Summary:

- Canoo has a solid product strategy, focusing on a flexible vehicle platform and the underserved niche of light commercial vehicles.

- The company relies heavily on shareholder dilution for liquidity, raising over $400 million since its IPO. Canoo has access to another $200 million through dilutive agreements with Yorkville.

- Canoo has delivered almost no vehicles in the last 12 months, raising serious concerns about its execution capabilities. Despite opening its Oklahoma production facility, Canoo does not disclose production targets.

- Canoo has between $9 million and $18 million in cash, with a runway of only one to two months. This limited financial cushion and need for further dilution contribute to my “SELL” rating for Canoo stock.

Ralf Hahn/iStock via Getty Images

I covered Rivian Automotive, Inc. (RIVN), Lucid Group, Inc (LCID), Fisker and NIO Inc. (NIO) in a recent article, arguing how they do not represent a compelling proposition for shareholders. Some readers reached out asking my opinion about Canoo Inc. (NASDAQ:GOEV). In this article, I examine how Canoo stacks up against other Electric Vehicle “PurePlayers”, i.e. car makers that exclusively focus on producing EVs.

I believe it is worth nothing that since my last article, Fisker has declared bankruptcy. This was a risk I mentioned back then and the reason why I will not compare Canoo to Fisker in this new analysis.

Thesis: Canoo has a solid product strategy but is short of cash and presents no credible execution plans

I believe Canoo has a superior product strategy compared to other early-stage PurePlay EV players. The company developed a flexible and scalable automotive platform, allowing to quickly target different markets with distinct models. More importantly, Canoo has chosen to focus on an underserved EV niche: Light Electric Commercial Vehicles. This is a high-growth EV segment, and neither Tesla, Inc. (TSLA), nor Rivian, Lucid or NIO offer vehicles to tackle it.

However, the good news for Canoo ends with its product strategy. Looking at how management has executed since IPO, a dire picture emerges. The company has raised over $400 million through agreements with Yorkville, leading to significant shareholder dilution. As a result, the company’s stock has plummeted by 99% since its peak in early 2021.

Even more worryingly in my view, Canoo has delivered no more than 25 vehicles in the last 12 months, despite opening its Oklahoma production facility in November 2023. Canoo also does not disclose numbers on expected deliveries or how many vehicles they expect to produce in 2024. I view these as red flags that the company is failing to mass produce EVs and start generating cash flow from its operations.

The company has access to another $200 Million, which also comes in the form of agreements that will keep diluting shareholders. There is no doubt in my mind that management will need to dilute shareholders further, given the company has limited Cash on Hand at the moment, and an expected runway of 2 months at best, in my calculations. Canoo has actually very recently announced the sale of up to 13 Million more shares, which are outside of the agreements with Yorkville.

For these reasons, I can only recommend a “SELL” for Canoo’s stock. I like the product strategy and a possible risk to my thesis is that the company could be acquired for someone else to execute on it. However, with current management needing to raise capital and dilute shareholders, I see no upside in entering Canoo at these levels.

What I like: Canoo has a scalable EV platform and focuses on an under-served EV niche

I like Canoo’s product strategy, because I see it as fairly unique, targeting a well defined niche. More specifically, I see Canoo’s product strategy as based on two pillars.

The first pillar concerns the development of a flexible, cheap and scalable automotive platform for producing EVs. This is a similar approach to what Tesla’s pioneered with the Model 3 and Model Y – which share up to 75% of components together. While Canoo does not reveal exactly how many components are shared between its different models, a visual comparison like the one below shows just how similar their vehicles are.

Canoo’s EV Line Up (Author’s work based on information on Canoo.com)

At the time of writing, Canoo is advertising 5 different EVs that are either planned for the future or can be booked with a deposit. These vehicles are targeted at very different customers:

-

The LDV130 and LDV190 (on the left in the image) are two Light Commercial Vehicles that the company calls “Lifestyle Delivery Vehicles”, and they are targeted to commercial users. The LDV190 has been recently sold to the US Postal Services.

-

The Multi-Purpose Delivery Vehicle (at the bottom of the image), or MPDV, is a larger version of the LDV190 with significantly higher cargo capacity.

