Summary:

- Canopy Growth faces significant financial challenges, including a stressed balance sheet, high debt, and potential equity dilution, making it an unattractive investment.

- Despite initial excitement over potential cannabis rescheduling, the long-term impact on growth is uncertain, leading to renewed stock correction.

- Canopy’s revenue is declining, with limited growth in international markets and reduced R&D and advertising expenses, further hindering growth prospects.

- Given the high valuation and ongoing regulatory headwinds, I recommend a “Sell” rating for Canopy Growth, favoring companies with stronger financial flexibility.

Morsa Images

Investment Overview

The cannabis industry has witnessed challenging times for an extended period. Regulatory headwinds have been the key reason and the industry is also characterized by intense competition.

Amidst these challenges, I believe that there are few long-term investment opportunities and I have discussed a few cannabis ideas in the recent past. At the same time, there are multiple stocks to avoid in this overcrowded space. This thesis talks about one of the cannabis companies where I hold a bearish view.

I am initiating coverage on Canopy Growth (NASDAQ:CGC) with a “Sell” rating. I believe that Canopy Growth will continue to face challenges related to financing and growth acceleration. While there are potential positives, it’s overshadowed by the concerns. The initiation elaborates on the factors that make Canopy Growth stock “relatively unattractive.”

It’s worth noting that Canopy Growth stock traded at lows of $2.76 in mid-March 2024. With the news of possible reclassification of cannabis as a Schedule III drug, CGC stock skyrocketed to $14.9 by the end of April 2024. The excitement was however, short-lived and CGC stock corrected back to current levels of $4.6.

I believe that there are three reasons for the renewed correction.

First – The initial excitement related to cannabis rescheduling diminished as the markets figured out that it’s a long-drawn process. Even if cannabis is reclassified as a Schedule III drug sometime in 2025, the impact on growth will be in 2026 and beyond.

Second – Canopy Growth utilized the rally to raise US$250 million. The at-the-market program translated into dilution of equity. Given the company’s debt position, I expect growth to be funded by further round(s) of equity dilution.

Third – The markets shifted focus to the company’s growth and fundamentals. With several points of concern on the financial front, the stock has trended lower.

Weak Fundamentals Will Impact Growth Potential

One of the key reasons to be negative on Canopy Growth is a stressed balance sheet and weak credit metrics. At some point of time, regulatory headwinds will wane. However, the winners will be companies with high financial flexibility to make aggressive investments.

For Canopy Growth, I see the following concerns –

First – The company ended Q1 2025 with a cash buffer of $195 million. For the quarter, the company’s free cash flow was an outflow of $56 million. If a similar outflow is assumed for the coming quarters, Canopy Growth will need to dilute equity within the next 3-4 quarters. Therefore, the cash buffer is slim and the risk of equity dilution is high.

Second – Canopy reported total debt of $585 million as of Q1 2025. On a year-on-year basis, the company’s debt has declined significantly. However, for Q1 2025, the company reported adjusted EBITDA loss of $5.3 million.

Even if EBITDA turns positive in the coming quarters, the debt servicing metric (EBITDA-interest-coverage-ratio) will remain stressed. This further underscores the view that Canopy would need to dilute equity to pursue growth.

It’s worth noting that for Q1 2025, Canopy reported interest expense of $18.2 million. This would imply an annualized interest cost of $70 million. Even with the deleveraging, Canopy has a significant debt servicing burden.

Given the cash position and balance sheet health, Canopy Growth is not positioned to make big investments. As an example, the company’s R&D expense was $32.3 million for the financial year 2022. For the latest (FY2024), the company’s R&D expense has declined to $4.6 million. Even the advertising expense has declined from $53.4 million to $28.7 million in the two comparable periods. The improvement in adjusted EBITDA is therefore through aggressive cost-cutting and not backed by operating leverage.

I therefore believe that the company’s financial flexibility is limited. Of course, there is an option to leverage or massively dilute equity to push for growth. That will, however, come with an increased credit risk and the stock rating is likely to be downgraded.

If we look at peers, Cronos (CRON) is among the best from the perspective of financial flexibility. The company ended Q2 2024 with a cash buffer of $848 million. Further, revenue growth has been accelerating as Cronos makes inroads into new markets.

Struggling for Growth Acceleration

The second key reason to be bearish on Canopy stock is the company’s growth trajectory. I believe that this is closely related to the financial constraints.

For FY 2024, Canopy Growth reported revenue of $297 million, which was lower by 11% on a year-on-year basis. This de-growth was primarily due to the divestiture of the company’s retail business in Canada. Further, the divestiture of “This Works” in Q3 2024 impacted growth.

The concern is that even the business-to-business segment witnessed de-growth of 3% on a year-on-year basis. The company’s medicinal cannabis business growth was 10% on a year-on-year basis to $61 million.

However, with Canopy curbing on R&D investments, I would wait for a clear trend in the medicinal cannabis business. Earlier this year, the American College of Physicians called for “rigorous research into the health effects, potential therapeutic uses, and the impact of legalization on cannabis use.”

The markets will increasingly move towards evidence-based medicinal cannabis products. This necessitates significant investment in research and development.

