Summary:

- Intel Corporation’s market capitalization has dropped over 35% YTD, despite progress on 5 nodes in 4 years to compete with TSMC.

- Intel’s financial performance remains strong with revenue and EPS growth, positioning the company for future success.

- Intel’s reputation has suffered from crashing CPUs, but the company’s outlook shows potential for growth and value as an investment.

FinkAvenue

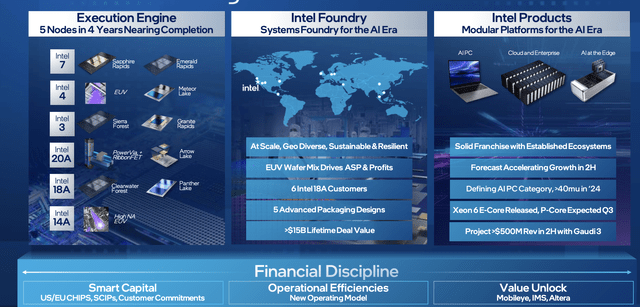

Intel Corporation (NASDAQ:INTC) has had a rough year, with its market capitalization dropping more than 35% YTD. That’s despite a strong core portfolio as the company continues to move forward on 5 nodes in 4 years, to become competitive with TSMC (TSM) again, while building its own processors on TSMC nodes to hedge against a downturn. As we’ll see throughout this article, this weakness makes Intel a valuable investment.

Intel Overview

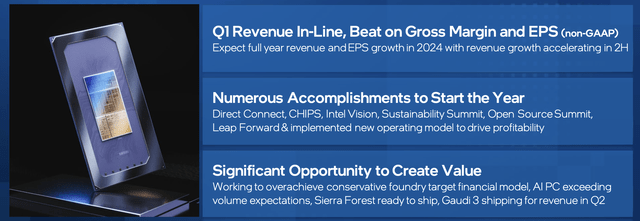

Intel has continued to work hard on executing its lofty set of goals.

The company’s Q1 revenue was in-line, but the company’s efficiency has enabled it to beat in both gross margin and EPS. The company expects FY 2024 revenue and EPS growth, and it’s continued to move towards its growth. After an atrocious end to the 2010s, 2024-2025 are the years of truth for Intel, and the company’s investors are expecting it to underperform.

The company has had numerous accomplishments, and we expect it to create value with its new foundry model, enabling it to have strong vertical integration. The company stands to benefit substantially from the growth of AI and its fully integrated model.

Intel Transformation

The company is working to transform its portfolio as its ambitious 5 nodes in 4 years, nears completion. The company has been supported by the U.S. desire for strong, homegrown talent.

The company is expected to start shipping Arrow Lake as a 20A processor in 2024. That represents Intel’s 15th generation, with 13 SKUs including a full Desktop line. The line is expected to reach towards 24 cores with 125W of power. It’s the company’s second to last node, and launching it competitively in 2024 is important.

TSMC is expected to launch its 2 nm chips in 2025, and if Intel can launch a competitive chip it might finally reclaim parity with TSMC, which would be enormously critical for the company’s future ambitions. Rumors are that Samsung continues to struggle with its 3 nm node and yield rate, but it is also competing for 2 nm.

TSMC has announced that it believes its 2 nm mode will outcompete Intel’s 18A node. Intel’s 2 nm node is expected to be a breakthrough with RibbonFET GAA transistors and backside power delivery. The node could be a breakthrough for what’s been a tough time for the company since its 10 nm node, but that remains to be seen.

Intel Financial Performance

The company’s financial performance remains reasonable given the fact that the company is in one of its toughest periods.

The company saw 9% YoY revenue growth and is staying roughly flat with its January outlook. The company earned $12.7 billion in revenue with a 45.1% gross margin. That’s substantial YoY gross margin growth, above the company’s outlook. That’s the kind of margin that will enable the company to drive substantial returns.

The company saw strong positive EPS of $0.18 / share, or ~$0.75 annualized. For a company trading at just under $33 / share, that’s a P/E of ~44 which is a relatively low P/E given its growth potential. The company’s ability to generate strong returns in a difficult time is exciting for its ability to grow its return even further.

Intel Outlook

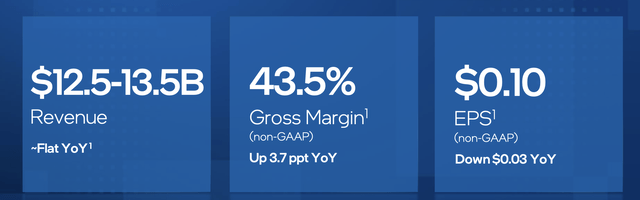

Intel’s outlook is for continuing strong financial performance and YoY improvements for the company.

The company expects roughly flat revenue YoY with ~$13 billion in revenue. The company is expecting 43.5% in gross margin, up 3.7% YoY, however, EPS is expected to be roughly $0.1 / a slight YoY decrease. Still, maintaining a strong gross margin with flat revenue is important, and the company’s outlook shows its overall financial strength.

The company’s outlook shows its ability to continue performing well in a tough market.

Intel’s Crashing CPUs

There is a new dynamic that’s occurred. The company’s reputation has obviously struggled with the 10 nm issue, and the company needs to do whatever it can to redeem that.

Intel’s 13th and 14th generation CPUs are crashing. The reasons are still under investigation, but the root cause appears to be tracing down to both a potential node contamination in 2023 along with the P and E-cores sharing the same high voltage lines, which is overwhelming the CPUs. However, the company is still tracing down the root cause of the issue.

There’s some potential FW fixes, however, part of the guidance also appears to be that already crashing CPUs can’t be repaired. Discussions on various threads are already heated, including Intel honoring their warranty, but the company has made minimal states about future steps.

What happens remains to be seen, but it’s clear that, given the company’s already weak reputation, it needs to make a stand here and quickly make customers whole. A mistake here could hurt years of progress.

Our View

Intel has a market capitalization of roughly $140 billion, making it substantially smaller than some foundry peers such as TSMC. It’s also dramatically smaller than other companies such as Nvidia. The company is also protected by the U.S. desire to have a strong manufacturing domestically for critical technology.

That’s highlighted through the $8.5 billion that the company is earning from the Chips Act. The company is in one of its most difficult periods and has continued to earn strong cash flow. The company can drive substantial returns as it reclaims its competitive dominance, and 2024-2025 is an enormous time for that.

The company appears to have realized its mistakes and is acknowledging them. Its low market cap means substantial upside should the company become competitive again, making it a valuable investment.

Thesis Risk

The largest risk to our thesis is that Intel needs to deliver. The company has laid out ambitious goals and while it’s currently on track, the truth will be in the pudding when it releases products to customers and shows an ability to generate volumes and shareholder returns. That’s worth paying close attention to over the next year.

Conclusion

Intel has worked hard to fix its portfolio after its 10 nm struggles. The company is working through its 5 nodes in 4 years plan and 2024-2025 are the key years to show that the company can once again regain parity with both Samsung and TSMC. That’s especially true as artificial intelligence continues to increase demand for cutting-edge chips.

The company’s financial position remains reasonable, as the company has a P/E of ~44. The company’s revenue remains relatively strong and profits remain strong as well. The company needs to invest heavily in capex, with capital spending at $24 billion annually. The company’s recent node issue might need to hurt its reputation, though, and has to be handled tactfully.

Still, the company is undervalued and has the ability to drive strong returns before its reputation is fixed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.