-

The Pickup and LV (“Lifestyle Vehicle”, on the right in the image) are two more traditional electric passenger vehicles targeted to consumers.

I think developing such a flexible platform is a solid first pillar of Canoo’s product strategy, as it tackles the issue of the automaker industry being very capital intensive. By developing a flexible, scalable platform that can serve different markets, economies of scale are achieved. This strategy is similar to other PurePlay EV carmakers like Rivian and Lucid, which also developed flexible platforms for their models. However, I think Canoo’s design choices and style take this strategy to an extreme, allowing the company to expand quickly into different niches.

The second pillar of Canoo’s strategy is focusing on the underserved niche of light delivery trucks. The global light commercial vehicle market is expected to grow at a CAGR of over 34% until 2030 . Interestingly, this market remains relatively underserved, as most EV PurePlayers focus on consumers rather than businesses.

With the exception of Nikola Corporation (NKLA), none of the other American EV PurePlayer carmakers focus on light delivery trucks. Tesla does not currently produce any vehicle that can be sold to companies for deliveries. Nore do Rivian or Lucid, which are focusing on competing with Tesla’s models, targeting the same consumers. This is something I covered in more detail in my recent article.

This commercial EV segment is rather served by traditional automakers like Volvo, Mercedes-Benz Group AG (OTCPK:MBGAF) and Chinese manufacturers.

Canoo has recently reached an agreement with the US Postal Service for the future purchase of commercial vehicles. As per Canoo’s Q1 earnings report, the company has also managed to deliver the first vehicles as part of this agreement.

The deal with USPS was signed at a time when Canoo barely produced any vehicles – something I will cover in more detail later in this article. I believe this shows how demand for EV light trucks is strong, and that the product strategy of Canoo is a solid one.

However, it is my opinion that the execution of this solid strategy has left a lot to be desired since the company was listed in 2020, and I have strong concerns about its future execution, as well – something I will cover in the next sections.

What I do not like: very limited runway and historical share dilution

I believe the main issue with Canoo is that the company is experiencing a negative Normalized Net Income of $ 84.5 Million (TTM data from Seeking Alpha), while having between $ 9 and $ 18 Million in cash and equivalents. This discrepancy stems from Seeking Alpha considering Canoo’s cash and equivalents at just below $ 10 Million, while Canoo reports they have $ 18 Million. The difference is that Canoo considers “Prepaids and other current assets” as cash and equivalents in their earnings report. The difference is minimal in my view, and does not change the overall financial picture for the company.

On top of Cash at Hand, Canoo has access to more than $ 200 Million thanks to agreements with Yorkville Advisors Global LP, as outlined in the company 10K report from Q1 2024. Access to these funds comes mostly via a series of agreements with this institution, dating as far back as 2022. More specifically:

-

Prepaid Advance Agreement (PPA) worth $300 million, nearly fully utilized.

-

Convertible Debentures in the form of multiple notes totaling $117.5 million, with $25 million outstanding.

-

Warrant Cancellation and Exchange Agreement representing a potential of $29.2 million from warrant exercise.

-

At-the-market (ATM) Offering Program worth $200 million in total, with $149.5 million remaining accessible.

These agreements are all in the form of dilutive convertible debt and will result in the company having to dilute shareholders, should management need to raise more cash.

