Summary:

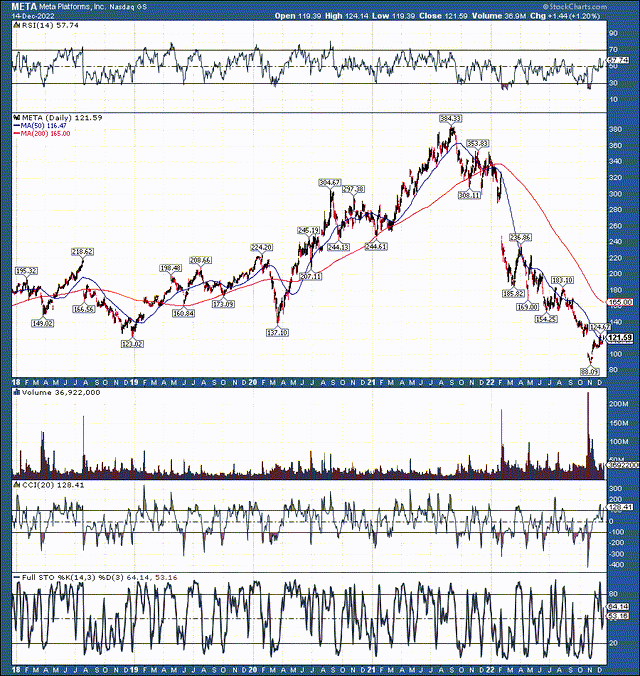

- Meta’s stock recently dropped to a low not seen since 2015, which is still 70% below its ATH in 2021.

- A challenging macroeconomic environment and other transitory factors caused Meta’s revenue growth to slow and earnings to decline.

- However, growth and profitability should improve when the downturn passes.

- Also, while the company’s expenses have increased due to its bet on the Metaverse, the investment should pay off in the long term.

- Meta’s stock is too cheap to pass up here, and shares should appreciate considerably as the company advances.

Tatiana Antonenko

The last time we discussed Meta Platforms (NASDAQ:META), the stock dropped below $100 for the first time in years. I added to my Meta position at around $97 around there. However, the stock went on to form a low below $90, dropping to its lowest price since mid-2015. The challenging macroeconomic environment, increased spending, a slowdown in ad revenues, and other transitory factors have caused Meta’s growth to slow and profitability to decrease in recent quarters. However, Meta’s growth and profitability issues appear temporary and are correlated with the current economic downturn. Once the economy stabilizes, ad revenue should improve, leading to increased growth and higher profitability. Oh, and that Metaverse project that Meta has been pouring tens of billions of dollars into should pay off.

Meta: 5-Year Chart

The decline in Meta’s stock has been brutal, dropping from an ATH of around $384 to just $88. This mega drop represents a decline of 77%. The same goes for the company’s market cap, where wealth destruction has been epic.

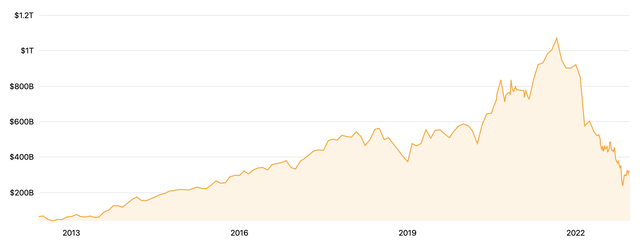

Meta (Facebook) Market Cap

Meta market cap (companiesmarketcap.com)

We’ve seen a significant drop from Meta’s $1.07T valuation at its high in 2021. The fall represents a 78% peak-to-trough decline, and Meta’s current market cap of merely $322 billion is still 70% below its ATH. We need to go back to 2015-2016 to see similar metrics.

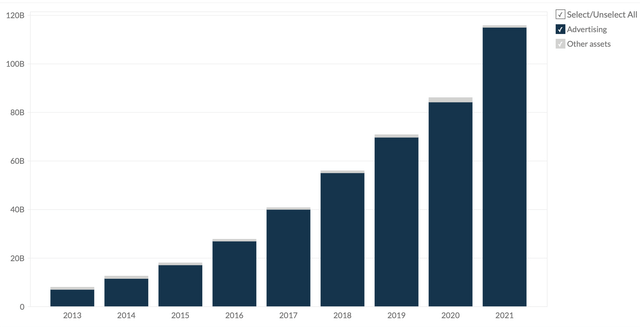

Meta’s Revenue and Profit Progression

Meta financials (SeekingAlpha.com)

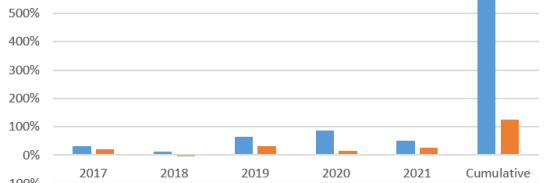

In 2015, when Meta’s market cap was akin to the recent low, the company provided $18 billion in revenues. Meta’s revenues for the TTM are $118 billion, 555% above its 2015 sales figures. Gross profit has increased to $95 billion compared to just $15 billion in 2015. Also, Meta has a remarkably high 80% gross margin for its TTM.

So, Where is All The Money Going?

Expenses: Going Through The Roof

Meta’s expenses (SeekingAlpha.com )

Operating expenses reached more than $59 billion for the TTM period. R&D ballooned to a staggering $32 billion. What can the company spend $32 billion on over the last 12 months? It’s primarily this thing called the Metaverse, which we’ll talk about later. However, with costs of around $10 billion a quarter, this project must pay off in the long run. Otherwise, the company is burning cash in a bottomless pit. Also, we saw the SG&A costs rise to roughly $27 billion TTM. Yet, the company recently cut its workforce by approximately 13%, addressing the issue. Lower SG&A costs should enable the company to cut expenses and improve operating costs in future quarters.

