Summary:

- Capital One Financial’s valuation now exceeds its pre-financial crisis level.

- The bank’s net interest margin is likely to come under pressure due to the Federal Reserve’s tightening policy.

- Credit provisions in the credit card business have remained high, posing a challenge to the bank’s profitability.

- Shares now trade above the 3-year average P/B ratio.

Win McNamee/Getty Images News

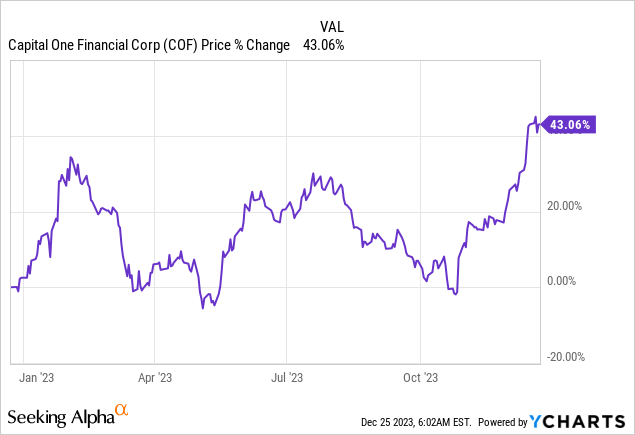

Capital One Financial (NYSE:COF) now has a valuation that exceeds the valuation from before the financial crisis in the first quarter, which means shares have fully revalued. After the collapse of Silicon Valley Bank in Q1’23, regional banks sold off heavily, resulting in exceptionally attractive buying opportunities back then. Capital One Financial is now trading much closer to book value, despite the bank likely seeing considerable net interest margin headwinds in FY 2024 after the Fed said that it would end its tightening policy. I have sold out of all of my bank holdings and continue to see growing risks for Capital One Financial!

Previous rating

I recommended Capital One Financial at the onset of the financial crisis in the first quarter and lowered my rating to sell in July due to my concerns relating to rising credit losses in the bank’s core business, credit cards. Capital One Financial is a very consumer-oriented bank with considerable exposure to credit cards and, therefore, is vulnerable to a rise in loan defaults. Since Capital One Financial’s shares have since revalued to the upside again and now trade very close to book value, I believe the risk profile has further deteriorated.

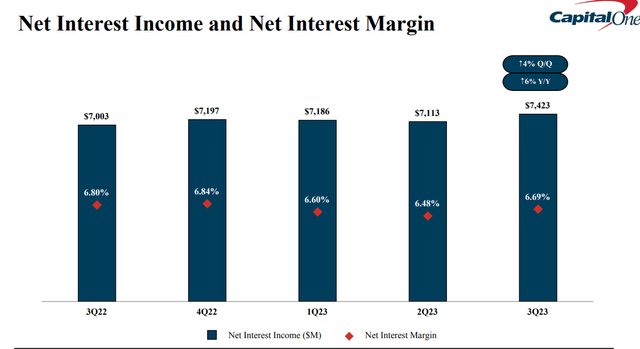

Challenges to net interest margins

Capital One Financial reported $7.4B in net interest income in the third-quarter, showing 4% quarter-over-quarter growth due to growth in its credit card portfolio and higher yields. However, the bank’s net interest margin declined 0.11 percentage points on a year-over-year basis to 6.69%. Going forward, given the Fed’s announcement that it would pivot in terms of interest rates in 2024, Capital One Financial’s net interest margin is set to come under further pressure, despite its comparatively high yields achieved from its credit card portfolio. As a result, I expect a changing interest rate landscape to result in lower bank profitability and capital returns for shareholders.

Capital One

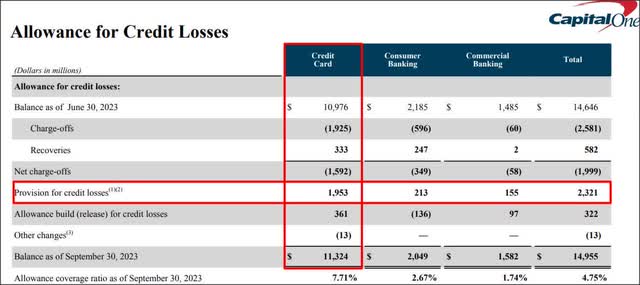

Focus on credit losses

In my July work, I mentioned that the lender had a high level of credit provisions which posed a challenge for the bank’s profitability, especially if the U.S. economy headed for a down-turn.

