Summary:

- Caesars stock has underperformed the market despite strong business performance in Vegas, regional markets, and digital business.

- Projection of $5.50-8.20 in free cash flow per share by 2025, suggesting a significant upside in Caesars shares.

- Limited downside in Caesars stock due to its strong cash flow generation, deleveraging, and real estate portfolio.

RudyBalasko

Caesars (NASDAQ:CZR) shares have significantly underperformed the broader market since my July article with Caesars stock price down nearly 20% while the S&P 500 (SPY) is up nearly 17%. Given the magnitude of the underperformance, one might expect that Caesars has experienced some sort of business headwinds. However, this is not the case as Caesars continues to generate excellent results – Vegas is producing record results, the regional business remains resilient, and the digital business has inflected to profitability.

Given the divergence between Caesars’ business performance and Caesars’ share price performance, I have significantly increased my position in Caesars stock. As I outline below, looking out to 2025, I expect Caesars will do somewhere between $5.50-8.20 in free cash flow per share, which suggests a significant (65-214%) upside in the stock.

Of equal/greater importance, given Caesars’ prodigious free cash flow generation and rapid deleveraging coupled with a meaningful real estate portfolio (discussed in further detail below), I see a very limited fundamental downside in the stock. This combination of large potential upside but limited downside makes Caesars an asymmetric investment proposition at $39 per share.

Recent Results

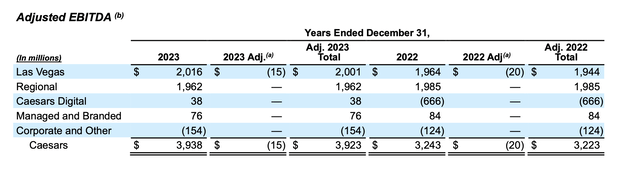

As shown below, Caesars generated record results in 2023 with all parts of its business performing strongly.

Caesars 2023 Segmental EBITDAR (Caesars Earnings Release)

Las Vegas has remained strong with 2023 results eclipsing 2022’s record performance despite a few headwinds including rooms being offline for refurbishment, a security breach/data hack, and higher labor costs from a new union contract.

The regional business held up well, nearly matching 2022 record results. Looking forward, the regional business is expected to benefit from the new Dansbury casino coming online in December 2024 as well as the overhaul of the New Orleans property.

Most notably, the digital business inflected from large losses to profitability as a result of both top-line growth and a meaningful reduction in marketing spending. Relative to digital pure-plays, Caesars benefits from a customer database of 60 million (Caesars Rewards) whereby it can develop digital customer relationships at a very low cost.

Valuation

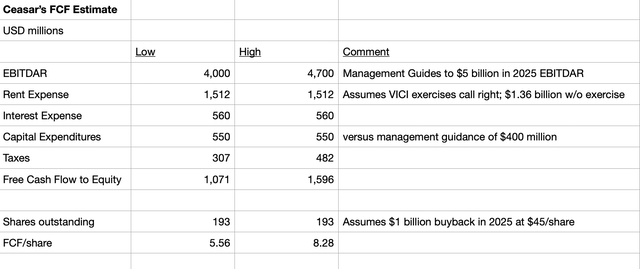

As shown below, looking out to 2025, I estimate Caesars will produce free cash flow per share of $5.50-8.20 on a fully taxed basis.

Caesars Free Cash Flow Estimate (Company Filings; Author Estimates)

In my ‘Low’ case, I assume that EBITDAR is only 2% higher than in 2023. Given that digital business profits are likely to be meaningfully higher (the business grew the top line 77% in 2023) and that Caesars will realize benefits from its new Danville casino (as well as the overhaul of the New Orleans property), the low case effectively assumes a falloff of the base Las Vegas/regional business of 5-10%.

