Summary:

- Adobe is well-positioned to capitalize on digital transformation and generative AI services.

- Adobe is the top choice for content creation, consumption, and collaboration, thanks to its extensive software solutions.

- Adobe’s integrated approach sets it apart from competitors, enabling comprehensive sales across its various cloud offerings.

- I believe Adobe has an organic solution for future growth through its generative AI platform called “Firefly.”

SeanShot

Investment Thesis

Adobe Inc.’s (NASDAQ:ADBE) extensive range of software solutions has established it as the leading choice for content creation, consumption, and collaboration. In a broader sense, I believe Adobe is strongly positioned to capitalize on the opportunities presented by digital transformation. Its comprehensive and integrated end-to-end offering sets it apart from competitors and enables the company to generate more comprehensive sales across its various cloud offerings. Adobe’s new generative AI services, including Firefly, are expected to be offered through subscription plans, increasing customer spending. Adobe’s trusted reputation, emphasis on trust and copyright compliance, and long-standing investment in AI contribute to its advantage over alternative models in the enterprise market. I view the stock as buy and have an end of fiscal year price target of $566 based on a 12x EV/CY24 Sales.

Q2 2023 Review & Outlook

Adobe demonstrated strong performance in the second quarter, surpassing expectations in terms of annual recurring revenue (ARR) and margins. The guidance for the third quarter also exceeded expectations, with a modest increase in net-new ARR and a slight raise in total revenue for the fiscal year 2023. Adobe’s solid position can be attributed to achievable short-term growth targets, favorable foreign exchange movements, modest pricing advantages, and stable momentum across their Digital Media suite. I see the company’s rapid innovation and release of AI-enabled creative tools as long-term growth drivers, although the revenue impact from GenAI is not expected to be significant for several quarters.

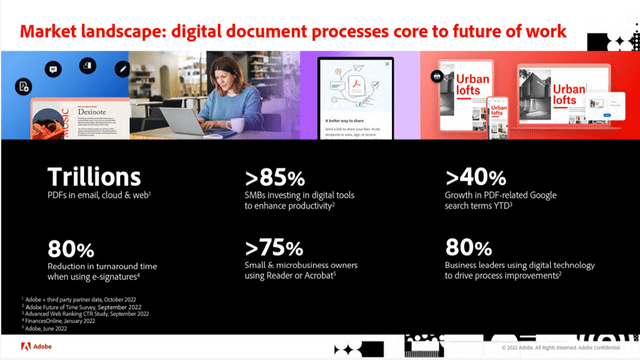

Steady Growth for Document Cloud

A steady increase in workflow digitization is key to driving growth for Adobe’s Document Cloud, and since the shift is still in its infancy in the public sector and emerging markets, I expect mid-to-high teens sales growth for the unit for at least the next three years. Premium services like e-signature and integration across Adobe’s suite of products can boost average revenue per user.

Document digitization, changing global regulations that allow e-signature for legal records and PDF leadership in electronic text are the three key growth drivers for Adobe’s Document Cloud unit. I believe Adobe’s platform approach is superior to rivals, capable of driving mid-to-high teens sales gains for the next few years. Adobe estimates that Document Cloud’s total addressable market is $32 billion, from a current revenue base of $2.5 billion, up $116 million from the past quarter.

Adobe Experience Cloud Segment Is The Largest Opportunity Long Term

Adobe’s Experience Cloud, with an annualized run rate of just $4.2 billion in sales, could be the company’s biggest expansion opportunity, given its wide array of end markets and cross-selling possibilities. Subscription growth in the segment may moderate slightly near term as larger projects continue to be deferred amid economic weakness.

The Digital Experience segment only accounts for only 25% of total sales but may be the largest untapped market and growth opportunity, given it represents a potential total addressable market of about $110 billion. Customer-experience management, Data and Insights and Content and Commerce are the cornerstones of this segment, and each could help keep subscription growth in the double digits. Though the economic environment is lengthening deal cycles and might suppress this segment’s growth to about 10-12%, I continue to believe that Digital Experience can expand 16-18% in the mid to long term.

Adobe’s Position in the AI Debate

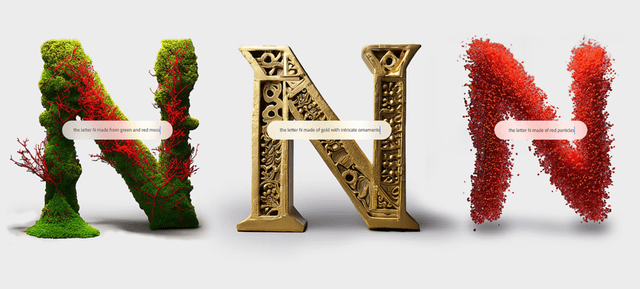

Adobe is likely to sell subscription plans for its new generative AI services, which I view as a positive way of increasing average customer spending over the long run. These products, introduced at the Adobe Summit in March, were highlighted by Adobe Firefly, a product that uses generative AI to create images from text. A differentiator from other competing generative AI products is that Firefly uses the digital assets owned by the client or Adobe, making the result ready to use without any intellectual property issues.

