Summary:

- Since my last update on Amazon in late April, its stock price has increased by ~25%.

- In light of this bounce, I shall provide an update on my 5-yr expected return expectations for Amazon stock.

- With the tech rally still going strong, investors are pondering if the positive momentum in AMZN can sustain in the back half of this year.

- In today’s note, we will look into the potential pathway for Amazon stock to reach $150 in 2023.

- Under the caveat of pursuing slow, staggered accumulation, I continue to rate Amazon stock a “Buy” at $130.

porcorex/E+ via Getty Images

Introduction

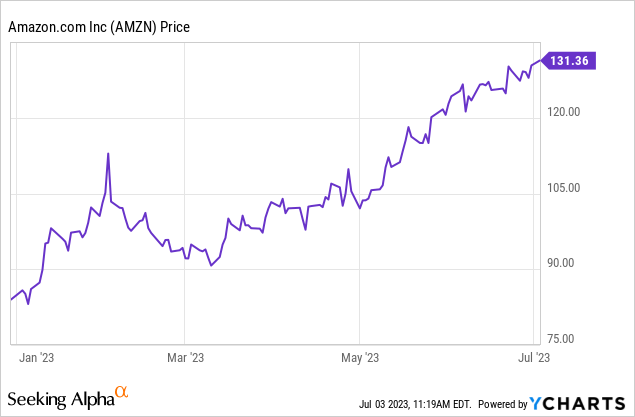

Despite experiencing a growth slowdown and margin contraction in its cloud business (AWS), Amazon.com, Inc.’s (NASDAQ:AMZN) stock has marched higher in 2023 on the back of falling inflation, stabilizing interest rates, stronger-than-expected financial performance in Q1, and rising investor optimism around generative AI.

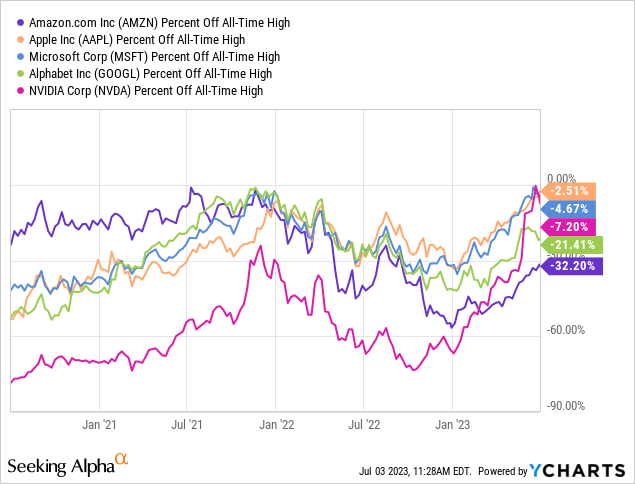

With a year-to-date return of ~56%, Amazon has outpaced the broader tech sector (QQQ) this year; however, Amazon is still trading well off its all-time highs, whilst fellow trillion-dollar club members like Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA) have been hitting new all-time highs in recent trading sessions.

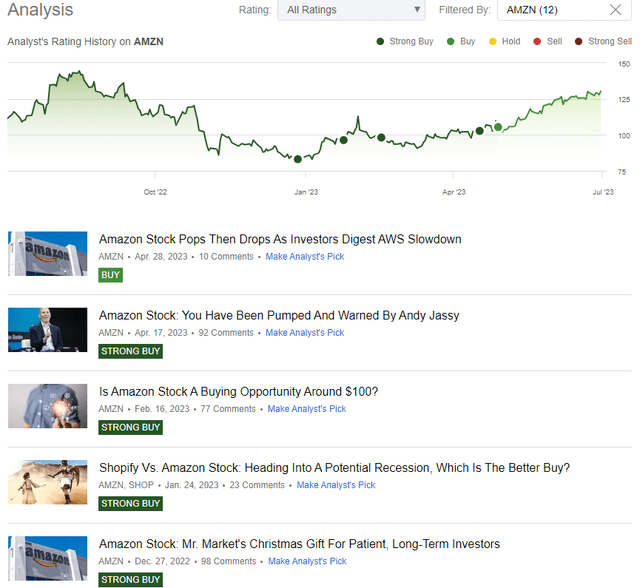

Back in late 2022, I highlighted Amazon as a “Strong Buy” in the low $80s:

And since then, I have published four positive endorsements for the stock in the low $100s:

Author’s ratings on AMZN (Seeking Alpha)

In my latest report on Amazon, I rated the stock a “Buy” based on its better-than-expected Q1 financial performance, discounted valuation, supportive technicals, and improving quant factor grades. Here’s what I wrote in this bullish report for Amazon’s technical setup:

After the release of its quarterly report, Amazon’s stock jumped +12% to hit the $120 level; however, the stock reversed during the earnings call and ended the after-hours session in the red. We already know that the sharp reversal was driven by management’s commentary on a further slowdown in AWS; however, technically, this leaves Amazon’s stock at a key pivot level at ~$110. If AMZN manages to break above this level, we could be headed to the $120-140 target range.

Source: Amazon Stock Pops Then Drops As Investors Digest AWS Slowdown

Since I made this call in late April, Amazon’s stock has bounced up by ~25%, and it is now trading smack in the middle of the $120-$140 range we discussed in our detailed post-earnings analysis.

In today’s note, we shall re-evaluate our expected return for Amazon in light of this significant jump in its stock. Furthermore, we will try to reason out a potential path to $150 for Amazon’s stock in 2023.

Amazon’s Fair Value And Expected Return

Since we are only looking to analyze the impact of the jump in AMZN’s stock price on its 5-yr expected CAGR returns, I will not repeat the finer details of our model in this note. However, if you’re interested, a detailed explanation of our valuation model for Amazon is available in this report on SA.

The one major update I have made in today’s iteration is that the LTM revenue base assumption has been moved from $525B to $535B to include the revenue estimate for Q2 2023.

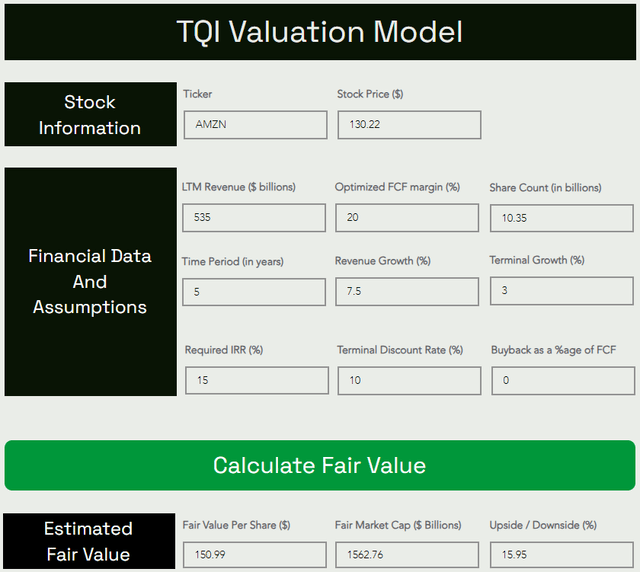

Here’s TQI’s latest valuation model for Amazon:

TQI Valuation Model (TQIG.org)

According to TQI’s Valuation Model, Amazon’s fair value is ~$151 per share (or $1.56T). With the stock trading at ~$130 per share, AMZN is still trading at a sizeable (~15%) discount to its intrinsic value.

While Amazon’s fair value estimate has only moved up slightly from our previous update, the bounce in AMZN stock has altered its expected returns significantly. Here’s where 5-yr CAGR expected returns stand now:

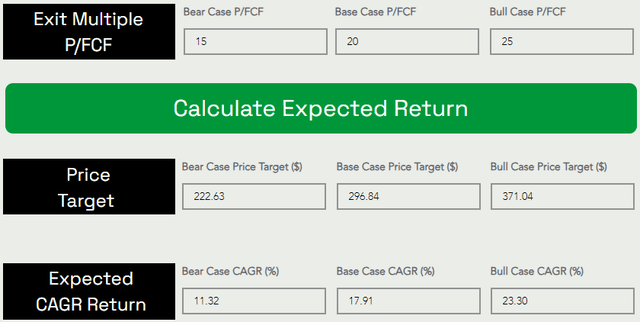

TQI Valuation Model (TQIG.org)

Assuming an exit multiple of 20x P/FCF, I see Amazon’s stock price rising from $130 to $297 at a CAGR rate of ~18% over the next five years. While Amazon’s expected CAGR has dropped from ~21.5% to ~18% after the recent jump in its stock, AMZN’s 5-yr expected CAGR return is still higher than my investment hurdle of 15%. Hence, Amazon remains a “Buy” under our valuation process.