What is The Metaverse?

The Metaverse is a fascinating concept and is already here in many ways. The Metaverse is an evolution of the internet that incorporates advanced technologies, creating a more enhanced user experience. We have virtual and augmented reality and other aspects of the Metaverse today. The Metaverse is an expansive, virtual, parallel universe that could ultimately attract billions of users. The applicable market includes gamers, social media users, online daters, virtual world explorers, and more. Provided that people spend a great deal of time immersed in their technologies, there is significant ad and other revenue growth potential in the Metaverse space.

Meta and other companies are investing billions of dollars into the Metaverse project to build the infrastructure and create a platform for which this future internet can take off. The first companies and those investing the most and wisest will ultimately be the winners. Other top companies investing big now to own the Metaverse are Alphabet (GOOG) (GOOGL), Microsoft (MSFT), Nvidia (NVDA), and others.

Surprisingly For Many, The Metaverse Should Pay Off

Meta has burned a good deal of cash exploring the Metaverse. However, the company develops the software and hardware elements required for the project to advance. Meta is pioneering and should have a prime position in the Metaverse space as the next wave of the internet takes off in future years. Therefore, while the company’s R&D investments seem extreme now, spending should stabilize. More importantly, Meta’s investments in the Metaverse project should pay off, leading to significantly higher revenues and increased profitability in future years.

Meta’s Revenue Projections

Revenue estimates (SeekingAlpha.com)

Meta, like many companies, is going through a transitory slowdown phase due to challenging macroeconomic elements and other temporary factors. However, once the economic downturn concludes, Meta should continue increasing revenues.

Meta’s Past Revenues

Meta revenues (Businessquant.com )

We saw significant revenue growth from Meta in recent years as the company continues dominating the social media ad revenue space. Last year, the lion’s share of the company’s revenues, roughly 99.4%, came from advertising. The current economic slowdown is forcing many companies to cut down on ad spending, causing Meta’s revenue growth to slow. Nevertheless, ad spending should improve once the slowdown passes, and Meta’s revenue growth should increase.

In 2021, Meta’s revenues surged by 35%, but the company’s revenues may come in about flat YoY in 2022. Consensus revenue estimates for future years have come down by 15-20% over the last six months. However, the market may be underestimating Meta’s growth potential, and consensus figures may be skewed too much to the downside now. Revenue growth may accelerate to 10-15%, higher than the projected 5-10% in future years. Moreover, Meta could deliver higher profitability than current consensus estimates suggest.

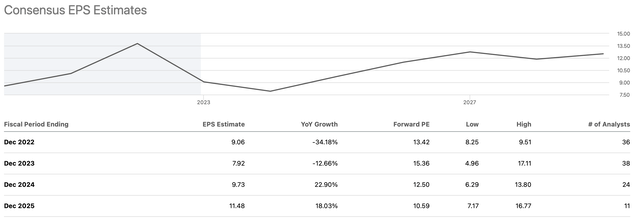

Meta’s Earnings Could Surprise

EPS estimates (SeekingAlpha.com )

Meta’s earnings estimates are all over the place due to the recent volatility. However, as ad spending improves, R&D spending mitigates, and the company’s SG&A costs decrease, Meta should become increasingly profitable in future years. Therefore, the earnings drop may not be as severe as current consensus estimates envision. 2022 may be the low point concerning Meta’s EPS, and moderate EPS growth in 2023 could elevate earnings to around $10-$12 per share next year. We may also continue seeing 15-20% EPS growth beyond 2023 in future years.

What Meta’s financials could look like in future years:

| Year | 2022 | 2023 | 2024 | 2025 | 2025 | 2027 | 2028 |

| Revenue Bs | $120 | $138 | $157 | $178 | $199 | $221 | $243 |

| Revenue growth | 1.7% | 15% | 14% | 13% | 12% | 11% | 10% |

| EPS | $9.50 | $11 | $13 | $15 | $18 | $21 | $25 |

| Forward P/E | 11 | 15 | 17 | 18 | 17 | 16 | 15 |

| Stock price | $120 | $195 | $255 | $324 | $357 | $400 | $450 |

Source: The Financial Prophet

Modest revenue growth can enable Meta to double revenues by 2028. Moreover, relatively modest earnings growth of 15-20% can bring EPS up to approximately $25 in 2028. While a higher P/E ratio may materialize, even a 15-18 forward P/E ratio can significantly increase Meta’s stock price in the coming years. My 3-5 year price target for Meta remains in the $350-$500 range.

Risks to Meta

While I am bullish on Meta’s future, some analysts aren’t. There is skepticism that the Metaverse will pay off in the long run. Meta has invested tens of billions into the concept and has a lot of burnt cash to answer for. Moreover, there is a concern that Meta will continue burning money on the Metaverse without recouping its investment in the long run. There are also concerns associated with sustainable growth in its ad business and other risk factors. Therefore, Meta’s revenue growth could be slower, and its profitability may be less than projected. Investors should consider these and other risks before committing to a Meta investment.

Disclosure: I/we have a beneficial long position in the shares of META, GOOG, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long a diversified portfolio with hedges.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2021 return 51%), and achieve optimal results in any market.

- Our Daily Prophet Report provides the crucial information you need before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!