Summary:

- AVGO stock has increased by almost 7% since January 2024, outperforming the S&P 500.

- Broadcom is strengthening its position in the AI revolution with improved hardware offerings and diversifying product lines.

- The Company’s valuation is attractive compared to other semiconductor stocks, and a DCF model suggests it is undervalued by 17%.

G0d4ather

Introduction

I had a thesis about Broadcom’s (NASDAQ:AVGO) stock in January 2024 with a “Strong Buy” rating. Since my first publication, AVGO’s price increased by more than 3%. The stock’s dynamic is better than S&P 500, meaning that my thesis is keeping up well. It seems that the market sentiment around semiconductor stocks is cooling down, but as a long-term investor, I prefer to look at the company’s fundamentals instead of the sentiment. From this perspective, AVGO continues demonstrating several optimistic signs. My valuation analysis suggests that AVGO is attractively valued at the current price. Considering all the positives, I am reiterating my bullish opinion on AVGO.

Fundamental analysis

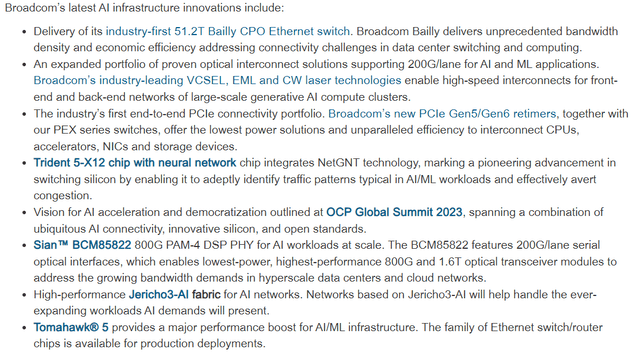

Broadcom continues fortifying its strategic strength in the AI revolution by improving its hardware offerings. The company’s products offer the highest-performance options to enable chip connectivity to integrate multiple AI accelerators. Its product line is consistently diversifying and improving, which provides opportunities for the company to expand its reach within the global digital transformation.

It is crucial that Broadcom offers several products across the whole AI infrastructure, each of the parts of this chain delivering best-in-class performance. I am not a semiconductor or AI expert, but it looks apparent that with the wider expansion of advanced machine learning (“ML”) models, workload, and computing capacity will continuously expand. With that being said, Broadcom’s consistent upgrades to its solutions is crucial to sustain its dominance in high computing infrastructure business.

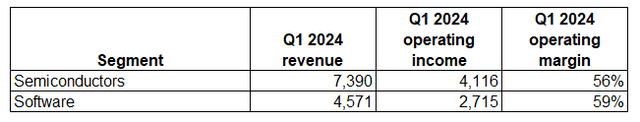

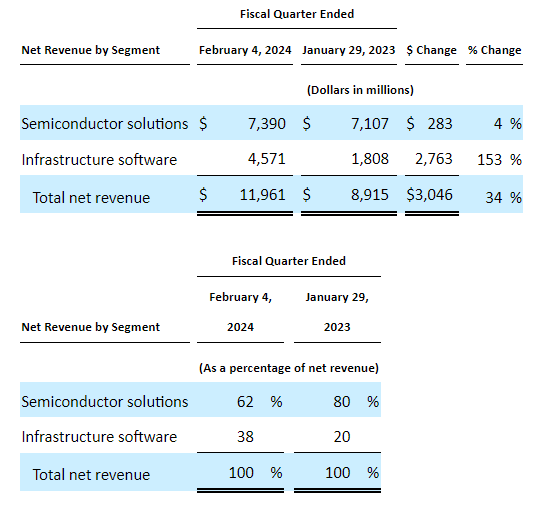

With all these technological advancements and solid potential to expand its AI reach, I am not surprised that AVGO delivered a strong FQ1 2024 on March 7. With the VMware acquisition effect eliminated, AVGO’s revenue grew by a solid 11% on a YoY basis. Thanks to the contribution from VMware, AVGO’s revenue mix between Semiconductors and Software improved significantly.

AVGO’s Q1 2024 10-Q

I say “improved” regarding revenue mix because Software is a more profitable business despite smaller scale. Furthermore, as software can rarely be considered as Capex from the customers’ side, this segment is likely to be less cyclical than semiconductors.

