Summary:

- Nvidia Corporation invests heavily in Artificial Intelligence advancements to meet the growing demand for AI applications in the future.

- Nvidia’s price structure is strongly bullish, with an inverted head and shoulders and ascending broadening pattern.

- A market decline to $225.46 and $186 would present excellent buying opportunities for long-term Nvidia investors.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) has experienced phenomenal growth in recent years due to strong financial performance, rising demand for products, and growth in Artificial Intelligence (AI). Therefore, Nvidia has gained popularity among investors seeking to capitalize on the growth potential of the technology industry.

This article focuses on the technical assessment of the future direction of the Nvidia stock price in order to discover investment opportunities for long-term investors. Nvidia’s total revenue has increased by 553.12% to $26.9 billion since 2014. The stock price of Nvidia has also emerged with an inverted head and shoulders pattern and strong bullish momentum. A correction in the stock price of Nvidia from current levels is viewed as an excellent buying opportunity for long-term investors.

Financial Performance

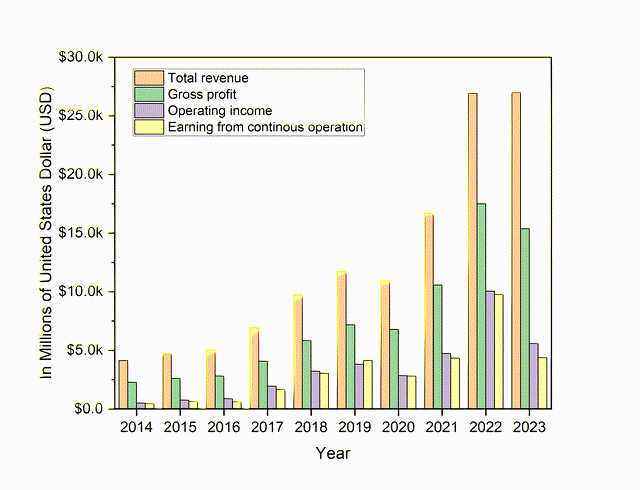

Nvidia’s total revenue for the fiscal year 2023 increased by 0.22% from the previous year. However, the overall revenue has increased significantly from 2014 to 2023, as shown in the chart below. This growth is a result of Nvidia’s expansion into all business segments, including gaming, data center, visualization, and automotive.

The total revenue for Nvidia from 2014 to 2023 (Prepared by author (data from seekingalpha.com))

Nvidia’s revenue remains stagnant at $26.9 billion in 2023, due to excessive inventories of gaming and visualization chips for Ethereum mining and a failed attempt to acquire ARM holdings. This also results in a 44.46% decline in operating income and a 54.80% decline in earnings per share (EPS) compared to the previous year.

Nvidia’s gross profits for the fiscal year of 2023 were $15.35 billion with a profit margin of 56.9%. The average profit margin for fiscal years from 2019 to 2023 averaged 61.7%, driven by robust growth in the gaming and data center markets. In my opinion, the introduction of the TX 4090 series and the Hopper in data centers will increase Nvidia’s gross margin in the coming years.

Operating income for the fiscal year 2023 was $5.58 billion, and the operating margin has averaged 29% over the past five years. Nvidia is investing heavily in R&D innovation, as R&D expenditures increased by 39.31% compared to the previous year. The earnings from continuing operations for the fiscal year 2023 for Nvidia were $4.37 billion, a decrease of 55.21% from the previous fiscal year. A decline in Nvidia’s operating income indicates that the company’s core business operations are generating less income, which leads to a decline in earnings from continuous operations.

Nvidia experienced significant growth during the past decade, owing to the high demand for its products and services. The operating margin grew significantly during the past decade, indicating strong cost management and operational effectiveness. An increase in the operating margin indicates that Nvidia can effectively control costs and generate more profit from revenue. Over the years, the company has streamlined its operations and implemented measures to improve its supply chain and manufacturing processes, allowing it to increase profitability. Nvidia’s revenue growth and high gross margin demonstrate its leadership in the technology industry and ability to consistently deliver shareholder value in the form of dividends and stock price appreciation. The leadership of Nvidia can also be defined by comparing it to Advanced Micro Devices, Inc. (AMD), one of its primary competitors. Nvidia dominates the GPU market with a market cap of $634.38 billion compared to AMD’s market cap of $157.66 billion.

Nvidia’s Development in AI Innovations

Nvidia is at the forefront of developing Graphic Processing Units (GPUs), which are used to accelerate the performance of AI and deep learning algorithms. The GPUs are specifically designed to handle the large amounts of data and intricate mathematical calculations required for training and running AI models. Therefore, Nvidia has become a major provider of GPUs for AI applications, with its products being used for autonomous vehicles, cloud computing, and gaming.

In recent years, advancements in the AI industry have increased the demand for Nvidia products and services. Since AI applications become more prevalent, the demand for GPUs that can handle the computational requirement of AI continues to increase. The company is well-positioned to meet market demand for GPUs. On the other hand, the increasing complexity of AI models also increases the demand for high-performance computing (HPC). Nvidia invests significantly in R&D to meet the demand. The new Tensor Cores development, which is designed to accelerate the performance of deep learning algorithms, is further driving up demand for Nvidia’s products.