In the third quarter, Capital One Financial’s credit provision situation did not deteriorate, but it also didn’t get much better. The bank reported credit provisions in the amount of $2.3B, compared to $2.5B in the second quarter. The majority of credit provisions, again, occurred in the credit card business, which represented $1.95B or 84% of total provision expenses in Q3’23. In the second quarter, Capital One Financial’s credit card business required $2.1B in provisions (83% of the total). In other words, the credit card provision trend did not deteriorate most recently, but the situation could get a whole lot worse for Capital One Financial if the U.S. economy tanks in 2024 and loan defaults rise.

Capital One

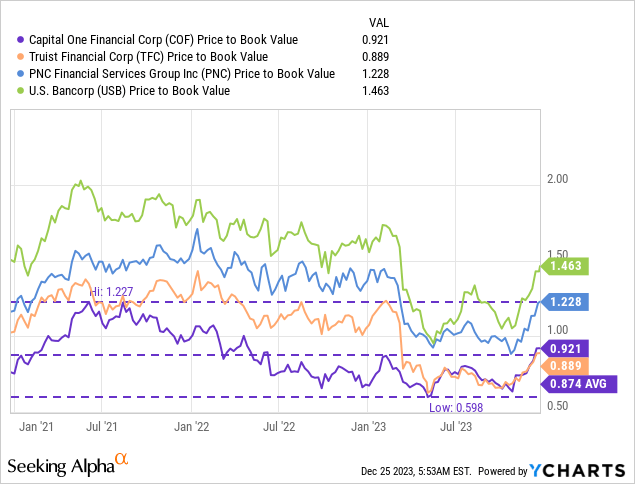

Capital One Financial is now trading near its long-term P/B ratio

Capital One Financial is a sell for me chiefly because of a strong revaluation of the bank’s shares to the upside which happened in the context of the Fed pivot. Capital One Financial’s shares have historically sold at a discount to book value which is due, in my opinion, to the lender focusing chiefly on its credit card operations which are cyclical in nature and tend to generate rising loan defaults in a down-economy.

Currently, shares of Capital One Financial are trading at a price-to-book ratio of 0.92X, which is slightly above the bank’s three-year average P/B ratio of 0.87X. Since a full revaluation has taken place in the last two months, I believe that, given the Fed pivot context, Capital One Financial has an unattractive risk profile. Other mid-sized lenders like PNC Financial (PNC) and U.S. Bancorp (USB) have also seen strong re-ratings, indicating that investors are now overly exuberant following the Fed decision from earlier this month. Since U.S. Bancorp and PNC Financial are more diversified than Capital One Financial (non-core credit card focus), these rival banks are selling at much higher price-to-book ratios as well.

Risks with Capital One Financial

The risks here chiefly pertain to continual upside potential for banks even if the Federal Reserve lowers interest rates. This could be the case if the U.S. economy retains its good constitution and Capital One Financial, which is oriented towards consumers through its vast credit card operations, avoids a rise in loan defaults. However, even in this scenario, I would not recommend shares of Capital One Financial due to valuation considerations and the general cyclical nature of the credit card business.

Final thoughts

Capital One Financial, after such a strong increase in pricing, especially in the last two months, remains a sell, in my opinion. The credit card-focused lender is set to see a changing interest rate landscape in FY 2024 which should further erode its net interest margin outlook. Also, shares of Capital One Financial now trade above their 3-year average price-to-book ratio, a fact that in my opinion is related to investor exuberance following the Federal Reserve’s announcement that it would start to cut interest rates soon. With shares now trading close to book value, I believe the risk profile is not attractive at all and my rating on the credit card lender remains a sell!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.