Another point of concern is as follows – For Q1 2025, Canopy reported revenue of $66.2 million. On a year-on-year basis, the company’s revenue declined by 13%. Only the medicinal cannabis business reported 20% revenue growth. International revenue was flat and growth was muted for Storz & Bickel. Therefore, it’s just one segment of the company’s business in Canada that’s witnessing growth.

It’s worth noting that in the international cannabis market, Canopy has presence in Australia, Germany, Poland, Czech Republic, and the United States. However, Q1 2025 revenue from these markets was just $10.1 million (excluding Storz & Bickel vaporizers). This implies significant revenue concentration in Canada, which is an intensely competitive market.

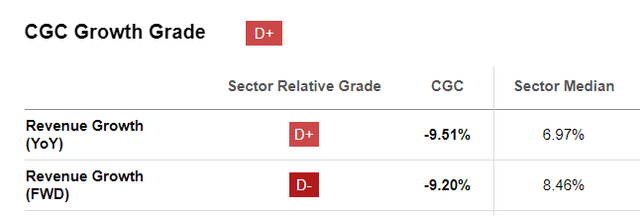

The stagnation of revenue in international markets can potentially be a function of the company’s restricted financial flexibility. With low R&D and declining advertising expense, it’s unlikely that growth will gain significant traction in these markets. As the data below indicates, the company’s forward revenue growth is likely to disappoint as compared to the sector median.

Risk Factors to The Bear Thesis

With divesture, cost control, and shift towards high-margin businesses, Canopy is focusing on achieving profitability. If the company achieves EBITDA breakeven in the coming quarters and EBITDA growth accelerates, CGC stock can possibly trend higher. The concern, however, relates to top-line de-growth in FY2024 and Q1 2025. Canopy has guided for return to growth in the second half of the fiscal year. I would prefer to wait-and-watch before considering exposure.

Canopy is betting on “near-term market opportunities in the U.S.” This is another potential growth trigger for the company. However, these opportunities are subject to the potential reclassification of cannabis as a Schedule III drug. The process is however long-drawn, and there is unlikely to be any impact on growth immediately after the rescheduling.

Further, I like Trulieve Cannabis (OTCQX:TCNNF) as better investment options when it comes to presence in the U.S. Additionally, companies like Cronos are also sitting on a significant cash buffer to capitalize on any potential regulatory tailwinds. Therefore, on a relative basis, Canopy stock looks unattractive.

Canopy is also targeting the German market after the legalization. Currently, the focus is on increasing flower supply to the German markets. If the medicinal cannabis segment growth accelerates, Canopy can be one of the beneficiaries. I must however reemphasize that for Q1 2025, international cannabis revenue was just $10.1 million. The revenue contribution from Germany is therefore miniscule and the impact on overall growth remains to be seen.

Another important point to note is that Canopy is looking to pursue an asset-light business model for the European markets. The company has signed multiple agreements with EU-based flower suppliers. As these come into the supply chain, the company expects to boost its medicinal cannabis presence in Germany. Third-party supply will also imply relatively lower capital investments.

Having said that, there is a risk associated with dependence on external suppliers. If the demand for flowers increases significantly, the company is likely to face pricing pressure from third-party suppliers.

It’s worth pointing out here that Canopy stock has declined by 13.5% for year-to-date. During the same period, Cronos has trended higher by 3.4% and Trulieve has surged by 128%. The markets are clearly unimpressed with Canopy, even as the company guides for a strong second half.

Overall, Canopy is betting on the U.S. and Germany for growth. However, financial flexibility remains a major concern. I believe that another round of equity dilution is on the cards and will impact CGC stock.

Concluding Views

My bear thesis on Canopy stock is further strengthened considering the valuations. For fiscal year 2026 ending (March 2026), Canopy stock trades at a forward EV/EBITDA of 62.5. Even if we look at FY 2027 for Canopy, the EV/EBITDA is estimated at 48.3x. In comparison, the sector median (forward) EV/EBITDA is 13.7. This indicates a significant valuation premium for Canopy.

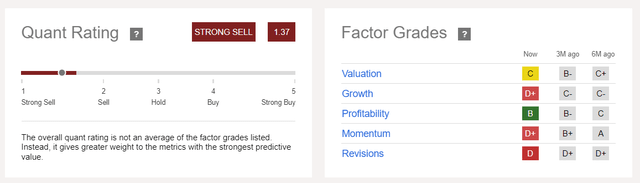

If we look at Seeking Alpha’s “Quant Rating,” there is a “Strong Sell” signal and this is broadly in-sync with my view on CGC stock.

Canopy has indicated that it expects “Q2 to be impacted by continued supply challenges.” There is unlikely to be any positive price-action that’s backed by Q2 2025 results.

I must add that Canopy stock continues to trend lower, even after the guidance for a comeback in the second half of the year. A potential explanation comes from the valuation coupled with the point that the markets will wait to see a turnaround in Q3 2025. One reason is that Canopy reported earnings miss in the last quarter (revenue and EPS). This has a negative impact on the market confidence related to any potential guidance.

Overall, given the company’s balance sheet position and revenue de-growth, I am bearish on the stock. It’s also worth noting that the cannabis industry continues to face regulatory headwinds.

In my view, it makes sense to consider very selective names that have a strong balance sheet to navigate an extended period of challenging market conditions. Considering the factors discussed, Canopy Growth does not find a place in my list of top cannabis stocks.

Note: The financials are in Canadian dollars, unless otherwise mentioned.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.