Summary:

- Caesars Entertainment needs a recapitalization program, blending refinancing and potential property sell-offs, to address its $11.7 billion long-term debt.

- JPMorgan’s latest analyst focus list shows a 58% upside in the price target for CZR, highlighting its strong asset base.

- CZR’s 65 million-member rewards database provides stability against debt concerns, maintaining its position as a leader in the sector.

- Despite debt issues, Caesars’ global brand remains strong and attractive in key high-end player markets worldwide.

Above: The world’s most famous casino is the way the company’s circular data base marketing with regional works good. Marcin_P_Jank

- $11.7b in long-term debt won’t be significantly reduced at the current FCF generation level. CZR needs a serious recapitalization program, blending both a refinancing and possible sale of some regional properties.

- JPMorgan’s latest Analyst Focus List includes a CZR upside in a PT target by58%. The CZR asset base and largest in the sector rewards database (65m) has created a stability against worrisome debt threats. But the clock is ticking. The bright spot getting brighter is CZR’s sports book.

- Investors are beginning to see CZR as the next online operator to move to a double-digit share of the market, moving toward BetMGM range.

The global brand Caesars Entertainment (NASDAQ:CZR) has not lost its glitter in every key high-end player node on the globe. The database has created a circular marketing power: Customers accumulate reward points at CZR regional properties. It circles back to Caesars Palace visits.

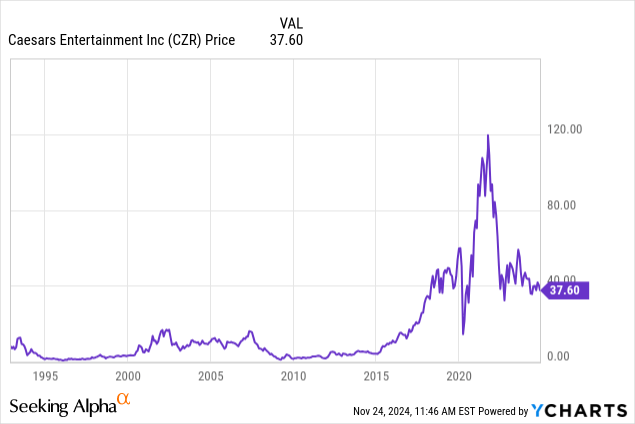

Premise: During my last post on Seeking Alpha, Sept 11th, CZR stock was at $36 per share. I made a bullish call, but Alpha Spread’s DCF estimate was $28.70 – indicating 20% overvalued. CZR began to move, it hit $45 in late October, moving north. Then the Q3 results quashed the bullish trend.

Above: Q3’24 results returned the stock price to $38 due to flat to dipping land-based results, while digital has formed an alternate rationale that is very bullish.

A capsule look at Q3’24 results

Net debt TTM: $11.7b – the net debt is manageable, per se, but worrisome given the modest pace of repayment afforded by FCF. My guess: It’s key to what turns off buyers.

EPS: ($0.04) Miss

9 month net loss $9m vs. $7.4m YoY.

Revenue: $2.87b miss by YoY from $3b – flat Vegas, soft regionals.

LV revenue: ($145m)

Regionals: Down ($149m)

AEBITDA: $1b YoY $1b – flat.

Cash on hand $802m, borrowing capacity $2b. Not great but will do.

So where does an CZR bull scenario come from?

Stipulation: As I have done in all my SA posts on CZR, I add that the context of my opinions is framed within my five-year tenure as a c-suite executive of the company for five years prior to the various mergers and management changes since the early 1990s. In many ways, it’s a different company. In many other ways, it is still driven by a sturdy customer culture and legacy from when it reigned supreme as the far away most famous brand in gaming. To a reasonable extent, that sense of legacy branding still represents a portion of the rationale for owning the shares. I chat time to time with former colleagues. Those talks help form my guidance for this stock.

The El Dorado merger reinforced a customer service culture aimed at a broader base, deepening penetration of mass play.

Sifting through Q3 results with several former colleagues, now competitors of CZR, is the conviction that the rationale for a bull case for the stock lies in that part of Q3 results in online gaming. It’s excellent results, of course, are related to the vitality in general over the online sector.

