Summary:

- Target’s strong recovery is driven by increased customer traffic, robust digital sales, and strategic focus on private brands, despite recent stock struggles.

- The company aims to boost margins by simplifying processes and improving inventory management, positioning itself for long-term growth.

- TGT stock’s attractive valuation, solid dividend, and proven strategy make it a compelling choice for investors, even amid ongoing consumer uncertainty.

Daniel Grizelj

Introduction

It’s time to talk about a fascinating company. Target Corporation (NYSE:TGT) isn’t just one of America’s favorite consumer stocks, but also a company studied intensively by supply chain and transportation experts, as it tells us so much about the state of the consumer and the transportation industry.

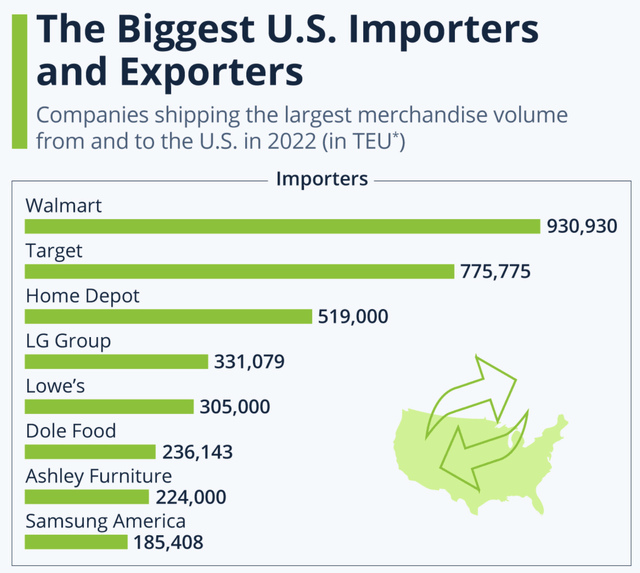

According to Statista, which used Journal of Commerce data, Target imported close to 780,000 TEUs in 2022. In this case, TEU stands for twenty-foot equivalent unit containers. Only Walmart (WMT) imported more goods.

Statista

These containers are usually filled with goods produced in lower-cost nations like China that end up in the Ports of Los Angeles, Long Beach, and others before they are shipped across the country to the company’s network of roughly 1,900 stores.

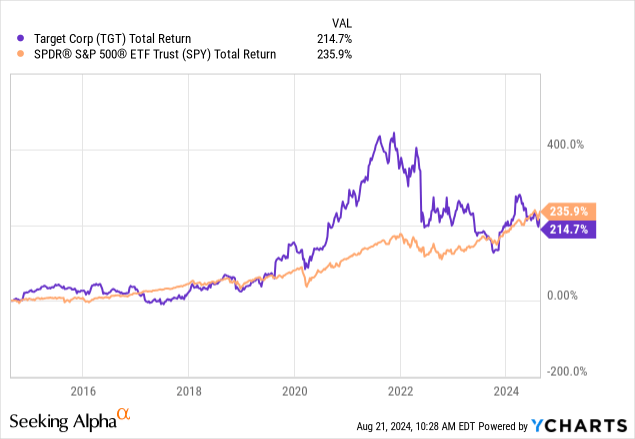

Unfortunately, while Target is a fascinating company to study, its stock price hasn’t done so well lately. After “crushing” the S&P 500 in the bullish pandemic years of 2020 and 2021, the company’s stock price has disappointed investors, pressured by poor consumer sentiment, elevated inflation, and the fact that most stores ordered too many goods when consumers were still upbeat.

The good news is that the company is recovering.

My most recent article was written on September 14, 2023. Although I did not manage to write it at the very bottom for the stock price, the stock has returned 34% since then, supported by its just-released earnings.

Target is currently up more than 12% after reporting better-than-expected earnings that came with good guidance as a cherry on top.

Hence, in this article, I’ll walk you through these numbers and explain what they mean for Target, its investors, and the economy.

So, let’s get to it!

