Summary:

- Caesars Entertainment, Inc.’s stock is viewed narrowly, with a current price of $36, overvalued by 20% according to Alpha Spread’s DCF valuation.

- Caesars has reduced its long-term debt by 13.23% since 2021, focusing on debt reduction and cost savings to improve financial health.

- The company’s digital market share is a bright spot, with the potential to reach double figures, enhancing overall market performance.

- Caesars and Warner Bros. Discovery are focusing on debt reduction to unlock future value, with CZR potentially reaching $61.30 by Q2 2025.

RudyBalasko

Above: The Palace still reigns supreme as a recognized brand leader.

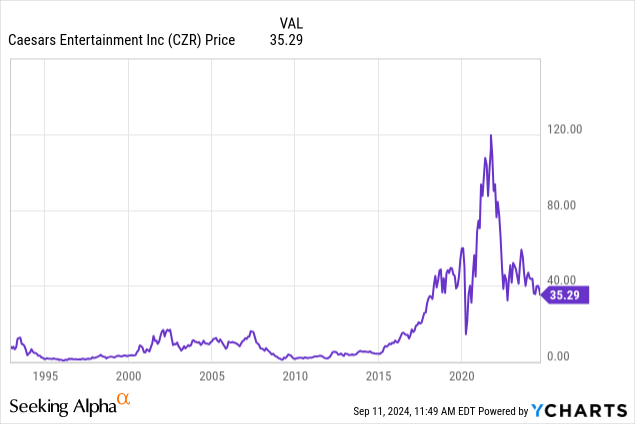

- The $31b paid for Caesars Entertainment, Inc. (NASDAQ:CZR) by private equity firms Apollo Global Management, Inc. (APO) and TPG Inc. in 2008 became an epic disaster which still haunts the stock.

- After a gigantic $18b struggle with bondholders after the 2015 Chapter 11 filing, CZR emerged in 2017 with the massive debt burden still weighing down its prospects.

- Mr. Market should understand how Warner Bros. Discovery, Inc. (WBD) and CZR are using debt reduction as essentially a marketing approach to Mr. Market’s bullish takes.

Carl Icahn took a position that triggered a bold move by El Dorado to swallow CZR for $8.5b in 2020. A new management bought the William Hill sports betting site in 2021 converted t CZR Sportsbook.

Premise: Investors today are narrowly viewing the stock of Caesars Entertainment (price at writing $36). Alpha Spread puts its current discounted cash flow (“DCF”) value at base case $28.70—overvalued by 20%, Worse case: $11.80, Best case: $67.7. Nearly all the negative sentiment on the stock is the lingering aftermath of the colossal mess that erupted in 2008 when the PE deal went effective in the face of the 2008 financial crisis. Between then and 2017 there had been a stubborn battle between its bondholders and the PE owners to shift assets and re-engineer financial structures that caused an eruption of second tier lenders.

The overall 2023 result left CZR with $12.2B in long-term debt (“LTD”), a decline of 3.33% YOY. For 2022 LTD was $12.6B, a 7.5% YOY decline. In 2021 LTD was the debt was $13.7B, a 7.75% YOY decline. In 2021, the LTD was $13.7B, a YOY decline of 2.49%. So, overall, CZR had reduced its LTD by 13.23%. That’s a reasonably decent job, considering just how many headwinds slowed its progress in building free cash flow (“FCF”) capable of accelerating debt reduction.

CZR had bought the UK’s William Hill sports books in 2021 for $4b to avoid the punishing expenses required to quick start a customer database from its existing casino customers. Overall, the idea was praised by many analysts as making great financial sense. But the outlay, to an extent, stalled the pace of debt reduction.

Above: A good entry point now as we move into high season for digital.

A year ago CZR traded at $43.44 meandering between down from late 2023 to the low fifties. The trading pattern since, despite some good quarters in the period, has been imprisoned by recurring worries about debt burdens. That has heightened somewhat as the possibility of Fed rate action appears to be getting nearer. Otherwise, CZR performance has been spotty. Most recently, its 2Q results, in brief, were solid results for Vegas, sluggish, persistent missed revenue forecasts on regional casino properties, slowly ramping upward on its digital revenue gains, but overall market share remains around 6%. Digital is a bright sport going forward. The rest of the segment appears to worry investors, not encourage them.