I recall one conversation I had with an old colleague a few years ago at CP. He was Gary Selesner (d.2024), a very close friend, a mentee of mine, sadly gone. He was President of CP, after a long career that began with Harrahs in 1985-ish. I asked him if the CZR I worked for still relied on the high-end international baccarat play.

We remain huge in VIP – that’s the same. But what has changed is the massive reach to everyday players and tourists springing from the database. It’s a flawless system moving play from our regional properties into our Vegas properties. Especially to the Palace.

Caesars Sportsbook: Aiming toward a double figure share of a $11b market dominated by its two leaders, Fan Duel and Draft Kings

The endgame now of the US sport betting sector largely remains with the two aforementioned leaders’ ability to remain way ahead in share of the market from the pack of nine viable competitors. Together, they own over 70% of the market with all others fighting for single digit shares – except BetMGM whose expensive and aggressive marketing edge has brought its share of the market to an estimated 13% to15%. Sifting through the sector for trends I see now, it’s difficult to see how any peer can penetrate the FD/DK wall.

There is one exception that several of my industry colleagues agree has that forward propulsion: Caesars Sportsbook – with 7% share of market.

The reasons are these: Like MGM, it controls both live sports books at multiple properties, and its overall brand presence in gambling is deeper than any competitor. ESPNBet is late to the party, so its brand power is diminished. All other online only sites have neither the brand presence nor the resource base that adds up to quantum leaps in market share.

At writing, CZR’s market share stands at around 7%+. That includes the base business it inherited when they bought William Hill in 2022 for $4b. They kept the online sports book business but quickly sold off the betting shops and global action for $2.7b, netting the acquisition cost to $1.3b. It was a smart deal by CEO Tom Reeg. In the sports betting boom, CZR had two clear entry strategies before them: One, build an entirely new site on brand power alone using the existing CZR database to start. And two, compare the cost of that against the Hill deal, which for $1.3b gives you an existing business in live and online sports betting to build much cheaply in the long run.

We looked at the 9-month results of CZR’s digital segment:

Revenue came in at $861m, up from $669m, up 28%, while operating at a loss of $143m. Profitability is closer to Q2’25, in my opinion, once revenue gets past $1b.

We acknowledge that the sector is surging on organic growth, so the YoY gain may not appear as big to some investors. But remember this: CZR is the leading mega brand in all US gaming, like MGM with live sports books in every state where online sports betting is legal. Coming up soon is Missouri, making it the 39th state to join the legal sports betting fraternity. Boyd also enjoys live and online sports books, but its 28 properties in LV locals and the regions do not have the scale of CZR’s 67.

Overall, CZR has held a higher percentage over the normalized 7% hold history for the sector, reaching 10%. The trailing 12 mo. EBITDA reached $126M, with flow through ranging above its 50% target.

CEO Reeg said he expected digital performance to rise significantly above the $500m in EBITDA, as enhanced programs in parlay and other new bets will help support the ongoing superior hold percentages. Other than digital, CZR casino results were at best flat. The overall low hold of its brick and mortar properties is part of its 40-year legacy of marketing focus on the upscale end of the gaming market. So aside from the influence of the El Dorado mass market customers, we have wider swings in hold percentage in the live table games business. Yet, overtime, CZR balances low hold quarters against high hold quarters and comes right with legacy performance.

Still, Mr. Market, ever since I was an executive in the company, saw short-term holds as omens and hit the shares. Yet going forward in high hold periods, the upside has been sluggish. But now, the sprint of its digital segment I believe is part of what the Morgan analysts saw that is the growing strength in digital worth a stronger forward PT.

After drilling through the current tracking by the top ten sites, my analysis shows an easy pole vault over $1b CZR digital revenue this year and a march by 2027 into double-digit market share around 12%. If that goal is reached, against the long-term growth of the sector of $30b by 2030, CZR digital segment will move its 2030 revenue to an E$3.6b.

During this period of powerful digital growth, CZR’s brick and mortar casinos will be participating in a continuing growth in land-based slots and table games, according to the AGA of 10%. But the growth rate for digital will rise to 46% YoY. And I suspect it is the real prospects of CZR online business entering double-digit growth territory at a faster pace than expected that will contribute to a rise in many analyst price targets going forward.

I’m looking for $51 as a first step in the share price rise, where the entire CZR performance rides tandem to a sustained revaluation in the $50s and beyond.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.