Summary:

- Netflix’s strong earnings and market cap indicate that its competitors are prioritizing other areas over streaming.

- The company’s financial performance and viewing share remain strong.

- Justifying NFLX’s valuation with shareholder returns is still a challenge.

AzmanJaka/E+ via Getty Images

Netflix (NASDAQ:NFLX) had blockbuster earnings pushing the company back towards a quarter-trillion dollar market cap and near its 2021 highs. That strength is indicative of its competitors deciding streaming is less important, multiple people keeping it as a key account, along with an expansion of ad-based services.

As we’ll see throughout this article, despite the company’s recent strength, justifying its valuation with shareholder returns remains a tough sell.

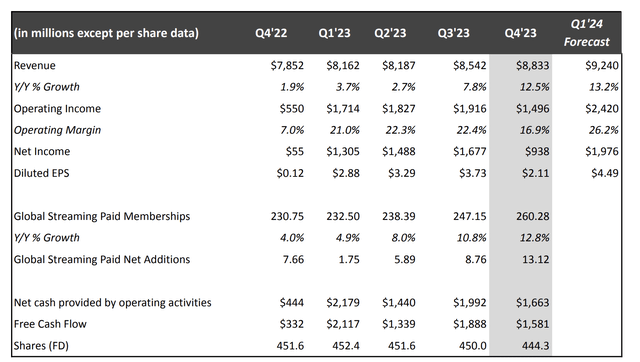

Netflix Financial Performance

Netflix has improved its financials, as an ad business, and sticky customers have enabled revenue to remain strong.

The company managed to achieve 12.5% YoY revenue growth pulling revenue to almost $8.9 billion and operating income to $1.5 billion. While revenue increased QoQ, the company’s margins were actually the weakest of the year. However, the company did manage to see 12.8% in streaming membership growth, an improvement from earlier in the year.

The company’s net additions are exciting to see, and its FCF has remained relatively strong for the year. However, for a $250 billion company, we still don’t think it’s enough. The question will be whether the company can continue this growth. The company’s guidance is strong, but we don’t see its growth permanently continuing.

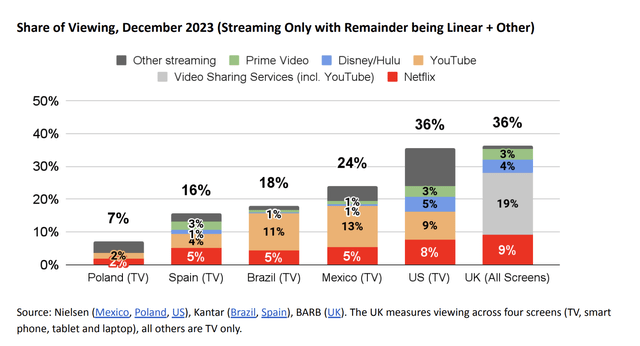

Netflix Viewing Share

The company has continued to maintain strong viewing shares in the market, but competition is clear.

In the company’s key U.S. and U.K. markets, the company has an 8% and 9% share of the markets. However, YouTube is roughly as big in both markets, and Display/Hulu + Prime Video in the two markets has become as big as Netflix. The fact that these competitors are half as big, and in the U.S. especially there’s a large chunk of other streaming is concerning.

It’s showing that the company’s competitors, many of which didn’t exist at scale half a decade ago, are quickly ramping up their market share and growing. We expect competition from HBO Max, Disney, etc. to keep growing.

There’s also an interesting dynamic here. Many Netflix users might have learned recently that shows such as HBO Max’s Young Sheldon have appeared on the service. In fact, Young Sheldon is currently the most-watched show on Netflix. The fact that Netflix’s current success is being driven by other shows is in line with the original goal of Netflix and could help stay in power.

However, competitors with their own streaming services will also expect much more of the money to come back versus enabling Netflix to permanently have content once produced. Some of these bigger shows have historically cost a lot, Netflix historically paid $100 million/year for Friends.