Is Amazon Stock Projected To Go Up?

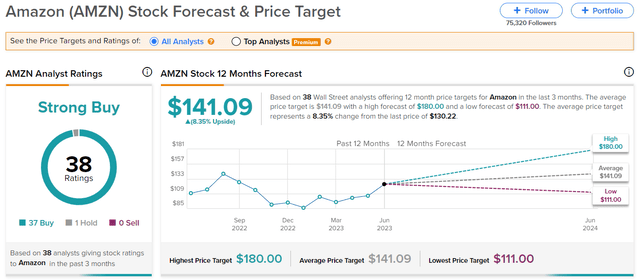

While Amazon’s stock performance has trailed some of its big tech peers, it has certainly regained its status as a Wall Street darling in recent months. As of today, Amazon’s stock is projected to rise by 8.4% to ~$141 per share in the next twelve months based on 38 Wall Street analyst ratings, with 37 “Buy”, one “Hold”, and zero “Sell” ratings!

In my view, Amazon stock is still undervalued. And the consensus Wall Street analyst sees AMZN heading higher in the next twelve months. However, with mega-cap tech valuations looking stretched after a lopsided run-up, investors are rightly pondering if AMZN stock can keep going higher in the rest of 2023. Let’s solve this quandary!

Can Amazon Stock Rally To $150 In 2023?

After a stunning 25%+ jump since late April, Amazon’s stock has moved right into the middle of the $120-$140 range we were looking for earlier this year. With several large and mega-cap tech stocks breaking out to new highs, most investors and traders are scrambling to participate in the generative AI wave. As the leading cloud provider, Amazon will likely be a big beneficiary of the explosive growth in compute workloads from the breakthroughs in generative AI technology. And given Amazon is still sitting ~32% off of its all-time highs, momentum-chasing investors and traders could look at AMZN stock as an opportunistic purchase.

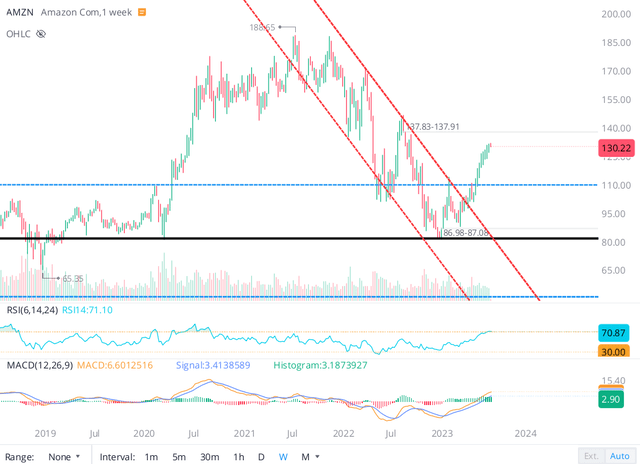

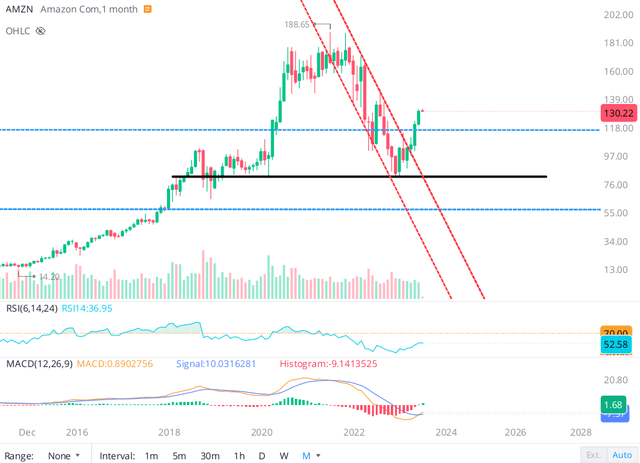

Having cleared the $110 level in recent weeks, Amazon has exited its downtrend from last year. And while AMZN stock is entering overbought territory (RSI > 70) on the weekly chart after its recent run-up, its longer-term technical setup on the monthly chart is looking bullish, with a positive MACD crossover in the works right now.