Target Delivered When It Mattered Most

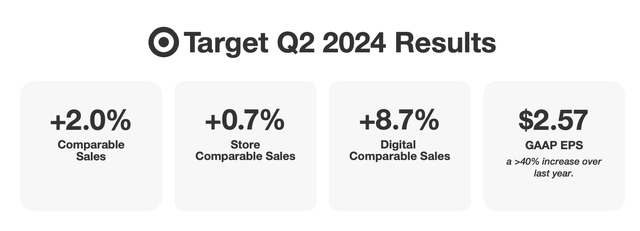

Starting with some of the most popular numbers, the company reported comparable store sales were up 2%. This was at the upper end of its guidance range.

Target Corp.

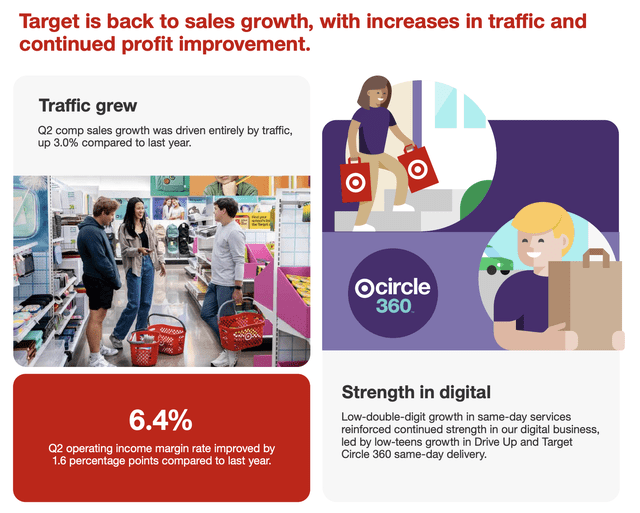

According to the company, this growth was entirely driven by increasing customer traffic, which is a good indication of the company’s ability to attract and keep customers. In general, it’s also great news for the economy, as Target’s size makes it a good economic indicator.

Traffic is also known as the number of transactions. In the second quarter, that number was up 3.0%. The only reason why comparable store sales weren’t up 3.0%, is because the average transaction amount was down roughly 1%.

In other words, while the company handled more transactions, people spent less on each transaction.

Target Corp.

On top of that, digital sales did very well. As we can see above, comparable digital sales increased by 8.7%. Target noted that value-added services like same-day services, including Drive Up and Target Circle 360, saw growth in the low teens. Even better, same-day sales now account for more than two-thirds of sales, according to the Minnesota-based consumer company.

Essentially, Circle 360 allows customers to purchase a membership for $99 (without a discount). This entitles them to free same-day delivery on orders of more than $35. This was recently tested by a “die-hard” Target fan from Business Insider.

Although the reporter did not believe the membership added a lot of value to her personal needs, the feedback confirmed why the program is successful:

However, I’m a firm believer that the free Target Circle membership is a must, even for casual Target shoppers. It gives me instant deals and cash back and has been one of my favorite store-rewards programs since it launched. So far this year, I’ve saved over $55 through the program by shopping sales and deals. – Business Insider

Beyond these services, the company’s focus on discretionary spending paid off. In the second quarter, discretionary categories like apparel and beauty did very well, with apparel comps rising by more than 3%. Same-store sales in the beauty segment grew by 9%.

Target Corp.

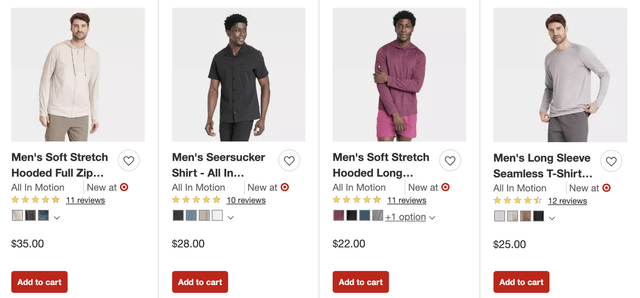

I also like that the company has pushed its private brands much harder, which gained market share in an environment where consumers are increasingly “value-conscious.” This includes brands like All In Motion and Wild Fable.

