Summary:

- Capital One Financial gets its Hold rating from 2023 reaffirmed, agreeing with the consensus today from Wall Street.

- Strengths are EPS growth estimates in 2024, a market leader in US in credit cards that keep growing, and sector bullishness in financials.

- Weaknesses include YoY flat or declining growth in revenue/earnings after recent results, along with loan growth declines beyond credit cards.

- A key risk is rising trends in provisions for credit losses, offset by low exposure to office loans in their CRE portfolio.

John M. Chase/iStock Unreleased via Getty Images

Quick Overview

Today’s research note covers a stock I am already quite familiar with as I’ve covered it twice on this platform: Capital One Financial (NYSE:COF), so to wrap things up this busy January I am revisiting this stock one more time.

So far, since I called it a hold in my November coverage it has gone up +29.5%, and since my May coverage when I called it a hold it is now up nearly +55%.

Capital One – price since may rating (Seeking Alpha)

We are reaffirming our hold rating on this stock as we don’t see a value buying opportunity at the current price but rather a long-term hold potential. This outlook is driven by several factors including a lackluster dividend yield and a rising trend in allowance for credit losses, while at the same time the analyst consensus is for future earnings growth, and the firm has grown its credit card business nicely despite declines in auto loans.

We believe it being known as a major credit card issuer in the US will be beneficial in the confident US consumer spending environment we continue to be in.

Methodology

This article will make use of our Investing Flow below which is based on waterfall methodology from the world of project management.

Today’s article aims to answer questions like why this specific stock and sector, what are the risks and benefits we can plan for, whether the current share price and valuation makes sense, what metrics matter to this specific sector, and what could be a long-term exit strategy for this stock?

The answers to these questions, holistically, should lead to a business decision of whether we buy, sell, or hold this stock today. Our aim is to make a case using plain and straightforward language, without a lot of financial wizardry.

investing flow (author work)

Initiating: Why this Stock & Sector?

Capital One is listed by Wikipedia as the 12th largest bank in the US, and according to its own profile it has been around since the late 1980s, trades on the NYSE, is headquartered in Virginia, and provides a variety of consumer and commercial banking products.

A notable to mention from its recent press is that Capital One ranks highest nationally in the J.D. Power 2023 U.S. Small Business Banking Satisfaction Study.

So, the answer to why this company is because it is a leading US bank in the top 20, has a significant brand recognition, and both of my prior ratings have proven to be on the right track.

As far as the financials sector, it catches our attention as key market data shows this sector has recently seen significant improvement, even to the tune of +29% growth in 3 years, and up +3% in the last month. This market bullishness on financials certainly warrants further analysis, so here we are.

Further, we think the constant talk of interest rate decisions by the Fed certainly will continue to have an impact first on this sector, and then trickle its way to the rest of the economy, since a lot of this sector makes money from interest, at least in part.

As investors putting together a portfolio, we care about those interest rate movements as it can help or hurt the underlying bank stocks in our portfolio.

US equity sectors (Seeking Alpha)

Planning: What are Risks & Benefits?

Now that we know why you should care about this stock and its sector, we are at the stage of planning for risks and benefits of investing in this stock, and sector.

With Capital One’s most recent earnings results on January 25th still fresh, let’s first talk about their past performance.

We can see from the income statement that YoY revenue growth was practically flat, with the quarter-ending December at $6.6B, practically the same as December 2022.

Net income/earnings saw a YoY decline, dropping 43% to $706MM.

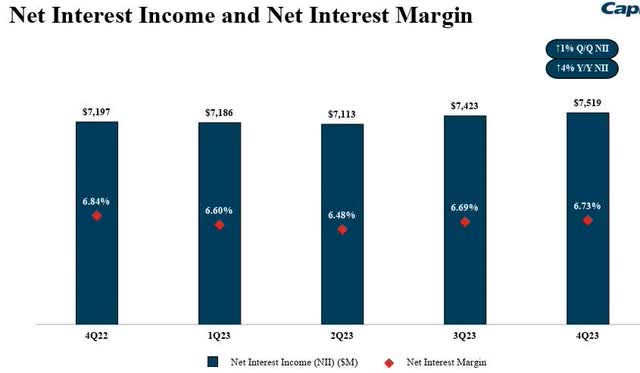

Though total interest expenses climbed significantly YoY, the firm managed to achieve YoY growth in net interest income, the difference between interest received and interest paid out, an important metric in banking.

