Summary:

- Canoo has pushed through a 1-for-23 reverse stock split to remain in compliance with NASDAQ’s minimum listing requirements.

- The EV upstart is operating on shoestring liquidity with heavy cash burn and substantial dilution.

- Dilution is set to continue with the reverse stock split set against strong demand for EVs but a dire capital backdrop for EV upstarts.

CASEZY

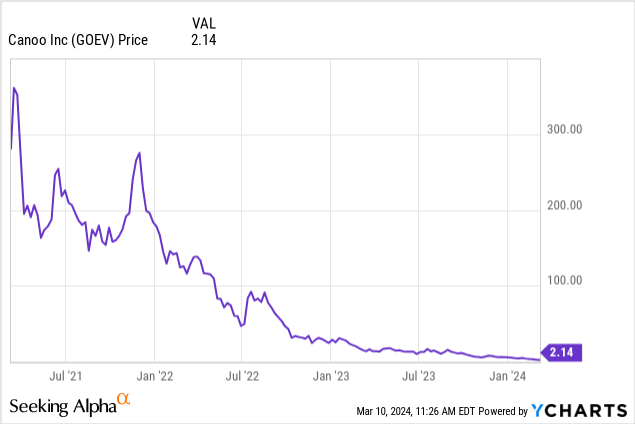

Canoo (NASDAQ:GOEV) just engineered a 1-for-23 reverse stock split that has placed the EV upstart back in compliance with NASDAQ’s $1 minimum listing requirement. The company last filed a Form 10-Q for the period ending 30 September 2023, hence, its current exact market cap is hard to ascertain with its diluted weighted average shares outstanding likely up significantly since on the back of subsequent liquidity raising events. This figure was 621,286,000 at the end of September, up 126% from its year-ago comp. It would be 27,012,434 shares post the reverse stock split. Selling pressure could continue against a roughly 28% short interest pre-reverse stock split as continued cash burn is set against the specter of back-to-back bankruptcy filings of GOEV’s peers.

Arrival (ARVLF) has recently joined the expanding list of bankrupt EV companies that I flagged in my last article on GOEV as harbingers of the dire backdrop the company is operating in. The promising British upstart tried to champion a microfactory approach to EV development but filed bankruptcy last month. It joins a list that includes electric bus company Proterra (OTCPK:PTRAQ), Lordstown Motors (OTCPK:RIDEQ), and Electric Last Mile Solutions (OTC:ELMSQ). EV charging company Charge Enterprises (OTC:CRGEQ) also filed for bankruptcy this month. I think GOEV’s reverse stock split only means a delay of a delisting event that’s been fundamentally set in motion by its poor liquidity and cash burn profile.

Liquidity, Bears, Bulldogs, And The Electric Future

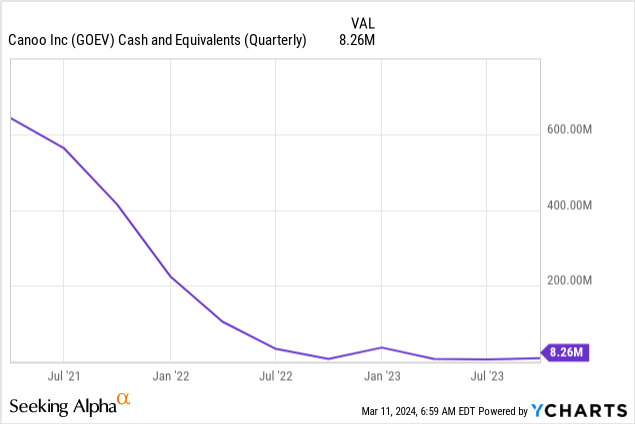

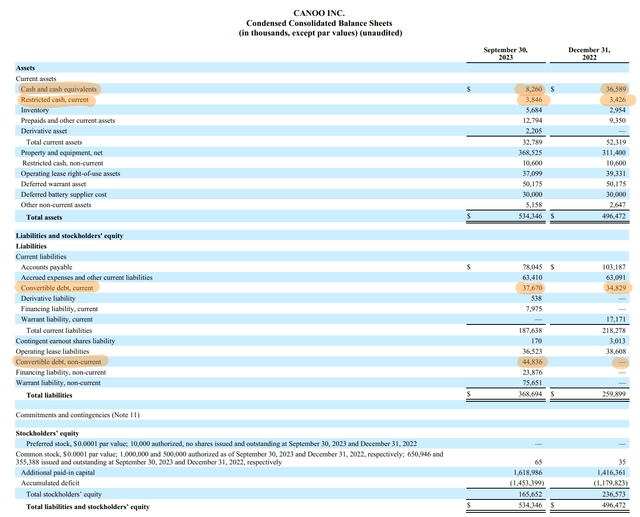

GOEV needs more funds. The upstart held cash and equivalents of $8.26 million at the end of September. While another $3.8 million was available from restricted cash, aggregate current liquidity of roughly $12 million is woefully inadequate when set against the trajectory of GOEV’s cash burn rate over the last three years. There is another $10 million in non-current restricted cash. GOEV’s revenue during the quarter came in at $519,000 with a cost of goods sold that was in excess of this at $903,000 to drive a negative gross margin of $384,000.

