Summary:

- Caesars Entertainment’s stock rating has been upgraded to neutral due to the aggressive valuation re-rate suffered by the stock.

- We will be closely monitoring tourism data from LVCVA to spot tourism pick up, which serves as a bullish reversal for CZR financials.

- The stock now trades at a lower price and multiples, making it potentially attractive for investment, with a target price of $42 per share.

RudyBalasko

We have been covering Caesars Entertainment (NASDAQ:CZR) for more than a year now. Our first article was in October 2022, when we argued that rising rates would impact the company through its large variable debt and rent exposure. Then, in July 2023 we reiterated our bearish view, citing the disconnect in the valuation with the results. Today, we have decided to change our formerly pessimistic view with a rating upgrade to neutral. We think the valuation gap has now closed, and the stock is properly reflecting the challenging environment that Las Vegas tourism is facing. At the same time, we continue to monitor these numbers to spot a potential reversal and thus positive impacts on CZR business.

A quick snapshot: recent results and valuation

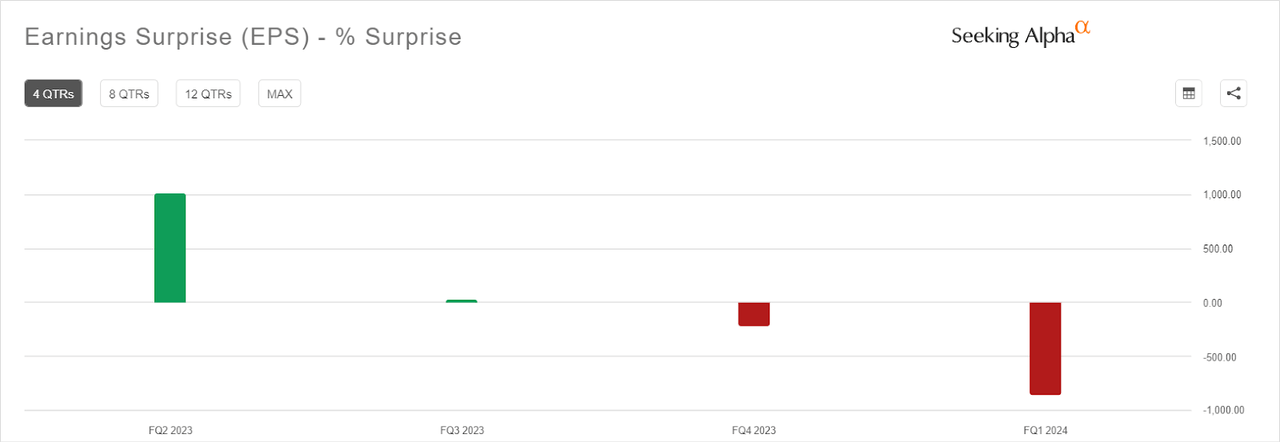

The company reported earnings on April 30 and posted disappointing results not entirely expected by the market, which is explained by the negative stock price reaction. Despite the Super Bowl and the Chinese New Year, Q1 results came significantly below last year’s.

Earnings Surprise – 4 Quarters (Seeking Alpha)

This was the worst negative surprise vs consensus in more than a year, and reflects a new challenging environment for Las Vegas tourism and spending. From Seeking Alpha article:

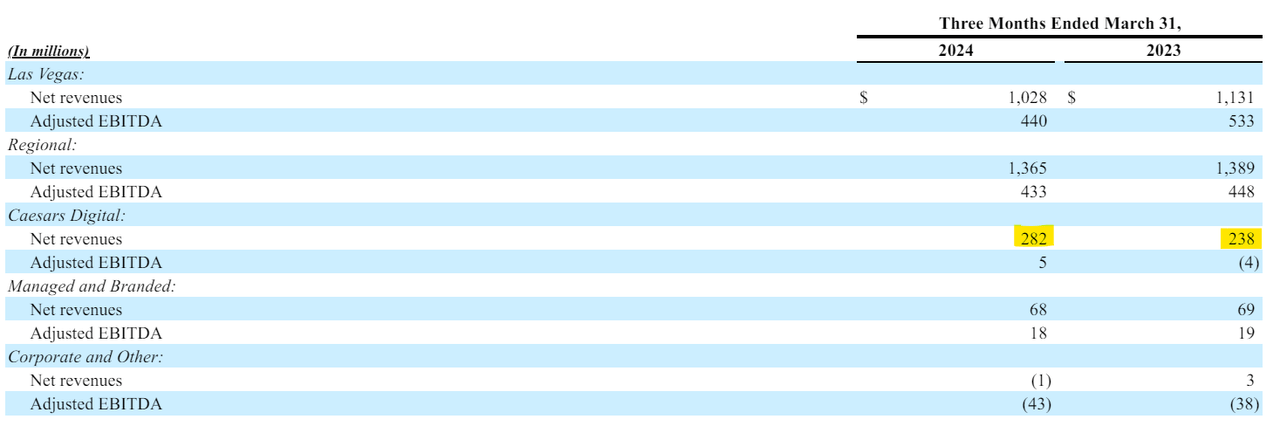

Revenue was down 3.2% year-over-year during the quarter to $2.74B. Las Vegas properties generated revenue of $1.03B vs. $1.11B a year ago, and regional properties churned up revenue of $1.37B vs. $1.39B a year ago. Same-store adjusted EBITDA was $853M, vs. $844.5M consensus and $947M a year ago. Notably, the Caesars digital turned profitable and kicked in $5M to the adjusted EBITDA tally.