After the acquisition of VMware last year, AVGO is positioned well to penetrate deeper into the Software business. VMware business is presented in the emerging virtualization software and services business. VMware also aims to become a leading private cloud infrastructure business. The markets where VMware is presented look promising. For instance, the worldwide virtualization software and services market is expected to compound with a staggering 22.3% CAGR up to 2033. The private cloud market is also hot and is expected to deliver a 26.7% CAGR by 2028. According to the latest available 10-Q report of VMware, the company has partnerships with the biggest public cloud companies in the world like Amazon (AMZN), Google (GOOG), Microsoft (MSFT), and Oracle (ORCL). This underscores the solid competitive edge of VMware Considering AVGO’s strong positioning in hardware, the acquisition is likely to bring substantial positive synergetic effects for VMware’s software and private cloud offerings.

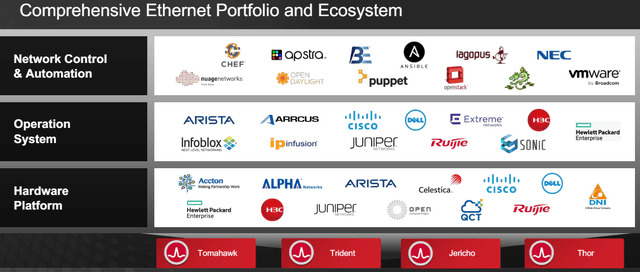

Broadcom’s latest presentation on AI

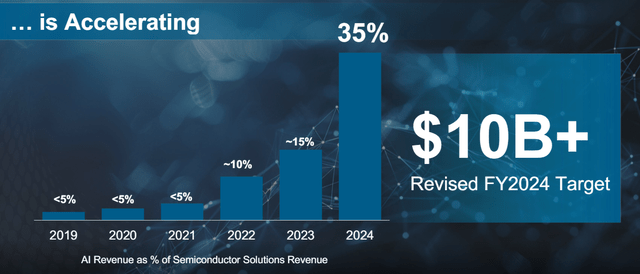

Besides the big potential to expand its software business, we should also not forget Broadcom’s strong positioning in the AI revolution. As I mentioned above, the company’s products enable interconnectivity of the highest quality and speed between most advanced AI chips. Broadcom’s flagship products can integrate within various hardware platforms, operations systems, and automation. This makes Broadcom firmly positioned in the AI revolution. Therefore, I am not surprised that AVGO’s management substantially upgraded expectations around its AI semiconductors’ portion of the total segment’s revenue from 25% to 35%, which is $10 billion in absolute terms.

Broadcom’s latest presentation on AI

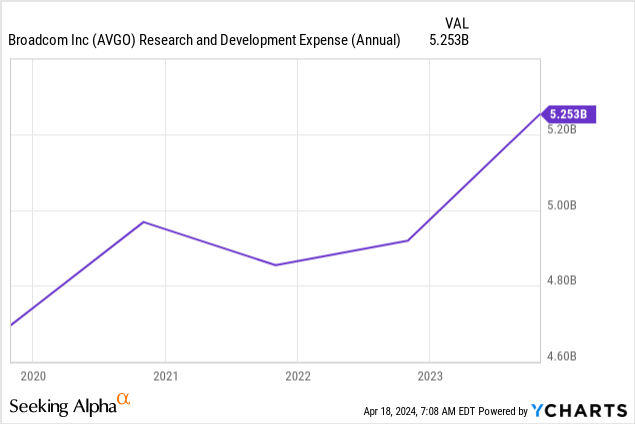

Due to the company’s stellar historical performance and substantial reinvestments in R&D, I expect AVGO to maintain its technological edge and continue enjoying the growing demand for cutting-edge semiconductors.

