Summary:

- DiDi Global, China’s largest ride-hailing company, has steadily regained its footing after a tumultuous period of regulatory scrutiny and delisting.

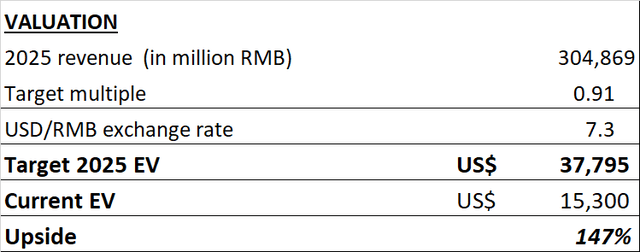

- Despite positive business fundamentals, DiDi’s stock price remains undervalued, with an upside potential of 147% based on EV/Sales metrics.

- DiDi’s turnaround is attributed to the reinstatement of its app on domestic app stores, resulting in a rebound in market share and significant financial progress.

Sanya Kushak/iStock via Getty Images

Investment Thesis

DiDi Global (OTCPK:DIDIY) is China’s largest ride-hailing company. After experiencing the perfect-storm of regulatory crackdown in 2021 and a delisting in 2022, DiDi has started to regain momentum since 2023 as both regulatory environment and competitive environment have improved dramatically. Yet Didi’s stock has not reflected the positive changes in business fundamentals. I believe DiDi is significantly undervalued with an upside potential of 150% based on EV/Sales metrics. Accordingly, I assign a “strong buy” rating to DiDi.

What went wrong for DiDi?

According to DiDi’s IPO prospectus, DiDi was founded in 2012 as the “Chinese Uber app”. It acquired its major competitor Kuaidi in 2015 as well as Uber China’s operation in 2016, thus becoming China’s dominant ride-hailing player. The company then started global expansion in 2018, mostly in Asia, Africa and Latin America.

Everything was going smoothly for DiDi until its botched IPO plan. It was reported that the Chinese government suggested DiDi to delay its IPO because of data leakage concerns. However, faced with enormous pressure from Didi’s investors, Didi’s management went ahead with the planned IPO without properly noticing the Chinese government, which angered the Chinese government.

DiDi was listed on the New York Stock Exchange at the end of June of 2021. Ironically, for DiDi, the U.S. IPO marked its peak. Didi’s market capitalization peaked at more than $87 billion on the day of IPO. Merely two days after Didi’s IPO, the Chinese government cracked down on DiDi. Specifically, the Cyberspace Administration of China announced the launch of a cybersecurity review on DiDi and subsequently removed DiDi’s app from app stores in China.

In November of 2021, it was reported that the Chinese government told DiDi to devise a plan to delist from the New York Stock Exchange. Subsequently, in June of 2022, DiDi delisted from the New York Stock Exchange and moved to the pink sheet.

The above sequence of events led to DiDi’s almost 80% decline in market value since its IPO.

