Summary:

- Despite the F4Q24 double beat, and a maintained FY 2025 outlook, Microsoft’s earnings outperformance was largely overshadowed by weaker-than-expected near-term prospects at Azure.

- The limited Azure uplift continues to highlight the extended impact of AI capacity constraints, considering better-than-expected commercial bookings in the quarter.

- Meanwhile, management is pushing forward with an elevated capital investment cycle into AI infrastructure, drawing up execution risks ahead.

FinkAvenue

Despite being regarded as one of the key beneficiaries of AI, thanks to its prescient investment in OpenAI, the Microsoft stock (NASDAQ:MSFT) has underperformed broader markets and its megacap peers this year. And despite continued momentum exiting FY 2024, the stock has continued to lose ground as investors react to underperformance at Azure. Yet, the company’s robust FY 2025 growth guidance continues to highlight a favorable monetization ramp trajectory for the hefty capital outlay Microsoft has earmarked for its next-generation AI ambitions.

Specifically, management expects sustained double-digit revenue growth in FY 2025, with further contributions from Azure in the second half when addition compute capacity comes online to address outsized demand. This is in line with the preliminary outlook provided in April, when management was eyeing double-digit revenue and EBIT growth, alongside a 1-point y/y decline in operating margins due to AI-driven capital intensity and ongoing cost impacts of Activision integration. The outlook is corroborated by robust market share gains at Azure, particularly with expanding AI contributions that represented 8-points of the segment’s growth, which translates to an annual revenue run-rate of $5 billion.

Taken together, Microsoft continues to mitigate its exposure to rising investors’ concerns about ROI compression. Albeit a rising capex spend trajectory, exiting FY 2024 at more than $55 billion with further increases through FY 2025, Microsoft’s robust growth guidance suggests tangible monetization avenues for its massive capital outlay earmarked for AI developments.

This is further corroborated with ongoing AI capacity constraints when compared against a resiliently growing demand environment. Although Azure’s near-term growth outlook falls shy of previous estimates, Microsoft is expecting reacceleration in F2H25 when additional AI capacity comes online. The company is also aligning capital spend with demand signals to reduce exposure to ROI compression, with a designated 15+ years realization timeline. This differs from recent investors’ scrutiny observed over Google’s (GOOG / GOOGL) ballooning AI-spend, which management had justified by merely highlighting the significant risk of “under-investing”.

We believe the stock continues to find durability at its current valuation, as management continues to execute on ramping the underlying business’ renewed growth roadmap enabled by the emerging AI-first era. The potential expansion of its share buyback authorization later this year could represent a near-term catalyst to the stock’s outlook.

How Durable is Azure Strength?

Azure’s growth outlook is corroborated by consistent market share gains observed through FY 2024. The cloud service provider grew revenue by 29% y/y in F4Q, in line with the lower end of management’s guidance. AI services contributed eight points to the business’ growth, accelerating from the seven-point contribution observed in F3Q. This implies a maintained $1+ billion quarterly AI revenue run-rate, highlighting Microsoft’s continued strength in monetizing the nascent developments.

Azure is Steadily Gaining Share

Azure’s rise in the ranks to becoming the primary cloud service provider for enterprise customers also supports its leadership in addressing rapidly expanding AI-driven compute capacity demands. A recent survey of CIOs conducted by Jefferies now shows Azure as the leading primary cloud service provider, with a 45% market share. This is up from 43% exiting CY 2023, and 38% exiting CY 2022 based on a CIO survey conducted by RBC Capital Markets. Azure has also effectively dethroned AWS (AMZN) from its years long leadership as the primary cloud service provider, with the latter’s share falling from 50% exiting CY 2023 to 43% based on the latest survey responses.

And continued acceleration of AI-driven growth contributions continues to highlight tangible monetization of relevant investments in recent quarters. As discussed in the earlier section, AI services contributed eight points to Azure’s 29% y/y growth in F4Q, up from seven points in F3Q, six points in F2Q and three points in F1Q. This implies an annual AI services revenue run-rate of about $5 billion exiting FY 2024. This continues to be additive to Microsoft Cloud’s performance, driving further scale of relevant AI investments to enable sustained margin expansion.

