Summary:

- Capital One plans to purchase Discover Financial, building a strong credit card portfolio and driving long-term shareholder returns.

- Capital One had a strong Q2 with net income of almost $600 million, maintaining a strong efficiency ratio and increasing average deposits.

- Despite risks such as cultural clashes in the acquisition, Capital One’s strong cash flow and ability to maintain net interest ratios make it a valuable investment with future growth potential.

JHVEPhoto

Capital One (NYSE:COF) is a strong credit card company that has recently announced its plan to purchase Discover Financial (NYSE:DFS). As the company builds up a strong credit card portfolio and invests more into its future business, Capital One has a unique ability to drive long-term shareholder returns.

Capital One Q2 2024 Highlights

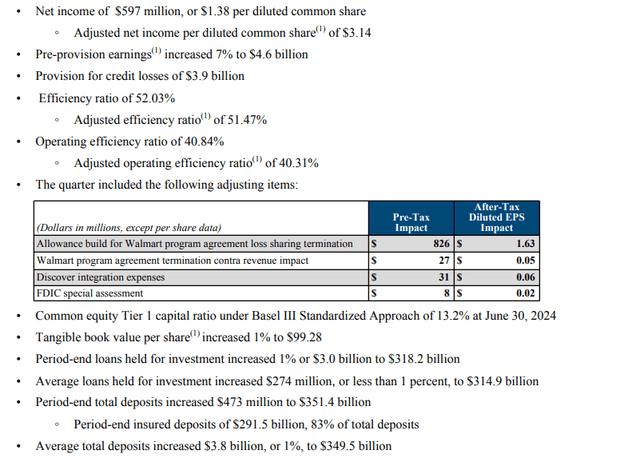

Capital One had a strong quarter, despite missing expectations, with net income of almost $600 million giving the company a P/E of just over 20. The reason we call it a strong quarter is because the company’s misses are due to loan allowances being impacted by higher for longer rates, however, in our view the company’s core business continues to execute well. We also see massive benefits from the company’s acquisition of Discover Financial.

Capital One Investor Presentation

The company has had to continue to allocate significant cash for credit losses, not surprising given the company’s focus on credit cards. The company has continued to maintain a strong efficiency ratio, though. It’s worth noting the quarter also contained a one-time allowance build for the company’s Walmart program agreement loss.

The company managed to increase average deposits by 1% along with loans held for investment and its price to book value is roughly 1.3x. The company’s tier 1 capital ratio is 13.2%, well above minimums, as the company continues to have minimal risk here.

Capital One Allowance Coverage Ratios

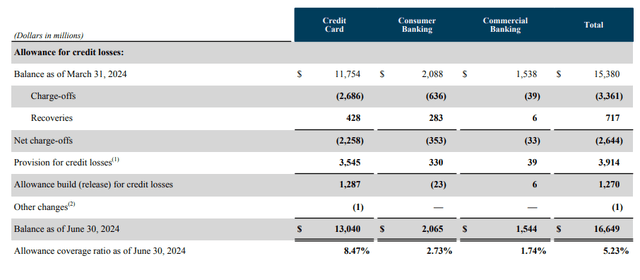

The below shows the specifics of the company’s allowance coverage ratios in the credit card business.

Capital One Investor Presentation

The company had $2.6 billion in total net charge-offs, the vast majority of which occurred within its credit card business, known for being much riskier. The company still built up $1.27 billion in net allowances, primarily due to the end of loss sharing with Walmart. Its overall balance here is $16.6 billion, which is quite strong.

However, it’s worth noting that we remain in an era of higher for longer interest rates, which is something that could hurt the company’s losses going forward. The company has increased allowance ratios in credit cards specifically as a result, but it’s still a real risk.

Capital One Interest Income

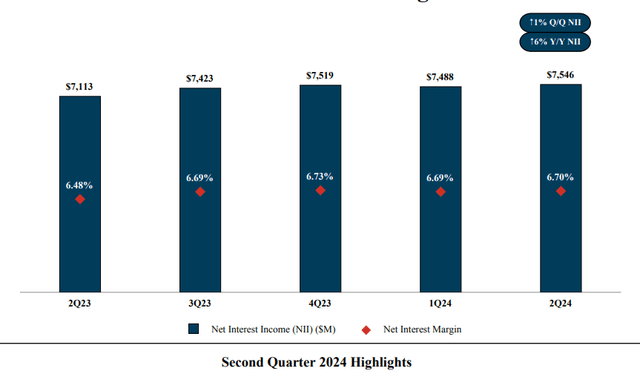

The company’s NII for the quarter was just over $7.5 billion, with small margin improvements.

Capital One Investor Presentation

We’re actually excited to see margins even remaining constant. In a higher for longer view, competition has increased among banks much more so than when interest rates were first being raised. This has resulted in higher interest rates being offered to depositors and pressure seen on NII values across the board. In this market, Capital One has managed to excel.

Capital One Credit Card

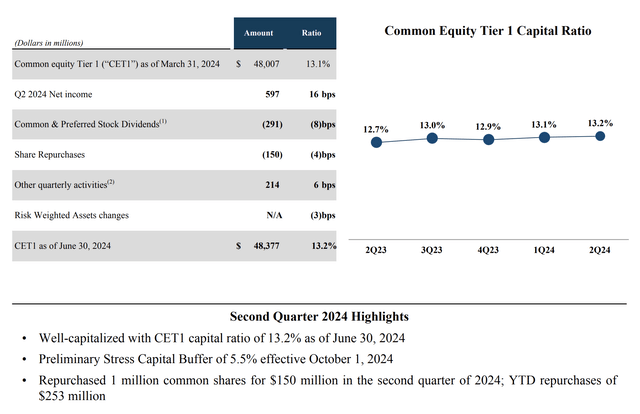

Capital One is a $51 billion company from a market capitalization point of view, with a growing capital ratio (13.2%).

Capital One Investor Presentation

The company needs to maintain certain capital ratios and depending on its goals here and various testing it can pay out shareholder returns. The company in the quarter repurchased 1 million shares of common stock and paid out its 1.78% dividend for total shareholder returns of approximately ~2.5% annualized. This is obviously a level the company can afford.

However, it’s a level we’d like to see higher over time. However, we view the Walmart buildup as a one-time factor, and the company’s P/E in a normal market to be closer to 15. At the same time, we see significant long-term potential from the acquisition of Discover Financial, which will bring an in-house payment processing network to one of the largest credit card companies.

Lastly, anecdotally, using Peter Lynch style investing, we see a strong market position for the Capital One travel cards in our immediate group. Given that Citi has exited the premium travel card market, Chase and American Express are the dominant players, and Capital One could step in a big way, especially with its own payment network.

We saw similar performance for T-Mobile several years ago in our immediate group.

Thesis Risk

The largest risk to our thesis is that Capital One is undergoing a massive acquisition with Discover Financial. Massive acquisitions have cultural clashes, and there’s no guarantee that this one will pan out. We think it’s a high potential acquisition, but there are numerous risks worth paying close attention to.

Conclusion

Capital One has an impressive portfolio of assets, and the company is making an intelligent decision with the proposed acquisition of Discover Financial. The company has strong cash flow and shareholder returns through both dividends and share buybacks, and we view the quarterly net income as a temporary blip impacted by Walmart.

The company has shown a unique ability to maintain strong net interest ratios despite a high-interest rate market with hefty competition. Overall, we expect the company to be able to generate strong shareholder returns with future growth potential, making it a valuable investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.