Summary:

- Exela reported Q4 results highlighted by continued weakness in sales and earnings.

- Management believes operating conditions can recover to pre-pandemic levels supporting a more positive outlook for the year ahead.

- Recognizing the potential for a turnaround story, Exela’s weak balance sheet with high levels of debt may limit upside in the stock.

Exela Technologies Inc. (NASDAQ:XELA) develops business process automation “BPA” software targeting a diverse mix of industries. The solutions here include everything from an enterprise-level finance suite integrating procure-to-pay “P2P” and order-to-cash “O2C” workflow tracking, healthcare industry insurance claims processing, to a digital-mailroom correspondence management tool. While an ongoing transition to focus on its digital strategy along with disruptions last year due to the pandemic has pressured sales and earnings, the company just reported its latest quarterly result highlighted by encouraging growth in its digital asset group with positive guidance from management. We see a potential turnaround story emerging as the operating environment normalizes, but remain cautious on the stock as the high balance sheet debt level likely limits upside in the stock from the current level.

(Seeking Alpha)

XELA Earnings Recap

Exela Technologies reported its fiscal 2020 Q4 results on March 16th with a net loss of $88.9 million representing negative EPS of ($1.82). Revenue of $314 million in the quarter declined 20.2% year over year, although 3% higher compared to Q3. The silver lining here is that quarter revenue was slightly above management’s prior guidance range between $300-$310 million.

Still, the headline figures don’t tell the whole story, as the company has been undergoing a strategic shift going back to the end of 2018 when it announced the exit from certain business lines described as low-margin along with some asset sales reflected in ongoing restructuring expenses. The efforts have been made to make the business more sustainable with higher profitability potential. The COVID pandemic in 2020 added a separate set of pressures on the business considering some customers pulled back on making investments to process automation tools, particularly in areas that relate to office environment-type workplaces.

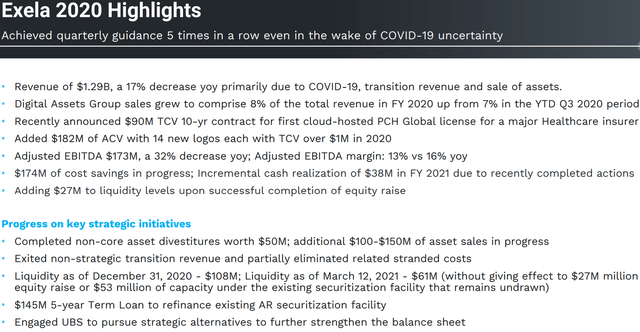

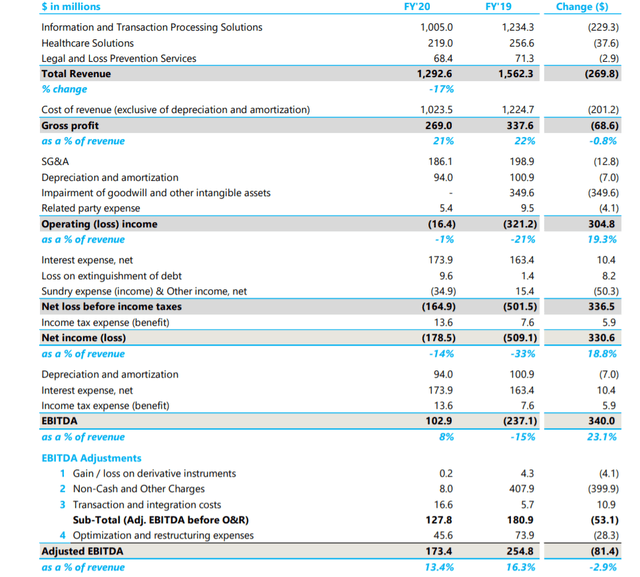

In this regard, there wasn’t much to be excited about in what was a difficult 2020. Full-year revenues declined by 17% y/y with lower results from each of the three operating segments compared to 2019. Some efforts at cost-cuts including a 6% lower SG&A helped to narrow the operating income loss.