Capex Ramp Depends on Demand Signals

Although Microsoft has been investing heavily in expanding its cloud and AI footprint in recent quarters, management remains committed to long-term ROI creation by aligning capital spend with demand signals. Specifically, Microsoft reported capital expenditure totaling close to $56 billion in FY 2024, with expectations for a further increase in the current fiscal year.

The majority has been attributed to expanding cloud and AI capacity, with half related to infrastructure expansion, and the remainder for the acquisition of hardware like AI accelerators. Infrastructure-related spending refers primarily to the expansion of its global data center footprint, which management expects to monetize over the span of more than 15 years. This is consistent with recent market disclosures regarding Microsoft’s ongoing data center expansion plan:

- Palmetto, Georgia – Microsoft has begun construction at the Georgia site in April. The space is designated for a 250,000 sqft data center, which will come online in later 2025. This will add to Microsoft’s existing Georgia data center developments in Douglas County and Fulton County.

- Licking County, Ohio – Microsoft received approval in June to build a campus of six data centers spanning 200 acres of land in Licking County. The investment earmarked for the relevant infrastructure is about $3 billion, or $500 million per data center excluding hardware costs (e.g. servers, chips, etc.). The first data center at the Licking County campus is expected to go online in 2026 at the earliest.

- Leeds – Microsoft entered into an agreement in June with developer Harworth to acquire 38 acres of land in Leeds for £106.6 million. The company plans to build a “hyperscale data center” in the region.

- Aragon, Spain – Microsoft is considering a €6.7 billion investment into data centers in Aragon, a rapidly expanding European cloud computing hub. The company has submitted investment plans to the Aragon regional government that will span over 10 years.

- Madrid, Spain – Microsoft’s €2.1 billion data center investment in Madrid has become operational in June, providing AI and cloud services to the European region.

- Sweden – Microsoft announced a $3.2 billion investment in June towards the build-out of cloud and AI infrastructure in Sweden over the next two years. The investment will include deployment of 20,000 GPUs at its Swedish data centers in Sandviken, Gavle and Staffanstorp. This will add to Microsoft’s expanding footprint across the Nordic region, which spans Denmark, Finland, Iceland, and Norway, in addition to Sweden. Microsoft’s growing infrastructural presence in Sweden bodes favourably with burgeoning AI opportunities in the region. Current industry forecasts estimate a 9% GDP contribution from generative AI developments over the next decade, which equates to an opportunity of more than $50 billion.

- Northwest Indiana – Microsoft announced plans in June to invest $1 billion into the construction of a new data center in La Porte. This effectively deepens its portfolio of existing projects in Indiana this year, which also includes the acquisition of 929 acres of farmland in St. Joseph County for $77.5 million in May for data center developments. This follows a slate of consecutive investments in the region from Microsoft’s hyperscaler peers, including Meta Platforms’ (META) $800 million data center investment in Jeffersonville; Google’s $2 billion investment in Fort Wayne; and Amazon’s $11 billion investment in St. Joseph County.

- Phoenix, Arizona – Microsoft’s ongoing expansion of its data center footprint in Phoenix includes the June acquisition of another 280 acres of land in the region for $258 million. The additional land is acquired to support an existing data center development in the area. The city’s data shows development plans for three Microsoft data center buildings totalling 750,000 sqft.

And the relevant strategy remains highly dependent on end market demand signals. Management has referred to the data center investments as long-term assets that will remain “semi-constructed shelves” in preparation for deployment when there is sufficient opportunity. This compares to a similarly aggressive AI infrastructure investment plan from rival Google, which has garnered investors’ scrutiny last week after management gave an arbitrary view on the monetization outlook.

Risks of AI Bubble

Admittedly, decelerating Azure revenue growth expected in F1H25 alongside accelerating capex expansion earmarked towards supporting infrastructure represents an adverse combination. There are also risks that AI-related cloud TAM expansion will take time to materialize, which is consistent with the modest software spending environment.

