Summary:

- Capital One Financial Corporation has seen its share price partially recover with announcements such as an investment from Warren Buffett, but it’s not overpriced.

- The company has a respectable 2.3% dividend yield and an aggressive share repurchase program to help out.

- The company has some risk from rising loss provisions but overall, we expect Capital One Financial Corporation to be able to provide shareholder returns.

John M. Chase

Capital One Financial Corporation (NYSE:COF) is a bank holding company that specializes in credit cards. The company’s share price has gone up more than 20% from its lows as its financials remain strong as it has had a new investment from Warren Buffett. As we’ll see throughout this article, the undervalued company can generate strong shareholder returns.

Capital One Q1 2023 Overview

The company had a strong quarter, showing the strength of its business.

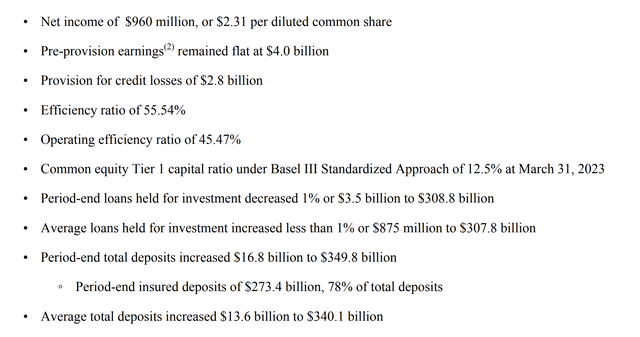

Capital One Investor Presentation

The company earned $960 million in net income with $1.2 billion after a substantial $2.8 billion provision for credit losses. The company’s tier 1 capital ratio is 12.5%, a strong ratio. The company’s bank side deposits remained strong, and the company continues to maintain a mostly insured deposit portfolio that minimizes the risk of a run on the company.

The company’s annualized net income gives the company a P/E of ~10 and shows the strength of the company’s assets.

Capital One Credit Losses Allowance

The higher risk nature of the company’s business means the need to make substantial allocations for credit losses.

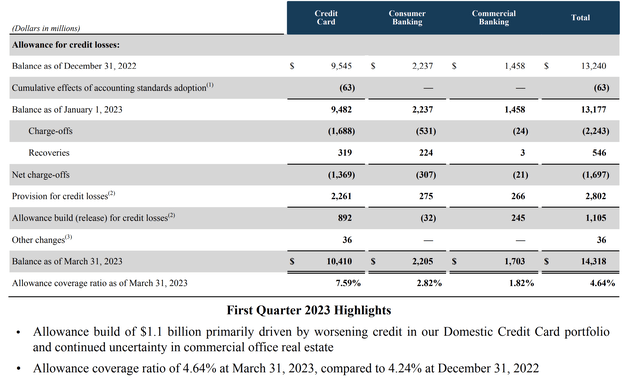

Capital One Investor Presentation

The company made $2.25 billion in allocations for charge-offs throughout its portfolio. $1.7 billion of these were credit card charge-offs. The company’s total balance here is just over $14 billion, and the company’s coverage ratio has grown from 4.6% to 7.6%. The company has the ability so far to cover potential losses.

However, there is some risk with the $2.8 billion / $4 billion allocation for charge-offs. It shows if the market becomes riskier, the company could see its net income quickly drop drastically.

Capital One Liquidity

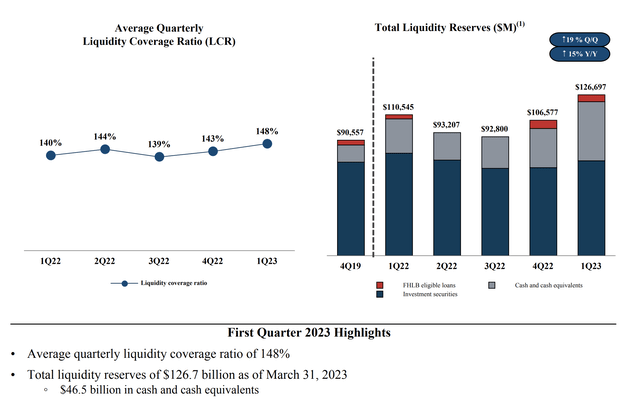

Overall, the company’s liquidity remains incredibly strong given that there’s only $75 billion in uninsured deposits.

Capital One Investor Presentation

The company has a 148% quarterly liquidity coverage ratio with $127 billion in available liquidity. The company has substantially built up its liquidity over the past two quarters, to help protect itself as the banking volatility has increased. The company’s coverage isn’t just over typical customer money movement, the company has ~1.7x coverage on uninsured deposits.

Protecting the company at its base is hefty cash and cash equivalents. As a result, we think the bank runs that have affected other banks won’t hurt the company.

Capital One Net Income

At the end of the day, the company’s ability to drive shareholder returns depends on its net income.

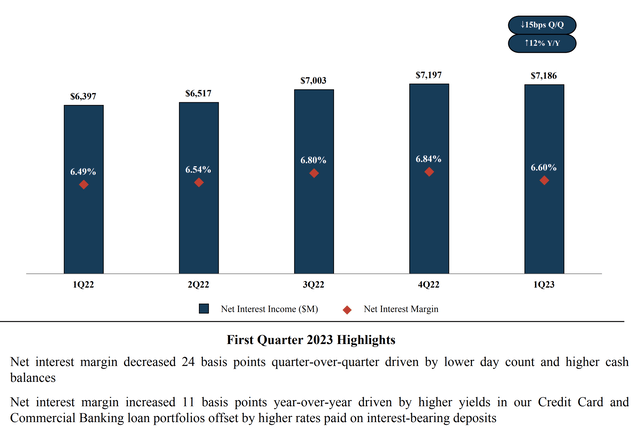

Capital One Investor Presentation

The company’s net interest margin decreased 24 basis points QoQ with less days and higher cash balances. We don’t expect net interest margins to improve even with higher rates as the company needs to increase what it pays out to those who provide deposits. Still over the last year, the company has kept margins strong as interest margins have gone up.

This net income is a fundamental basis to drive shareholder returns.

Our View

The company has an impressive portfolio of assets.

Its net revenue is just under $9 billion a quarter ($36 billion annualized). From this, the company has just under $20 billion in non-interest expenses each year and ~$11 billion in annual provisions for credit losses. That means the company, at the end of the day, can make close to $5 billion in annualized profit, a substantial amount for a $40 billion company.

The company has a 2.3% dividend yield. The company has also recently announced a $5 billion repurchase, which is more than 10% of its outstanding shares. Over the past several years, the company has done a great job repurchasing shares, substantially reducing outstanding shares. We expect that to continue.

That could enable the company to continue driving double-digit shareholder returns.

Thesis Risk

The largest risk to our thesis is difficulty in the markets. That could combine with competition in the credit industry, which is a tough and competitive industry with other large banks. Losses from credit card loans combined with increased competition could hurt Capital One Financial Corporation’s margins to drive future returns.

Conclusion

Capital One Financial Corporation operates as both a bank and a credit card issuer. Higher interest rates, along with a strong deposit basis, and the interest rates that credit cards get, has resulted in high margins for the company. The company has had to increase its provisions for credit card charge-offs, which could be a risk if it increases, but overall the company remains strong.

Capital One Financial Corporation has a high single-digit P/E ratio as it trades at a relatively low valuation. The company has used its earnings to aggressively repurchase shares, showing its financial strength. As Capital One Financial Corporation’s outstanding share count decreases, its earnings increase, making it a more valuable company for the long run.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.