Keep in mind that the 2019 results last year included an impairment charge of $350 million to goodwill and other intangible assets which was reviewed as part of the company’s restructuring. A portion of the amount was related to the 2017 merger with SourceHOV Holdings, Inc. and Novitex Holdings, Inc. that simply did not generate the value as expected over the period. The adjusted EBTIDA margin for 2020 at 13.4% declined from 16.3% in 2019 which excludes the non-cash charges.

(source: company IR)

(source: company IR)

What management is focusing on is the more positive momentum among its new products and services related to the ‘Digital Assets Group’ where sales climbed to represent 8% of the total business in 2020, up from 7% in Q3. An important metric for the company is the new business contracts as a percentage of revenue have remained in-line with historical trends, implying the Exela brand maintains momentum in the market with clients recognizing the value and attraction of the platform. In Q4, the company added $60 million in new annual contract value, up from $30 million in Q3 and $38 million in Q4 2019.

(source: Company IR)

One area that has been positive is the “PCH Global” healthcare industry end-to-end processing of insurance claims and multi-channel correspondence. PCH Global is a cloud and on-site analytics solution able to manage the entire workflow sending out invoice notices while managing the data. To get a sense of how this product works, a typical healthcare event will generate several notices and transaction data relevant for multiple parties including the provider, insurance company, patient, and member network. This month, Exela just announced a new 10-year, $90 million contract with an undisclosed “major U.S. healthcare company” representative of the potential in this segment.

The company ended the year with $70 million in cash against $1.5 billion in long-term debt. Considering the adjusted EBITDA of $174 million in 2020, the effective net debt to adjusted EBITDA leverage rate is at 8.6x. This is an objectively high level but expected to improve through 2021 as operating and financial conditions normalize. It’s worth noting that Exela recently raised $27 million through an equity offering to support liquidity.

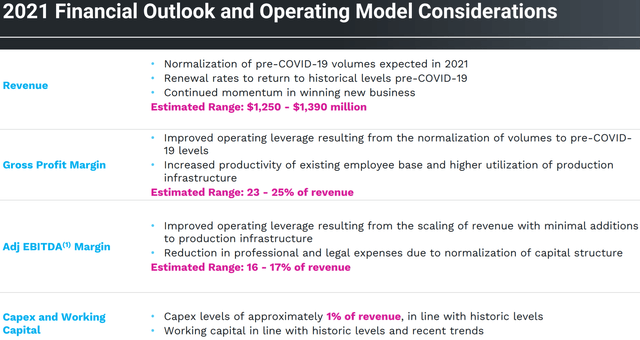

As it relates to guidance, management is targeting 2021 revenue between $1.25 billion and $1.39 billion. At the midpoint, the estimate represents an increase of 2.1% over the 2020 result. Much of this stabilization can be driven by operations recovering to pre-COVID levels in terms of sales volumes. The gross margin guidance between 23% and 25% compares to 21% achieved in 2020. From there, adjusted EBITDA forecast between 16% and 17% of revenue, implying around $218 million or 26% higher than last year. Management believes it can gain some benefits through high productivity while building momentum with new business.

(source: Company IR)

Analysis and Forward-Looking Commentary

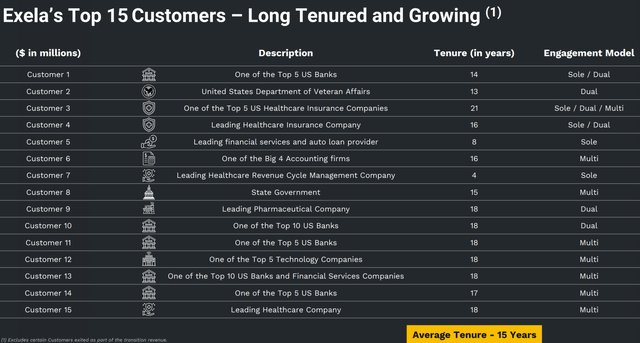

Acknowledging the relatively weak fundamentals as it relates to financial results and balance sheet position, it’s important to recognize that Exela with an equity market value of just $130 million is still a major company that generated over $1.2 billion in revenue last year with an infrastructure that includes over 21,000 employees operating in 23 countries. Exela counts on major global corporations and public sector entities as key clients using its products and there is an expectation that a good portion of this revenue has long-term visibility with renewals expected going forward. Among the top 15 customers, Exela notes that the average relationship is 15 years with engagements across several products. The point here is that the business is real and has an intrinsic value given the underlying cash flows.

