Summary:

- Canopy Growth’s shares have risen by 28% in the past month due to the potential rescheduling of cannabis in the U.S.

- However, the company is facing operational and financial challenges, with persistent cash flow difficulties and declining sales growth.

- The company’s low valuation does not make it an attractive investment, and its future outlook remains bleak.

stockstudioX

With the prospect of rescheduling cannabis back on the table in the U.S. this year, shares of Canopy Growth (NASDAQ:CGC) are up by 28% over the last 30 days. But the Canadian marijuana company’s fortunes remain in dire condition, and it might not survive the next couple of years.

Due to a combination of operational, financial, economic, regulatory, and competitive concerns, it would not be wise to bet in favor of this business, and its low valuation and potential upcoming catalysts do not change that calculation very much. Here’s why.

Operational and financial concerns mount

Canopy Growth’s future looks bleak for many reasons, starting with its persistent difficulty with generating more cash than it spends to cover its obligations and keep the lights on.

Canopy’s operational efficiency is a major drag on its viability as an investment despite last year’s cost-cutting campaign that aimed to slash up to CAD$160 million in expenses by roughly the middle of February of this year. That initiative resulted in laying off 60% of its workforce and the closing of a handful of production facilities, not to mention the total divestiture of its Canadian retail footprint. Nonetheless, in its fiscal Q3 of 2024, which is its most recent quarter, it reported operating losses of CAD$24.9 million.

Furthermore, sales growth has been difficult to come by due to an ongoing oversupply of cannabis in the Canadian market, which is the only place it competes in both the recreational and medicinal product segments. In the third quarter, its revenue fell by 7.5%, reaching CAD$78.5 million. The sale of its Canadian retail locations and scaling down of its cultivation capacity mean that it likely left demand on the table, even when taking the slack in its market into account. There is also a substantial probability that its brands are not strong enough to constitute a competitive advantage that would help with retaining customers in the wake of its downsizing.

In Q3, it also paid CAD$24.6 million in interest expenses, and it’s now carrying CAD$520.7 million in long-term debt. Paying down that debt will continue to be a major financial constraint moving forward. And, it only has CAD$186.1 million in cash, cash equivalents, and short-term investments, so between covering its operational losses and its interest expenses, there won’t be much flexibility for management to continue trying to execute a turnaround.

As it is already heavily indebted, with the size of its total debt at 127% of its equity, any further debt financing it takes out will not be at a favorable interest rate. Therefore, expect the company to issue more stock in an attempt to gather enough resources to survive. That means even more rounds of dilution are in store for current shareholders. It’s also possible that its stock will eventually be delisted from the NASDAQ exchange despite recently executing a 10 to 1 reverse stock split to stay in good standing with its bid requirement.

Regulatory changes won’t be enough to salvage the situation

So why is Canopy’s stock rising? There are indications that the U.S. could soon rework its regulations by rescheduling or legalizing cannabis for recreational use. The U.S. government’s Department of Health and Human Services (HHS) recently recommended that the Drug Enforcement Agency (DEA) should reschedule the plant into Schedule III, a conclusion that certain senior members of the Biden administration seem to support as a stepping stone to full legalization.

It’s true that the odds of near-term marijuana legalization are better than ever. But Canopy Growth does not actually currently have any operations in the U.S. Instead, as of late 2022, it created a parallel organization called Canopy U.S.A. It doesn’t currently own a voting interest in Canopy U.S.A., though on April 12 it will ask shareholders to vote on whether to create a class of exchangeable shares which ultimately would enable it to gain control of the business and effectively enter the market, assuming regulators allow it.

Entering the U.S. precisely when cannabis is federally legalized sounds bullish, as demand will be very high for a time. But if the company’s U.S. operations are as unprofitable as its Canadian operations, an influx of demand will simply mean that it burns money faster. And with cash running low and many of its Canadian assets already sold off with the cost cuts, it is very unlikely that there will be an opportunity to capture a large share of the market, never mind defend it against the local competition.

Its valuation is no bargain

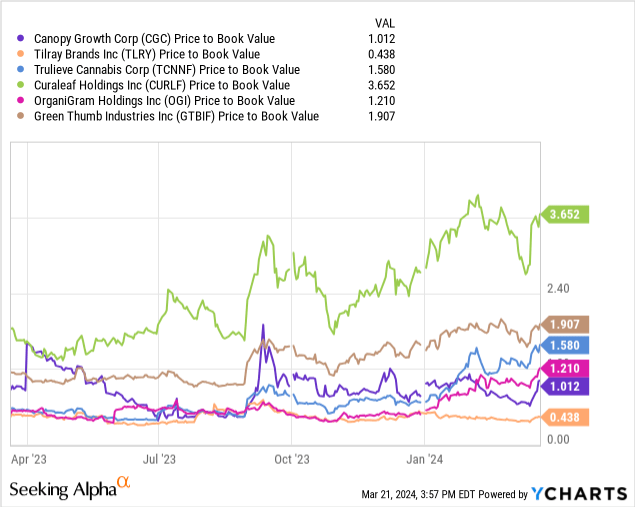

Canopy’s stock appears to be very inexpensive, with a price-to-book (P/B) ratio of near 1.0, and an enterprise value to revenue (EV/R) ratio of 2.1. But there is no bargain to be found here.

Examine how it compares to its peers in the U.S. and Canada:

As you can see, its P/B is very much on the low side. The takeaway is that the market is not at all confident that the company can operate its assets to produce more value than the historical cost of those assets.

In the context of its poor performance over the last few years, such a conclusion is reasonable until proven otherwise by a drumbeat of favorable audited financial data. Management expects that each of the company’s segments will report positive adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) before the end of its 2024 fiscal year. In Q3, its unaudited adjusted losses before interest, taxes, depreciation, and amortization were CAD$9 million, so that goal may well be possible, even if it wouldn’t solve the upcoming cash crunch.

The outlook is bearish

Canopy is not an attractive investment at the moment. It’s far too risky to approach on account of its persistent unprofitability and difficulties in fitting its capabilities to its markets, regardless of the recent bull run. Other cannabis companies are more likely to experience outsized benefits if the U.S. legalizes marijuana, and they won’t need to rely on any special governance processes to enter the market.

Similarly, investors will be less exposed to dilution if they invest in an alternative, as many of the major multi-state operators ((MSOs)) are in significantly better shape financially. Therefore, current shareholders should consider selling this stock today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.