Summary:

- Canoo Inc. has generated positive news flow with EV deals and asset acquisitions, but the company lacks the cash on hand to reward shareholders.

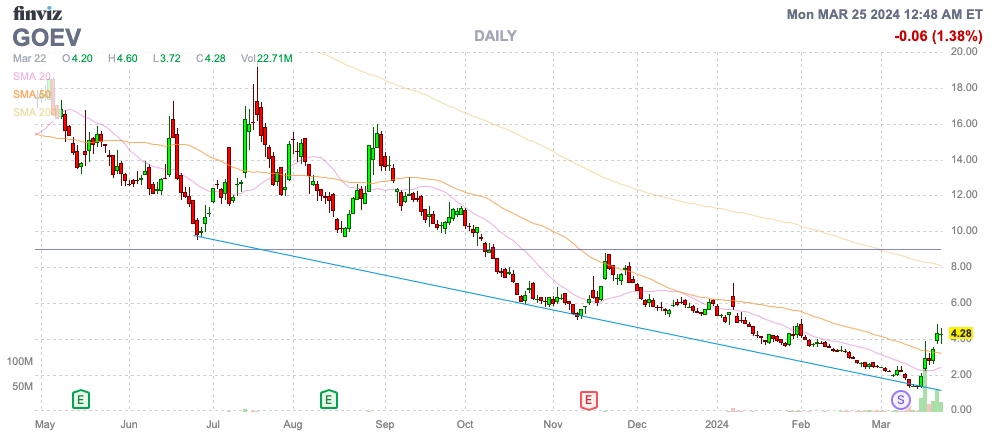

- GOEV stock plunged following a reverse split, but snapped back after the U.S. Department of Transportation approved the Oklahoma City facility as a FTZ.

- Canoo entered Q4’23 with an effective cash balance of only $53.3 million and will need to constantly dilute shareholders to fund ongoing operating losses in the EV manufacturing ramp phase.

PhonlamaiPhoto

The electric vehicle (“EV”) sector has gotten crushed in the last year, and Canoo Inc. (NASDAQ:GOEV) stock has been no exception. The company has generated a lot of positive news since reporting the Q3 ’23 earnings report, sending the stock soaring to end last week, but the mobility company lacks the cash on hand to reward shareholders. My investment thesis is more Neutral on the stock following the bounce off the reverse split lows.

Source: Finviz

Positive News Flow

Canoo went public via a SPAC, similar to a lot of other EV companies, and the company has spent the whole time just building towards the manufacturing and revenue-generation phase. The company officially announced the start of this phase with the Q3 results in November, but reaching this point has come at a huge cost.

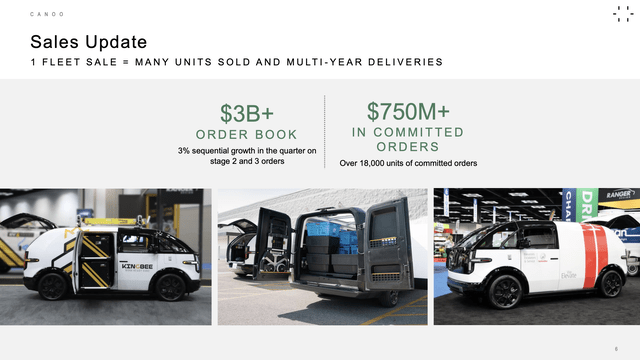

Since the quarter ended, Canoo has announced vehicle deals with The U.S. Postal Service, Prime Time Shuttle, and Zeeba. The company has acquired assets from Arrival to help improve manufacturing processes and obtained Foreign Trade Zone (FTZ) status to help lower import costs.

An example of the recent deals, Los Angeles-based Prime Time Shuttle signed a contract to purchase up to 550 EVs over the next few years. Prime Time operates in 34 states and will initially use the Canoo Lifestyle Vehicle for shuttles in the LA area.

Canoo has huge plans for 20,000 annual unit capacity. A big reason for this plan is the large order book of $3+ billion for over 67,000 vehicles with $750+ million in committed orders even before the above additional deals.

Source: Canoo Q3’23 presentation

Canoo has gotten to the point where a viable business is around the corner. The big question is the dilutive impact of financing the next few years before the company can turn cash flow positive.

Canoo Stock – Major Red Flag

In no surprise, the stock plunged following the completion of the reverse split effective March 8. Management chose a massive 1-for-23 reverse split to get the stock back above the minimum listing standards for the Nasdaq.

Canoo quickly plunged to a 52-week low of $1.28 before the snap back rally. The key here is that the reverse split naturally has a negative connotation, but the share move has no meaningful impact on the valuation of the company.

GOEV stock really snapped back on the U.S. Department of Transportation approving the Oklahoma City facility as a FTZ. The FTZ designation eliminates customs duties on vehicles sold internationally and defers customs duties on imported parts used in domestic vehicle sales.

Canoo estimates international sales will see a 5% cost reduction due to the FTZ. While this is a huge positive long-term for any manufacturing company with low margins, Canoo has bigger problems right now.

The domestic EV manufacturer ended Q3 with a cash balance of only $8.3 million. Due a preferred stock and warrant subscription agreement during early Q4 for $45.0 million, Canoo started the quarter with an effective cash balance of $53.3 million.

The problem is that the EV company used $61.9 million in cash from operating activities during Q3 ’23 alone along with additional money for capital spending. Canoo won’t report Q4 ’23 results until Monday April 1 after the market close, and the company has now gone 6 months without updating the cash balance and financing activities due to the extended period for reporting full-year 2023 results.

The company has access to funding, but the ATM and the existing agreement with Yorkville Advisor comes at a huge dilutive cost after the reverse split sent the stock into the $1s. Even after the recent rally to $4, Canoo would be raising capital with a market valuation of only around $250 million.

The Q3 adjusted EBITDA loss was only $40.4 million and the guidance for the 2H of last year was $95 million at the midpoint. The problem with the ramp-up manufacturing phase is the cost ramps only accelerate and a lot of the other EV companies have run into similar issues.

Canoo has started delivering units to the state of Oklahoma and announced deliveries to Kingbee as part of a binding order for 9,300 EVs. The company is forecast to lose money for years, though revenues are expected to jump dramatically in 2024.

Takeaway

The key investor takeaway is Canoo stock probably got beaten down too far on the negativity surrounding the reverse stock split. Canoo has entered the interesting manufacturing phase of the business, but the stock just doesn’t have any real investment appeal without cash on hand to fund ongoing operating losses for years until Canoo can ramp up to the estimated annual production of 14,000 vehicles to reach breakeven. The EV company likely will have to constant dilute shareholders in order to run operations for years, limiting the upside of GOEV stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.