Valuation analysis

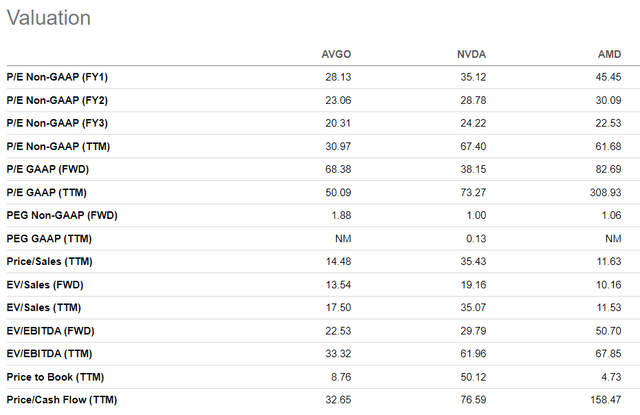

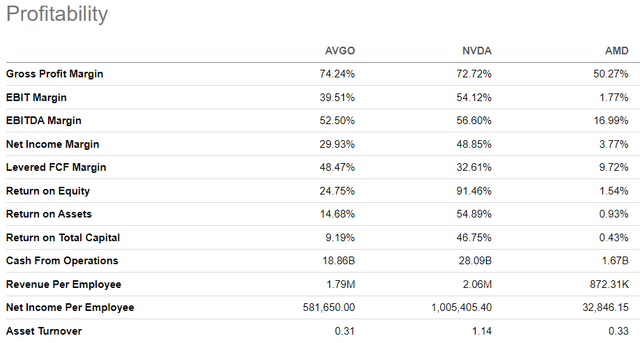

AVGO appears much cheaper than other hot semiconductor stocks like AMD and NVDA, if we look at multiples. While NVDA’s high multiples appear to be fair considering this company’s spike in revenue and EPS in fiscal years 2024-2025, AVGO seems unfairly cheaper than AMD.

I think that much higher AMD’s multiples are unjustified because its YoY and forward revenue and EBITDA growth is not even close to Broadcom’s. Furthermore, Broadcom’s profitability is also substantially higher compared to AMD and is much closer to NVDA. Therefore, based on peer valuation ratios analysis, I can conclude that AVGO’s valuation is sound.

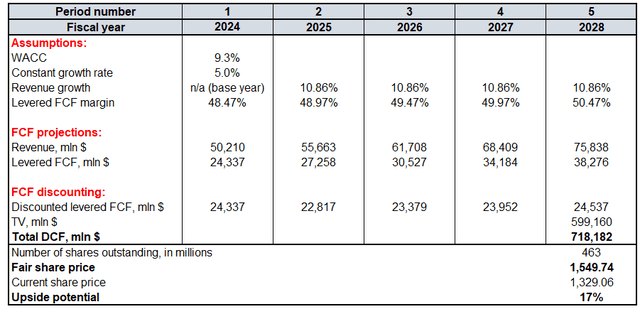

To determine my target price for AVGO I need to run a discounted cash flow (“DCF”) model. Due to the uncertainty around interest rate cuts, I use a slightly higher 9.3% WACC compared to my previous DCF model. A $50.2 billion FY 2024 revenue is based on consensus estimates and a 10.86% growth rate for FYs 2025 to 2028 is a semiconductor market growth projection from Mordor Intelligence. A 5% revenue constant growth rate for the terminal value (“TV”) estimation is in line with my previous analysis. A 48.5% levered FCF margin is the current TTM level. Since revenue is projected to grow with notable pace, I expect the FCF margin to follow and expand by 50 basis points yearly. According to Seeking Alpha, there are currently 463 million AVGO shares outstanding.

My DCF model suggests that AVGO is 17% undervalued and the target price is above $1,500. For a company which appears to be the cornerstone of the AI revolution, I think that 17% discount is a gift.

Mitigating factors

The rally of the last 12 months in the most prominent semiconductor names has been staggering. Therefore, expectations of investors on positive earnings surprises and guidance upgrades are high. That being said, it appears to me that large players like AVGO, NVDA, and AMD share the same market sentiment and if one of them delivers disappointing earnings or guidance it might drag shares of all three players down.

Broadcom’s concentration in China is notable. According to the 10-K, net revenue from China (including Hong Kong) for fiscal years 2023, 2022, and 2021 was $11.5 billion, $11.6 billion, and $9.7 billion, respectively. These are substantial portions of AVGO’s sales, and I see risks in it. It is widely known that relationships between the U.S. and China are complicated, and AVGO already experienced adverse consequences on its financial performance in 2019 due to the Huawei export ban.

Recent news revealed that AVGO is being questioned by EU regulators over licensing for its VMware cloud computing unit. This is relatively fresh information and there are not many details, but scrutiny from EU regulators regarding developments around AVGO and VMware integration might affect AVGO’s ability to exercise all planned synergies.

Conclusion

AVGO appears to be a vital company for the global AI transformation and the company is capitalizing on it with its staggering almost 50% FCF margin. AVGO continues to innovate to fortify its presence in the AI revolution, and I see great potential in its software business. The valuation is very attractive, and I am inclined to reiterate my “Strong Buy” rating for AVGO.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.