Summary:

- Microsoft Corporation share price has had a strong rally in 2023, and I expect that will continue.

- Technical analysis suggests that Microsoft is in a new uptrend and has multiple support levels in place.

- Seasonality and strong growth in cloud services are positive factors for Microsoft’s future performance.

HJBC

Ubiquitous enterprise software OG Microsoft Corporation (NASDAQ:MSFT), like most large tech companies, has enjoyed a banner year for share price returns in 2023. After a tumultuous bear market last year, the rally we’ve seen this year has recaptured that and then some. However, I think Microsoft’s next leg higher is just getting started, despite selected iffy fundamental characteristics that could be better. Behemoths like Microsoft have led this rally in 2023, and I think we’re going to get more of the same looking ahead.

I like the chart for Microsoft, as well as seasonal tailwinds, but the fundamental picture is a bit more mixed. Still, I’m slapping a buy rating on Microsoft; permit me to explain.

Has a new uptrend already begun?

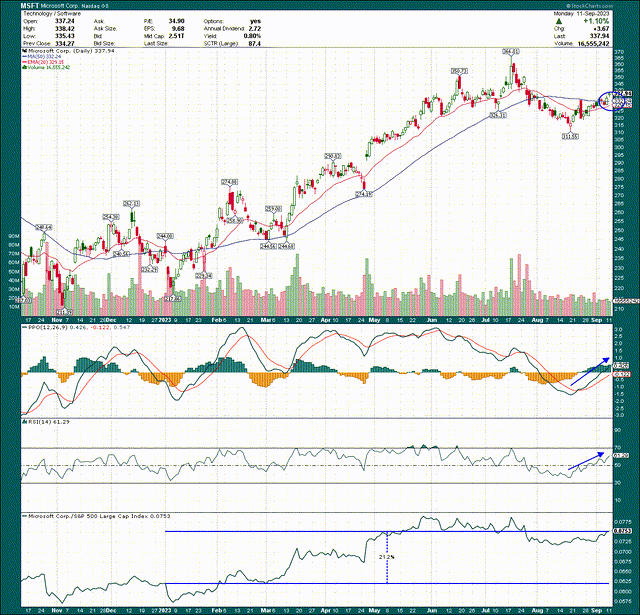

The answer to that question, if I had to make a choice right now, would be “yes.” I think the bottom made in August at $311 will prove to be durable, but to be fair, we haven’t yet had a test of it. The key will be when the stock finally does pull back, and how far that pullback goes. I’d be absolutely shocked if we get a pullback that gets anywhere near $311, so I’m of the belief this is a new uptrend.

Why? The 20-day exponential moving average is going to make a bullish cross of the 50-day simple moving average shortly, probably this week. That then becomes support on pullbacks, and adds another layer of protection for the bulls once the stock does inevitably pull back.

The PPO is now above the centerline, and the histogram really couldn’t look better. That’s indicative of something more than just a bounce, and even when the stock does pull back, I’m looking for a continued move higher.

The 14-day RSI shows similar behavior, and a confirmation of a larger bullish move would be seeing the RSI hit 75 or 80 (or more). That sort of behavior is indicative of a sustainable bullish move, but we haven’t seen that since July, and only briefly.

Now, none of this guarantees the stock is in a new uptrend, but if you want for all of these things to be confirmed, you are likely to miss a lot of the move. Using technical analysis is a great way to put the odds better in your favor, and anticipate moves before they happen. Given what I see right now, I think Microsoft’s path of least resistance is higher.

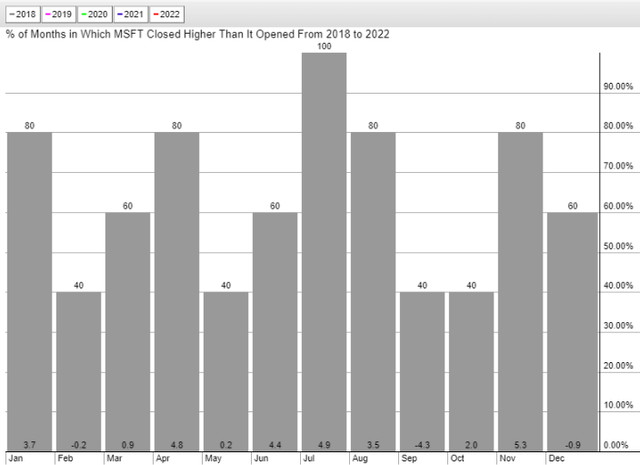

That’s particularly true when we consider seasonality, which we have below for the past five years.

September is a rough month, averaging a loss of 4.3%. However, October is better at +2%, followed by a very strong November, which averages 5.3%. Seasonality is far from a guarantee; 2022 was more than enough evidence of that as seasonality was pretty much ignored for most of the year while stocks just fell and fell some more. However, in most years, 2023 included, it’s a decent indicator, and it’s saying Microsoft is much more likely to go higher into year-end than lower.

Growth is the wildcard

I know that I mentioned “Microsoft” and “iffy fundamentals” in the same paragraph above, but hear me out. I know this is one of the most elite businesses in the entire world, and it almost certainly will be for a long time to come. It has an enormous installed customer base, has diversified into several different business lines, and generates huge margins and free cash flow. It’s a great business. However, growth rates are slowing across some of the portfolio, and that’s where Microsoft needs to pick up the pace in order to maintain its strong share price growth long-term.

