Summary:

- Broadcom’s Q3 FY24 earnings report showed strong AI revenue growth and successful VMware integration, despite non-AI revenue dragging performance.

- The company’s Infrastructure Solutions segment, boosted by VMware, saw significant growth, while Semiconductor Solutions faced declines in non-AI segments.

- CEO Hock Tan indicated non-AI revenue deceleration has bottomed, but the stock dropped 10% post-earnings report.

- I maintain a Strong Buy rating for Broadcom, confident in its AI tailwinds and margin expansion strategy despite potential short-term pullbacks.

G0d4ather

Investment Thesis

Broadcom (NASDAQ:AVGO), a major chip supplier for technology companies, reported its Q3 FY24 earnings report which showed the San Jose, CA-based chip supplier beat top line and bottom line estimates.

The company demonstrated accelerating growth in its AI-focused revenue, which continued its pace of growth through Q3. However, Broadcom’s non-AI revenue continued to be a drag on its earnings performance as sales continued to slack. Still, Broadcom’s CEO, Hock Tan, announced on the call that the sales deceleration in its non-AI revenue has bottomed.

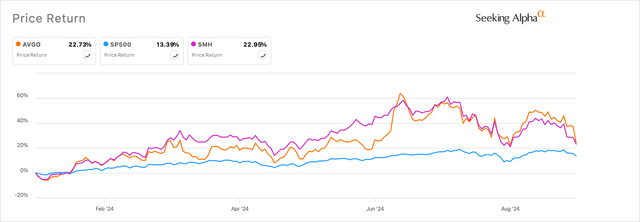

Tan’s comments did not do much to buoy Broadcom’s stock, which shed 10% the day after its Q3 earnings report was announced.

Exhibit A: Broadcom’s 10% stock drop on Friday means, the company’s stock is now up 22% year-to-date (Seeking Alpha)

In my view, the more interesting perspective was the progress that its VMware integration showed, which was in line with Tan’s previous guidance and the CEO’s usual playbook of acquisitions in the past.

These results and commentary attest my optimistic view of the company that I expressed earlier, and I still believe Broadcom is a Strong Buy at current levels.

Q3 Recap: Strong AI revenue, VMware Integration Tailwinds

My previous coverage on Broadcom delved into the specifics of how Broadcom was benefiting as it continues to hold its dominance in the custom AI chips market, which boosts the company’s outlook due to the AI tailwinds. In my previous note, I highlighted the company’s projections specifically related to AI-related sales, where it was expected to generate at least $11 billion from the sales of chips, networking products, and other components.

In the Q3 earnings report released late last week, Broadcom’s Tan announced that they now expected ~12 billion in AI-focused sales, higher than the $11.8 billion that markets expected. One of the reasons for that boost was the benefit that the company saw from its VMware integration.

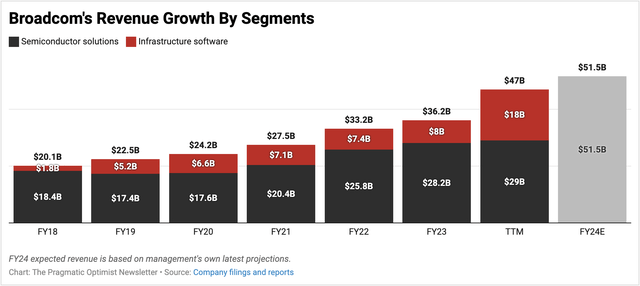

Exhibit B: Broadcom’s Q3 revenue beat means the company is on track to deliver roughly $52 billion in revenues this fiscal year. (Company sources)

While Broadcom’s consolidated Q3 revenues were up 34% y/y to $12 billion, it was really the company’s Infrastructure Solutions segment that did most of the heavy lifting. Broadcom’s Infrastructure Solutions segment grew revenues by almost 4 times its revenues reported in the same quarter a year ago to $5.8 billion. The integration of VMware’s solutions was the main reason for the boost in this segment, accounting for $3.8 billion, or 66% of the $5.8 billion within the Infrastructure Solutions segment.