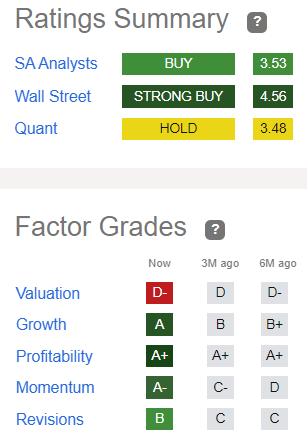

According to Seeking Alpha’s Quant Rating system, Amazon is still rated a “Hold” with a score of 3.48/5 (up from 3.37/5 in late April). While Amazon’s “Valuation” grade has deteriorated to “D-” on the back of a sharp rally in its stock, its (technical) “Momentum” grade has moved from “D” to “A-” over the last six months.

Quant Ratings for Amazon (Seeking Alpha)

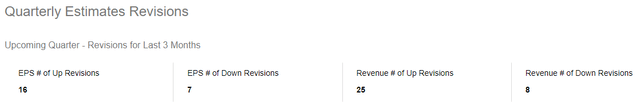

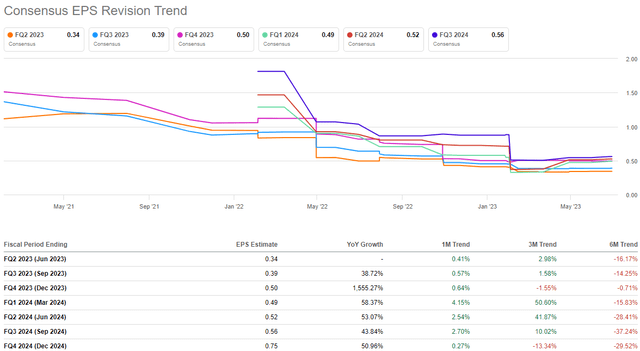

Additionally, Amazon’s “Growth” and “Profitability” grades have remained robust, whilst (earnings) “Revisions” grades have improved significantly in a clear sign of an imminent re-acceleration in earnings growth.

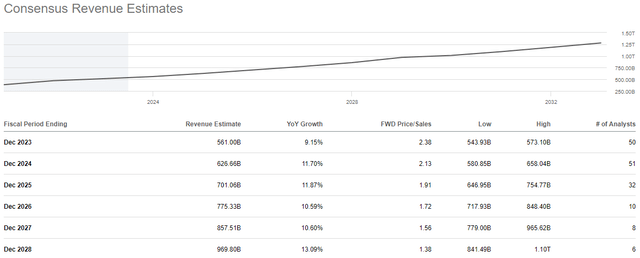

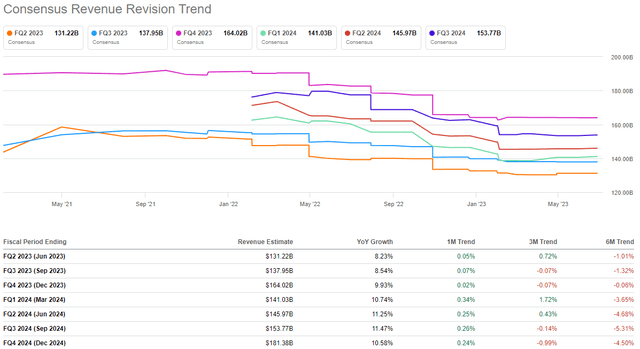

Over the next few quarters, Amazon’s revenue growth rates are expected to pick back up into the double digits, with AWS growth rates set to trough (at ~11% y/y) in Q2 2023. Furthermore, margin expansion is projected to drive rapid earnings growth at Amazon in the coming quarters.

Seeking Alpha Seeking Alpha Seeking Alpha

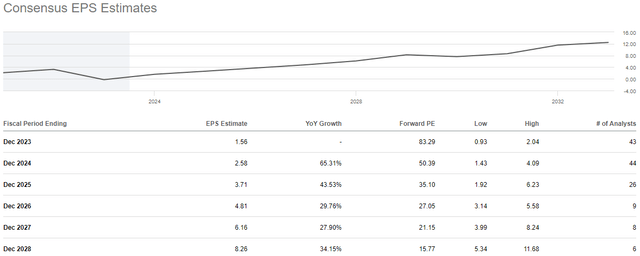

As we have discussed in the past, Amazon.com, Inc. is set to be a big beneficiary in the artificial intelligence space, and consensus analyst estimates from Wall Street firms are calling for healthy double-digit revenue growth and much faster earnings growth over the next five years.