Yet management’s continued attribution of Azure growth limitations to capacity constraints highlights a strong demand environment. This is further corroborated by industry expectations for resilient hyperscale demand over the next three years to support ongoing cloud migration alongside incremental AI-driven capacity requirements. The data-first era also provides durability to long-term hyperscale demand, mitigating Microsoft’s inherently elevated exposure to ROI compression risks. This is in line with management’s attribution of Microsoft’s near-term capital intensity to a 15-year returns realization timeline, with deployments dependent on demand signals. Looking ahead, additional capacity coming online in F2H25 is likely to address current constraints, and allow Azure to better capture incremental AI-driven opportunities and unlock growth acceleration.

Fundamental Considerations

Despite extended Azure deceleration expected through F1H25, Microsoft remains well-positioned for a back-end weighted year given pent-up demand. This is consistent with management’s commentary that the slowdown remains the result of constrained capacity, and aligns with strong commercial bookings exiting F4Q, as highlighted by gains in high-value contracts in the $10+ million and $100+ million segments. And realization of this growth is expected to become evident in F2H25, as additional AI capacity stemming from elevated capital investments in recent quarters start to come online.

Meanwhile, AI-focused solutions like Azure Arc and Microsoft Fabric are expected to drive sustained workload acquisition and market share gains. Specifically, Azure Arc, which enables customers to streamline workload migrations in their multi-cloud environments, has grown its installed base to 36,000 users, almost doubling from the prior year. Fabric, Microsoft’s AI-enhanced analytics and data platform, has also grown its paid customer base 20% sequentially to 14,000.

This will be additive to existing strength in uptake of Microsoft’s AI software, and reinforce confidence in the company’s guidance for sustained double-digit revenue growth in FY 2025. For instance, Microsoft 365 Copilot has doubled its seat uptake sequentially to 10,000 exiting F4Q, with daily active users of the feature also doubling over the same period. This remains highly accretive to Office Commercial ARPU growth, which is critical given moderating seat growth due to the sheer size of Microsoft’s installed base. The company has also reported strong uptake of AI-enhanced features in Power Platform, with monthly active users growing 40% y/y in F4Q to 48 million. Teams Premium subscriptions have also jumped four-fold y/y to more than 3 million, as the commercial end-market continues to benefit from the product’s AI-driven productivity gains. Meanwhile, GitHub Copilot remains Microsoft’s most monetizable generative AI tool, with more than 77,000 paid customers to account for 40% of the business’ annual revenue growth.

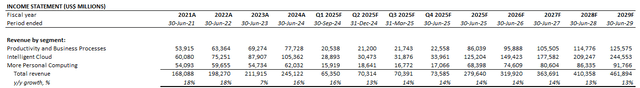

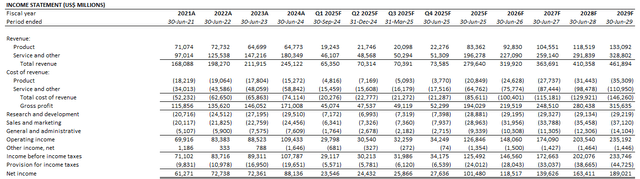

Taken together, we expect Microsoft FY 2025 revenue to grow 14% y/y to $279.6 billion. This will be driven by Intelligent Cloud revenue growth of 19% y/y to $125.2 billion, with anticipated acceleration in the second half of the year. Productivity and Business Processes revenue is expected to grow 11% y/y to $86.0 billion, in line with continued ARPU accretion from robust uptake of Copilot tools. More Personal Computing revenue is expected to grow 10% y/y to $68.4 billion, driven primarily by Windows uptake with the gradual PC market recovery, offset by the moderating impact of Activision contributions to gaming sales.

Continued market share gains in Microsoft Cloud will be key to scaling AI-related capital intensity and drive continued operating leverage improvements. Taken together with management’s guidance for a one-point decline in operating margin, we expect GAAP net income to grow 15% y/y to $101.5 billion.

