsoft, Apple etc. They also already have a lot of their own tech prowess.

With Blackwell margins in the low-70s, and a cost per GPU of ~$35K, the difference between a 1 million equivalent GPU cluster at cost for Microsoft versus 1 million GPUs from Nvidia is $25 billion. That’s massive savings, and it’s no wonder that these companies are investing billions with Broadcom as a result.

It’s an opportunity worth potentially $10s of billions to Broadcom. And it could cost Nvidia massively.

Why Nvidia? Why AMD?

Interested investors might be wondering Why Nvidia? Why AMD? Why won’t the XPUs be independent. We highlight 3 reasons here:

1. Companies are becoming more thoughtful about GPU purchases.

Executives at Google and Meta have already stated they might be spending too much on GPUs, but they’re continuing to do so because they’re afraid of being left behind. One way to continue having the compute power you might require, without overspending, is to allocate your budget to XPUs instead of GPUs.

2. Large scale XPUs will decrease the moat of high-margin GPUs.

Nvidia GPUs are currently the best way to get hyper-scale GPU compute at volume with existing SW support. CUDA, Nvidia’s SW stack, is considered a huge part of the company’s moat. However, our view is that as we get 1+ million XPU systems, that moat will chip away, companies will need to support their own XPUs.

Given that many of these companies (Google Cloud) etc. offer their HW outwards, that could have a universal affect.

3. They have the present customers.

And then there’s the last reason, and the most obvious. Nvidia and AMD have the largest source of customer’s today. Broadcom can’t take Intel’s (INTC) lunch because Intel has no lunch today. Nvidia is making the lion’s share of GPU revenue and that means that if there are changes in the market, they stand to lose the most.

Our View

We were initially against Broadcom given its lofty valuation. However, the company’s packaging tech with XPUs is a new segment in the market, and Nvidia’s massive margins are causing its largest customers to turn away and look at the alternatives. With millions of XPUs in demand, Broadcom is well positioned to help customers build their own silicon, as seen with its growth.

That could enable the company to earn billions, if not $10s of billions in reasonable revenue as customers move away from Nvidia. It can still have reasonably high margins and enable the company to grow into its valuation. That will enable Broadcom to generate strong shareholder returns.

Thesis Risk

The largest risk to our thesis is the company’s largest present day customer, Apple (NASDAQ: AAPL). Rumors are that Apple is building its own chip to transition away from Broadcom, and Apple is Broadcom’s largest customer, accounting for ~20% of FY’23 revenue. A shift away could hurt Broadcom’s continued profits.

Conclusion

Broadcom is a massive company and might soon cross the $1 trillion valuation threshold. The company grew by double-digits after hours, with a strong earnings announcement. The company is seeing strength with an integrated VMware, and the company is seeing massive demand for its XPUs as Nvidia’s largest customers build their own GPUs.

That could result in customers moving away from Nvidia, however, Nvidia’s losses are Broadcom’s gains. The company will be able to grow its FCF and earnings to justify its valuation, resulting in a ratings upgrade from our side. We now see Broadcom as a valuable investment proposition. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.