Despite some skepticism from those focused on traditional seat-based models, I believe that Generative AI will prove to be advantageous for content creation. Adobe is well-positioned to capitalize on early enterprise adoption due to its trusted status. Trust is a key emphasis in Adobe’s press releases and Firefly-related media materials. The platform is built around principles of trust, including model ownership, adherence to copyright laws, and proper content attribution. This is a significant differentiator in my view, driving interest and adoption at an enterprise level.

It is important to note that Adobe’s development of Firefly and its efforts in Generative AI have not been sudden. The company has been working on AI models, including generative AI, for nearly a decade through its Sensei platform. These models were trained on one of the largest available datasets for image design, which Adobe owns through Adobe Stock. Adobe Stock ensures compliance with copyright laws and appropriately compensates and attributes contributors. Adobe’s participation in initiatives like the Content Authenticity Initiative (CAI) further demonstrates its commitment to proper content attribution.

The combination of these factors is crucial, while alternative models such as Midjourney, Dall-E 2, and Canva exist in the market, none of them possess the established base of research and development, ownership of training data, and trusted reputation within enterprises that Adobe has cultivated over decades. Therefore, I anticipate that these alternatives, despite potentially having more advanced image generation engines, will struggle to gain significant traction in the enterprise space. Enterprises place a strong emphasis on security, compliance, trust, and governance, areas in which Adobe excels.

Firefly Gen AI Image Example (Company Website)

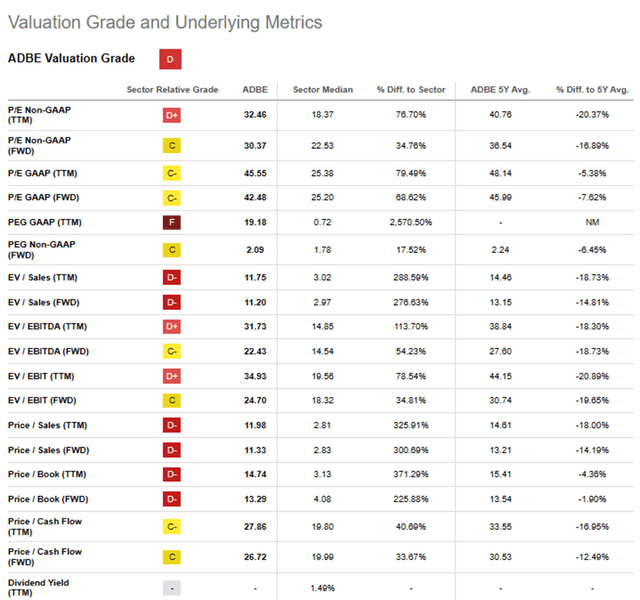

Valuation

ADBE is well positioned to gain from the rise in content consumption, the paper-to digital movement, and increasing demand for better customer experiences. Furthermore, I believe ADBE should see a significant boost from increasingly monetizing its large installed base and driving more holistic sales over time. My end of the fiscal year price target of $566 is based on a 12x EV/CY24 Sales.

Risks to Target

If Adobe fails to effectively execute in new market opportunities, it could result in slower overall revenue growth, especially considering the potential saturation of its existing offerings. Investors closely monitor Adobe’s ability to achieve double-digit year-on-year revenue growth driven by its Creative Cloud suite within its large TAM. A failure to meet growth expectations and demonstrate sustained momentum in new product areas may lead to a decline in the company’s stock value as investors might need to reassess their valuation models, considering a potentially slower long-term growth trajectory for Adobe. Moreover, given the wide range of products in Adobe’s portfolio within the creative software industry, the company faces competition from various software vendors in the digital marketing solutions space. Established players like Alphabet Inc. (GOOG), Salesforce, Inc. (CRM), SAP SE (SAP), Microsoft Corporation (MSFT), and others continue to invest in creative tools integrated with different software workflows, which could result in consolidation of enterprise-level spending. At the lower end of the market, emerging vendors like Canva, offering more competitive pricing, pose a potential threat to Adobe’s market share in the SMB segment. This is especially true if consumers opt for specialized solutions rather than a comprehensive end-to-end platform.

Conclusion

I consider Adobe to be a trusted software platform, thanks to its strong core position as the go-to toolkit for creative professionals. With the tailwinds of digital transformation and an extensive TAM related to user experience, coupled with its excellent financial profile, Adobe stands out among its peers. Despite concerns related to the Figma deal, I believe Adobe has an organic solution for future growth through its generative AI platform called “Firefly.” I view the stock as buy and have an end of fiscal year price target of $566 based on a 12x EV/CY24 Sales.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.