Summary:

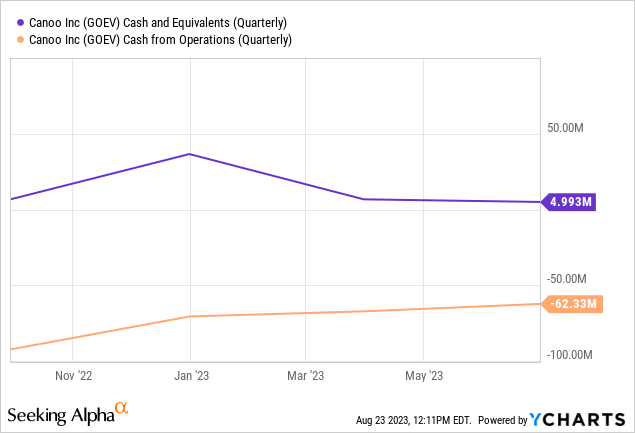

- Canoo ended its fiscal 2023 second quarter with cash and equivalents of $5 million.

- This was set against cash outflows from operations of $62.3 million and guidance for at least $70 million in capital expenditure through its third and fourth quarters.

- The company has raised more funds but currently has a cash runway of around two quarters left.

gerenme

What exactly is going on with Canoo (NASDAQ:GOEV)? The EV upstart has been rallying from recent 52-week lows on the back of its fiscal 2023 second-quarter earnings, which saw the announcement of a large customer agreement with a Fortune 100 company. This was as the pre-revenue company ended the quarter with a cash and equivalents position of $5 million. The earnings also came against the backdrop of the collapse of Proterra. The electric bus company became the latest EV company to file for bankruptcy in a slowly expanding list that includes Lordstown Motors and Electric Last Mile Solutions. Canoo faces the same backdrop of a collapsed stock price and a dearth of liquidity against ambitious plans to bring thousands of units up to production. I previously covered Canoo in June.

Why do I remain bearish on Canoo? Cash burn. The company recorded cash outflows from operations of $62.3 million for its second quarter. Critically, the company’s current market cap of $320 million will be increasingly insufficient to support the type of dilution required to expand its cash runway. Further, capital expenditure during the second quarter stood at $15.5 million, down from $37 million in the year-ago comp but with the company guiding for capital expenditure of $70 million to $100 million through the third and fourth quarters of 2023. Canoo’s shareholders need to be aware that whilst market appetite for riskier companies could be set to improve were the Fed to pause any further rate hikes, the company still needs to raise at least $300 million through the next four quarters to meet both operational cash outflows and capital expenditure.

Where Is The Cash Coming From?

Canoo was able to raise $53.2 million from the issuance of convertible debentures to Yorkville, with a further $3 million raised from an August pipe. Had these been completed during the second quarter, then the company would have seen its liquidity position at $61.2 million as of the end. However, this is not nearly enough funds for more than two quarters of operations, and Canoo will find itself requiring further external capital to remain a going concern. Any such transaction is required just after the end of summer and is set against a total debt balance as of the end of its second quarter came in at $96.8 million.

Bulls would be right to flag that Canoo has been making some strides in rightsizing its operational footprint, with a monthly cash outflow for the second quarter that was roughly 38% lower than its average cash flow per month in the year-ago period. Cash used in operations for the first half of 2023 was $129.5 million, down from $237.6 million from a year ago. To be clear, Canoo does not currently have sufficient cash to bring its EVs to market in sufficient volumes and over the time frame required for any production ramp to filter through to positive gross margins and eventually positive cash flows. The company management seemed optimistic during the second quarter earnings call about the prospect of raising more funds and flagged that they should generate positive free cash flows once they hit a 40,000-vehicle per year production run rate by the end of 2024.