Looking at the value these brands bring to the table explains why some higher-end companies like Nike (NKE) have a hard time in this economic environment.

Target Corp.

As a result, Target is expanding this market by launching Auden, which focuses on sleepwear, including $15 bras and $20 pajama sets. It also cut prices on roughly 5,000 staples.

Before I turn this article into an ad for Target, let’s move to a key topic: operating efficiencies.

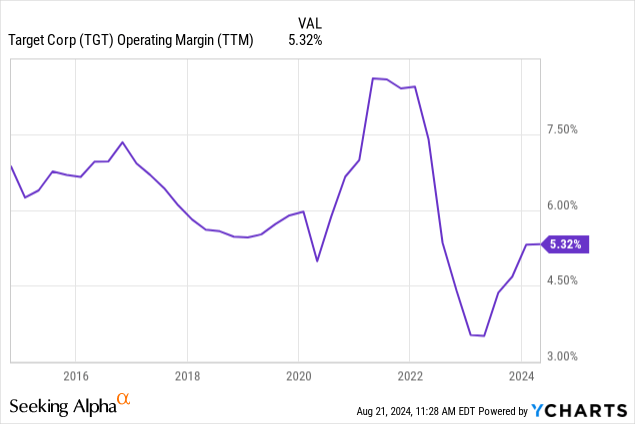

During its earnings call, the company mentioned something very important. It is looking to expand its operating margin to 6% (and beyond) on an annualized basis, a number it achieved before the pandemic hit. As we can see below, 6% wasn’t even special back then. However, when it had too many products in inventory and consumer spending slowed down, margins dropped toward the 3% range.

As one can imagine, growing margins as a retailer is very hard. The company is large and has to deal with countless suppliers of goods that all struggle with inflation themselves. It also has very limited pricing power, as it battles competitors and price-conscious consumers.

So, in order to grow margins, the company is focused on factors it can control. This includes simplifying processes.

[…] we’ll focus on simplifying processes end to end, including how our teams work together as well as with our external partners, with the goal of driving efficiencies and streamlining how work gets done. We should also be relentless in our pursuit of creativity, bringing innovative ideas to market that are original, inspiring and unmistakably Target. – TGT 2Q24 Earnings Call

In the second quarter, the company grew its gross margins by 190 basis points to 28.9%, supported by factors like a more favorable sales mix. The company also noted that lower inventory shrink added roughly 90 basis points to this improvement.

This boosted the operating income margin rate to 6.4%.

I believe the company’s better grip on inventories was a big reason why investors gained more trust in the company after its earnings hit the wire.

In general, the company was upbeat about its future. While its guidance is not spectacular, its expectations of full-year comparable store sales growth of no less than 0% is a good sign in this environment.

With these considerations as context, we’re planning for third quarter comparable sales growth in the 0% to 2% range, and GAAP and adjusted EPS of $2.10 to $2.40. And while our full year comp guidance range remains the same at 0% to 2% growth and the breadth of possibilities remains quite wide, our baseline plan for the fall season would put us in the lower half of that range for the full year. – TGT 2Q24 Earnings Call

What does this mean for shareholders?

TGT Shareholder Value

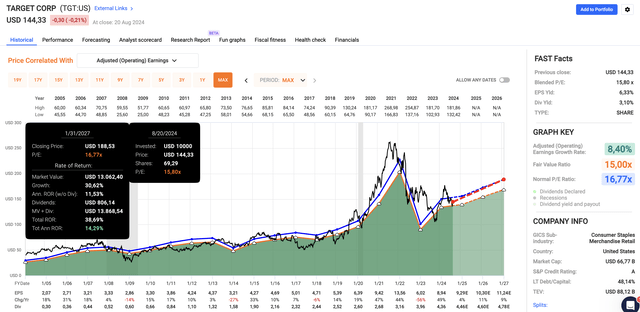

Analysts are upbeat about Target’s future. Using the FactSet data in the chart below, the company is expected to grow its EPS by 4% in the fiscal year ending January 2025. In the two years after that, growth is expected to average 10%.