I must confess I look at CZR performance with a different POV due to my years in the mid to late ’80s when I was a c-suite executive in the company. Of course, in many ways a different company. In other ways, not. When I was recruited by then CEO Henry Gluck, I recall him saying, “Caesars was special-it is the most famous gaming brand worldwide and will always be.”

To an extent, it is still true until this day. No competitor comes anywhere close to matching its rewards membership numbers, now believed to be 65m. Its circulatory marketing system is where cardholders earn points at the regional properties that can be redeemed for comps and deals at the flagship Caesars Palace (“CP”). The key to that lies in the player’s perception that CP is indeed the mecca of global gambling. It has gotten much competition these days compared to them in terms of the perception of luxury no other property can match. But as is clear from the market shares across the globe that some of the gloss has faded a bit, yet the Palace remains the perception leader.

Spotty 2Q results not the problem per se, but debt burden remains #1

Much of the CZR results studied over the past two years began to appear to me to be similar to the dilemma facing Warner Bros. Discovery. And comparing deeper into the strategic focus of both managements, I concluded that for better or worse, CZR management was following the WBD playbook–at least for now.

In brief: Keep reducing debt at as fast a pace as FCF can allow. Focus on cost savings, and debt reduction, and run the operating businesses to generate enough cash flow to widen the gap between interest payments and operating income going forward. And specifically for CZR, stay tightly focused on building digital market share into double figures comparable to MGM Resorts International’s (MGM) BetMGM. Right now at 6% share at the cusp of the NFL season, CZR can make the jump to low double figures. If so and we see debt pay downs continuing to a pace above say 4% a year, we are, unquestionably, looking at a $60+ stock by the end of 1Q25. CZR has the goods. They own 59 casinos. Most of which are in demo rich gambler regions. Their fundamental marketing strategies built around their massive database work well.

The strategic similarities with WBD are difficult to ignore

1. Playing defense first. Both companies have enormous debt burdens sticking out are the most probable reasons their stocks are stuck, regardless of what the operating numbers show. WBD has paid down an impressive $12b in debt, leaving $41b since its beginnings two years ago. WBD was formed out of the chaos ATT endured after its terrible decisions to buy Warner. Nearly all its debt was the result of the spinoff.

CZR’s massive debt also came out of the same recipe of chaos evoked by the struggles of WBD: massive debt dump, battle between investors, lenders and early confusion of management priorities. Both ultimately found sure hands on the helm that has steered the company. It has fought back by steady debt reductions amounting to 13.2% of the total it inherited after the bankruptcy.

2. Thus far, the debt reduction focus has failed to stir investors into seeing value in the lower debt of either stock. Yet, we believe that if this track continues at anywhere near the pace of the past three years, that it will begin to impress the market. Then the ongoing plans to enhance earnings of standing properties will kick in. And in the case of CZR, a leap into double figure market share to say 11% will power an upside all by itself.

3. WBD has options like sales of segments or spinoffs not readily prudent currently for CZR, but if revenues are hit by a recession next year, there are properties in the system which are indeed salable.

Conclusion

Both companies have been victimized by the old dumb excuses for terrible decisions by shrugs accompanied by the phase “It seemed like a good idea at the time…” That unquestionably proves that the valuation of companies caught in the delusional process of acquisition or spin off that still victimize WBD and CZR are mostly wrong. That’d why it takes years, not months, to turn such companies around, if ever. Born out of classic horrid decisions by acquirers, the only smart moves are indeed the defense play of unloading the tonnage of debt laid on the acquired company.

Yet at their base, both CZR and WBD are good businesses, throwing off lots of cash regularly. And it is clear that neither of these recognized that big-time structural moves must await a time when the company is not as strapped to financially dead-ended debt burdens. Then, they could have a clear road to powerful upsides ahead. I believe under the present business models, CZR will arrive there first. CZR is a $61.30 stock in hiding by Q2 of 2025 assuming no major recession pokes its ugly head into the macroeconomy by then.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.