Summary:

- Huntington and Capital One are cheap compared to their peers based on P/E and P/B ratios, indicating undervaluation.

- Both banks have strong capital ratios, book values, and dividends, offering value and protection to investors.

- Huntington and Capital One have attractive dividends, but for different reasons.

- Two super investors, Warren Buffett, and Michael Burry, bought Capital One Financial (COF) in Q1 2023, indicating a deep undervaluation of the bank.

da-kuk

This article’s purpose is to compare these two financial stocks which are taking part in the banking sector recovery. First, I will assess the nature of Buffett and Burry’s Investments. Next, I will compare using three simple and easily comparable criteria, value, profitability, and dividend. Additionally, comparisons to peers will be utilized to demonstrate the wide gap in value. Finally, I will look at some risks and assert an individual investment strategy for each based on my findings.

The Buffett and Burry Bonus

It is always important to consider when a super investor takes a new position. after all, Charlie Munger and Mohnish Pabrai did tell us to shamelessly copy super investors. Warren Buffett needs no introduction; Michael Burry, on the other hand, is lesser known. He is most widely known for predicting the 08′ housing collapse and being portrayed in the movie “The Big Short”. I am more well acquainted with him for his outstanding return (a 3-year performance of 356%), and as you likely guessed, it isn’t because he picks a bunch of losers.

Capital One Financial (NYSE:COF) is one of the most unique investments I have happened upon in a long time. Why? Because it appears in both Berkshire and Michael Burry’s Scion Asset Managements’ 13F. It’s quite uncommon for us to witness the two open a position in the same or even similar companies. Berkshire acquired 9,922,000 shares, and Burry, with a much smaller portfolio, snapped up some 75,000 shares. Burry tends to buy out-of-favor businesses and sell them when they’ve been “polished up a bit.” To me, this is the cigar butt investing Buffett once described. Buffett, on the other hand, has moved towards buying good companies at reasonable prices. In my view, the two of them buying Capital One indicates an extreme undervaluation.

Huntington Bancshares (NASDAQ:HBAN) is a very interesting play that I wrote about in-depth here. This one is a Burry-only acquisition, but that’s no knock on it. Burry would likely have acquired it for around $10.22 a share. I’ll let him explain why he would have bought in this range.

“As for when to buy, I mix some barebones technical analysis into my strategy — a tool held over from my days as a commodities trader. Nothing fancy. But I prefer to buy within 10% to 15% of a 52-week low that has shown itself to offer some price support. That’s the contrarian part of me. And if a stock… breaks to a new low, in most cases I cut the loss. That’s the practical part. I balance the fact that I am fundamentally turning my back on potentially greater value with the fact that since implementing this rule, I haven’t had a single misfortune blow up my entire portfolio.”

This means you can grab shares near his likely buy-in price, and looking at the price per share in the months preceding the 13F only confirms this belief.

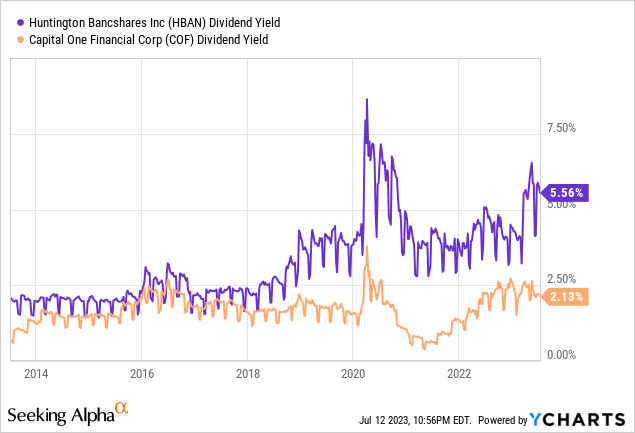

The Greatest Difference: Dividend

One of the more appealing aspects of owning Huntington and Capital One is their dividend. The annual dividend for HBAN and COF at present is $0.64 and $2.40, respectively, which translates to a yield of 5.56% and 2.13% based on present stock values. Huntington stands tall, significantly above the average yield of 2.9% for the regional banking sector and 1.66% for the S&P 500 index. Capital One does not have the same distinction, but in their case, this is a good sign.

Author, Y Charts

Huntington Banks dividend stands out not for its attractive yield but also for its reliability and consistent growth. The bank maintains a payout ratio of 40% surpassing the industry average of 34% while remaining within its range of 40% to 60%. This demonstrates the banks ability to retain earnings for business expansion and future investments. Moreover Huntington generates cash flow relative to its market value with a free cash flow yield of 3.39%. Such robust financials allow the bank to comfortably meet dividend obligations and other commitments.