The positive development is that same-store numbers were stable (slightly increasing), and that their digital offering (Online Casino) turned a profit.

Additionally, growth in the digital segment continues at an accelerated pace compared with the other segments. Revenue was up 18% YoY. Clearly, there is much more to do, but it looks like Caesars is on the right path to adding a new profitable division which is also relatively uncorrelated with the others.

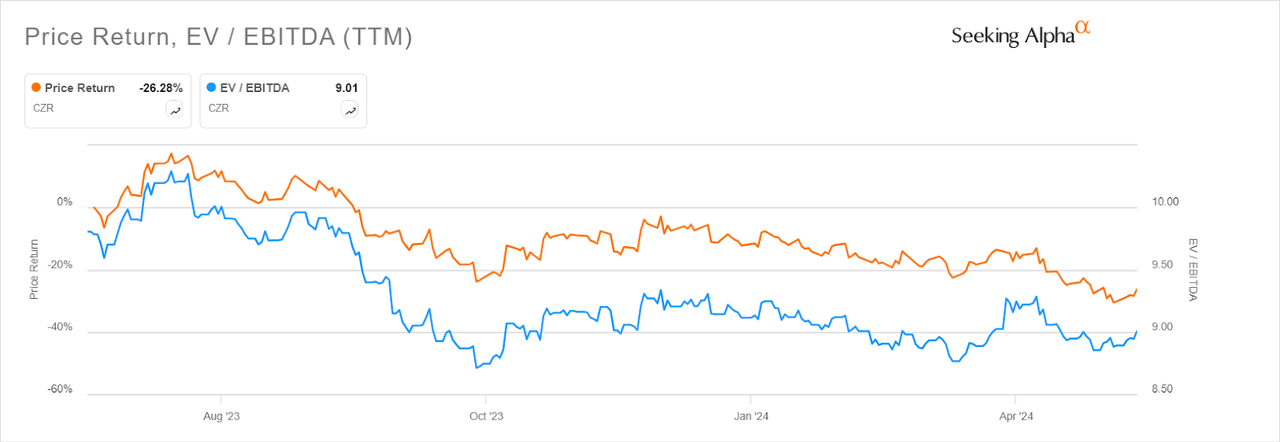

But this still does not answer a key question: why are we changing our rating, despite this financial underperformance, which we long expected? And the answer lies in the valuation. We believe that eventually every business – even the worst ones – becomes attractive at a certain price. In the case of CZR, the stock is now down 35% since our publication in July of last year, and the multiples attached to it have retraced significantly.

EV/EBITDA Evolution (Seeking Alpha)

This is price performance and EV/EBITDA in the last 10 months. As one can appreciate, we are now paying a very different price to buy the company. What was going for more than 10x EBITDA, today trades at 8.6x forward EBITDA.

Not too fast though: closely monitoring tourism data to spot an entry

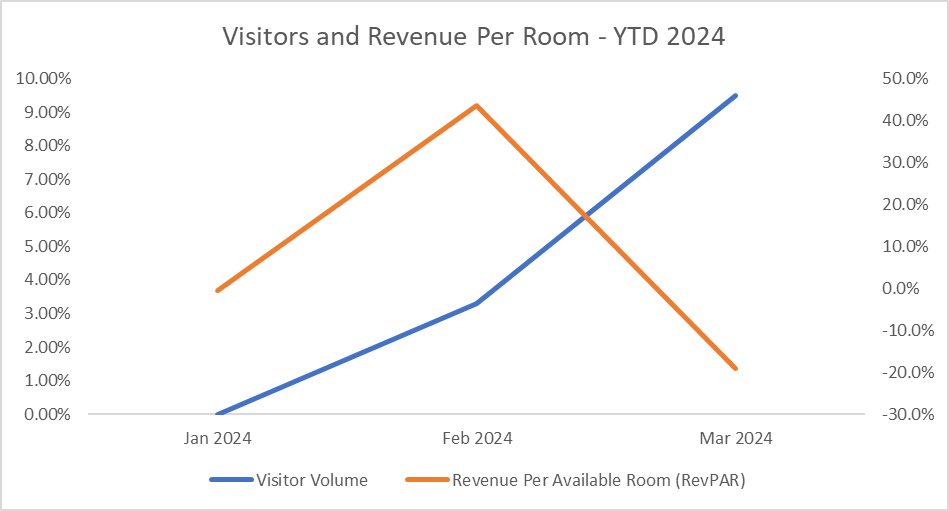

While this is a rating upgrade, we do not feel confident in calling an entry as of yet. As we did in the past, we closely monitor the Las Vegas tourism data that is posted on a monthly basis by LVCVA to see how spending and volume are changing. In the latest reports, we witnessed what we were expecting as a strong slowdown in both occupancy rates and hotel pricing (-16% for March YoY). So overall, to be more confident about a potential entry, we want to spot a reversal of these trends.