The Electric Car Ramp And The Future Of Driving

Cox Automotive

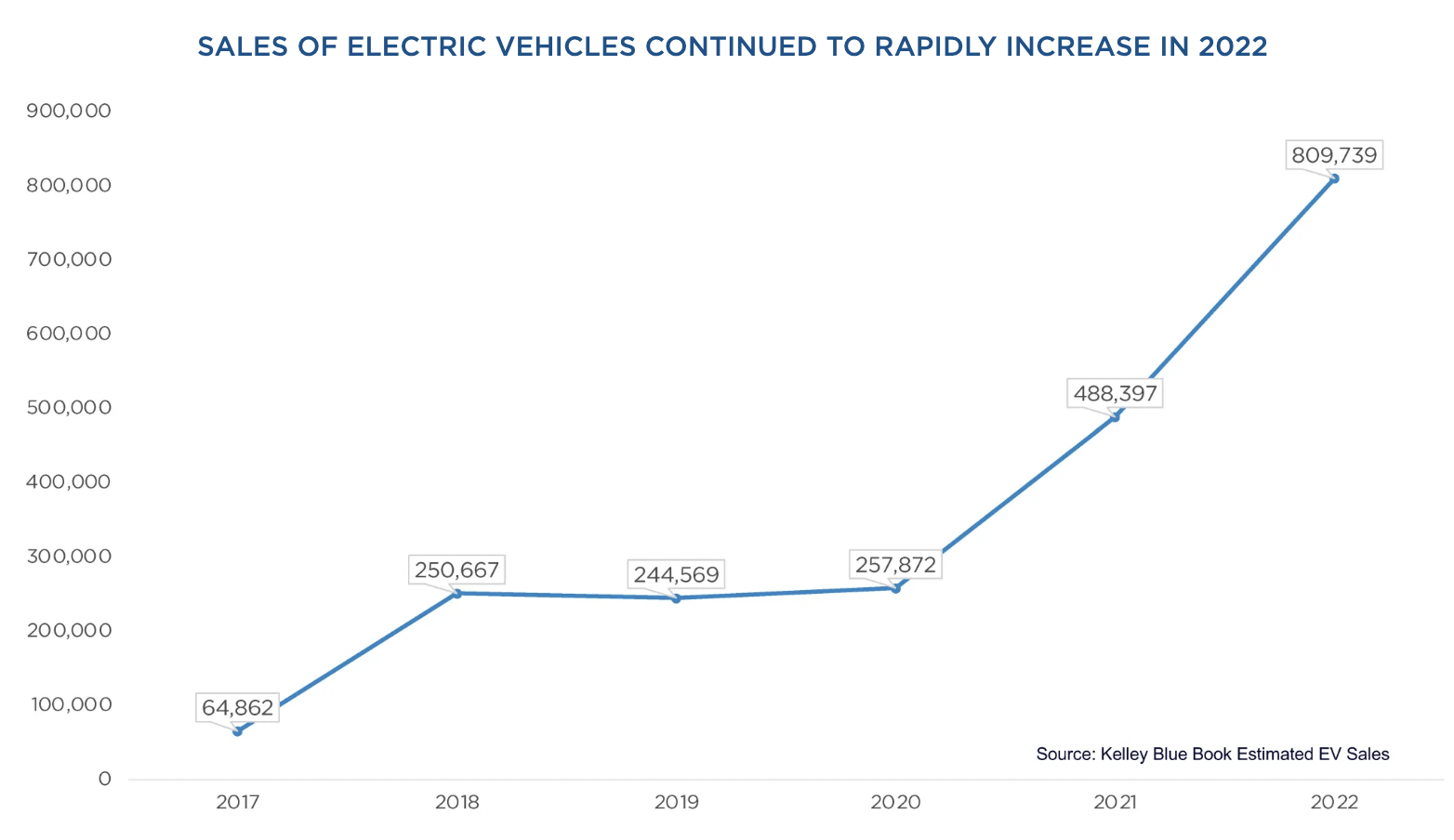

The electric car revolution is real with sales of 809,000 units in the US in 2022, around 5.7% of total cars sold. EV sales are currently on track to surpass one million units in 2023 with this set to ramp every year on the back of government subsidies and increasing awareness of the incompatibility of internal combustion engine vehicles with a world looking to manage anthropogenic climate change. The all-EV future is coming as more states including California institute hard dates for the total phase-out of new ICE vehicle sales. This positive macro backdrop combined with a possible dovish Fed pivot if the headline CPI print in the coming months was to reach the Fed’s 2% target would reignite the risk-off trade and push the commons up. For bears, this represents one of the greatest risks and would also set the backdrop for Canoo to raise more funds by selling shares.

Canoo expects an adjusted EBITDA loss of $120 million to $140 million through its third and fourth quarters, even as it moves production capacity at its Oklahoma City production facility to a 20,000 unit per year run rate. The cash flow position remains the core factor for shareholders to be focused on. Canoo has ambitious plans, but will be unable to translate this to revenue without a material fundraising event to expand out a cash runway that currently stands at around two quarters at best. Hence, the company’s near-term future is likely to be defined by a constant flirting with Chapter 11. This would be even as demand for EVs reaches record highs. Bears, who form the 12.6% short interest, would be right to flag that the company also runs the risk of being delisted from the Nasdaq on the back of a stock price that has fallen below minimum listing requirements. It’s hard to see what the bullish case is here, with a constant dearth of liquidity, heavy cash burn, and dilutive external fundraiser set to be the defining features of Canoo’s future.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.