Summary:

- Devon Energy boasts a premium asset portfolio across five basins, with a strong focus on the Delaware Basin, driving efficient production and capital savings.

- Despite oil price volatility, Devon Energy’s diversified assets and strong cash flow support continued dividends and share repurchases, making it a valuable investment.

- The company maintains a robust financial position with $4 billion in liquidity and a strategic debt reduction plan, targeting a <1.0x debt-to-EBITDAX ratio.

- For 2025, Devon Energy aims for ~800 MBOEPD production, with a 9% FCF yield at $70 WTI, highlighting impressive financial resilience and growth potential.

Andy Andrews

Devon Energy (NYSE:DVN) is a mid-size upstream oil company, with a market cap of just over $20 billion. The company has an almost 6% dividend yield and a respectable portfolio of assets, along with a manageable debt load. The company has gone down since our last recommendation, however, its strong 3Q earnings along with continued growth will enable future returns. As we’ll see throughout this article, the company’s assets will enable continued growth and shareholder returns.

Devon Energy Portfolio

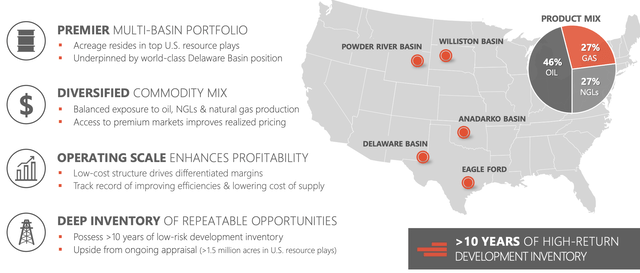

Devon Energy has a premium asset portfolio across 5 different basins, which we’ll discuss in more detail below.

Devon Energy Investor Presentation

The company has a long duration inventory and substantial acreage across these asset plays, with concentration in some of the most prolific basins in the United States. The company is also well positioned with 46% oil, 27% gas, and 27% NGL production. Given growing natural gas demand from datacenters and LNG, we expect natural gas prices to perform well into 2025.

The company maintains an efficient operating portfolio, which we expect will enable it to continue performing well.

Devon Energy Asset Breakdown

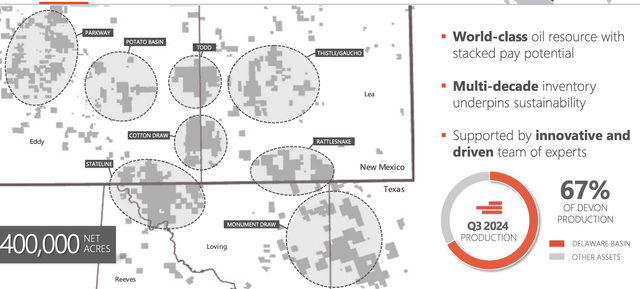

Looking at the company’s most important asset, the company has 400K net acres in the Delaware Basin.

Devon Energy Investor Presentation

This singular basin makes up 2/3 of the company’s entire production, and the company has acreage with substantial laterals across both New Mexico and Texas, which enables efficient wells to be drilled. The company has a multi-decade inventory here. In 2024, the company intends to slightly decrease its rig count, dropping from 240 2023 wells to ~230 in 2024.

On the plus side, though, the company expects a $200 million capital expense saving as a result. The company’s PV-10 breakeven here is $40 WTI, and the company is exiting 2024 with strong production.

Devon Energy Investor Presentation

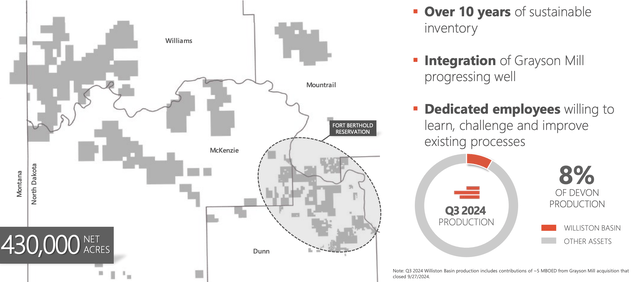

In the Williston Basin, the company also has 430 thousand net acres, but only sees 8% of its production here. Still, capital expenditures here are low, at just over $100 million annually, and the company plans to increase its average operated rig count from 1 in 2023 to 1.25 in 2024. Production here is also 60% oil, favoring oil prices.

