Summary:

- I’m upgrading Tesla to “Buy” ahead of the Robotaxi event, expecting significant positive announcements that could boost the stock’s value and analyst forecasts.

- Despite mixed Q2 results and automotive revenue decline, Tesla’s shift to non-automotive segments like energy and mobility promises sustainable EPS growth.

- Tesla’s financials show strong cash flow and manageable debt, supporting ongoing R&D and expansion, crucial for long-term growth and diversification.

- If we look at TSLA today as more than just an automotive stock, we can clearly see how its mobility and energy segments contribute to and explain its valuation premium.

- Risks include competitive pressures, regulatory hurdles for FSD, and high valuation multiples, but the potential upside from diversification justifies the current investment.

wellesenterprises

My Thesis Update

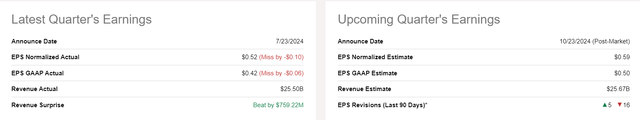

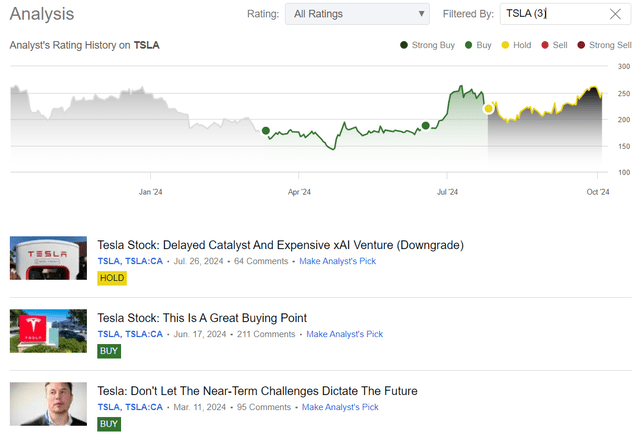

I initiated coverage of Tesla, Inc. (NASDAQ:TSLA) stock in March 2024, when it was trading at ~$178/share. Despite the ongoing downtrend at that time, I saw Tesla as an excellent opportunity for a long-term investment. In mid-June, after TSLA sellers failed to push the price below $150 and the company began to deliver the first positive news, I reiterated my “Buy” rating. However, one month later I decided to downgrade TSLA to “Hold” considering its poor Q2 results, uncertainties in the xAI project, and the delayed robotaxi event as a potential bullish catalyst.

Seeking Alpha, Oakoff’s TSLA coverage

Even though the stock has outperformed the market since my downgrade, I don’t think it’s too late to buy TSLA today – the delayed catalyst I talked about last time is just around the corner while the company actively shifts to the non-automotive business, which should give Wall Street more hope for sustainable EPS growth in the next few years.

My Reasoning

Tesla’s results in Q2 2024 were a mixed bag of ups and downs. First off, the firm’s total revenue was up slightly by 2% to $25.5 billion; yet, the automotive business – a major source of consolidated sales – saw a 7% YoY drop to $19.9 billion. Compared to this, Tesla’s “Services and Other” had a healthy 21% gain at a $2.61 billion gross margin (just edged down to 18.0% from 18.2% last year) based on lower average selling prices (ASP) and more expenditure due to the start-up of new initiatives such as Cybertruck and AI projects. Overall, what I wrote about earlier – the high price tag for AI projects – really put pressure on margins (but nothing extreme yet). Regarding the bottom line, Tesla generated an adjusted net profit of $1.8 billion ($0.252 per diluted share) as compared with $3.15 billion ($0.91/share) during the same period last year – this EPS decline was below internal and consensus estimates, respectively $0.64 and $0.61. Again, the major contributors to this decline included lower ASP of vehicles, poor vehicle mix, higher OPEX due to investment in Cybertruck, AI, and other R&D initiatives, and decreased vehicle deliveries. The bottom line miss led to earnings revisions to the downside:

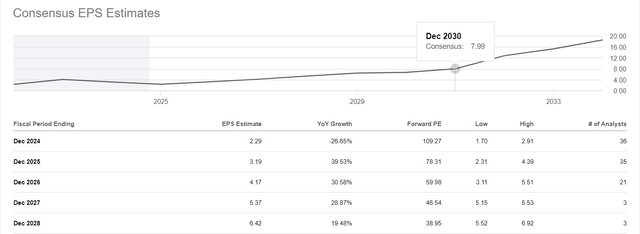

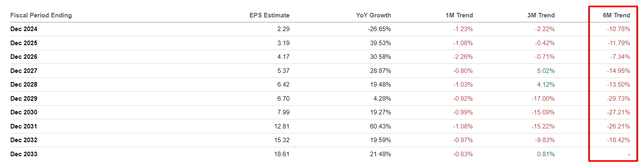

During Q2 2024, Tesla shipped 443,956 vehicles – a 5% decline from last year. This was 21,551 Model S and Model X vehicles, and 422,405 Model 3 and Model Y vehicles. The reduced deliveries came in part from lower production levels in previous quarters, though the Shanghai plant has now restarted full capacity. On a more upbeat note, Energy Generation and Storage doubled revenue to $3.014 billion driven by strong demand for Powerwall and Megapack products, with 9.4 GWh of deployments. I think that the ongoing shift in the share of sales to the non-automotive segment should lead to more stable business growth in the coming quarters. And the market seems to price this in with the consensus EPS CAGR estimation of about 22.9% for the next 5 years:

Going forward, I see Tesla’s management is still focused on its long-term growth model, even though the growth of the electric car industry is currently slowing down. However, the company will likely strive to weather short-term demand and production difficulties to become a more efficient manufacturer, so I consider the current headwinds to be temporary.

In Tesla’s balance sheet at the end of Q2 2024, total outstanding debt totaled $12.5 billion versus $5.8 billion a year earlier – primarily based on “higher R&D and production capacity costs.” Debt to capital ratio improved to 15.7%, still lower than the industry’s average (Argus Research, proprietary source). Net cash and cash equivalents were up $30.72 billion and still left ample cash flow to continue product expansions and capacity expansions. Operating cash flow increased to $3.6 billion (up from $3.065 billion), while the company doesn’t pay dividends or engage in a share repurchase program.

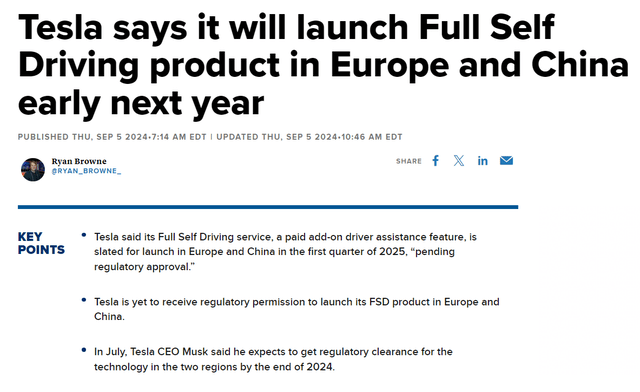

The most important question for Tesla today is “What’s next for Tesla’s new projects now?” The full-autonomous (FSD) software for Tesla drivers should be available in Europe and China as early as 2025, depending on regulatory clearance – this is in line with an expected 50% adoption rate increase in FSD for 2025.

The company also has its eye on the Robotaxi event in which it is going to announce updates on its autonomous vehicle service, including a possible prototype.