Valuation Considerations

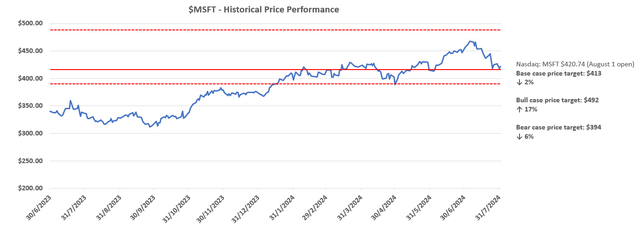

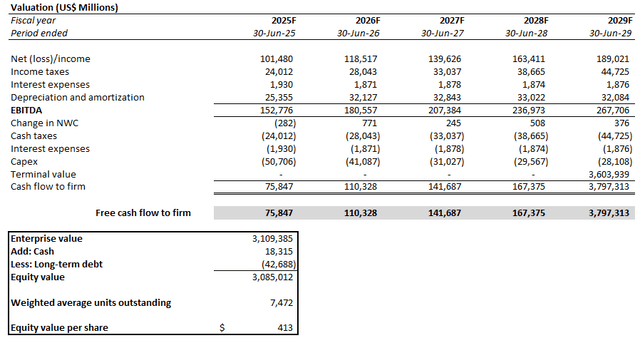

Based on Microsoft’s FY 2025 outlook, which includes a resilient cloud demand environment and continued ramp of AI-related investments, we are setting the stock’s base case price target at $413. This is largely in line with the stock’s post-earnings price, which reflects our view that Microsoft is likely to find durability at current levels as management continues to execute on ramping its AI roadmap. The updated price target is slightly lower than our previous forecast, given a stronger than expected capital expenditure outlook and delayed monetization due to near-term capacity constraints.

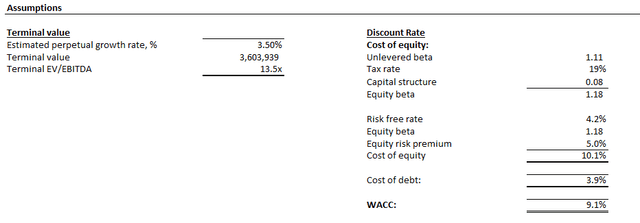

The price target is derived using the discounted cash flow (“DCF”) approach. The analysis considers cash flow projections taken in conjunction with the fundamental forecast discussed in the earlier section. A WACC of 9.1% is applied to reflect Microsoft’s risk profile and capital structure. Our analysis also considers an estimated perpetual growth rate of 3.5% for Microsoft to determine its terminal value.

The potential expansion of its existing share buyback authorization could be a catalyst for a further upsurge in the stock this year. The existing $60 billion share buyback authorization was approved in September 2021, when the company had $8.7 billion remaining in the preceding authorization at the time. This is similar to the about $10 billion remaining in the existing buyback authorization after Microsoft completed about $12 billion in share repurchases during FY 2024. Microsoft also exited F4Q with a cash and cash equivalents balance of $18 billion, which is consistent with levels during the time that the existing $60 billion authorization was announced in 2021. Despite the company’s continued focus on AI investments, its shareholder returns program remains a critical piece to the stock’s performance. A renewed share buyback authorization will likely drive a further upsurge from current levels and further complement any prospects of fundamental outperformance.

Conclusion

Microsoft’s robust FY 2025 outlook continues to drive resilience for the stock at current levels, as it assuages investors’ concerns about risks of over-investing into AI developments. This is further reinforced by a better-than-expected cyclical recovery outlook in the PC market, driven by the anticipated refresh cycle and AI PC adoption, as Windows remains the key operating system. The gradual growth in AI PC uptake rates, supported by increasing use cases, will also be additive to Microsoft’s growth outlook given relevant devices continue to generate a higher ASP while also reinforcing adjacent AI software sales.

However, a further sustained upward valuation re-rate for the stock from current levels will likely require additional growth drivers beyond the existing AI roadmap. Looking ahead, there is limited room for outperformance as investors mull on whether management’s expectations for acceleration in Azure in the second half of FY 2025 will materialize to justify the company’s elevated capital intensity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.