Devon Energy Investor Presentation

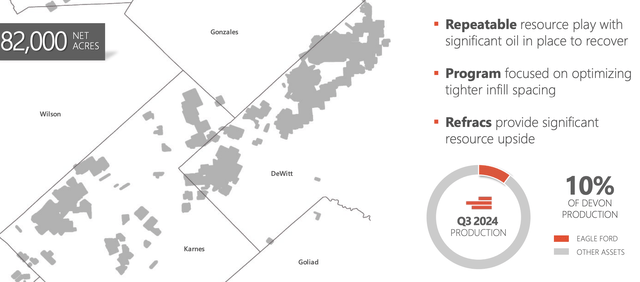

In the Eagle Ford, the company has a mere 82k acres, driving 10% of production. Here it needs to focus on tighter infill spacing and efficiency given the limited acreage (a single 15K foot lateral can use 80 acres, and the company’s acreage is of course not perfectly lined up for 15K foot laterals). Still 2023 rig count has gone from 3 to 4 rigs in 2024 with a decline in capital.

The company is also entering 2025 with strong production here.

Devon Energy Investor Presentation

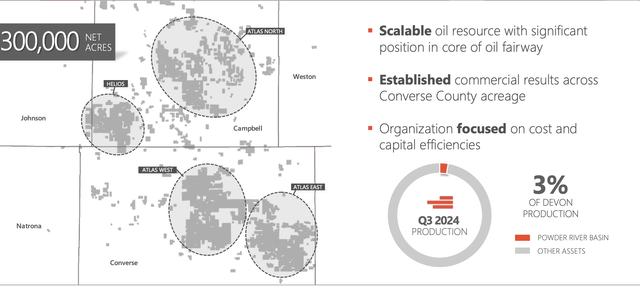

In the Powder River Basin, the company has 300k net acres, driving a mere 3% of production. Capital is ~$200 million / year for more than 70% oil, so a strong oil ratio but also capitally intensive. 2024 capital expenditures alone are almost $30 / barrel, which makes this one of the company’s more expensive / higher breakeven sites.

Devon Energy Investor Presentation

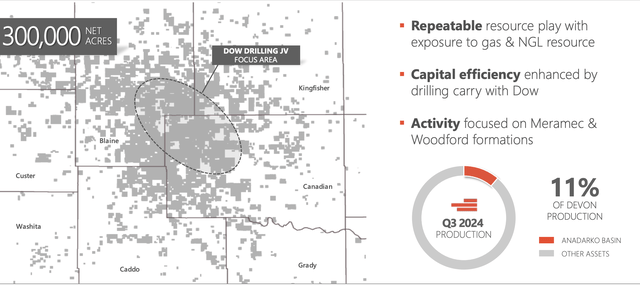

In the Anadarko Basin, the company operates the Dow Drilling JV as its core focus area, with a drilling carry helping capital efficiency. It has 300K net acres and 11% of the company’s production here. The production here is virtually all gas, and the company operated one less rig in 2024 despite bringing almost 3x as many wells online.

This is an asset we think could benefit well from a growth in natural gas prices into 2024 given its strong integration into the natural gas markets.

Devon Energy Financial Picture

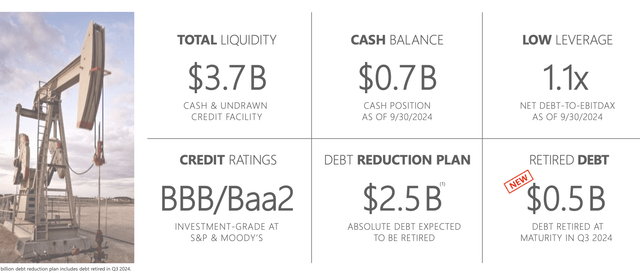

The company maintains an incredibly strong financial picture with almost $4 billion in total liquidity, including almost $1 billion in cash.

