Summary:

- 2023’s tech rally has cooled, creating opportunities in formerly overbought stocks like Tesla, Inc.

- Technical indicators show mixed signals, with potential for another bout of selling.

- Seasonality suggests potential for higher Tesla prices in October and November, but short-term concerns about margins and valuation remain.

Xiaolu Chu

The tech rally of 2023 has cooled significantly, and that has created new opportunities in a lot of stocks that were massively overbought earlier this summer. I firmly believe we’re going potentially a lot higher into year-end, so I see this selling as a blessing.

One such name that has sold off is perennial growth stock favorite Tesla, Inc. (NASDAQ:TSLA), which had a pullback of about 90 bucks from July to August, and has since recaptured about half of that. While the outlook for the stock has improved, I can’t be completely sure it’s out of the woods just yet. However, heading into the end of the year, I’m looking for a new high above $300.

The last time I covered Tesla, I said it was almost time to buy the stock. I feel pretty much the same way now, as I think we have a murky couple of weeks in front of us, but then I’m extremely bullish leading into year-end.

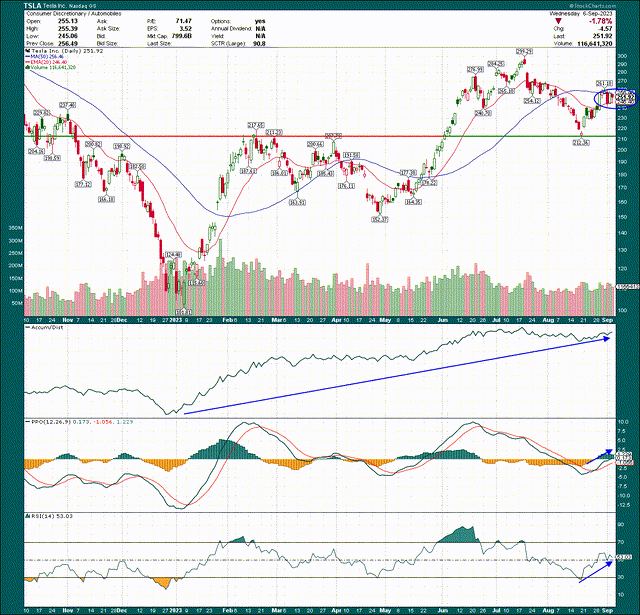

Bounce creates a mixed bag technically

We can see the selling that punished the stock ended at $212 in mid-August, a level that is no accident; that was prior support from earlier this year, and the bulls stepped in at exactly the right time to defend the stock. Since then, we’ve seen heavy buying and a rapidly improving momentum picture.

The 14-day RSI is above the centerline, and the PPO is as well. Both of those are good signs for Tesla bulls, but I’m not totally sure we’ve seen the end of the selling just yet. First, the RSI and PPO both reached oversold levels in August, which is not indicative of a strong bull advance. Second, we can see that the momentum indicators are running into areas of resistance, indicating a weakening bullish momentum picture.

Third, the zone of congestion I circled on the price chart shows recent trading activity, the still-declining 50-day simple moving average, and the rising 20-day exponential moving average. We need the shorter line over the longer line to help confirm the bull move, and we need price to clear that 50-day SMA convincingly. Until those things happen, Tesla is vulnerable to another bout of selling. It’s possible the stock just blows through all of that and goes higher, but that’s not my base case at the moment.

Now, so long as selling is contained above $212, there will be no harm done. And, assuming we get another move down at all, I suspect we’ll see a higher low above $212, which would help build confidence Tesla is soon to be off to the races higher.

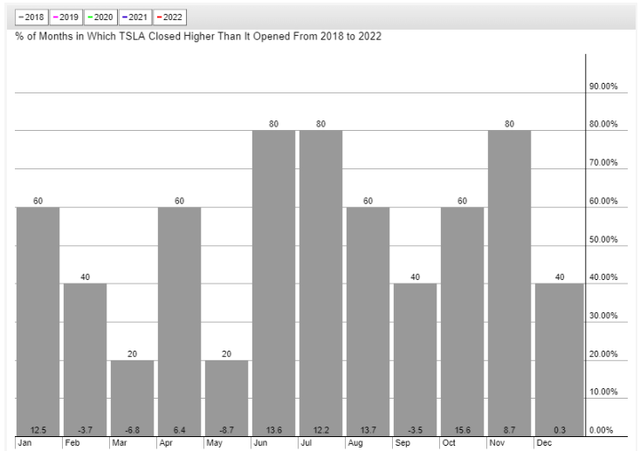

Why do I think that? Seasonality is about to be a massive boost for Tesla. This is the past five years of data per month, showing the percentage of the time the stock finishes the month higher than where it started, with annualized returns list for each month on average.

September is weak, although modestly so. However, October has produced average annualized returns of 16%, with a further 9% in November. If Tesla trades lower in September and makes a higher low, look out above in October and November.

Let’s now take a look at the fundamental picture to make sure the Tesla bull case hasn’t come off the rails.