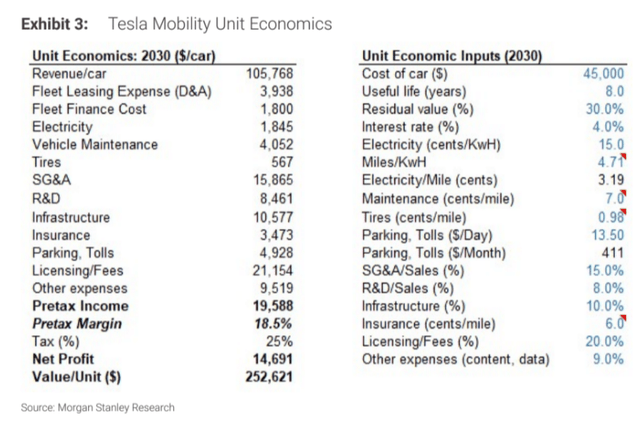

As Morgan Stanley analysts noted in their recent research report (proprietary source, October 2024), Tesla will show off a “cybercab” on a closed course and may launch commercially in late 2025 or early 2026. Tesla will likely use a hybrid strategy for autonomous ridesharing, both a completely autonomous, app-based offering and a supervised autonomous/FSD rideshare option. The latter, in which vehicles are leased by individual drivers or by third parties, is expected to dominate the market through 2030 and beyond – this strategy may elude investors and gain great traction shortly.

Also, MS expects Tesla to target specific metropolitan areas in the U.S. with a high density of Tesla owners, particularly in mild-climate regions. TSLA might also release the estimated number of its FSD Hardware 3 and Hardware 4 installed base, which is expected to grow to over 3 million units in North America by the end of the year. The firm has recently released FSD 12.5 and is already starting to roll out 12.5.5 to some models. They could offer the latest FSD version to rideshare riders through the Tesla app at a discount or for free to grow the FSD network and the user experience.

From a driver economics perspective, Tesla also offers smart marketing capabilities and could have a better take rate than rivals such as Uber (UBER) who have a US rideshare take rate of 30%. Morgan Stanley notes that Tesla would tempt drivers with a steeply discounted take rate – maybe 0% for a first month – to promote its rideshare platform. So the move wouldn’t affect rider price but instead leave drivers with a bigger profit margin, which allows Tesla to create a new driver pool in a market that is saturated.

Morgan Stanley (proprietary source, October 2024)

If all this becomes known to the market and the Robotaxi event actually reveals all that MS expects (or most of what they expect), I think this should boost TSLA stock – primarily due to a possible change in analyst forecasts, which have fallen significantly over the last six months:

Seeking Alpha, TSLA’s EPS revisions, Oakoff’s notes

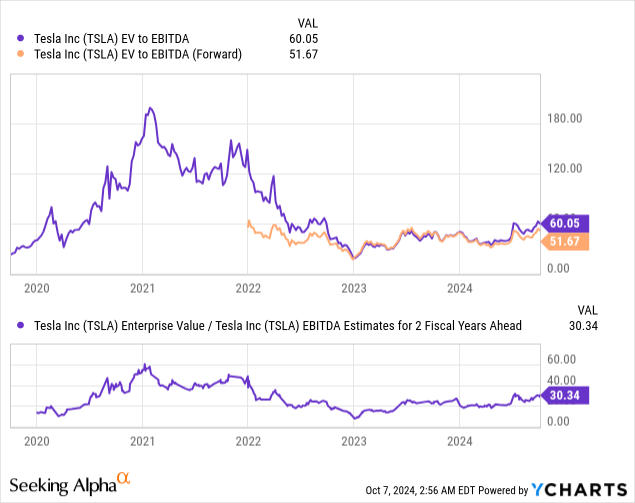

Of course, TSLA trades at a huge valuation premium today – even the next year’s EV/EBITDA multiple of 51.7x can’t justify it. But if we take a longer-term look at it, we’ll see TSLA trading at 2026 EV/EBITDA of slightly over 30x, and it doesn’t take into account possible upside revisions to today’s estimation of EBITDA. So I think the multiple contraction priced-in today speaks of a generally favorable picture for the stock’s growth in the medium term.