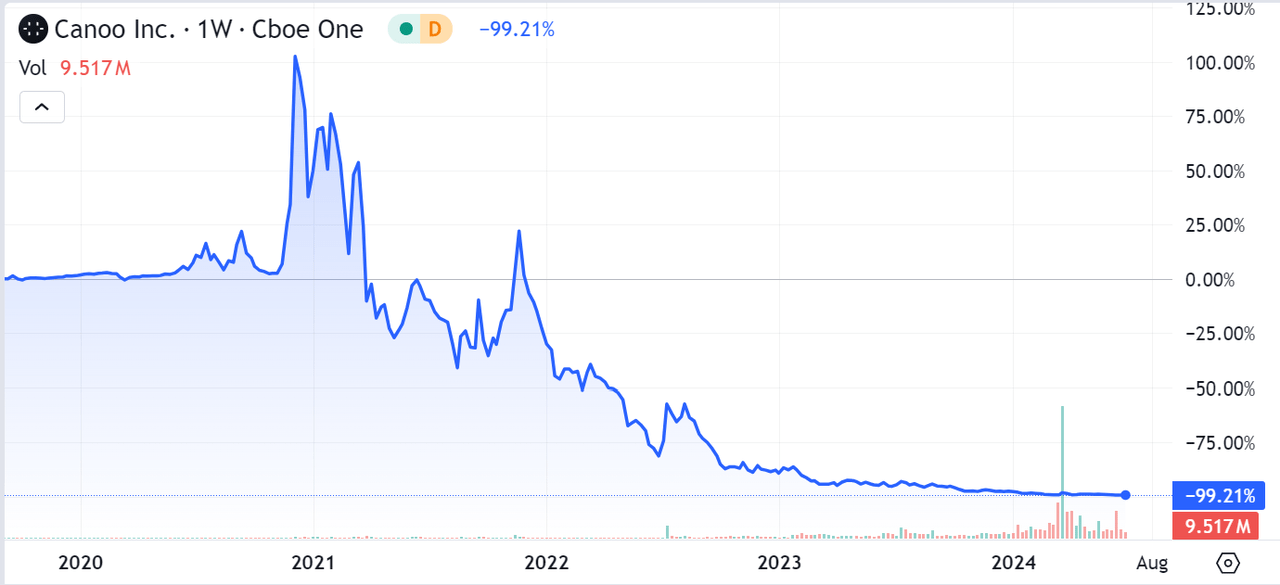

Canoo Stock Performance since IPO (Seeking Alpha)

As per the figures just presented, Canoo has historically exercised its agreements with Yorkville to raise more than $400 Million in capital. This substantial and continued dilution is what’s behind the performance of Canoo stock – which is down more than 99% since its IPO in 2020. Canoo’s shares traded at just shy of $500 in early 2021, and are currently trading at $1.80.

In their latest 10K, Canoo’s management also recognizes how the company’s principal source of liquidity is: “access to capital under the Yorkville PPA (as defined in Note 9 Convertible Debt)”.

The fact that Canoo has historically almost exclusively relied on shareholder’s dilution to get liquidity is not the only element that makes me think history is bound to repeat itself. The difference between the company’s Net Income and Cash at Hand results in an expected runway (time the company can operate based on cash available) of 1 month. This figure only doubles to 2 months when taking into consideration what Canoo considers Cash at Hand in their latest earnings.

The earnings of Canoo were released in mid-May. It is now end of June, and it is not surprising – given an expected runway of between 1 and 2 months – that Canoo has just announced they will issue up to $ 13.7 Million shares, equivalent to roughly $ 25 Million at current market prices.

Finally, the company does not currently mass produce any vehicle, and their plans to start production seem unrealistic, as I will cover in the next section.

For the reasons above, I expect Canoo to raise cash using their existing agreements with Yorkville and keep to significantly diluting shareholders as a result.

I see no realistic plan for Canoo to start mass producing and delivering EVs at scale

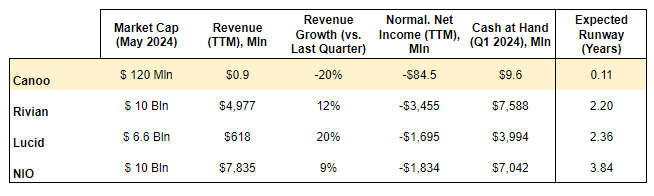

Canoo vs. Rivian, Lucid, NIO – key financials (Author’s own work based on Seeking Alpha data)

To put Canoo’s execution plan into perspective, I am comparing the company with Rivian, Lucid and NIO in the table above. The difference is in my opinion quite evident: while I am no fan of Rivian, Lucid or NIO, they are all delivering products, growing sales and have a defined plan to bring more EVs to the market.