Devon Energy Investor Presentation

The company retired $0.5 billion in debt in 3Q 2024 and is planning a $2.5 billion debt reduction plan while maintaining an investment grade credit rating. The company is targeting a <1.0x debt-to-EBITDAX ratio. 70% of the company’s debt matures after 2030, but the company does have almost $9 billion in total debt.

The debt reduction program will effectively enable the company to close out all debt retiring 2030 or earlier and be paid through cash flow. The company’s FCF should be sufficient to handle this plan, which will save it almost $200 million in annual interest obligations.

Devon Energy 2025 Outlook

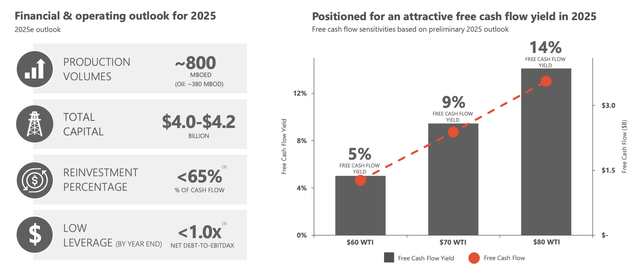

For 2025, the company plans to hit ~800 MBOEPD at almost 50% oil, in line with 2024.

Devon Energy Investor Presentation

The company expects total capital though to come it at ~$4.1 billion, versus ~$3.4 billion in 2024, relatively lofty growth. However, reinvestment percentage will be manageable, and the company is expected a 9% FCF yield at $70 WTI (just below current prices). Natural gas prices are assumed at 25% of oil.

For perspective, 1 barrel of oil is 5.6 mmbtu, so the company is presuming $3.1 Henry Hub. That’s slightly above current forecasts for 2025 at ~$3. Still, an almost double-digit FCF yield in an expensive market, at prices before current levels, is quite impressive.

Devon Energy Shareholder Returns

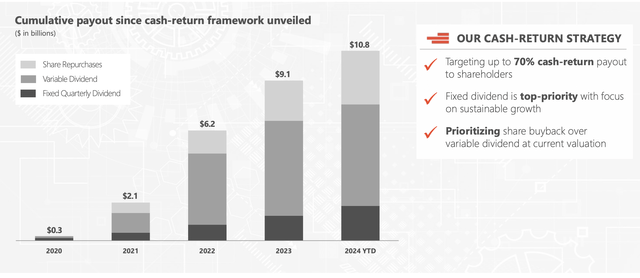

The company remains committed to its overall shareholder return plan.

Devon Energy Investor Presentation

For 2024 YTD it returned $1.7 billion (annualized at ~$2.3 billion) or a double-digit yield, and it took advantage of prior years to also have strong returns. More importantly, the company has steadily reduced its outstanding share count, something that we tend not to see from companies chasing yield, which is exciting to see.

That’s on top of maintaining a very strong dividend policy through a tough market in COVID-19.

Thesis Risk

The largest risk to our thesis is oil prices. The company has impressive assets, a long-term inventory, and strong execution, but as discussed above, its cash flow drops off substantially with a downturn in prices. Given President-elect Trump’s goal to drop gas prices and increase drilling, from their already record high levels, that could have a strong impact.

Conclusion

Devon Energy has been punished by a decline in oil prices; however, the company maintains a strong portfolio of assets. The company’s assets are well diversified, and the company has strong both oil and natural gas production, which will enable it to take advantage of an expected recovery in natural gas prices going into 2025.

The company has continued to generate strong cash flow. We expect it to continue generating strong cash flow going into 2025, driving a strong dividend and share repurchases. Overall, Devon Energy is a valuable investment for any portfolio. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.