DiDi‘s turnaround

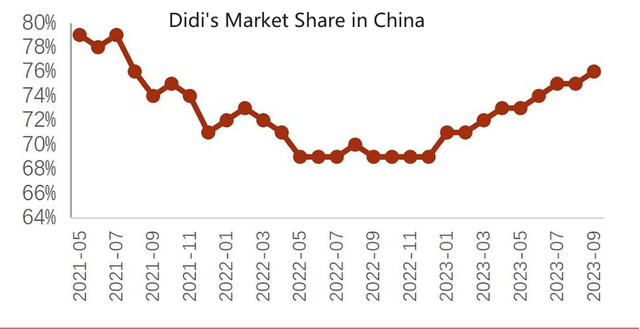

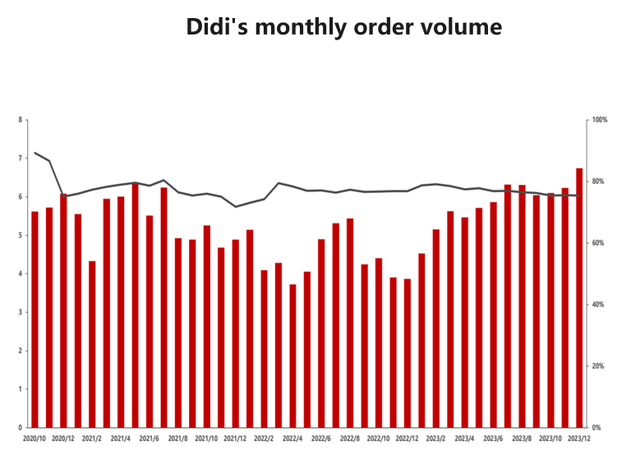

DiDi was seriously tested after the Chinese government removed its app from the domestic app store. Prior to Didi’s exclusion from China’s domestic app store, Didi’s market share in China’s ride-hailing market has been consistently above 80%. During the 18-month period of time when DiDi was removed from the app store, various platforms such as Alibaba’s Amap, Meituan, and T-3 have all tried to take market share from DiDi. Their success is very limited, to say the best. At the lowest point, Didi’s market share dropped to 69%, still much larger than Didi’s competitors.

DiDi’s turnaround started in January 2023, when Reuters reported that the Chinese government had granted permission for the company’s app to return to the domestic app stores. Since then, DiDi has continued to regain market share. Didi’s monthly order volume has also picked up, exceeding the level it reached before the app store ban.

Ministry of Transportation, Minsheng Securities

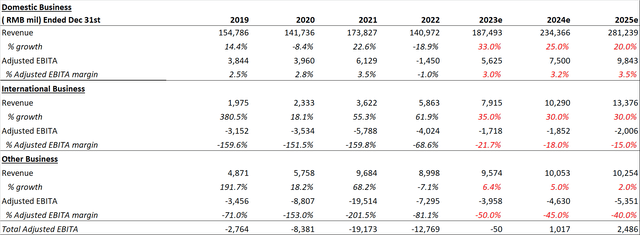

DiDi’s improving operating metrics have translated into improving financial metrics as well. In the first nine months of 2023, the company reported that the domestic ride-hailing business experienced revenue growth of 33%. Adjusted EBITA margin for the segment has turned from -1% in 2022 to almost 3%.

DiDi improving financials extend beyond the domestic business. Its international ride-hailing business and other business have cut losses significantly. For the first nine months of 2023, Didi’s international business segment adjusted EBITA margin improved to -21.7%, compared to -68.6% for FY 2022. The adjusted EBITA margin for other businesses improved from -81% to -50.5%.

Financial projections and valuation

In my model, I assumed that the DiDi’s domestic revenue will grow 33% in 2023, consistent with the growth rate for the first 9 months of 2023, and level off gradually to 20% in 2025. I also assume that DiDi can improve its adjusted EBITA margin to its 2021 level of 3.5% in 2025. For the international business, I assumed that Didi’s revenue can grow at 30% for the next two years, which is conservative because Didi’s international business has grown at a much faster speed in the past (62% in 2022 and 55% in 2021). The adjusted EBITA margin for Didi’s international business is very likely to go up because of the revenue growth. Combining these assumptions, I arrive at my own estimate of Didi’s 2025 adjusted EBITA of RMB2.5 billion.

When it comes to valuation, I have applied a TTM EV/Sales multiple of 1.09 times, which is approximately 50% of the sector median of 1.81 times. This discount reflects the fact that DiDi is a Chinese ADR and trades on the pink sheets.

author’s estimate

Based on these assumptions and valuations, DiDi could potentially more than double from the current price within the next two years.

Risks to consider

The biggest risk to DiDi is still regulatory risk, given DiDi owns vast amounts of data of Chinese citizens. DiDi can be the target of another crackdown if Didi’s management don’t behave properly in the future.

The second risk to DiDi is the possibility of larger-than-expected loss in the international business segment and other business segment. If DiDi can’t continue to improve profitability in these two segments, it will fall short of investors’ expectations in terms of adjusted EBITA, which will then lead to lower valuation.

The last risk to consider is the liquidity risk as DiDi trades on the pink sheet with very low trading volume. It’s also a Chinese ADR, which unfortunately means more volatility.

Conclusion

DiDi went through two years of adverse environment after a botched IPO attempt and a crackdown by the Chinese authorities. As DiDi made peace with the Chinese government, it has re-emerged as the dominant player in China’s ride-hailing market. However, Didi’s stock is trading at a significant discount to its global peers with huge upside. Therefore, I am giving DiDi a “strong buy” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIDIY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.