Unlike a JPMorgan Chase (JPM), however, Capital One does not seem to have much diversification in the way of a major investment banking, wealth management, or asset management shop, nor is it a major global custodian bank like Bank of New York Mellon (BK). So, that poses the risk of investing in a bank heavily exposed to consumer banking and credit cards, and that should be understood before getting into this stock at all.

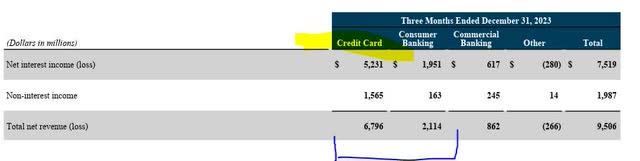

As you can see from their own table, their main segment is their credit card business, followed by consumer banking:

Capital One – business segments (Capital One)

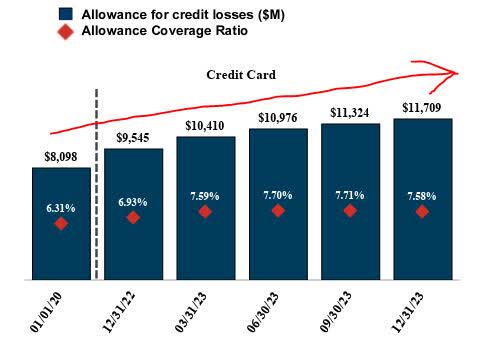

Because of this, the bank is affected by allowance for credit losses, an estimate of bad debt that will be unrecoverable, and as we like to follow longer trends the trend shows this metric is steadily climbing, which is not a great sign necessarily.

Capital One – allowance for credit losses (capital one)

On a macro level, this type of trend has been recognized at other banks too and even back in August, when a study by S&P Global highlighted “concerns about future credit deterioration.”

More recently, banking peer Wells Fargo (WFC) “reported a higher provision for credit losses in the fourth quarter,” according to Barron’s.

Further, Dow Jones’ Marketwatch reported a few days ago that “at the start of the year, U.S. household debt reached a record high of $17.3T, according to data from the Federal Reserve Bank of New York.“

Now, for the positive news. We believe the firm is well capitalized enough that it can take the hit on some bad consumer debt, as its CET1 ratio of 12.9% has only been climbing since 4Q22 along with a liquidity coverage ratio (“LCR”) of 167%, according to its recent Q4 presentation. It also has +$120B in total liquidity reserves.

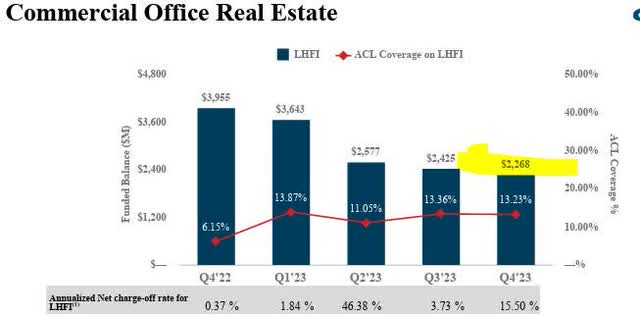

Another positive is that this bank has only minimal exposure to that dreaded word these days.. office property.. and according to their Q4 presentation it appears that “office real estate represented 2.5% of our Commercial Banking LHFI portfolio.”

Consider that a January 9th piece by industry tracker Mortgage Professional magazine highlighted the impact that the commercial real estate could have on banking:

According to a recent working paper from the National Bureau of Economic Research (NBER), banks this year stand to lose about $160 billion from commercial real estate – an amount that is about a quarter of the average lender’s total assets.

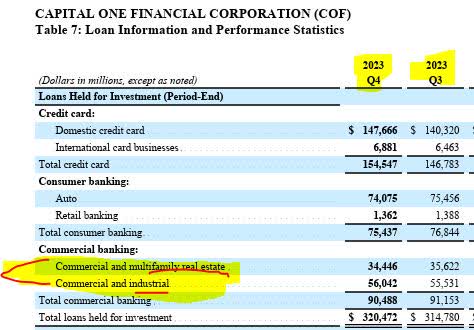

The small exposure to office property is in relation to the overall commercial portfolio which appears to be also tied to multifamily real estate and industrial property, as the table below shows.