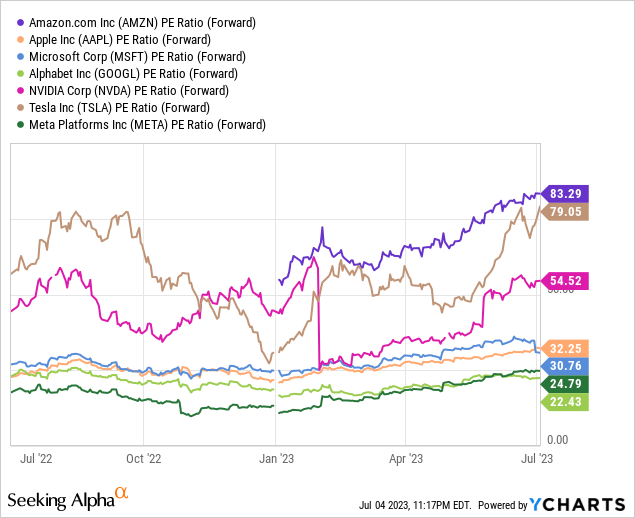

Despite having a large moat around several of its businesses, Amazon’s current and projected growth rates do not justify its forward P/E multiple of ~83x, which happens to be the highest among big tech companies.

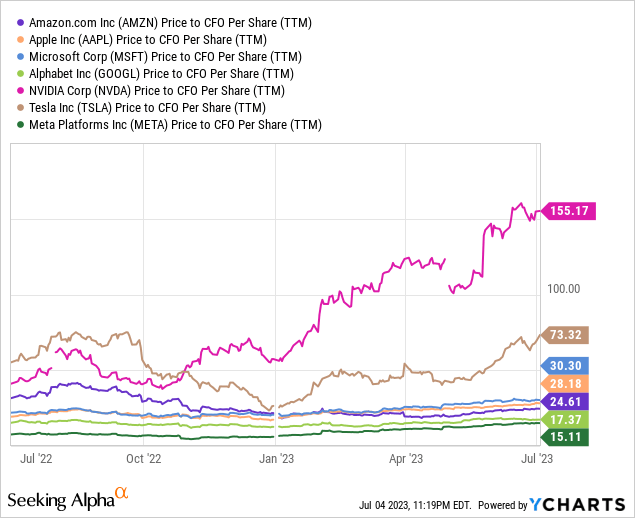

Now, most investors judging Amazon based on relative earnings would probably dismiss it as being grossly overvalued, but if we were to consider the big tech basket on a price-to-operating-cash-flow basis, AMZN’s relative valuation is quite attractive.

And given Amazon is still coming out of a heavy CAPEX spending cycle, I continue to think that investors should look at Amazon’s operational cash flows and not earnings when considering its valuation.

Concluding Thoughts

In an earlier section of this note, we reviewed Amazon’s intrinsic value estimate, which stands at ~$151 per share. Given AMZN’s improving fundamentals, technicals, and quant factor grades, I think there’s a good chance the stock takes a run at its fair value in the near future.

While Amazon’s risk/reward is not as good as it was a couple of months ago, rising investor interest in generative AI and current momentum in AMZN stock (and the tech sector in general) could continue to power it higher in the back half of 2023.

Due to the prevailing macroeconomic conditions and the increased possibility of an economic downturn, it is hard to foresee an expansion in trading multiples. Nevertheless, this is precisely the factor that has fueled the stock market’s upward trend in 2023 so far. Although the ongoing rally could potentially be a temporary recovery within a bear market, if it signifies a genuine bull market, Amazon stands to gain significantly from its current position. Under the caveat of pursuing slow, staggered accumulation, I rate Amazon a “Buy” at current levels.

Key Takeaway: I rate Amazon a “Buy” at $130, with a strong preference for staggered accumulation.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, GOOGL, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month) for a limited period only.