FAST Graphs

As TGT trades roughly one point below its long-term average P/E ratio of 16.8x, this translates to an implied fair stock price of $188, 18% above the current price ($160).

In the weeks ahead, I expect analysts to upgrade Target’s EPS outlook, as the company has clearly proven the power of its strategy and focus on cheaper brands.

Seeking Alpha

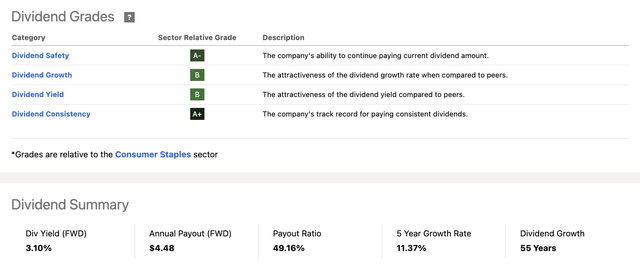

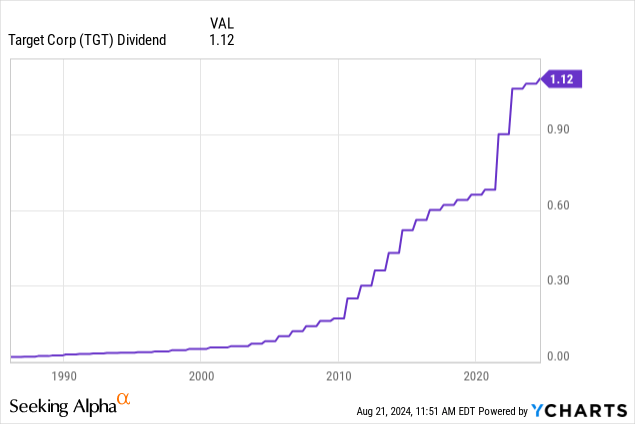

It also helps that TGT yields 3.1%. This dividend has a 49% payout ratio and a five-year CAGR of 11.4%. The company has hiked this dividend for more than 50 consecutive years, making it one of the few Dividend Kings with strong dividend growth (potential).

All things considered, I stick to a Buy rating. While I’m still downbeat on the consumer, Target has an attractive valuation and it continues to prove that its strategy works.

Even if the consumer remains under pressure, the long-term outlook for TGT remains good for dividend growth investors seeking consumer exposure.

Takeaway

Target has had its ups and downs. However, its recent financial numbers show it’s still a force to be reckoned with.

Despite challenging headwinds, the company has made a strong comeback, delivering solid same-store sales and upbeat guidance, especially considering the big picture.

With a focus on customer traffic, digital sales, and private brands, Target has proven it can adapt, potentially unlocking a lot of shareholder value.

Especially, the company’s efforts to streamline operations and grow margins are encouraging. While the consumer environment remains very uncertain, the company’s strategy and valuation make it an attractive option for long-term investors.

That’s why I maintain a Buy rating.

On a side note, as I own three railroads, I expect the good results of Target to be a good indication of tailwinds in intermodal growth – especially international intermodal, as it looks like industry-wide de-stocking is over.

Pros & Cons

Pros:

- Strong Recovery: Target has bounced back, with better-than-expected earnings and solid guidance. This signals the strength and a successful strategy.

- Customer Traffic & Digital Growth: Increased customer traffic and strong digital sales, especially in same-day services, support Target’s ability to attract and retain customers.

- Attractive Valuation: Trading below its historical P/E ratio with a solid dividend yield, Target offers compelling value for long-term investors.

- Operational Efficiency: The focus on improving margins and simplifying processes is driving profitability.

Cons:

- Consumer Uncertainty: The broader consumer environment remains fragile, which could have a negative impact on Target’s sales growth and margins.

- Margin Challenges: Despite efforts, sustaining and growing margins in a competitive retail landscape is tough, especially with inflationary pressures on suppliers and limited pricing power.

- Inventory Risks: Previous overstocking issues have hurt the company’s performance. Any missteps in inventory management could hurt margins and disappoint investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.