Notably Huntington has exhibited an increase in its dividend over time. Over the five years the bank has consistently raised its dividend at an annual rate of 10% while achieving a remarkable 15% growth rate over the past decade. While I anticipate that sustaining rapid dividend growth may be challenging due to prevailing low interest rates and the recent merger with TCF Financial Corporation (which was acquired in December 2022) I remain confident that Huntington will continue to deliver above average dividend growth and returns, for its shareholders.

Capital One is a different story altogether. For starters, its dividend is lower than the industry average. Why, then, would Burry and Buffett have such an interest here? Because the dividend is extremely well covered by earnings, and unlike other banks, seems to be at little risk of a cut. COF maintains a payout ratio of 16.5% of its earnings, making it an extremely safe dividend and reaffirming the supposed recession play that it has been described as.

An attentive investor may have noticed I used a 10-year chart when comparing dividends, and I did so intentionally. The purpose of the 10-year chart was to illustrate the commitment to dividends these two have made over the years. The chart fails to encapsulate an important fact: Capital One has paid a quarterly dividend every quarter for the last 28 years, and Huntington for the last 33 years. These are exceptionally rare qualities and demonstrate a longstanding commitment to shareholders.

Now it’s clear, Capital One offers a low but well-covered dividend, one that could withstand a recession. Huntington offers a significant dividend, subject to the economic climate. Your views on the coming years should significantly influence a decision to invest in either, or in neither.

The Profitability Factor: Which Bank Has the Edge?

| Profitability Metrics | HBAN | COF | Industry |

|---|---|---|---|

| Return on assets (ROA) | 1.26% | 1.24% | 0.98% |

| Net interest margin (NIM) | 3.65% | 6.60% | 2.97% |

| Loan/Deposit Ratio | 82% | 84% | 62% |

Here’s the significance:

Let’s first take a look at the return on assets (ROA) HBAN and COF’s ROA stand at 1.26% and 1.24%, respectively, which are much higher than the industry average of 0.98%. This means that the two are able to generate more income from their assets than their competitors. This reflects their ability to enhance asset mix, sustain high asset quality, and manage operating expenses.

Net Interest Margin (NIM) HBAN and COF’s NIM of 3.65% and 6.60, respectively, are much greater than the industry average of 2.97%. An elevated NIM indicates that a bank is superior in profitability and efficiency in managing its interest income and expense. This means that the two are able to obtain more significant interest income from their loans and investments than competitors. This reflects their ability to offer competing loan rates, develop the loan portfolio, and control specific interest rate risk.

Finally, we can observe the all-important Loan/Deposit Ratio. HBAN and COF carry a loan/deposit ratio of 82%, and 84%, respectively, significantly higher than the industry average of 62%. This means that they are fit to lend out more of their deposits than competitors. This reflects their ability to retain and gather deposit customers, establish liquidity, and garner loan demand.

After assessing the profitability of both institutions in-depth, I determined that where one bank shined, the other performed average or slightly above and vice versa. Thus I am both pleased and saddened to inform you that my conclusion is less than satisfying. I believe both are very strong in this regard. Perhaps that would explain my ownership in both, too difficult a choice.

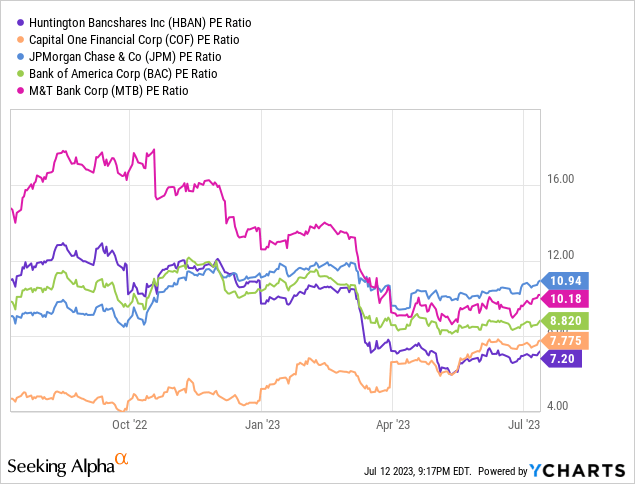

Banking Bargains

These financial companies are clearly undervalued. I usually use an excess returns model for banks. But for Huntington and Capital One, I think a peer analysis model is more appropriate. The two are among a sector that has been hit hard by the SVB crisis. But HBAN and COF are still the best deals in the sector. Just look at the chart below that compares their Price to Earnings (P/E) ratios with their peers.

