Summary:

- On August 17, 2023, Walmart, one of the largest food retailers in the world that serves about 240 million customers every week, released its financial results for Q2 FY 2024.

- Walmart’s revenue for the three months ended July 31, 2023, amounted to $161.63 billion, 6.1% more than the previous quarter.

- On September 6, 2023, Bloomberg reported that Walmart is considering purchasing a majority stake in ChenMed, which specializes in providing primary care to older people.

- The San Francisco Fed estimates that Americans’ excess savings stood at a record $2.1 trillion at the end of summer 2021, thanks to multiple rounds of stimulus that were aimed at mitigating the negative impact of COVID-19 on American lives.

- We initiate our coverage of Walmart with a “hold” rating for the next 12 months.

Deagreez/iStock via Getty Images

Walmart (NYSE:WMT) is one of the largest food retailers in the world, serving approximately 240 million customers every week. This multinational corporation, headquartered in Bentonville, has operated a vast network of stores in nearly every corner of the globe for decades. Walmart meets the needs of millions of customers every day with a diverse selection of products, including electronics, groceries, medications, and more.

Since the beginning of the 21st century, the company has been one of the first retailers to start its journey in the field of e-commerce. Since then, Walmart’s numerous platforms have not only brought innovation to the fast-growing global e-commerce market but also improved the quality of life for customers through lower product prices relative to competitors and a more comprehensive range of services provided. The company’s management does not stop at the progress achieved and, from year to year, improves the quality of services offered on platforms such as Walmart Connect and Walmart Fulfillment Services.

In addition, Walmart has continued to pursue an active M&A policy over the past two years, the purpose of which is to diversify its business and strive to improve its margins in the long term. On September 6, 2023, Bloomberg reported that Walmart is considering purchasing a majority stake in ChenMed, which specializes in providing primary care to older people. If the acquisition goes through, it will strengthen Walmart’s position in the primary healthcare market, which is becoming increasingly attractive as new waves of COVID-19 continue to emerge despite widespread vaccination efforts.

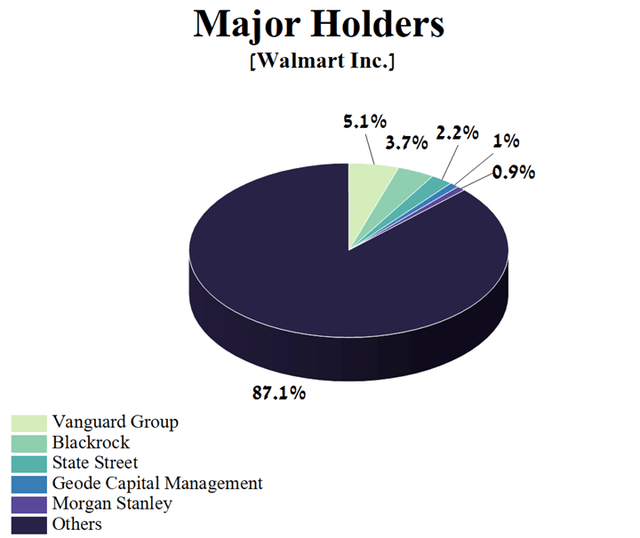

Furthermore, for a long time, Wall Street titans such as BlackRock, Vanguard Group, State Street, Geode Capital Management, and Morgan Stanley have been the five largest shareholders of Walmart.

Author’s elaboration, based on Yahoo Finance

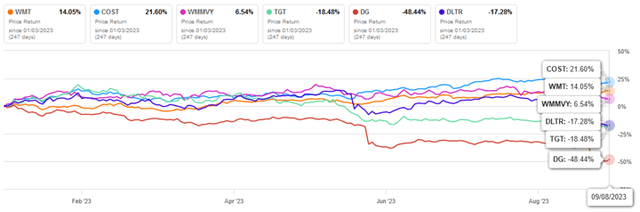

On August 17, 2023, Walmart published financial results for the second quarter of fiscal 2024, which not only beat analysts’ expectations but were also able to demonstrate that the strategies implemented under the leadership of Doug McMillon to improve the company’s margins are beginning to bear fruit. As a result, since the beginning of 2023, Walmart’s share price has increased by more than 14%, outperforming such major competitors in the consumer staples sector as Target Corporation (TGT), Dollar Tree (DLTR), and Dollar General (DG)

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Walmart with a “hold” rating for the next 12 months.