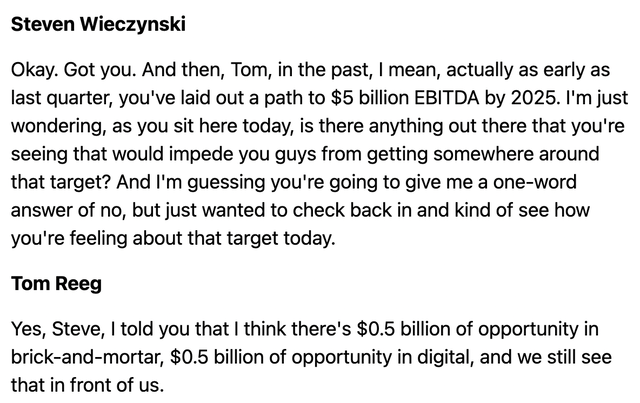

My ‘High’ case of $4.7 billion of EBITDAR is 3% below management’s guidance of $5 billion (see below). Within the $5 billion, management assumes $500 million of digital EBITDA which implies growth in both the Las Vegas and Regional business.

CZR management commentary on 2025 EBITDAR (3Q23 Earnings Transcript from Seeking Alpha)

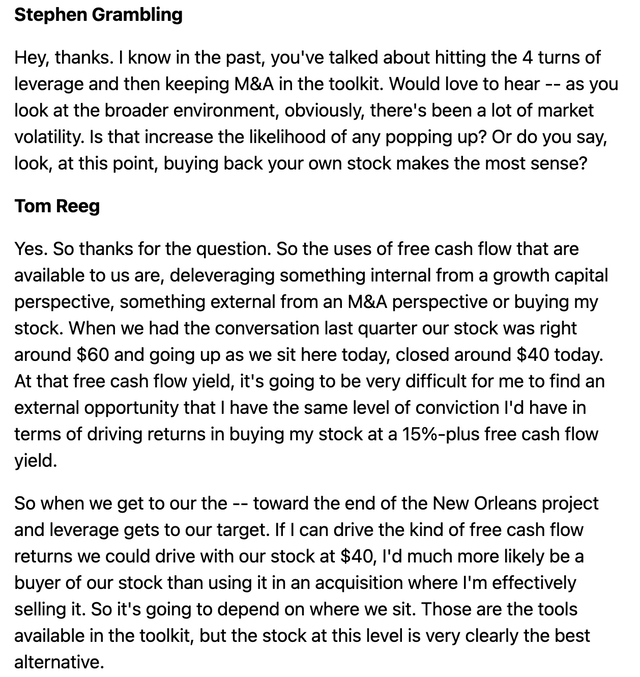

After deducing rental payments, interest, capital expenditures, and taxes, I get to a range of $1,059 – $1,584 of free cash flow available to equity holders. With regard to capital expenditures, by the end of 2024, Caesars will have completed its regional casino capital spending plan which will lead to a significant increase in free cash flow. As shown below, management has guided to share repurchases, and I assume a $1 billion repurchase (at $45 per share) during 2025.

CZR Management Commentary on Capital Allocation (3Q23 Earnings Call transcript from Seeking Alpha)

Assuming a Price to Free Cash Flow multiple of 12-15x, I get to a fair value of $66-123 per share which implies an upside of 68-214%.

Balance Sheet / Real Estate Ownership / Downside Protection

While the upside potential in Caesars shares is enticing, I find the limited downside to be equally interesting. While Caesars ended 2023 with a net debt of $11.4 billion, I expect the generate another ~$1 billion of free cash flow during 2024 which should bring the net debt balance down to $10.4 billion. Comparing this to my ‘Low’ 2025 EBITDA estimate (EBITDAR less rent), this would put Caesars just under 4.0x Net Debt to EBITDA (if Caesars achieves ‘High’ estimate, it would be ~3.0x).

Ceasar / VICI Put/Call (VICI Investor Presentation)

Further, there is a high probability that REIT VICI (VICI) exercises its call right to acquire certain regional casino assets in Indiana before the year end 2024 and the Forum Convention Center in Las Vegas starting in 2025. Depending on the ultimate terms of the deal, proceeds could be ~$2 billion (the offset is $150-160 million of higher rent expense as Caesars will then be leasing these properties from VICI). In such a case, CZR’s net debt would be just $8.5 billion and Net Debt to EBITDA (‘Low’ case scenario) would be 3.4x.

