Summary:

- Canoo has seen a significant drop in share price from over $572 to just $1.50, with minimal revenues and significant losses.

- The company is working on pilot testing its vehicles with hopes of generating meaningful sales in 2024, but revenue estimates have been continually dropping.

- Canoo’s negative working capital balance, high cash burn rate, and reliance on financing from Yorkville raise concerns about continuous dilution and future prospects.

Klaus Vedfelt

One of the worst performing names in the markets in recent years has been Canoo (NASDAQ:GOEV). The electric vehicle manufacturer saw its shares peak at a split-adjusted price of over $572 in late 2020, only to fall back to just a dollar and change these days. After the close of trading, the company reported its Q2 results, and the numbers show a name that’s still in tremendous trouble.

Canoo describes itself as a “high tech advanced mobility technology company with a proprietary modular electric vehicle platform and connected services initially focused on commercial fleet, government and military customers”. It believes that its “breakthrough EV platform” will be able to bring new products to market faster and cheaper than its competitors. To date, the company has produced very little in terms of revenues, but it has racked up sizable losses and significant cash burn. As a result, the balance sheet is in poor shape, and investors have been diluted quite a bit over time.

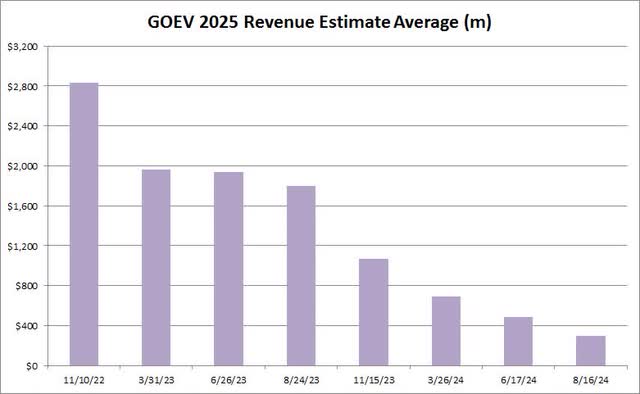

This year, the company is working with customers on pilot testing of its vehicles, and it hopes that 2024 will be the first year with meaningful revenues generated. In Q2, however, Canoo only reported revenue of $605,000 in total, badly missing street estimates for $1.56 million. As the chart below shows, estimates for next year’s revenues have come crashing down in the past nearly two years. Analysts went into last Wednesday’s report expecting about $65 million in total sales this year. That number was down about 96% in just the past 21 months already, but it plunged to under $20 million after the Q2 report. The company is working to get its production facility to an annual run rate of tens of thousands of vehicles, but obviously progress has been slow and painful.

Canoo Revenue Estimate Average (Seeking Alpha)

With very little revenues to work off currently, Canoo has racked up some pretty large losses. Gross margin dollars were negative in Q2, even before almost $42 million in operating expenses. While the quarterly operating loss did improve by about $30 million over the prior year period, the annual run rate here was still for a loss of around $175 million. The net loss was a lot better, but only because of an accounting gain on the company’s warrant liability due to the plunging share price.

Like its operating losses, management did talk in the earnings release about a solid reduction in cash burn. However, free cash flow was more than negative $90 million in the first half of this year, and quarterly trends should continue around those levels or even more in the back half. At the end of June, company’s the total cash balance was more than $19 million, but a lot of that was restricted cash. Short-term convertible debt on the balance sheet stood at more than $47 million.

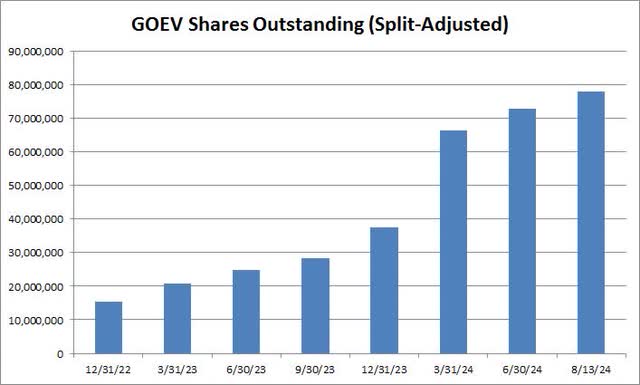

The company’s main source of financing currently is a pre-paid advance plan with Yorkville, a Cayman Islands exempt limited partnership. Last month, Canoo came to its latest agreement with Yorkville, providing for up to $100 million in funding, with $15 million initially. The advances are offset by the issuance of common stock, which as the chart below shows, has continued the surge in the company’s outstanding share count over the past year and a half.

GOEV Shares Outstanding (Company Filings)

At the end of the June quarter, the company had a negative working capital balance of more than $160 million. With Canoo likely to tap Yorkville for another $10 million or more each month moving forward, massive dilution will continue for some time. With a total market cap of only a little more than $100 million dollars as of Friday’s close, each of these advances is quite costly for shareholders.

In terms of valuation, Canoo finished Friday at about 0.41 times expected 2025 revenues. That put the name a bit above the valuation of names like Ford (F) and General Motors (GM). Most of the Chinese electric vehicle names go for around 0.65 times or so their expected revenues for next year, while other US names like Rivian (RIVN) and Lucid (LCID) average about 3 times. The major difference here is that Canoo’s revenue estimates have been continually dropping, so even with shares trading like a distressed asset, it’s hard to see much upside currently. The average price target on the street was north of $7 entering the Q2 report, but fell to under $6 afterwards. While that still implies tremendous upside, the average valuation was over $81 just a year ago.

With another near zero revenue quarter in the books for Canoo, I am placing a sell rating on the stock today. The company just hasn’t been able to generate revenues at any scale yet, with large losses and cash burn putting a significant strain on the balance sheet. With management likely needing to bring in a lot more capital to ramp up production, investors are facing continuous dilution for some time. If shares continue to be pressured, falling below $1 a share, another reverse split may be needed to remain listed, and that could be an additional negative catalyst in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.