In contrast, Canoo barely produces any vehicle as of the time of writing this article, 6 years after the company was founded and 4 years since its IPO. To be clear, Canoo has announced it started production of LDV vehicles in its Oklahoma facility in November 2023. However, the company does not release any figures of just how many vehicles have been produced or are planned to be produced for 2024. In its Q1 Earnings report, the company does not mention at all any numbers related to expected vehicle deliveries, nor its production capacity.

Other than the vehicles delivered to USPS in Q1, the only other delivery of Canoo vehicles to date concerns an undisclosed amount of LVs for NASA mission crew transportation. These LVs are going to be used to transport astronauts for 10 miles to the launch pad in Florida. I believe this amounts to little more than a PR move for Canoo, as these numbers are not enough to prove the company is actually producing vehicles at scale. I think this is also consistent with the fact that Canoo recently appointed Former NASA Chief Technology Officer Deborah Diaz and Veteran EV Transportation Leader James Chen to the Board of Directors.

Ultimately, the strongest data point showing how Canoo is not delivering vehicles at scale is the company’s revenue. Canoo only generated about $ 900,000 in revenue in the Trailing Twelve Months – and no revenue at all in Q1 2024. Even assuming that TTM revenue comes entirely from deliveries, and assuming an average price per vehicle between $35,000 to $40,000, Canoo could not possibly have delivered more than 20 to 25 vehicles in the last 12 months.

A final issue I see with Canoo’s execution relates to pricing. Canoo’s mission is to “bring EVs to everyone”. The product strategy of Canoo – focusing on a flexible, scalable platform – should in my view allow the company to be competitive in pricing their vehicles, as pricing is a key lever of EV adoption.

However, Canoo’s vehicles are not particularly competitive in terms of pricing based on what the company currently advertises on their website. The LV, a consumer-oriented vehicle that could compete with Tesla’s Model Y and Model 3, currently starts at just shy of $43,000, which is slightly above Tesla’s prices. The company currently does not disclose pricing for their LDV models or pickup truck.

The picture emerging, in my view, is that of a company that has raised $ 400 Million since IPO via diluting shareholders, but it has consistently failed to showcase success in producing and delivering EVs at scale, even 7 months after having allegedly opened its Oklahoma factory. Furthermore, the company is not showing price competitiveness on the market, before starting to actually deliver products to consumers.

Given the dire financial state of the company and its track record, I see no reason to trust management’s ability to execute a turnaround and generate enough cash flow from operations to reduce its reliance on shareholders’ dilution.

Risks to my thesis – can Canoo’s product strategy be saved?

The main hope for Canoo – and risk to my bearish thesis – is a company acquisition. As I have outlined, I believe the product strategy of Canoo is solid, and superior in many aspects to that of other early stage PurePlay EV players.

If a company were to acquire Canoo and their existing Oklahoma facility, they could inject the cash needed to boost production numbers and scale operations significantly. Shareholders could benefit from getting their shares purchased at a higher value than the current market price, and possibly future shares appreciation should the resulting legal entity keep being listed.

Another risk to my thesis is that I might be wrong about Canoo’s ability to quickly scale its business. While I do believe management will need to dilute shareholders to survive in the upcoming months, the company might also start showing solid sales and more contracts closed for their LDV models. That might result in the company increasing its ability to survive on cash flow generated by operations, and might translate in positive shareholders’ return in the longer term.

Conclusion

As a car enthusiast and keen follower of the automotive industry, I got genuine excitement when I first started researching Canoo. Their product strategy struck me as a breath of fresh air in an industry that tends to copy Tesla’s playbook a decade and a half too late. I still like Canoo’s product strategy and its focus on an underserved niche.

However, digging into the financials and executional challenges, I quickly changed my mind on this stock. While the product strategy is solid, management’s execution solely relies on diluting shareholders. The results are clear looking at past performance. Canoo has very little to show for the more than $ 400 Million it raised since IPO, and it will inevitably need to raise more money to have a chance at survival in a highly competitive and capital intensive industry.

For these reasons I recommend any investor should avoid this stock, and I assign a SELL rating to Canoo. If you are interested in the automotive sector and in EVs, Stellantis N.V. (STLA) and Tesla are in my opinion more favorable and interesting names to explore.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.