On the call to discuss Q3 earnings, Tan mentioned that VMWare booked millions of CPU compute costs of VCF (VMware Cloud Foundation), the latest version of VMware’s full stack server virtualization software that resulted in annualized bookings worth $2.5 billion, up 32% sequentially. Tan also called out the progress of VMware’s integration on the EBITDA front, where an overhaul of VMware’s operations is still in progress, pushing it closer to Broadcom’s overall software operating framework, which still puts VMware on track to achieve its targets:

Meanwhile, we continue to drive down costs in VMware. We brought VMware spending down to $1.3 million in Q3 from $1.6 million in Q2. And when we acquired VMware, our target was to deliver adjusted EBITDA of $8.5 billion within three years of the acquisition. We are well on the path to achieving or even exceeding this EBITDA goal in the next fiscal ’25.

Unlike its Infrastructure Solutions segment moving from strength to strength, Broadcom’s Semiconductor Solutions segment posted growth declines again after showing its first signs of re-acceleration in Q2. Q3 Semiconductor Solutions revenue slowed 4.8% y/y to $7.3 billion. Strong demand from hyperscalers for both AI networking and Broadcom’s custom AI chip products drove Broadcom’s Networking product segment, within Semiconductor Solutions, up 43% y/y.

This strength was offset by weakness in the other product segments, which were unrelated to AI, due to weak demand from its enterprise customers within the Semiconductor Solutions segment. Non-AI networking, server storage, and wireless and Broadcom product revenue were either flat or severely in the red and will continue to be at these levels in the upcoming quarter per management’s outlook. However, Tan did reiterate multiple times during the call that he sees non-AI revenue deceleration bottoming out:

In summary, here are the trends we are seeing in semiconductors. In aggregate, we have reached bottom in our non-AI markets, and we’re expecting a recovery in Q4. AI demand remains strong, and we expect, in Q4, AI revenue to grow sequentially 10% to over $3.5 billion. This will translate to AI revenue of $12 billion for fiscal ’24, up from our prior guidance of over $11 billion.

Putting it all together with software, here’s our forecast for Q4. We expect Q4 semiconductor revenue of approximately $8 billion, up 9% year-on-year. For infrastructure software, we expect revenue to be about $6 billion. So we are guiding Q4 consolidated revenue to be approximately $14 billion, which is up 51% year-on-year.

Margins shaping up nicely as Broadcom exits Q3

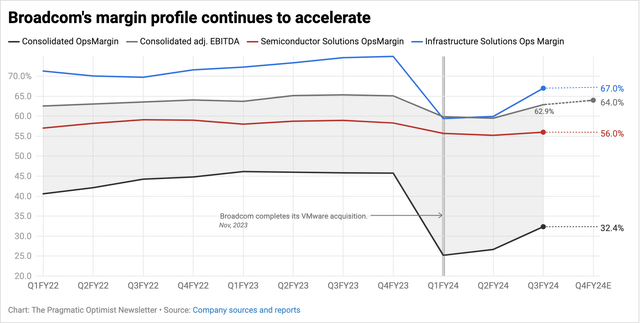

While markets were expecting more secular strength in the cyclical revenue deceleration in Broadcom’s Q3, I believe the earnings report was an attestation of the company’s profitable growth-led strategy. Exhibit C below shows how Tan & team have been navigating the company towards Broadcom’s overall EBITDA margin goals after integrating VMware last year.

Exhibit C: Broadcom’s margin profile is only getting better after absorbing VMware. (Company sources, earnings calls)

Broadcom’s margins have been accelerating impressively after absorbing VMware into its portfolio last year. While adj. EBITDA margins expanded 62.9% in Q3, GAAP operating margins also continued to sequentially expand to 32.4%. As observed in Exhibit C, the Infrastructure Solutions expanded by a robust 700 bp sequentially, adding a boost to the overall margin profile, while margins within Semiconductor Solutions also expanded by 80 bp.

The margin performance allowed Broadcom to report adj. EPS of $1.24, beating consensus estimates by 3 cents.