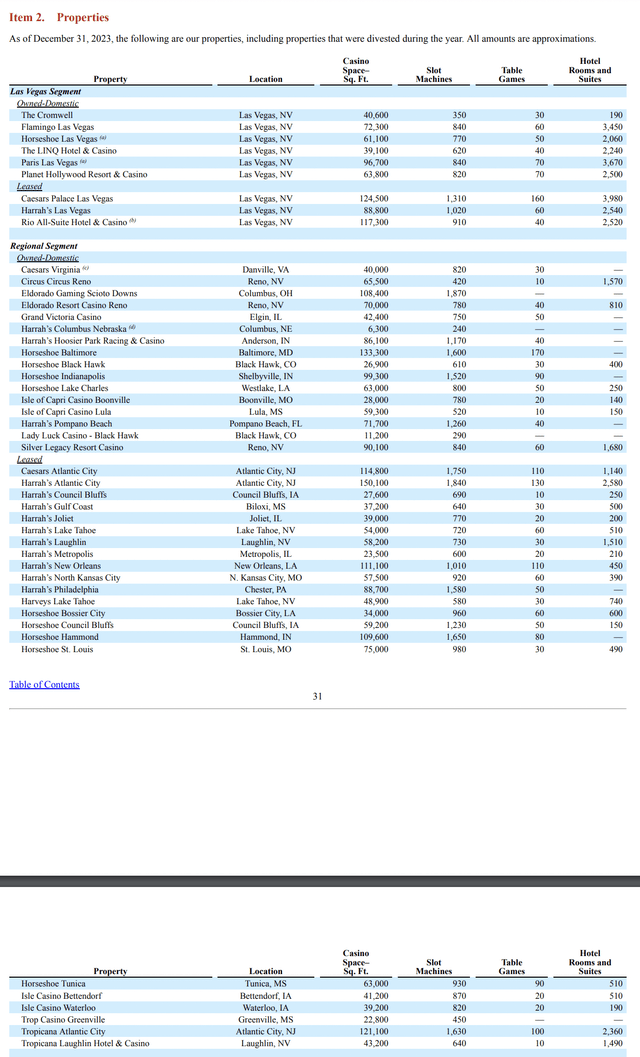

Even after selling these assets, as shown below, Caesars has a large property portfolio, particularly in its Las Vegas business:

Caesars Properties (Caesars 10-K)

Assuming VICI exercises its call option for Indiana/Forum, roughly 45% of Caesars EBITDA (so $1.8 billion under ‘Low’ scenario) will be coming from owned assets. Were management interested in doing so, I estimate Caesars could sell these assets (under sale-leaseback arrangements) for somewhere in the range of $13-14 billion assuming a 6.5-7% cap rate (and using a 2.0x EBITDAR to rent coverage ratio).

This would allow Caesars to pay down all of its remaining net debt (which I expect to be $8.5 billion after taking 2024 free cash flow and the sale of Indiana/Forum to VICI) and still have ~$5 billion leftover ($25 per share – though there would likely be some tax leakage).

Rent would go up significantly ($900 million in this example) but Caesars would still generate ~$4 per share in free cash flow and would have been able to return a significant amount of money to shareholders with the net proceeds from the asset sale.

I don’t expect (nor would I advocate) Caesars to sell off its real estate. The point is simply that while the balance sheet appears leveraged, Caesars has considerable flexibility if it were to want/need cash. In my view, this flexibility provides downside protection for shareholders.

The financial flexibility from owned real estate also extends to a potential acquirer. For instance, a private equity firm could purchase Caesars and finance a large portion of the purchase price by selling the real estate.

Risks

– Shares are heavily out of favor – cheap can get cheaper. I thought the stock was cheap in July at $49 and it has declined 20% even though the broader market has soared.

– Vegas is firing on all cylinders but could see a decline in results, particularly if the economy weakens. While I think my ‘Low’ case builds in some softening, it is possible that things could be worse than I expect.

Conclusion

I believe Caesars offers investors an exceptional risk-reward at $39, and have significantly increased my position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CZR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author owns VICI bonds.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.