If we look at TSLA today as more than just an automotive stock, we can clearly see how its mobility and energy segments contribute to and explain its valuation premium. Again, the Morgan Stanley report (proprietary source, October 2024) clearly shows why Tesla may be undervalued by the market today.

Morgan Stanley [proprietary source]![Morgan Stanley [proprietary source]](https://static.seekingalpha.com/uploads/2024/10/7/53838465-17282894379323099.png)

Having a more traditional approach to valuation (and hence a bit conservative view on the price target), Argus Research concurs with MS on TSLA’s upside:

The shares are trading at 90-times our 2024 EPS forecast and 66-times our 2025 forecast, compared to a 13-year average annual range of 102-227. They are also trading at a trailing price/book multiple of 10.7, below the low end of the historical range of 13.7-43.9; at a price/sales multiple of 7.4, below the midpoint of the range of 6.1-16.2; and at a price/cash flow multiple of 61.3, above the midpoint of the range of 30.0-68.4.

Despite the stock’s volatile trading history and relatively high P/E multiples (especially when compared to legacy automotive companies), we see significant value in the TSLA shares, supported by the company’s strong brand name, manufacturing efficiencies, new product line-up, and business diversification efforts. Our rating remains BUY with a target price of $286.

[Argus Research, proprietary source]

Looking at the TSLA stock chart, I see the overall medium-term picture looking quite bullish. The stock share has broken out of the triangle it formed on a weekly basis and is now trying to settle higher. TSLA’s October performance was statistically the worst in the last 14 years with only 30% of winning months – this is definitely a risk for the stock today as investors can simply “sell the news” once the Robotaxi event occurs. But already in November, we are seeing one of the most successful months for Tesla in terms of seasonality, so I definitely think we still see an excellent candidate for outperformance over the next few months/quarters.

TrendSpider Software, TSLA weekly, Oakoff’s notes

Based on the above, I have decided to raise my rating today – Tesla is a “Buy” just ahead of its big event in 3 days (the event will take place on October 10, 2024).

Risks To Consider

I generally see several areas where my today’s bullish tale could face challenges.

First, Tesla’s Q2 2024 results exposed some vulnerabilities as its automotive revenue keeps falling with even adjusted net profit declining over 42.5% YoY. The drop in ASP, vehicle mix, and higher OPEX, may continue unless market conditions improve or if new initiatives such as Cybertruck and AI demand continue to exhaust resources.

The competitive environment is another risk to keep in mind – the market share Tesla holds today can drop further as other carmakers get into the EV space. Even the company’s high-level visions of self-driving vehicles and rideshare rely on approvals and technologies that are themselves speculative – if Tesla’s FSD services fail to catch up as planned or regulatory obstacles slow the rollout, the planned revenues could evaporate. At the same time, while Tesla’s diversification into energy and mobility services is promising, these segments are still under development and can’t really compensate for potential weaknesses in the core automotive business in the short term.

Finally, TSLA’a EV/EBITDA ratio for 2025 at 51.7x suggests Tesla may be “priced for perfection” with the valuation multiples they hold so high. Any execution errors or overall market declines will likely result in a price collapse. Also, Tesla’s debt seems to be well-covered with cash, but more debt (as the firm expands) will reduce financial flexibility if cash flow doesn’t increase to keep up with growth.

The Verdict

Despite the obvious risks to my thesis, I recommend paying attention to Tesla just before the big robotaxi event. I think the upside for the stock has become much greater than before – the delayed catalyst I downgraded the stock on last time has finally arrived. The potential impact and announcements during the event could, in my opinion, create a big bounce and make it clear to a greater number of investors that Tesla is not just about making cars today. If we assume that the company continues its business diversification and makes a smooth transition away from its dependence on its automotive business, then the stock appears undervalued based on various calculation methods. Therefore, I think buying TSLA stock just before the Robotaxi event is a good decision – hence my upgrade to “Buy”.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.