Summary:

- Canopy Growth has reduced its free cash burn to CAD$67 million per quarter for an implied cash runway of five quarters against its current short-term liquidity position.

- Three institutional shareholders are looking to exit their positions, reducing their aggregate ownership from 13.4% to 2.5%.

- A high debt burden and elevated cash burn will drive continued near-term dilution for shareholders.

JannHuizenga/iStock via Getty Images

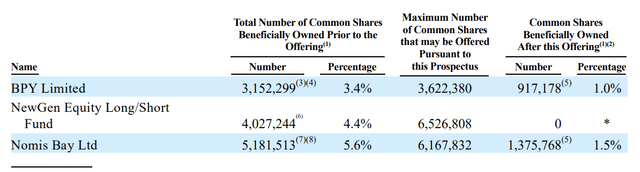

Canopy Growth Corporation (NASDAQ:CGC) did not spare any time after its recent 1-for-10 reverse stock split in December to sell more shares. The cannabis company entered into an upsized private placement with several unnamed institutional investors to raise US$35 million through the sale of 8,158,510 shares at US$4.29 per share. This equity raise followed a prior abandoned attempt to raise US$30 million. While the upsized private placement is positive, three institutional shareholders are also looking to exit their positions in CGC. The selling hedge funds pre-sale collectively owned 13.4% of CGC with this set to drop to 2.5% post-sale. This institutional exit follows from when I last covered the ticker.

Canopy Growth January 2024 Form S-1

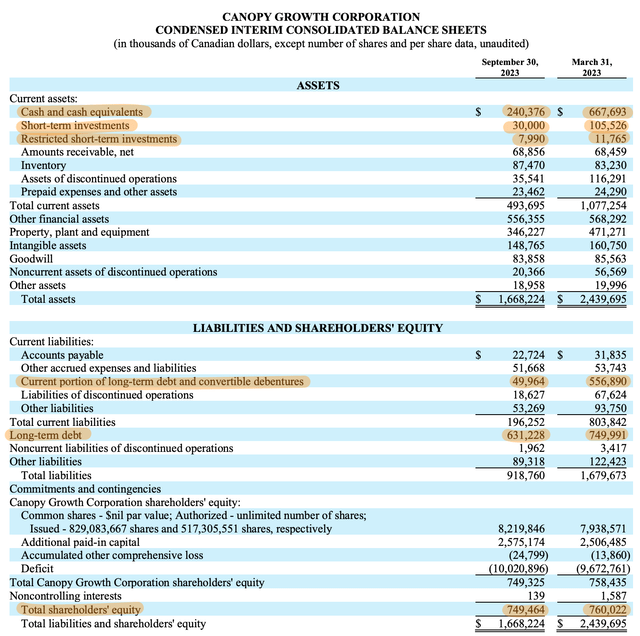

Critically, shareholders need to watch a few core numbers in the coming earnings reports as these are already flashing red to highlight the struggle CGC faces to remain a going concern. The first is cash and equivalents, including short-term investments and restricted cash, which came in at CAD$278 million at the end of its last reported fiscal 2024 second quarter. This was down CAD$507 million from the end of the fourth quarter of fiscal 2023.

Canopy Growth Fiscal 2024 Second Quarter Form 10-Q

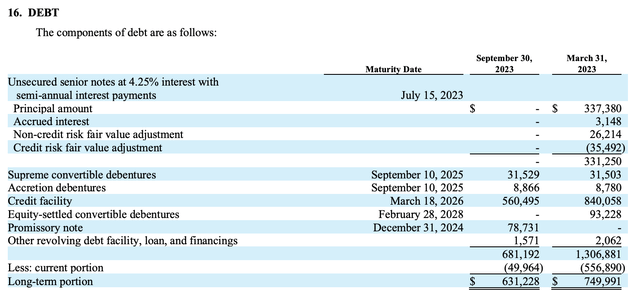

CGC has benefited immensely from the conversion of debt previously held as current liabilities on its balance sheet. There was around CAD$556.89 million of current debt held at the end of fiscal 2023 which has since dropped 91%. This has helped dampen the impact of the drastic fall in short-term liquidity on shareholders’ equity. CGC had around CAD$612.22 million of long-term debt left on its balance sheet at the end of the second quarter. This amounts to 227% of its short-term liquidity and 113% of its current market cap. CGC’s debt drove quarterly interest payments of CAD$27 million during the second quarter.

Canopy Growth Fiscal 2024 Second Quarter Form 10-Q

CGC does not have any debt coming due until September 2025 when it has to repay CAD$40.4 million. There is a significantly larger debt maturity of a CAD$560.5 million credit facility by March 2026. This facility is secured against CGC’s wholly-owned subsidiaries and will likely accrue interest at adjusted term SOFR plus 8.50% per annum as it was amended at the end of calendar 2023 from a prior peg to LIBOR.