Visitors and RevPAR (LVCVA)

Right now, the strongest pressure point seems to be Revenue Per Available Room (RevPAR). While the visitors count (right axis) is up YoY and increasing, the revenue per room indicator shows intense pressure in March relative to the same period in 2023. February was clearly impacted by one-time events that overly benefited pricing dynamics, but the most recent downturn sheds doubts over the possible developments in the next months. To minimize our entry risk, we will be looking for positive or flat changes YoY of this indicator.

Last but not least, there is another risk source we are closely monitoring: the expansion to the online gaming market. As mentioned, this is the fastest-growing segment of CZR and is being closely looked at by analysts trying to predict the next growing engine of the company. This expansion is clearly affected by some sort of execution risk, and the ability of Caesars to differentiate itself also in the online market. We will be looking for growth rates well aligned – if not above – the ones of peers expanding in the same space.

Valuation: a potential target for a potential entry

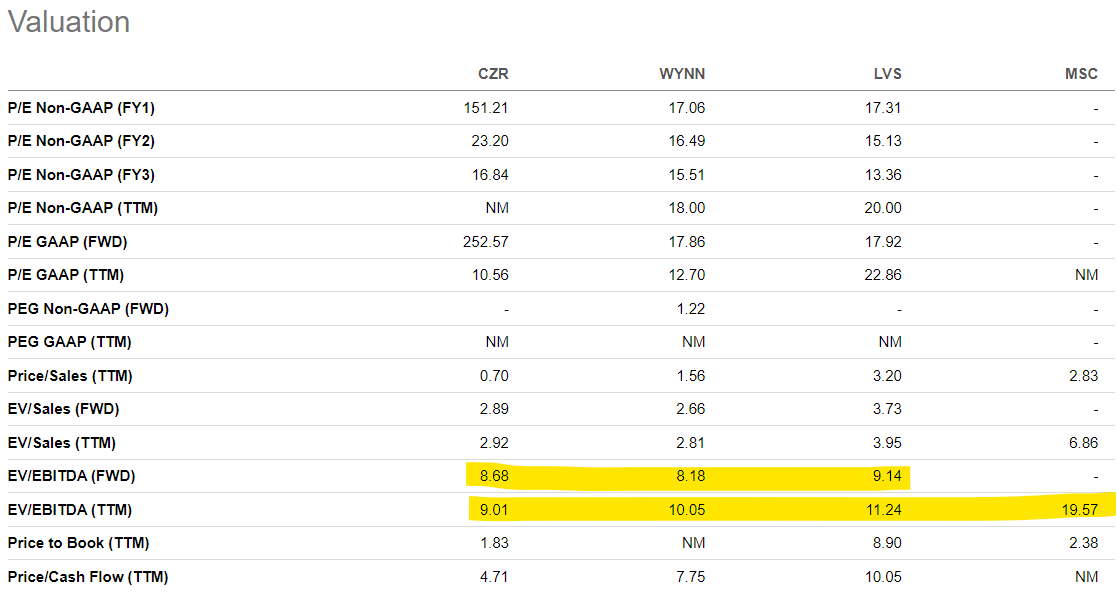

In the case the aforementioned indicator turns positive, we would be in a position for a buy recommendation. In that case, we also want to provide an overview of a potential target price. Since Caesars is a mature business, we will use a set of comparables that would most likely fall within the same business model and financial dynamics. We have identified these companies: Las Vegas Sand, Wynn Resorts, and Studio City International Holdings. While not in the same region, these are the publicly traded casino companies that most resemble CZR in their size and operating economics.

Valuation – Peers (Seeking Alpha)

This set of comparables shows a midpoint EV/EBITDA of 8.7x using forward numbers, and 12.2x using TTM figures. This is mostly explained by the lack of proper guidance from MSC on expected 2024 EBITDA. We believe that in the case of recovery of Las Vegas tourism numbers, CZR would deserve to trade at least at the same multiples of LVS and MSC, given its superior venue (US vs Macau). We believe that an EV/EBITDA of 9.0x would be justified. At that multiple, the company EV would stand at $35 billion, computed using an expected 2024 EBITDA (before interest on leases) of $3.9 billion. Then we subtract the net financial debt ($11.5 billion) and leases ($14.5 billion) to derive a fair equity value of $9.1 billion, or $42 per share. This represents a 17% upside potential relative to the current price.

Conclusion

We maintained our bearish view of Caesars for more than a year and expressed our concerns in two previous analyses. However, we think that circumstances – valuation in particular – have changed, and the stock might soon be an attractive buy. We will be monitoring the tourism statistics to spot a possible entry point and set a target of $42 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.