The company’s Office brand continues to perform very nicely, particularly the 365 Commercial line. LinkedIn is a steady grower (although its growth rates have slowed recently), and cloud services revenue is flying, including its flagship Azure brand. The problem is that Microsoft is still a hardware producer, among other things, and its More Personal Computing segment is a major drag on the company’s growth rate these days.

Device revenue has fallen off a cliff, while Xbox revenue growth oscillates around the flat line. Gross margins are doing okay, which is limiting the damage to operating income, but the point here is that Microsoft’s really exciting, forward-looking products are being dragged down by “old” Microsoft when growth rates are blended.

This matters because Microsoft will be assigned earnings multiples by investors based on a few factors, not the least of which will be its earnings growth rate. If revenue growth is slowing, that will limit earnings growth, which will limit its multiple, which limits its share price upside.

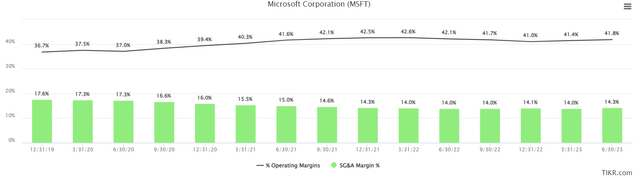

On the plus side, the company has tightened its proverbial belt in recent quarters, and is focusing on preserving margins, and it’s working.

I left gross margin off the chart because it pretty much never moves from about 70% of revenue. SG&A, however, has fallen about 330bps in the past four years, which is admirable. That has translated directly to the bottom line through operating margin growth, which means earnings have grown more quickly than revenue. This is great, but it only works to a point, and that point appears to have been earlier this year, as SG&A has started to creep back up again. If you’re still with me, that means earnings growth is going to have to rely more upon revenue growth now that margin expansion through cost-cutting is waning (or gone).

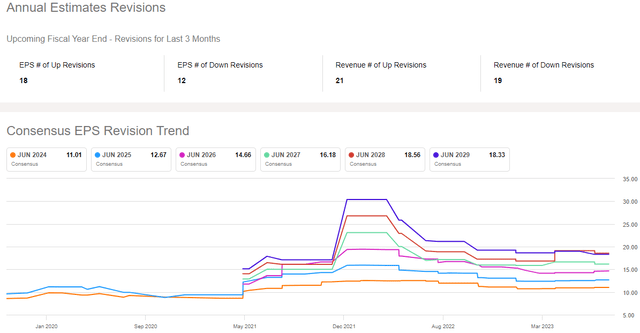

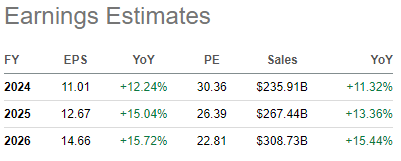

Analysts are looking for roughly equivalent EPS and revenue growth in the ensuing years, which indicates that the days of margin expansion are gone, at least for now.

Seeking Alpha

There are other ways to grow EPS, such as share repurchases, but it certainly appears that Microsoft’s absolutely torrid growth of the COVID years is unlikely to repeat.

Analysts had what – in hindsight – were fairly ridiculous estimates for EPS. I’m not sure I’ve seen EPS estimates move on a company this large as quickly as they did in 2022 for Microsoft. However, they’ve since come back down to earth, and have stopped declining. The current rate of $11 for fiscal 2024 has held, and given much more subdued expectations in place now, I don’t see a huge cause for concern that some massive round of cuts is coming.

Wrapping up

If we summarize the fundamental case, Microsoft has a few legacy businesses that are a drag on its growth rates. They’re good businesses, but for outright growth, they don’t work. Cost-cutting has helped with margins immensely, but that tailwind is close to or already expired. The newer businesses, mostly focused on cloud services, are performing tremendously and are the future. But will they grow quickly enough to offset low or no growth legacy businesses? That’s the big question.

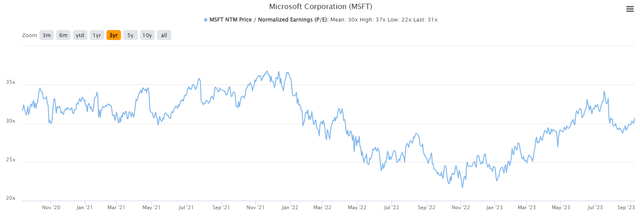

The final piece of the analysis here is the valuation. Microsoft will never be “cheap” because it’s a world leader in a massive, ever-expanding market. Those looking to buy something at 7X earnings need not apply here. Shares are at 31X earnings today, which is almost exactly in the middle of the 3-year trading range. It’s been more expensive, and it’s been cheaper; it’s fairly valued right now. That means I wouldn’t necessarily expect a big contribution to share price returns (in either direction) from the valuation in the near term.

So, how do I get to a buy rating? I like the chart, and I like upcoming seasonality. I love the various cloud services businesses that are growing quickly, and I think the company has done an admirable job cutting costs. The valuation is okay, and crucially, I think the downward EPS revisions that began last year have bottomed.

When I put all of this together, I’m not pounding the table here with a strong buy, but I think there’s an extremely high likelihood that Microsoft will outperform the broader market in the months to come, and that’s the very definition of a buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.