Cash Burn, Losses, Runway, And Acreage

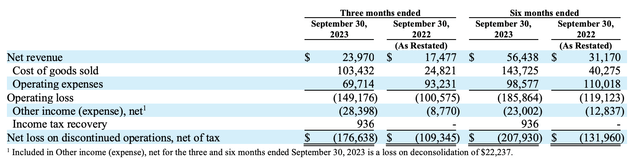

The second figure shareholders should be looking at is cash burn from operations. This was CAD$227.32 million for the first half of CGC’s fiscal 2024, down roughly CAD$46.60 million from its year-ago comp. However, the company’s sale of its BioSteel unit should provide an off-ramp for what’s currently elevated cash burn. CGC recently disposed of the unit for US$30.4 million. The divestment is material as BioSteel faced losses that were worsening on a year-over-year basis. Operating loss for the second quarter came in at CAD$149.18 million against net revenue of CAD$23.97 million. Hence, CGC should see a material improvement in consolidated revenue.

Canopy Growth Fiscal 2024 Second Quarter Form 10-Q

CGC recorded second-quarter revenue of CAD$70 million, a dip of 20.4% over its year-ago comp with a net loss attributable to CGC shareholders of CAD$310 million. CGC’s cash burn from operations is elevated, and its free cash burn of CAD$67 million in the second quarter means a cash runway of roughly five quarters with the inclusion of the post-period end cash infusion from the private placement and BioSteel sale.

The company has stated it expects free cash burn to moderate in response to continued cost reduction efforts. Burn realized during the second quarter did dip by CAD$32 million versus its year-ago comp, with CGC also generating CAD$155 million in gross proceeds from facility divestments in the nine months preceding the end of the second quarter. CGC now faces five long quarters of continued cash burn, dilution, and a possible continued lack of progress with the federal legalization of cannabis in the US. Acreage Holdings, Inc. (OTCQX:ACRDF) presents another conundrum for CGC as the company has the option to acquire Class E subordinate voting shares of the US multi-state operator. This option represents roughly 70% of the total shares of Acreage.

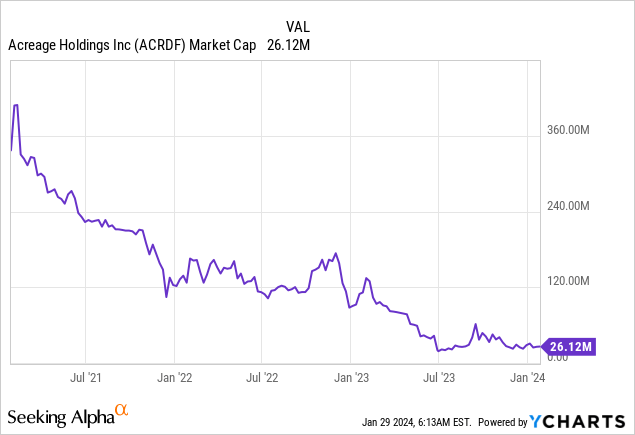

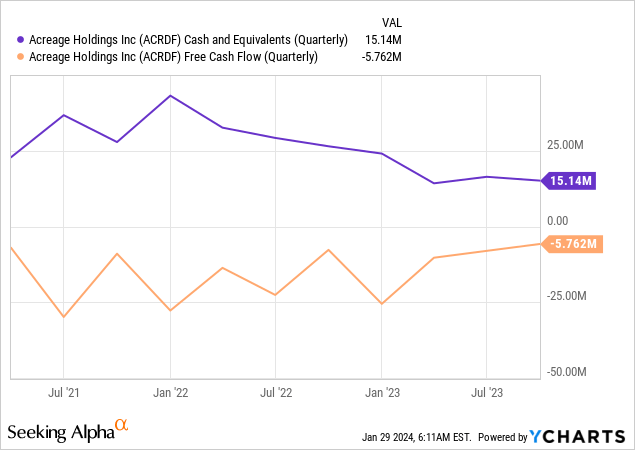

Acreage is essentially being priced for bankruptcy by the market. The company’s market cap has fallen to US$26 million from more than US$360 million a year ago and its cash and equivalents position has fallen to US$15.14 million as of its last reported earnings quarter. Acreage formed a core pillar of Canopy USA, a US-based holding company that forms CGC’s attempt to eventually break into the US cannabis market when federal legalization allows for it. Acreage will need funding against its current cash runway of just under three quarters. CGC’s cash burn, high debt burden, and dwindling cash balance only backstopped by constant dilution now render the ticker a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.