Summary:

- NVDA is the company driving the AI Boom, so any hints of caution or a slowdown will likely not be taken kindly by the market.

- The company trades with an estimated 2025 price-to-sales ratio of 27.9x.

- Typically, an earnings triple play results in an upside share-price reaction, but as we saw last quarter with NVDA when a triple play becomes the norm, sometimes it’s not enough.

BING-JHEN HONG

This quarter’s “earnings season” unofficially comes to an end this week now that Walmart (WMT) has reported its numbers and Nvidia (NVDA) is on tap to report tomorrow after the close. After NVDA, the number of earnings reports per day will slow to a trickle for the next six weeks before the next earnings season begins in early January.

As the largest company in the world, Nvidia’s quarterly earnings release is now inspiring watch parties at bars in New York City! Needless to say, investors are on edge from both a micro and macro perspective about NVDA’s report tomorrow. NVDA is the company driving the AI Boom, so any hints of caution or a slowdown will likely not be taken kindly by the market.

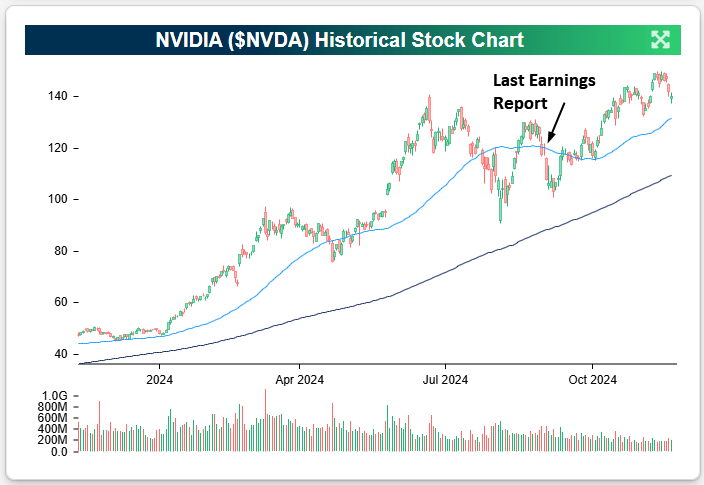

As shown in the chart below, NVDA is heading into its report tomorrow, down only slightly from all-time highs that were hit last week.

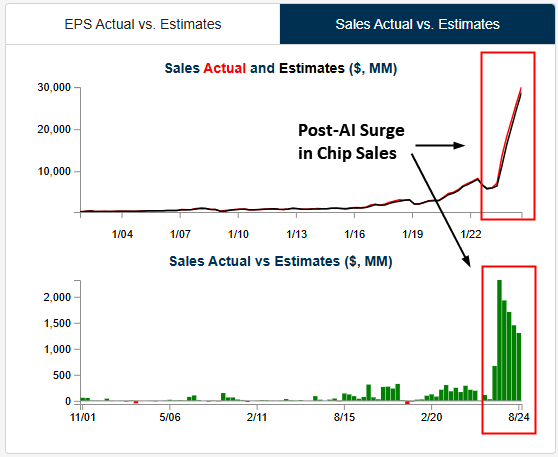

The chart for quarterly NVDA sales is one of the more remarkable ones you’ll ever see. Check out the absolute explosion in sales for NVDA beginning in 2023 (top chart) along with the massive beats versus expectations (lower chart).

NVIDIA (NVDA) shares are up nearly 1,000% since the end of October 2022, just before ChatGPT was released.

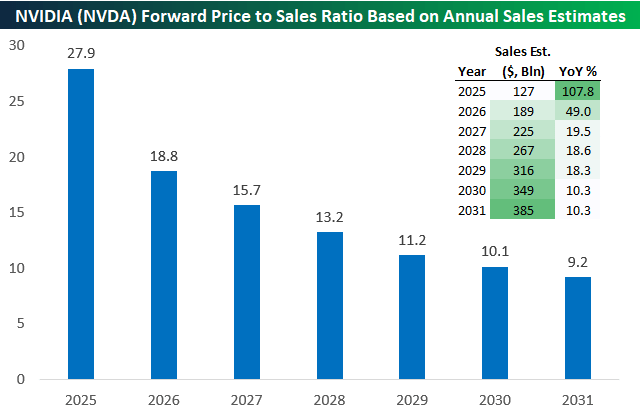

Revenue growth has been astronomical for NVDA over the last couple of years, but with a market cap of more than $3.5 trillion and expected full-year sales of $127 billion in 2025, the company trades with an estimated 2025 price-to-sales ratio of 27.9x. That is not cheap!