Still the leader, but concerns loom

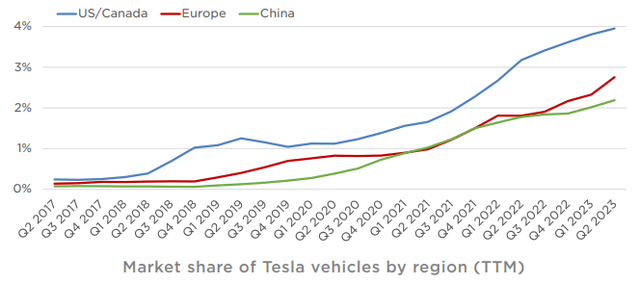

Tesla publishes market share data with each earnings release, which is pretty handy for those of us trying to understand its competitive positioning. We all know Tesla was the first mainstream EV maker, but that field is getting very crowded, very quickly. However, Tesla has massive scale and adoption advantages over newer entrants, and that includes the legacy automakers with deep pockets.

So long as these lines continue to go up and to the right, Tesla is in an extremely strong position. The company started investing heavily in cheaper manufacturing capacity years ago, and it’s seeing the benefits of those efforts, which is something no other automaker can replicate at the moment with EVs. Tesla is able to manipulate pricing of its vehicles to suit market conditions, which is also something the big boys of internal combustion can’t match. In short, Tesla is a proven winner in its field, and until that changes, you have to lean bullish long-term.

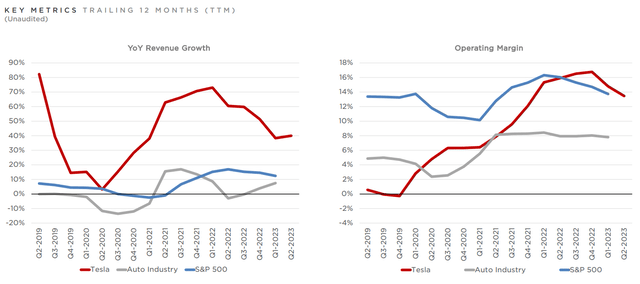

Now, the caveat is that margins are kind of all over the place, and in recent quarters, they’ve moved convincingly the wrong direction.

Gross margins have suffered in recent quarters, and while these things happen periodically, investors will only be so patient if it persists. There are numerous factors that make up gross margins for an automaker, not least of which is raw materials for things like battery components. Margin volatility is understandable for that reason; constantly down trending margins are not okay, so that’s what Tesla needs to avoid. That said, its margins are outstanding among automakers, and again, so long as that doesn’t change, you have to lean bullish.

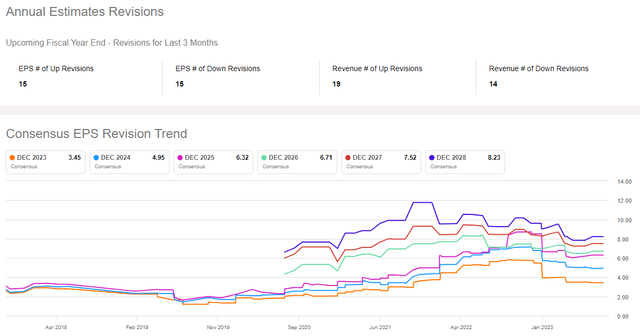

While I don’t think by any stretch that Tesla has persistent margin issues, it still matters short-term, as you can see with analyst revisions below.

This is, um, not great. Recent revisions have been split about 50/50 in terms of direction, but since last summer, the clear direction has been down. Part of that is because revenue estimates have been trimmed, but the other part of that is flagging operating margins. We seem to have a plateau in place in the past couple of months, and combined with mixed analyst revisions, may indicate we’re near the bottom of this revision cycle. If so, and we start to get upward revisions into 2024, look out above with the share price.

To be clear, I’m not suggesting that’s a certainty by any means. I’m balancing what I see as a very bullish technical picture into the end of the year with some meaningful fundamental concerns. As I mentioned, these things happen with any cyclical company, and I’m confident margins resolve higher given the company’s history. But until there are signs that’s underway, there is likely to be a ceiling on the stock.

A valuation only a mother could love

The way I like to evaluate any stock is to look at the technical picture, the fundamental outlook, and the valuation. I like the chart assuming we get through September without a lower low, and while Tesla is in fine shape long-term, there are some short-term issues with margins. Let’s call that one point for the bulls, and one for the bears. Let’s now turn our attention to the valuation, which is the last piece of this puzzle.

Shares are at 65X forward earnings, which is pretty difficult to defend as cheap. It’s not cheap on an absolute basis, and it’s not cheap relative to its own history. Tesla has certainly traded with higher multiples, but keep in mind that as it grows larger and larger, its growth rates are more likely to slow, meaning the multiples it can command will almost certainly shrink.

Would I recommend selling the stock solely due to the multiple? Absolutely not, but it’s a consideration given the seasonally weak period we’re in for the next three weeks.

If we wrap all of this up, I’m putting a buy rating on Tesla because I think it will end this year near or above its prior high at $300. However, I’m going to say again that patience may pay off here. September is a bad month in general for stocks, and Tesla is not immune. The mixed technical picture would look a lot better if we get a bit of selling in the next couple of weeks, and that’s the time to buy, in my opinion. I think Tesla’s going higher, but probably not right this second.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.