Summary:

- Capital One Financial’s shares have seen a strong performance this year, despite a banking crisis in Q1.

- The bank’s credit card business, its largest segment by revenue and income, is facing a rise in non-charge-offs, which is concerning.

- The bank’s risk profile has worsened due to declining deposits and early signs of deteriorating credit card quality.

- Shares have an unattractive risk/reward ratio, in my opinion.

Heather Shimmin

Shares of Capital One Financial (NYSE:COF) have recaptured all of their losses sustained during the first-quarter regional bank market meltdown. The bank also last week reported a mixed earnings sheet for the second-quarter that included a top line miss, but solid bank profitability. However, Capital One Financial’s deposit base also shrunk, and the bank is heavily reliant on its credit card business. With net charge-offs rising, a warning sign for investors, I believe the risk/reward relationship has further deteriorated and shares of Capital One Financial have limited upside potential from here. For those reasons, I am down-grading Capital One Financial from hold to sell!

Previous rating

I recommended Capital One Financial in late March — Buy The Bank Panic — due to the bank’s association with the regional banking sector, which was heavily punished after Silicon Valley Bank failed. I down-graded COF to hold in late June. Since then, shares of COF have appreciated 6.32%.

Mixed earnings sheet for the second-quarter

Capital One Financial submitted a mixed earnings sheet for the second-quarter that showed revenues of $9.01B, missing the consensus estimate by approximately $133M. Earnings per-share, adjusted, were $3.52 compared against an average prediction of $3.24 per-share.

Capital One Financial lost deposits in Q2

Capital One Financial reported a 2% decrease in total deposits in Q2’23. At the end of the second-quarter, the bank had $343.7B in deposits on its balance sheet, compared to $349.8B at the end of the first-quarter. Due to the bank’s heavy focus on the consumer-banking and credit card businesses, Capital One Financial had a very high share of insured deposits at the end of the first-quarter: 79%.

Deposits in commercial banking were down $1.6B (4%) quarter over quarter to $36.8B, while consumer banking deposits declined $5.0B (2%), also quarter over quarter. The decline in deposit balances related to the rise in interest rates, which is forcing some cash sorting behavior on the part of customers and businesses. However, some banks, like Western Alliance Bancorporation (WAL) have seen net deposit growth throughout the second-quarter.

Rising charge-offs in the credit card business are a potential warning sign

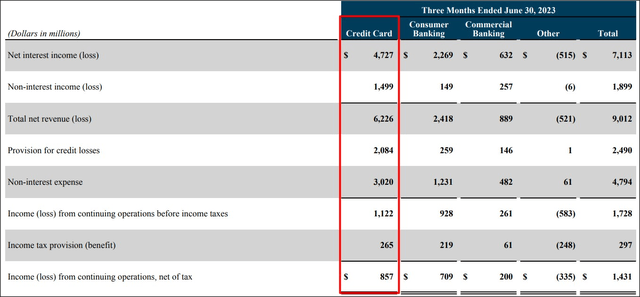

Capital One Financial operates a number of businesses, including consumer and commercial banking. The bank also operates a sizable credit card business… which is by far the largest segment for the bank regarding revenues and which is highly cyclical. The credit card business generated $6.2B in net revenues, showing growth of 17% year over year, and had a revenue share of 69% in the second-quarter. Capital One Financial’s CC business generated $857M in earnings, or 60% of total Q2’23 net income.

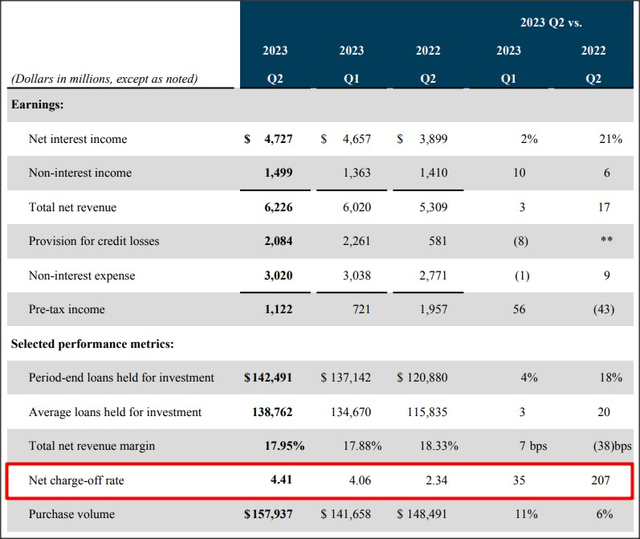

The problem that I see with Capital One Financial is that a rise in credit card defaults could weigh on the company’s profitability and affect the bank’s earnings estimates if the economy slows. Banks measure bad credit card debt with the net charge-off ratio, which has risen in the last two quarters to more than 4%. In Q2’23, the net-charge off ratio in the credit card business was 4.41%, showing an increase of 88% compared to the second-quarter of FY 2022.

Capital One Financial: limited upside potential

While shares of Capital One Financial are still trading at a discount to book value, I believe the upside for COF is limited going forward. For one, Capital One Financial has seen a large valuation increase since March and is now trading at a larger valuation factor than it did before the financial crisis. Second, Capital One Financial has significant credit card exposure, which I expect to be a considerable drag on earnings performance in a falling economy.

Shares of Capital One Financial are valued at 0.81X book value and 8.7X FWD earnings. I believe COF’s discount to book value is largely the result of investors being fearful of the bank’s cyclical credit card business, which is not totally unjustified. Considering that COF performed very well this year, I see higher upside potential in regional banks such as Western Alliance, which is a strong buy for me on deposit trends, valuation and recovery potential.

Risks with Capital One Financial

Capital One Financial has a large credit card operation, which by definition is a very cyclical business. The credit card business does well when people have jobs and make payments on time. However, a rise in delinquencies and credit card debt defaults must be expected in a down economy and the net charge-off ratio for Capital One Financial already increased sharply in Q1’23 and Q2’23, indicating problems in the credit card portfolio. While the economy is still strong, it is an early warning sign that investors may want to take seriously.

Closing thoughts

Capital One Financial missed revenue estimates and reported a decline in its deposit base as higher interest rates continue to pose a challenge for the banking sector in general. Since shares are now trading above their pre-crisis valuation and considering that the credit card business is seeing early signs of deteriorating quality, I believe there are better bargains to be bought in the regional banking market, such as Western Alliance. Since I view the risk profile as unattractive given the strong YTD performance and Q2 report, I am down-grading Capital One Financial to sell!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of USB, WAL, TFC, PNC, FITB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.