Author, Y Charts

The P/E ratio tells us how much investors are willing to pay for each dollar of the bank’s earnings. A lower-than-average P/E ratio could mean one of two things: either the bank is undervalued, or it has low growth prospects. Therefore if these entities have adequate growth prospects, then we can conclude they are indeed steeply and unfairly discounted. Take solace in knowing that neither Burry or Buffett were looking for businesses in decline.

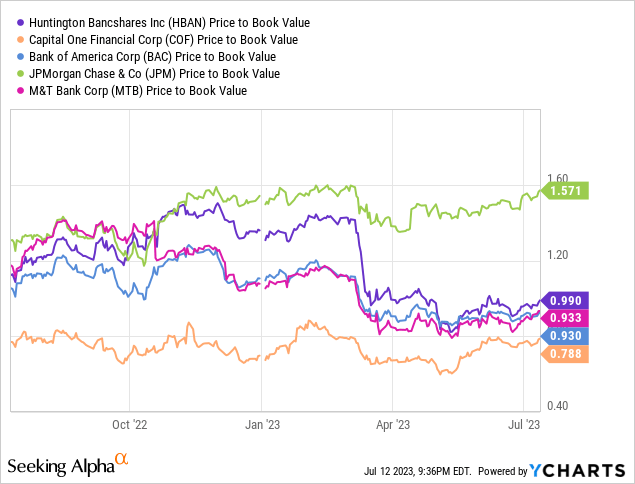

The P/E is not the only relevant metric when looking for the extent of a discount in a financial stock. We can also look at the Price to Book (P/B) Value.

Author, Y Charts

A lower-than-average P/B ratio could mean that a bank is undervalued by the market, meaning that its stock price is lower than its book value per share. This can be an opportunity for value investors who are looking for bargains in the banking sector. However, a low P/B ratio could also mean that a bank has low profitability, high risk, or poor growth prospects, which could justify its low valuation. I see no reason to suspect any of these detractions are at play, and thus, wager this is yet another Mr. Market screw-up. Here, Huntington has a comparable P/B ratio but a considerable dividend. Capital One has a much lower P/B with a comparable dividend. There really is something for every kind of investor here.

I also took the liberty of assessing the banks’ Capital Adequacy Ratio (CAR). I found that Both Huntington and Capital One maintained a Tier 1 Capital Ratio exceeding 12%. Not only are the two deeply discounted, but they offer downside protection by being well-capitalized and financially healthy institutions.

I will finish my valuation section with a simple observation. Huntington trades at just under its book value per share (BVPS) of $11.27. Capital One trades at 26% below its BVPS. You can buy both of these unparalleled financials for less than their book value. The companies trade at significant discounts based on nearly every relevant valuation metric and look like better deals than their already discounted peers.

Risks to Thesis

One of the most significant risks is also the most obvious with Capital One being its heavy exposure to the credit card industry, which is highly sensitive to economic cycles and consumer behavior. Credit cards are a profitable but risky product, as they charge high-interest rates and fees but also face high default rates and charge-offs. If the economy slows down or consumers face financial hardship, Capital One Financial could see a spike in its loan losses and a drop in its revenues. Although I believe that the worst of the regional banking crisis is over, there is still a possibility of new bank failures that could affect Capital One Financial’s deposit base. Deposits are a key source of funding for Capital One Financial, as they allow it to lend more money and earn more interest income. If depositors lose confidence in the banking system or switch to other alternatives, Capital One Financial could face liquidity and profitability challenges.

Takeaway

Capital One Financial Corporation is a unique company that combines banking and credit card businesses. The company benefits from higher interest rates, as it can charge more on its credit card loans and earn more on its deposits. The company has a solid deposit base that provides a low-cost and stable source of funding. The company has faced some challenges with its credit card quality, as it has increased its reserves for potential losses. This could be a problem if the economy worsens or consumers default more. However, the company still has a solid financial position and performance.

Capital One Financial Corporation trades at a low valuation, with an extremely low P/E and P/B. This could be an opportunity for investors who are looking for a growth-oriented and innovative company in the financial services industry. Huntington is a bargain for investors who are looking for a quality regional bank. The bank has a robust financial performance and low-risk exposure. The bank also rewards its shareholders with a high and increasing dividend that offers a reliable cash flow and a cushion against volatility. I assign a buy rating at present levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COF, HBAN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.