For reference, even the legendarily expensive Game of Thrones cost a total of $800 million to make as a one-time cost. That need to maintain growth by keeping these outside shows from other content powerhouses will put pressure on Netflix’s margins.

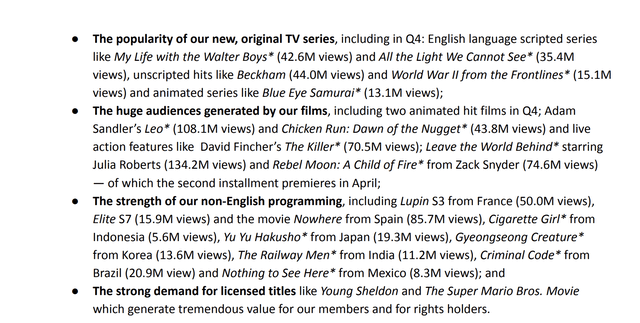

Netflix Positioning

Netflix continues to be decently positioned but continues to have massive content expenses.

Annualized revenue is $32 billion, and the company had $13 billion in content expenses in 2023. The company benefited incredibly well from the Hollywood strikes, which helped margins, but in 2024 the company expects content expenses to reach $17 billion. That will pressure FCF and margins where the company’s FCF is already low.

The company is right that licensed titles generate tremendous value but at the cost of lower margins.

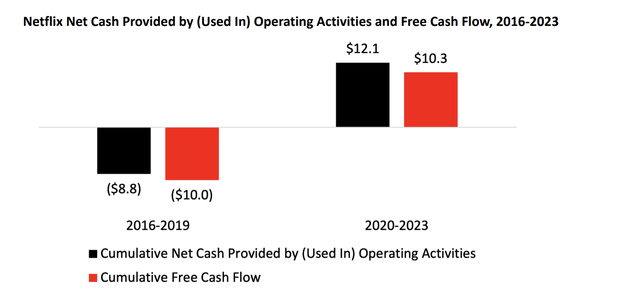

Netflix Shareholder Returns

Netflix has managed to substantially improve its cash flow, but it’s still not at the portion to drive returns.

The company has gone from strong negative FCF to $10 billion FCF over a 4 year period. However, for a $250 billion company, that’s a 1% average annualized FCF yield. The company needs to go up by an order of magnitude to justify long-term shareholder returns. Given the company’s revenue etc., we don’t see it as having a path to driving returns.

The reason is the amount of annualized growth it’ll need. The company is already the largest streaming company in the world and has arguably fully penetrated many Western markets. It still has growth opportunities in other markets, but margins here are lower. This is evidenced by the company’s paid membership growth outpacing revenue growth.

The company’s FCF is positive, which is nice to see, but it remains at 10% of where it needs to be to justify its valuation (assuming growth stops). Given that 2023 was abnormal in terms of costs, we don’t see FCF improving into 2024. We don’t see a path for a company with 9-10% growth rates currently, after offering new features, to hit 10x its FCF.

Thesis Risk

The largest risk to our thesis is whether companies decide that streaming is no longer worth it. Warner Bros Discovery has pushed its FCF from its streaming service positive, but it’s also offering its shows on Netflix to earn extra revenue. Other companies could decide that running a streaming service is no longer worth it and let Netflix resume a market-dominating position increasing profits dramatically.

Conclusion

Netflix had a great 2023. The company managed to resume growth in its service with an ad-supported offering and generate strong FCF. However, it also had the uniquely large Hollywood strikes save it roughly $4 billion in content expenses versus 2024, and competitors looking to cut back and focus on profits on their services.

The company’s largest shows being shows it’s paying competitors to borrow, likely at lower margins for its returns are significant. Its competitors are profitable, and FCF, even with the strikes being a fraction of what’s needed to justify its valuation is a tough position to be in. That’ll make it tough for the company to drive future returns.

Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.