Capital One – CRE data (company presentation)

So, the 2.5% tied to office property is of the total $90B in commercial property loans, which means office exposure is just around $2.26B as of Q4:

Capital One – CRE office chart (company presentation)

This is relevant because if you look at the net charge-off rate on those office loans, they have jumped to 15.5% in Q4, from just 0.37% in FY22Q4, which is quite a leap. Further, it appears the bank has been reducing its exposure to this asset class, according to the chart.

We therefore have a cautious outlook on this stock for the reasons mentioned.. weak YoY revenue and earnings growth along with rising allowance for credit losses, offset by capital and liquidity strength and very low exposure to high-risk office loans and further reducing exposure to this asset class.

Executing: Is the Price & Valuation Justified?

Since we went over a risk/reward scenario, the next step is to determine if the current share price and valuations are justified.

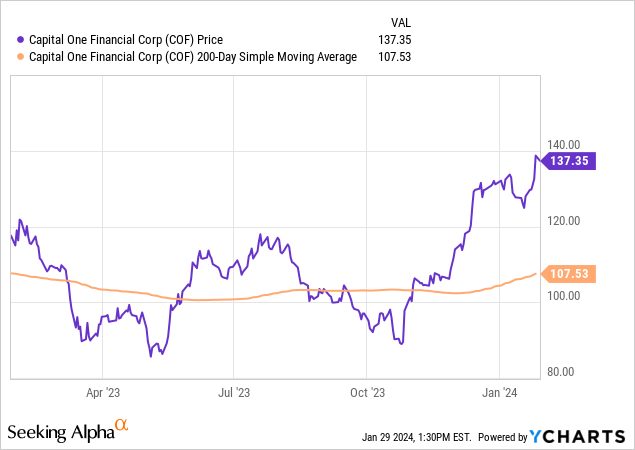

First, let’s pull the YCharts and compare the most recent price vs its 200-day SMA, a trend we like to use to smooth out short-term price volatility:

What it tells us plain and simple is that the stock trading at $137.35 is not only well above its autumn lows but is also nearly +28% above its 200-day moving average.

We think the forward price-to-earnings (P/E) ratio of 10.07, according to valuation data, is justified not just because it is below the sector average of 11.36 but also earnings estimates are calling for future earnings growth, and in the last 3 months there have been 8 upward revisions to EPS, indicating that analysts are bullish on future earnings potential.

We feel that earnings strength will likely come from continued strength in net interest income, as interest rates are not climbing any further (for now) and this bank is primarily an interest-earning shop and less so of a fee-earning shop or trading desk like some of the larger counterparts we mentioned.

JPMorgan Chase, for example, who also has a large consumer bank, as a company made about $3.7B just from trading income in Q4.

In our November coverage of Capital One, the forward P/E ratio was then 8.12 but the sector average was also lower at 9.33. At the time we called this an undervalued opportunity. Since then, we think the market has recognized the banking sector is long past the spring turmoil of last year and future earnings growth can be expected, so both the sector and this stock’s forward P/E have risen accordingly.

As for price-to-book value (P/B ratio), Capital One both on a trailing and forward basis is in the range of 0.88 – 0.99, lower than the sector which ranges from 1.11 – 1.17. Again, this is slightly higher now than in my November note where I said the forward P/B was a good value. I think the rise in valuation is justified.

Consider that from balance sheet data we see equity (book value) grew to $58B vs $52.5B in Dec. 2022, we would be investing in a company that has successfully grown equity, so we think that P/B valuation is certainly cheap.

In drilling down further into the balance sheet trends from Dec 2022 to Dec 2023, we see significant balance sheet expansion on both sides, as total assets kept growing and driven by growth in net loans, while liabilities also grew in this time as total deposits (a liability) grew as did the bank’s long-term corporate debt, however total equity(book value) ended up growing for most of this period. We think it is a sign of efficient management of assets and liabilities.

So far, at this stage we are inclined to say hold on this stock, agreeing with the Wall Street consensus, however next we want to talk about some more metrics that should be kept an eye on with this stock.

Monitor & Control: What Metrics Matter to this Sector?

So far, we are inclined to hold this stock rather than buy more shares at the current price, so here are some metrics we think matter to keep an eye on, and whether that may change our decision. Again, our current rating process is a “build-up” to a grand finale, speeding up on the track along the way as we gather more data, rather than playing a confusing soccer match.