(source: Company IR)

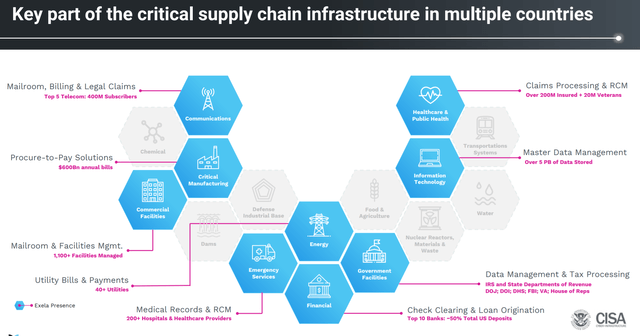

At its core, Exela helps customers digitize processes and transition into cloud-based applications. The software solutions with applications for various sectors represent critical aspects of supply chain infrastructure in what the company believes is a $207 billion total addressable market. Exela being able to simply capture an incrementally larger portion of that pie can represent a significant growth opportunity for the company.

(source: Company IR)

The key for Exela will be able to stabilize revenues around its core strengths and focus on growth opportunities this year. If we take management’s guidance at face value, the outlook is for a transitional year with improving metrics setting up a more positive long-term outlook.

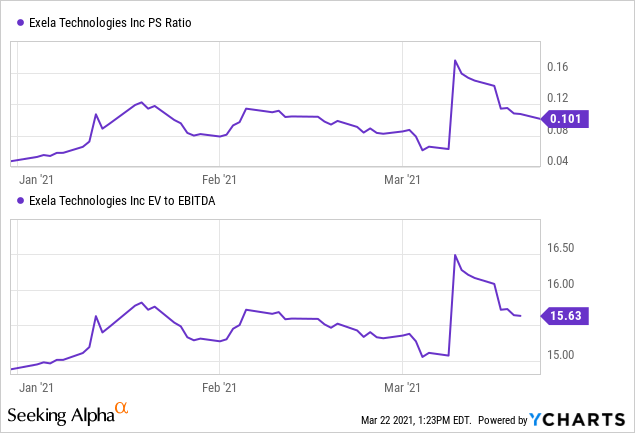

The company’s debt level concerns us and even at the high end of management’s 2021 adjusted EBITDA guidance, the net debt to adjusted EBITDA leverage ratio for the year ahead at 6.4x remains uncomfortably high. Shares of EXEL are discounted in the market given the balance sheet weakness along with the recent pattern of declining revenues, soft margins, and recurring losses.

While the price to sales ratio of 0.10x stands out as potentially “cheap” considering a market cap in the stock at just $125 million, the company’s enterprise value that includes its long-term debt at $1.6 billion highlights the underlying structural issues. A current EV to EBITDA level of 15.6x or 6.8x on a forward basis to management’s upper range 2021 EBITDA guidance is not necessarily attractive. Oftentimes, these multiples can be justified if the growth outlook is exceptional or there are signs of surging profitability which is not the case here.

Final Thoughts

We believe Exela is taking the right steps to improve its outlook. 2021 will be an important year for the company to convince the market its strategy works. The context here is that shares are up over 125% in 2020, likely already capturing some of the positives with an expectation that conditions can stabilize. We expect gains to be more limited going forward and rate shares of XELA as a hold with a year-end price target of $3.00. Our take is that it’s simply too early to bet on a type of growth “renaissance” that would be required to effectively reverse the balance sheet weaknesses.

The risk here is that the company fails to gain operating traction and upcoming quarterly results are weaker than expected. Disappointing sales trends would force a reassessment of the company’s going concern and likely lead to renewed bearish sentiment towards the stock. Monitoring points included cash flow levels and margins which will be important for the company to maintain elevated.

Analyst’s Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.