Canoo Fiscal 2023 Third Quarter Form 10-Q

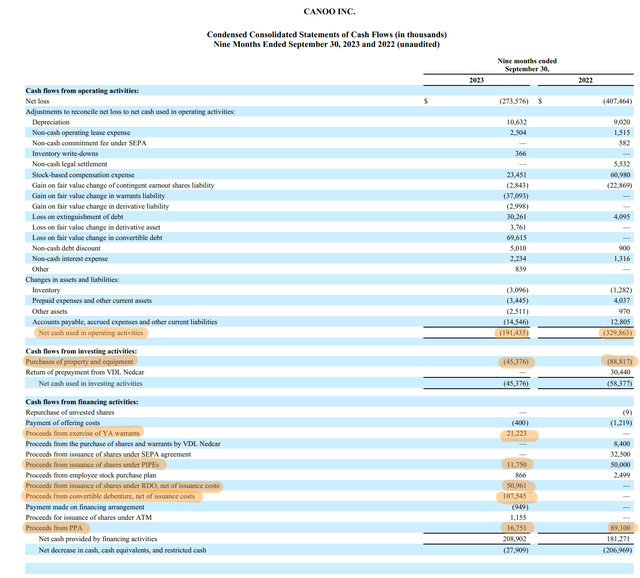

Net loss during the quarter was $112 million, a marginal improvement from a loss of $117 million in the year-ago comp with GOEV’s cash burn from operations from the trailing 9 months from the end of its third quarter at $191.43 million. These are substantial numbers. Bulls could argue that operational cash burn dipped from its year-ago comp of $329.86 million, but GOEV is trying to bring a high capital expenditure car to market while operating on shoestring liquidity. The company has also been issuing convertible debentures to tide over liquidity with $108 million of this issued in the 9 months from the end of its third quarter.

Canoo Fiscal 2023 Third Quarter Form 10-Q

GOEV recently unveiled a new EV model called the American Bulldog, a dual-cab pickup that’s described as a variant of the model delivered to the US Army in 2022. Critically, GOEV was able to raise $45 million post-period end from an unnamed foreign institutional investor with a scope to upsize this investment to $150 million. This capital injection is being structured through convertible preferred stock with dividends that can at the option of the institutional investor be paid with either cash, in kind, or with more GOEV stock. The precarious nature of GOEV’s cash position means an increased likelihood of common stock being used to satisfy the 7.5% annual coupon rate on the preferreds. This rate after five years will increase by 1.5% every year up to 12% per year. The company also issued warrants to the investor to purchase 22.96 million shares of common stock.

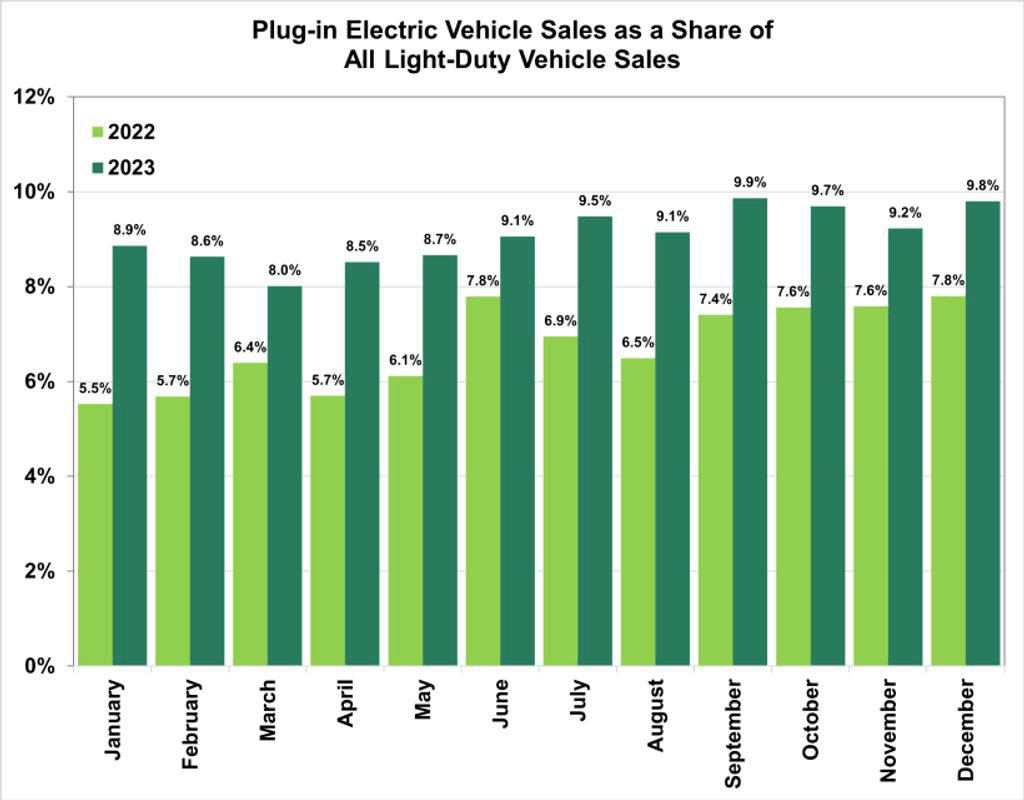

Insideevs.com

The headwinds facing EV upstarts have come at odds with the material growth of the plug-in EV in the US. This formed 9.8% of all light-duty vehicle sales in the US in December last year, up from 7.8% in the year-ago comp. The US Department of Energy placed 2023 EV sales at more than 1.4 million, a 50% increase over its year-ago comp with more than four million new EVs on the road since the pandemic. The future of automobile transportation is electric but it’s set to be entirely dominated by larger players like Tesla (TSLA), GM (GM), and BYD Company (OTCPK:BYDDF). GOEV now joins Fisker (FSR) in a shrinking basket of small independent EV upstarts still trading and chasing the electric dream but facing material liquidity constraints. Bringing a new car to market is not easy, is highly capital intensive, and with a high failure rate. GOEV’s reverse stock split is not a buy-the-dip opportunity with the company now in a phase of hyper dilution set against a competitive capital backdrop with the Fed funds rate at a 22-year high of 5.25% to 5.50%. The common shares might see a rally on pending Fed rate cuts but remain an avoid.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.