And while revenue growth is expected to jump more than 100% YoY in 2025, estimates drop to 49% in 2026, 19.5% in 2027, ~18% in 2029 and 2029, and then 10% in 2030 and 2031.Based on Nvidia’s current market cap, below is a look at its forward price-to-sales multiple going out to 2031 based on estimates. At NVDA’s current valuation, it’s trading at 18.8x 2026 sales, 15.7x 2027 sales, and even 9.2x 2031 sales.

It’s undeniable: NVDA has a lot to live up to in the coming years.

Getting back to the here and now, investors and traders are focused on how NVDA will react in the immediate aftermath of its earnings report tomorrow night.

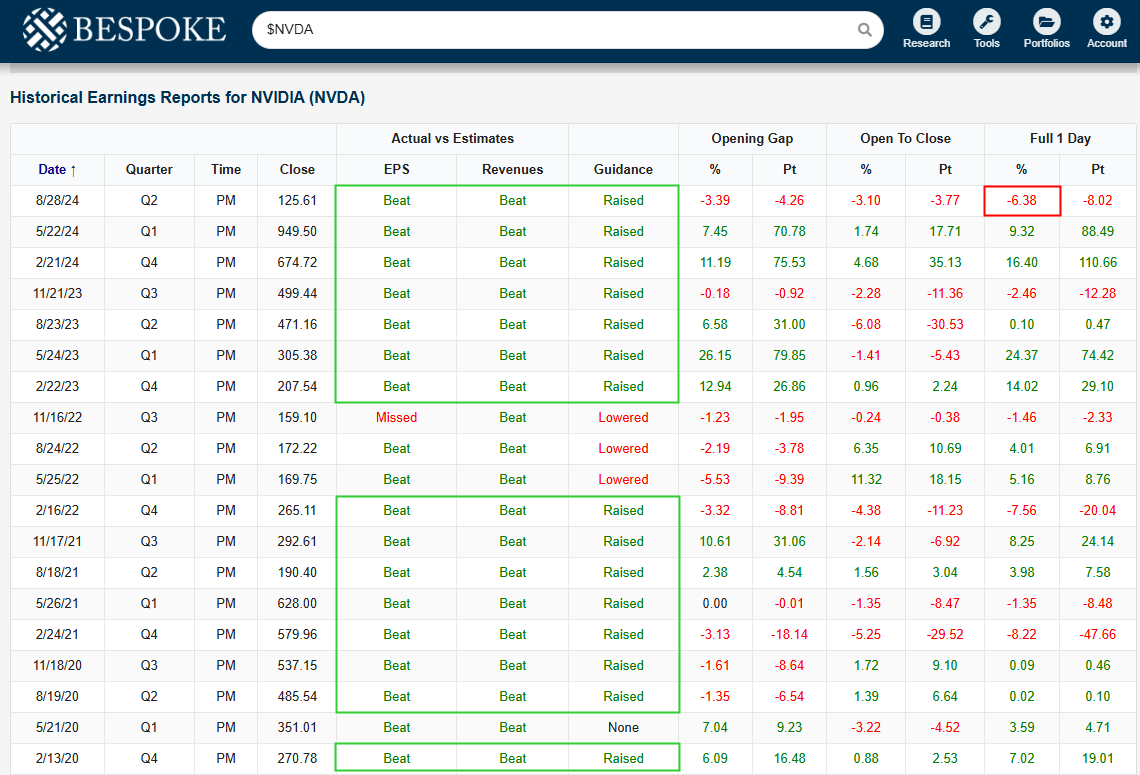

Below is a snapshot of NVDA’s historical earnings data pulled directly from our website. What you’ll notice with NVDA is just how often it reports an earnings triple play by beating EPS estimates, beating sales estimates, and raising guidance. Typically, an earnings triple play results in an upside share-price reaction, but as we saw last quarter with NVDA when a triple play becomes the norm, sometimes it’s not enough. Back in August, following NVDA’s seventh earnings triple play in a row, the stock ended up falling more than 6% on the day.

Looking ahead to tomorrow, it’s hard to envision NVDA shares performing well if it doesn’t manage to report yet another triple play.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.