This also requires knowing what numbers and trends matter to the sector itself.

Net interest margin is a key metric in banking. Although net interest income has risen at Capital One, we can also see the margin has squeezed, though not anything drastically. This is a reality of a high rate environment.

Capital One – NII and NIM (capital one)

Looking ahead at where we think interest rates could be later this year, we primarily use tools like CME FedWatch which acts as a barometer gauging the market’s expectation regarding Fed movements tied to its regular meetings, so we can see there is a nearly 97% market expectation the Fed will keep its policy rates the same after its Jan. 31st meeting, and 56% chance they are staying the same after the March meeting. It is not until after the May meeting that predictions call for a rate decline.

We think this is due to economic and consumer strength entering 2024 stronger than previously forecast (remember the talk of a recession in 2023), and the market expects the Fed to continue trying to keep the cost of debt high to cool down inflation.

We don’t think rates will go higher because it would just become too costly for most companies to even finance themselves via debt, and it would also increase the risk of further loan defaults and bad credit card debt from consumers who can no longer afford the high cost of credit. Likely, they will stay like this for a while longer and then gradually come down later this year if both inflation and the economy pulls back a bit.

Besides Fed movements, We also care about this bank’s loan growth since those loans can contribute to future interest income.

At Capital One, from their Q4 presentation, the growth is in their credit card businesses (ending loans up 12% YoY) while on the consumer and commercial loan side growth has declined, and auto loans which are a huge business for the Capital One brand have declined 7% YoY in originations. We think it is likely due to rates being too high right now, making it too costly for some to take out loans.

Lastly, the capacity of this firm to return capital to shareholders in the form of dividends is a metric that matters. We look at dividend yield compared to peers, and dividend growth.

In the last 10 years, the firm has grown its annual dividend from $1.20/share to $2.40/share, a +100% growth.

As for trailing dividend yield, Capital One at 2.28% falls behind banking peers Wells Fargo with 3.17%, JP Morgan Chase at 2.80%, and Bank of America at 3.23%. These comparables were chosen as they all are significant competitors of Capital One in the consumer banking segment in the US.

Personally, over a 30 year period I have either been a customer of one or more of these, have traded them in a portfolio, and/or have studied them at length.

Capital One’s forward yield of 1.73% is also not remarkable, and their history shows for all of 2022 and 2023 they have not grown the quarterly dividend past $0.60/share.

We expect that if the future earnings growth estimates come to fruition, it will be more likely to drive dividend hikes in 2024 and beyond.

The case here appears to us to support our earlier hold decision.

Closing: When do I Exit This Investment?

Holistically, from all the evidence we presented and forward-looking sentiment, we think reaffirming the prior hold rating is the best course for this stock.

It is unremarkable on dividend yield and growth, struggling with rising bad credit card debt projections, and weak YoY results on revenue and earnings in the most recent earnings call.

At the same time, analysts estimate future earnings growth, and despite the net interest margin squeeze it is growing net interest income. It also grew equity. Also, despite declining growth in consumer/auto/business loans, it has grown credit cards by double-digit percentages, seemingly fueled by consumer spending demand.

The canary in the coalmine here is whether a major US recession in 2024 would cause further headwinds to this bank which is heavily exposed to consumer credit cards.

What we know so far, according to a Jan. 25th article from Axios, is that we entered 2024 much stronger than earlier expected.

The fourth quarter’s hot growth resulted from bustling activity across the economy.

So, if we were trading Capital One our portfolio strategy on this stock would be to continue holding it and earning the steady $0.60/share quarterly dividend, as our strategy is a 100% dividend-income equity portfolio exposed to diversified sectors. We like banks because they are proven steady dividend payers, and a high interest rate environment does more to help banks than hurt them overall, we think.

As for when to exit this stock, we expect to keep this one in our bank stocks for a longer-term, expecting continued bullishness in the sector which could continue pulling up this share price and adding to unrealized capital gains, and as the Fed begins cutting rates this year as expected (if that actually happens) we expect lower interest expenses on deposits and a reversal in the trend of consumers burdened by expensive credit, but also as rates go cheaper it could fuel more demand for loans to be taken out which also can help Capital One to grow their loan book again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.