The financial position of Walmart and its prospects

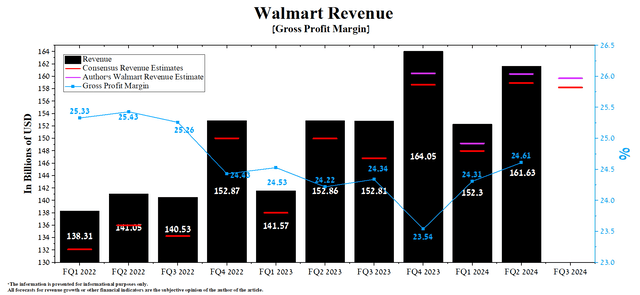

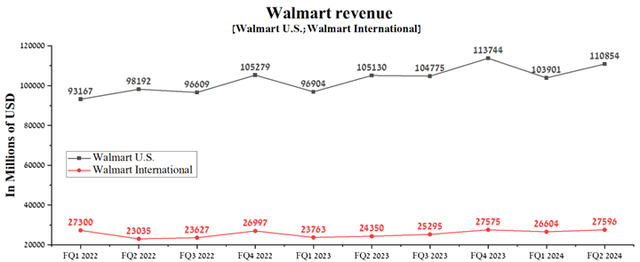

Walmart’s revenue for the three months ended July 31, 2023, amounted to $161.63 billion, 6.1% more than the previous quarter and 5.7% more than the 2nd quarter of fiscal year 2023.

Author’s elaboration, based on Seeking Alpha

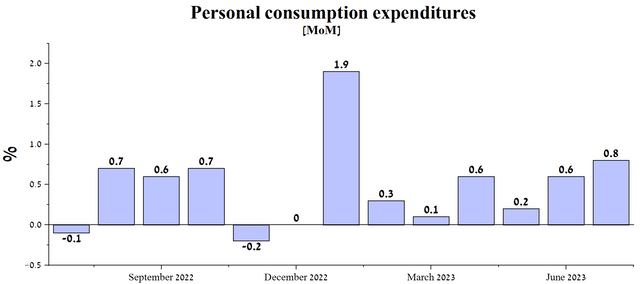

The Fed’s continued tight monetary policy, coupled with rising household debt and resumption of interest accrual on student loans, have not had a negative impact on US consumer spending in recent months.

The author’s elaboration, based on the U.S. Bureau of Economic Analysis (BEA)

As a result, the company’s actual revenue beat analysts’ consensus estimates for the last ten quarters, suggesting that Mr. Market is consistently underestimating its business outlook.

Walmart U.S.’s total sales were $110.85 billion in the second quarter of fiscal 2024, up about $5.27 billion from the prior year, driven by higher sales of food and various health products.

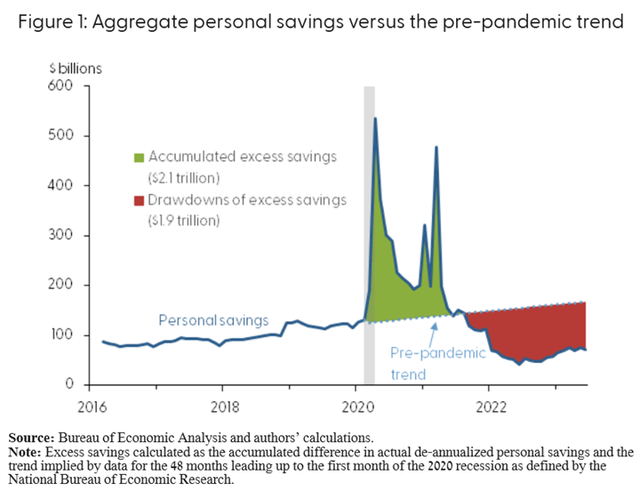

Author’s elaboration, based on quarterly securities reports

The company’s management continues to pursue a pricing strategy called EDLP, which allows Walmart not only to remain a leader in the U.S. food retail industry but also to attract new consumers whose savings cushion continues to shrink rapidly. The San Francisco Fed estimates that Americans’ excess savings stood at a record $2.1 trillion at the end of summer 2021, thanks to multiple rounds of stimulus that were aimed at mitigating the negative impact of COVID-19 on American lives. One since then, this value has continued to decline and reached $190 billion by June 2023. As a result, excess household savings are highly likely to be fully depleted in the middle of the third quarter of 2023, which is one of the risks for maintaining Walmart’s revenue growth rate in 2024 at the level shown from 2022 to 2023.

Bureau of Economic Analysis and authors’ calculations.

Just as important, the Walmart U.S. segment’s eCommerce sales continue to grow despite increasing competition from companies such as Amazon (AMZN), Home Depot (HD), and eBay (EBAY), thanks to the introduction of new technologies and services aimed at increasing customer loyalty.

According to Seeking Alpha, the company’s revenue for the third quarter of fiscal 2024 is expected to be $155.88-$163.96 billion, slightly less than analysts’ expectations for the three months ending July 31, 2023. At the same time, under our model, Walmart’s total revenue will be slightly higher than the median value of this range and will amount to $159.7 billion. When forecasting this value, we considered the impact of the resumption of student loan payments by tens of millions of people from October 2023. As a result, this will create an additional financial burden for Americans and temporarily reduce their purchasing power until the Fed begins to pursue a looser monetary policy.

