Summary:

- Warren Buffett’s Berkshire Hathaway has been consistently selling its Apple shares, reducing its stake by around 25% in the latest quarter.

- Apple’s valuation is high, and its balance sheet is weakening, making it prudent to consider locking in gains.

- Buffett’s selling trend suggests caution for Apple investors, similar to how his past buys were closely followed.

- With economic exposure and valuation concerns, following Buffett’s lead in reducing Apple holdings could be wise.

ozgurdonmaz

Article Thesis

Warren Buffett’s Berkshire Hathaway (BRK.A)(BRK.B) reported its most recent earnings results earlier this month, which included the fact that the Oracle of Omaha keeps selling down the company’s position in tech giant Apple Inc. (NASDAQ:AAPL). While Apple is by no means a bad company, investors in Apple should not ignore Buffett’s ongoing sales — similar to how they didn’t ignore his buys in the past. With Apple being exposed to the strength of the economy, and with Apple being quite expensive while its balance sheet is getting weaker, it could be a good idea to follow Buffett’s lead and to lock in some gains in Apple Inc.

Past Coverage

I have written about both Apple and Berkshire Hathaway in the past here on Seeking Alpha. My last article on Berkshire is from around two years ago, when I gave the company a Buy rating — shares have returned around 60% since then. I have been less bullish on Apple, with my most recent article on the company (bearish) being from this June, with Apple rising slightly since that report was published. With around half a year having passed since my most recent Apple article, it is time for an update — and Buffett’s ongoing selling is an important topic, I believe.

What Happened?

Berkshire Hathaway’s earnings report from earlier this month included the fact that the company’s stake in Apple declined further — not due to Apple’s share price performance, but due to Berkshire’s selling of AAPL shares. Seeking Alpha reports:

The Omaha, Neb.-based giant said the fair value of its equity investment in Apple (AAPL) was worth $69.9B at the end of the third quarter, compared to $84.2B at the end of Q2. Those numbers suggest that Berkshire’s (BRK.A)(BRK.B) position in Apple (AAPL) has been slashed to 300M shares from about 400M. That’s a reduction of nearly 25%.

Berkshire didn’t get rid of all of its Apple shares, of course — even if Buffett had wanted that (there is no indication of that), he likely would not have been able to pull that off without moving the market too much. But still, Apple sold around one-fourth of its position in the tech consumer giant during the quarter. This was not the first time Buffett sold shares of Apple, but rather the continuation of a recent trend, as Berkshire’s stake in Apple has been declining for some time. In total, Berkshire has now sold around 600 million shares of Apple, including the roughly 100 million share sale Berkshire reported with its most recent earnings report.

Apple: Growth Is Slowing Down

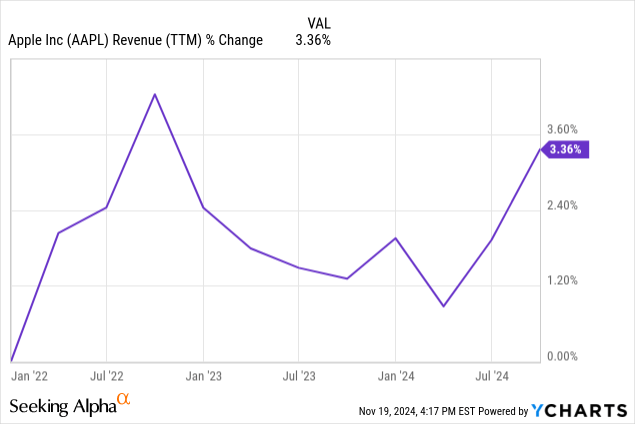

We do not know Warren Buffett’s reasoning for selling Apple, but I believe that the fact that Apple’s growth has declined meaningfully in the recent past could be an important factor for that. The following chart shows how Apple’s revenues on a trailing twelve months basis have changed over the last three years:

We see that there was almost no growth, with revenues over the last four quarters being just 3% higher compared to three years ago — and that’s in nominal terms. Cumulative inflation (as measured by CPI) over the last three years is around 14%, so Apple’s revenue pulled back by a little more than 10% in real terms over the last three years. This is not at all a strong result in absolute terms, and it also compares unfavorably versus Apple’s own track record and versus the growth performance of other Mag 7 stocks:

– Over the ten years before the 3-year period mentioned above, Apple grew its revenues by a cumulative 190%, with inflation (cumulative) coming in at 22% over that time frame. So in real terms, there was massive revenue growth in the decade between 2011 and 2021, but since 2021, Apple has shrunk in real terms. Compared to the company’s previous track record, that represents a massive deterioration.

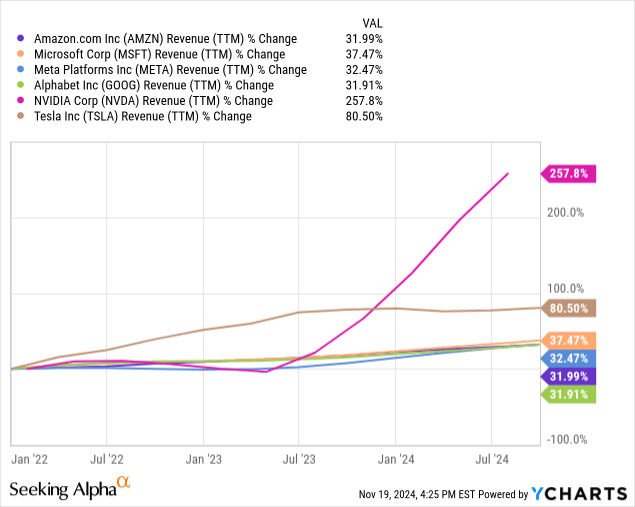

– Apple’s business growth looks quite unfavorable versus the growth seen by Amazon (AMZN), Microsoft (MSFT), Meta Platforms (META), Alphabet (GOOG)(GOOGL), NVIDIA (NVDA), and Tesla (TSLA) over the last three years, as we can see in the following chart:

NVIDIA is a massive outlier here, of course, thanks to the massive growth it has experienced with its AI data center chips. But all the others also handsomely beat Apple, with no other Mag 7 company experiencing a revenue decline in real terms — unlike Apple. Compared to its mega-cap tech peers, Apple clearly is the laggard when it comes to growing its business.