Broadcom exited Q3 with $10 billion in cash and $72 billion in debt, which incur an annual interest expense run rate of ~$4 billion. After taking into account management’s Q4 estimates for EBITDA margins at 64%, I estimate Broadcom’s leverage ratio to be ~2.3x on an adjusted basis, making this reasonably safe from a debt leverage standpoint. I had also pointed out in my previous coverage how Broadcom’s debt was upgraded a couple of months ago, pointing to a strong capital structure.

Valuation Points To Robust Upside

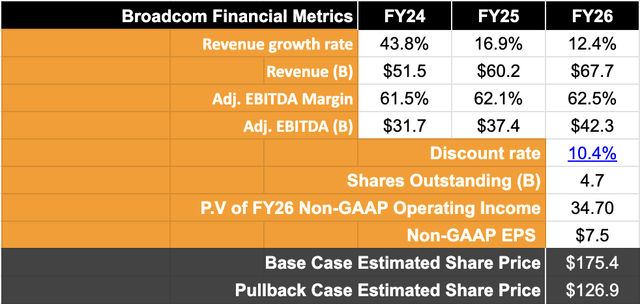

Taking into account management’s upgraded forecasts for Q4, the company is on track to grow revenues by ~44% to ~$52 billion this year. My expectations for >20% revenue growth through FY26 have not changed based on the Q3 earnings report.

However, on the margins front, I believe Broadcom has more room to grow their adj. EBITDA margins after the robust performance in this quarter. I believe margins can expand by at least 100 bp through FY26, implying 22% growth through FY26. This earnings growth should warrant an earnings multiple in excess of 35x, but after accounting for the $4 billion in annual interest expenses I mentioned earlier, I believe a forward earnings multiple of 23-24x is warranted. This implies an upside of 29% from current levels after factoring in a discount rate of 10.4% & and a shares outstanding base of 4.7 billion.

Exhibit D: Broadcom’s valuation model shows strong upside (Author)

The upside modeled above does not include the potential dividends. At the time of writing, Broadcom yields 1.5%, with consensus estimates projecting the yield to grow up to 2% through FY26.

VMware’s Integration Risks & Other Factors To Consider

One of the risks I will point out is that markets enter the usual seasonal patterns of the September depression, which will compress valuation multiples for the time being. In such situations, I believe markets would price Broadcom at a lower earnings multiple closer to the long-term PE of the S&P 500 of ~17-18x as questions about revenue growth and subsequent EBITDA margin proliferate through the seasonal pessimism. That would imply a price target of ~$125-128, as noted in Exhibit D in the earlier section.

One of the reasons for revenue growth would be around its VMware integration, where questions are raised about Broadcom’s imposing its own software operating model on VMware. This has led to some customers jumping ship from VMware onto its peers, such as Nutanix (NTNX), reporting benefits from any fallout of the VMware integration. At such times of doubt, I would remind investors of Hock Tan’s approach to his acquisition-led growth strategy, which entirely focuses on acquiring companies, redistributing resources, and offering customized solutions that can then be marketed to large enterprises and hyperscalers.

This has served Broadcom well through the multitude of its acquisitions, allowing Tan’s team to price to value and sustain its margin expansion strategy along the way. One commenter on a public forum who appears to be a prior VMware reseller said they would probably have to “advise our [their] customers to do the same since most of them are SMB and medium-sized companies,” reinforcing the fact that Tan is right to weed out the SMBs and other small clients that are not Broadcom’s focus.

Still, such media reports about VMware integration being unstable may pose some headwinds in terms of sentiment against Broadcom for the time being, causing pullbacks. Such pullbacks would only create buying opportunities.

Takeaway

In contrast to what most publications might report, I believe Broadcom had a robust earnings report as it exited Q3. The company continues to be a strong beneficiary of AI tailwinds despite the weakness being seen in its non-AI business lines, which should be bottoming out on a cyclical basis by the end of the year, if not already in Q3.

I remain confident in reiterating my Strong Buy on Broadcom.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AVGO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.