However, unlike many U.S. retailers, the company’s management is investing billions of dollars in modernizing and robotizing stores rather than increasing their number. In addition, under Doug McMillon’s leadership, the supply chain network’s efficiency is growing, and the range of services and products provided is being optimized, which ultimately helps to increase the level of customer satisfaction and Walmart’s revenue.

As expected, SG&A expenses were higher versus last year and deleveraged 33 basis points. This reflects higher variable pay expenses relative to last year when we were below our planned performance, tech investments and increased store remodel cost in the U.S. Partially offsetting this, international expenses leveraged significantly on strong sales growth.

As we increasingly utilize technology in our business, we’re pleased with the performance metrics from our newly automated distribution and fulfillment notes. Our automated e-commerce fulfillment centers are achieving efficiencies of 30% higher units per hour than non-automated buildings.

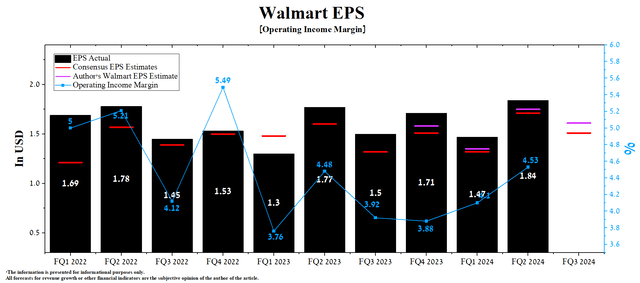

Walmart’s operating income margin in the 2nd quarter of fiscal year 2024 was 4.53%, continuing the growth that began in the first quarter of fiscal year 2023. We forecast that this financial metric will reach 4.5% by the end of 2024, including due to increased demand for the company’s advertising and financial services, lower inflation in the US and Canada, and optimization of human capital structure.

Walmart’s earnings per share (EPS) for the three months ended July 31, 2023, were $1.84, up 25.2% from the prior-year quarter and, just as importantly, beating analysts’ consensus estimates in nine of the last ten quarters. According to Seeking Alpha, the company’s EPS for the third quarter of fiscal 2024 is expected to be $1.43-$1.67, 11.7% less than the consensus estimate for the second quarter of fiscal 2024. While we believe this is slightly underestimated, our model projects Walmart’s EPS to be $1.61.

On the other hand, Walmart’s Non-GAAP P/E [TTM] is 25.12x, which is 41.03% higher than the sector average and 8.47% higher than the average over the past five years. Moreover, P/E Non-GAAP [FWD] is 25.28x, which indicates that the company is slightly overvalued in the current period of growing household debt and the ongoing strengthening of the US dollar against major foreign currencies.

Author’s elaboration, based on Seeking Alpha

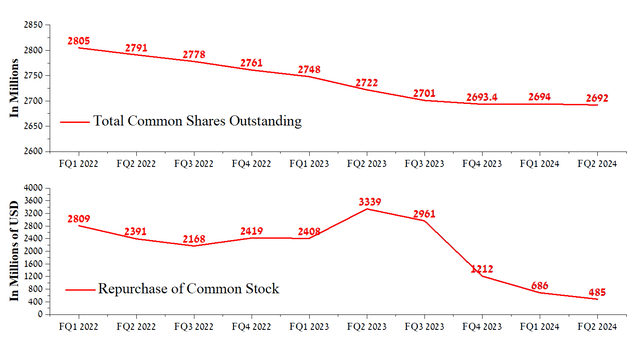

Even though Walmart has sharply reduced its free cash flow spending on share repurchases over the past three quarters, this has not interrupted the company’s EPS growth trend from year to year. At the same time, at the end of July 2023, the remaining authorization to repurchase Walmart shares amounted to $18.2 billion, which is sufficient to minimize the impact of short sellers on the price of the company’s shares if China’s economic slowdown continues.

Author’s elaboration, based on Seeking Alpha

Conclusion

On August 17, 2023, Walmart, one of the largest food retailers in the world that serves about 240 million customers every week, released its financial results for the 2nd quarter of fiscal year 2024.

The company’s year-on-year growth in revenue and operating income has allowed it to pursue an active M&A policy in the last two years, both to diversify its business and improve its margins in the long term. On September 6, 2023, Bloomberg reported that Walmart is considering purchasing a majority stake in ChenMed, which specializes in providing primary care to older people. If the acquisition goes through, it will strengthen Walmart’s position in the primary healthcare market, which is becoming increasingly attractive as new waves of COVID-19 continue to emerge despite widespread vaccination efforts.

Given the technical analysis, the imminent resumption of student loan payments by tens of millions of Americans, and our expectation that the AI hype is coming to an end, we believe that the price level at which the risk/reward profile will be attractive is $146-$147 per share.

We initiate our coverage of Walmart with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.