That isn’t too surprising, I believe, when we consider the following factors:

First, Apple is enormously large already. Maintaining a high relative growth rate becomes harder as a company grows in size, and Apple seemingly has hit the point where it is not able to do that any longer.

Second, most of Apple’s markets are mature. PCs are not a growth market, nor are smartphones — most that want one have one already, so there is no huge volume growth anymore. That is different for companies such as NVIDIA or Tesla, as those sell to fast-growing end markets.

Apple Is Pretty Exposed To China

Another potential reason for Warren Buffett to sell down Berkshire’s stake in Apple is the latter’s substantial China exposure. Apple is exposed to China when it comes to selling its products, but also when it comes to its supply system. While some iPhones are produced in countries such as India, most iPhones are produced in China. If a trade war between China and the US were to escalate — which seems possible under newly elected President Trump — Apple would be quite exposed, as China is essential as a manufacturing base for the iPhone, Apple’s biggest product by far.

Over the last quarter, Apple has generated around $15 billion in revenue from the Greater China area (including Taiwan, Hong Kong, and Macau), which is around $60 billion annualized. If things were to turn sour in China, Apple would thus be one of the companies with the largest exposure. A worsening real estate market in China is possible, while an escalating conflict with Taiwan is a possibility as well.

I do not believe that China is uninvestable at all, but there are risks, and those should be reflected in the stock’s valuation when a company is heavily exposed to China. With a company like JD.com (JD), that’s the case, as JD trades at less than 9x forward earnings. But Apple is quite exposed as well, with both its supply chain and since China is a huge end market, and yet that risk is not reflected in its high valuation — Apple trades at 31x forward earnings.

Apple Is Expensive And Its Balance Sheet Isn’t In Great Shape Any Longer

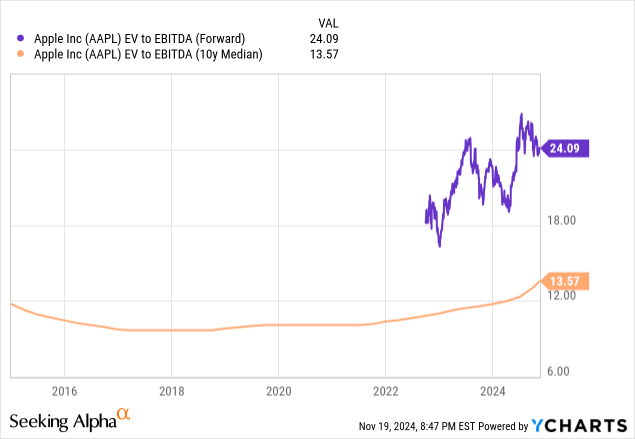

Apple’s valuation does not only seem high considering the “China exposure risk”, but it also seems high considering the weak growth performance. Last but not least, Apple is very expensive compared to how the company was valued in the past:

The above chart shows Apple’s enterprise value to EBITDA multiple for the current fiscal year, as well as the 10-year median for that valuation metric. We see that Apple currently trades at almost twice the historically normal valuation. And yet, Apple’s fundamentals do not really justify a premium valuation, I would say — Apple is growing a lot less today compared to the 10-year average, after all.

Also, Apple’s balance sheet has gotten quite a bit weaker in the recent past. As of the most recent quarterly report, Apple had $65 billion in cash, equivalents, and short-term investments on its balance sheet. On top of that, there were $91 billion of long-term investments, so Apple’s total cash, treasuries, etc. totaled $156 billion. At the same time, debt levels look like this: $10 billion in short-term debt, $11 billion for the current portion of long-term debt, and $86 billion of long-term debt. All in all, this makes for a net cash position of $49 billion, or $38 billion when we also account for capital leases. This compares very unfavorably to Apple’s net cash position a little less than a decade ago — in 2017, Apple’s net cash peaked at more than $150 billion. So two-thirds of Apple’s former net cash position has gone, mainly due to substantial buyback spending. At the time when Apple’s net cash position peaked, the company was valued at around $1 trillion, meaning net cash was equal to around 15% of the company’s market capitalization — a truly massive asset. Today, net cash is equal to roughly 1% of the company’s market capitalization, which isn’t very meaningful.

Buffett Has Good Reasons To Sell Apple

To sum things up, Apple is growing a lot less than it did in the past, it has a weaker balance sheet than it did in the past, and yet, it trades at a huge premium compared to the historic norm. That makes Apple’s shares look rather unfavorably today, I believe. Massive China exposure is a risk factor when investing in Apple as well. Whether Warren Buffett’s massive selling of AAPL is caused by these reasons or others, I believe that it is an opportune move by him to lock in gains — and other Apple shareholders may want to do the same.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!