Nvidia is the leader in the development of specialized hardware for AI applications, making AI the company’s backbone. Nvidia’s H100 data center GPU provides high performance and includes Megatron Chatbot and ChatGPT. Microsoft (MSFT) has invested $10 billion in OpenAI and announced Bing search engine integrations including plans to utilize Nvidia H100 and A100 GPUs to construct the most powerful AI-focused supercomputers. Microsoft also launched the ND H100 V5 virtual machine using Nvidia’s H100 and A100 data center GPUs and the Quantum-2 InfiniBand networking platform. This product enables the organization to directly leverage the power of Nvidia H100 GPUs via Azure. This huge contract with Microsoft constitutes a strong endorsement of networking technology. The rapidly increasing demand for AI and Nvidia’s dominant market position demonstrates that the company can meet this demand, thereby boosting its financial performance and stock price.

The Emergence of Bullish Momentum

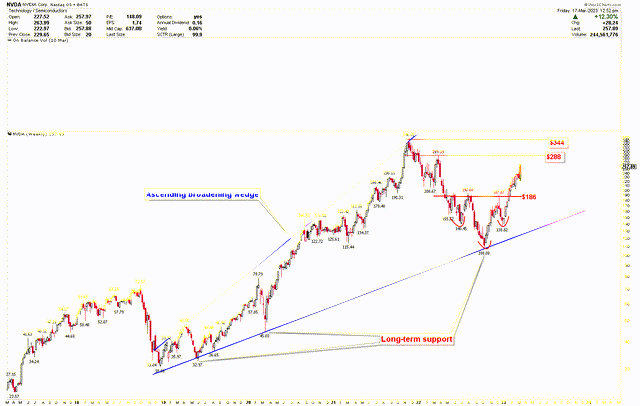

Nvidia’s weekly chart reveals a strong positive price structure. The blue lines on the chart portray the emergence of the ascending broadening wedge pattern. The wedge pattern is characterized by greater volatility, as both buyers and sellers are uncertain about the future direction of the market. Nonetheless, the formation of an inverted head and shoulders pattern within the wedge will likely result in a price surge in Nvidia stocks.

The lower trendline of the wedge is used as the long-term support, and after hitting support, the price surges, as shown in the chart below. Price has risen by 1020.63% from the wedge’s low of $30.88 to the wedge’s high of $346.05. The stock price retraced to the wedge’s lower trendline at $108.08 before resuming its upward trend. Price has emerged from the inverted head and shoulders patterns by consolidating within the wedge after hitting the wedge’s lower trend line. The formation of an inverted head and shoulders pattern within the wedge indicates strong bullish momentum in the market and higher prices. The nearest resistance is seen at $288 and $344, as marked by red lines, whereby a decent pullback is considered a strong buying opportunity in the stock.

Weekly chart for Nvidia (stockcharts.com)

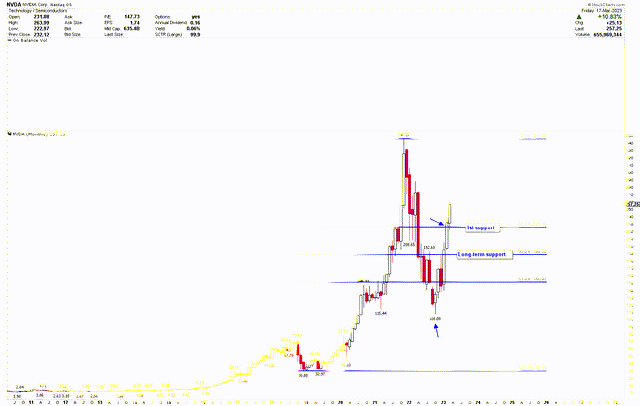

The monthly chart for Nvidia is also bullish, as the price has found support at the 61.8% Fibonacci retracement of the move from $30.88 to $346.05. Recent price growth from October 2020’s low of $108.08 has surpassed the 38.2% Fibonacci level at $225.46.A move above $225.46 signifies that the market correction that began in December 2022 has ended. The monthly candlestick pattern indicates bullish pressure, and the price is expected to continue to rise. The first support is at $225.46, and strong support is still at $186, as shown in the chart below. These levels are considered buying opportunities for long-term investors.

Monthly chart for Nvidia (stockcharts.com)

Market Risks

Nvidia’s financial performance remains robust, and the company’s share price has the potential to surpass all-time highs. However, recent microeconomic factors pose a risk to Nvidia’s stock price. The persistently high inflation causes Nvidia’s production costs to increase, which hurts the company’s profit margins and stock price. The Federal Reserve has raised interest rates above 4%, but inflation remains out of control. In my opinion, Federal Reserve will keep the rates higher for the long term to fight inflation. High interest rates reduce consumer and corporate spending, thereby affecting the demand for Nvidia’s products and services.

Other technology giants, such as AMD and Intel Corporation (INTC), are also developing GPU and AI hardware. These competitors have been aggressively pursuing the high-end graphics market, which could negatively affect Nvidia’s market share and profitability. Nvidia’s core business is GPUs for gaming, professional visualization, and artificial intelligence applications. This company’s dependence on high-end markets makes it susceptible to fluctuations in consumer demand and competition from lower-priced substitutes. Moreover, a price break below $108.08 would invalidate the bullish formation and elevate the risk of further losses.

Bottom Line

According to the discussion above, AI advancement increases the demand for GPU and HPC. Nvidia is investing heavily in R&D to meet future demand. Nvidia’s financial stability is demonstrated by its robust revenue growth. The stock price is emerging an inverted head and shoulders pattern, which shows strong bullish momentum. The breakout from $186 is a strong bullish case, and the price is expected to run higher. The appearance of an inverted head and shoulder pattern within an ascending broadening wedge pattern indicates that the decline has ended and that higher prices are expected. The initial support is located at the 38.2% retracement level at $225.46, whereas the long-term support is located at $186. If the share price of Nvidia Corporation experiences a price correction, these levels represent excellent buying opportunities for investors with a long-term horizon.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.