Summary:

- Capital One Financial is a good credit card business that is run by a seasoned management.

- The COF stock is currently trading under 5x P/E and 1x P/B. I believe this valuation provides a large margin of safety.

- Per my analysis, COF is a strong buy at current levels and has a potential upside of 30-40%.

Editor’s note: Seeking Alpha is proud to welcome Mauna Kea Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Heather Shimmin

Capital One Financial (NYSE:COF) is an understandable business with favorable economics and seasoned management, currently trading at an attractive valuation. The Company’s decent capital allocation record indicates that management is keen on increasing per share intrinsic value for the shareholders. Moreover, value-oriented fund managers are among the largest holders of Capital One stock, including the likes of the Sequoia Fund and the Oakmark Fund. My recommendation is to establish a long position in COF.

Capital One showed up on my screeners recently when it hit a 52-week low. Trading at 0.7x BV and 4.5x PE, these multiples would pique the interest of any value manager.

Company Overview

Capital One Financial Corp. is a financial service company headquartered in Mclean, VA. Originally a part of Signet Financial, Capital One was spun off in 1994, with Richard Fairbank as its CEO. The Company engages in 3 business segments: credit cards, commercial, and consumer banking. Serving customers through branches and online channels, Capital One has a global presence in the US, Canada, and Europe.

Good Business

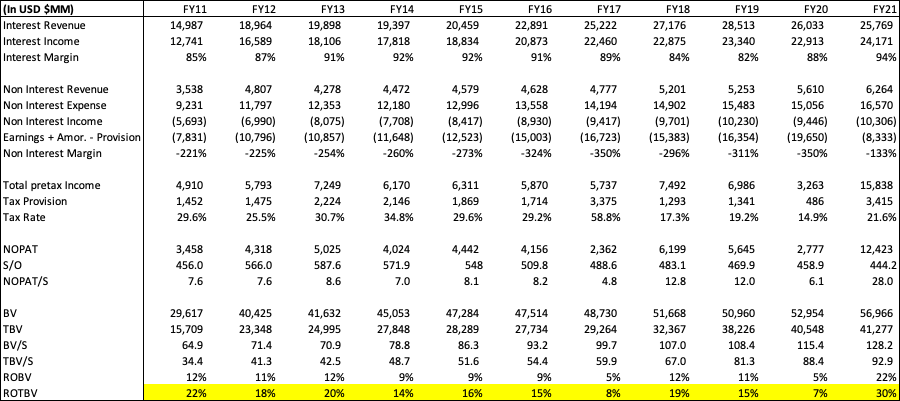

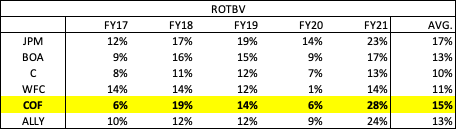

Banking is a wonderful business that bumps out 10-15% returns on tangible equity over the long term (see chart below). But since capital is increasingly a commodity in today’s world, why does the business of lending money yield such high returns?

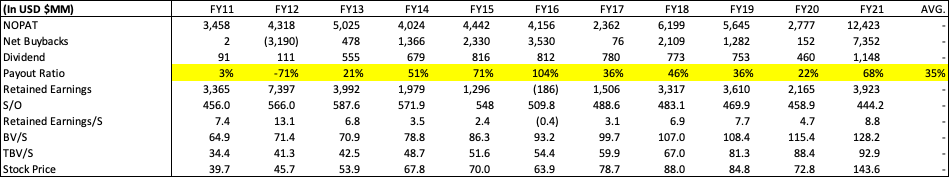

Financial Summary of COF FY11-21 (Author’s calculations)

Hypothetically, to start a bank, fixed cap-ex for ATMs, offices, and personnel is required. But after this initial outlay, a bank can just sit there and take in other people’s money, aka deposits. As the bank takes in more deposits and originates loans, revenue will increase while fixed costs stay constant, allowing it to enjoy economies of scale. High operating and financial leverage inherent in banks allow them to compound money at wonderful rates.

For Capital One, in particular, the Company originates a higher proportion of auto and credit card loans to subprime borrowers than industry peers, while borrowing cheaply from consumer deposits. The net result is that the Company generates a higher spread compared to other lenders. Lending to subprime borrowers can be risky, but Capital One claims to have proprietary technology that allows them to build accurate credit profiles. If true, I believe Capital One’s competitive advantage in lending, coupled with favorable economics, will allow it to achieve higher returns than its peers.

Margin of Safety

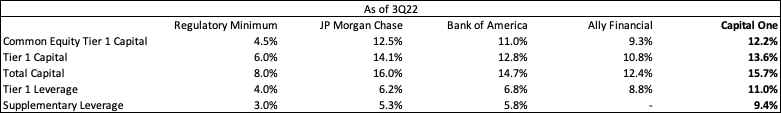

The table below shows Capital One’s capital adequacy ratios compared to the regulatory minimum for 3Q22. Capital One’s capital ratios are comfortable above regulatory hurdles, and on par with JP Morgan Chase. Moreover, Capital One is 88% funded by consumer and commercial deposits, which is a stable source of funds. Jaimie Dimon has claimed that JP Morgan possessed a “fortress balance sheet”. Using Dimon’s logic, Capital One is not far off from “fortress” status.

COF capital adequacy ratios compared to peers (Author’s calculations)

COF – Valuation

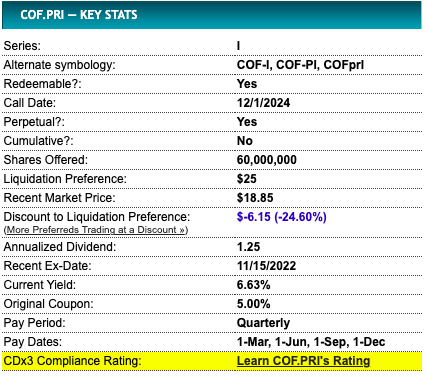

Turning to valuation, Capital One has generated returns on tangible book value (TBV) of 17% for the past 10 years. With global growth slowing, and Capital One approaching the law of large numbers, I think a normalized return of 15% is more probable. Right now, Capital One’s non-cumulative and soon-to-be redeemable preferred shares (COF.PI) are yielding around 6.6%. Common stocks should yield more than prefs, but a 15%-6.6%=8.4% spread seems excessive to me (see image below). The yield of Capital One prefs are another indication of the relative cheapness of its common.

COF preferred stock yielding 6.6% (Preferred Stock Channel)

To find our cost of capital, let’s start with the 10-year treasury, which is yielding ~4% today. I am not smart enough to forecast interest rates, but I think it is conservative to assume a long-term average yield of 6% on the 10-year. If the risk premium for investing in stocks is 300 bps, then our cost of capital will be 6%+3%=9%.

Capital One’s 3Q22 TBV was ~$81 per diluted share. On a normalized 15% return, the Company’s earnings should be $12. With a cost of capital of 9%, Capital One’s common stock would be worth ~$133. Capital One is currently trading at $93, presenting a price/value ratio of 69%. If it takes 3 years for the price-to-value spread to close, then the Capital One investor will achieve a 13% return compounded annually. If it takes 5 years to close, then the investor will receive an 8% CAGR. Not a bad margin of safety.

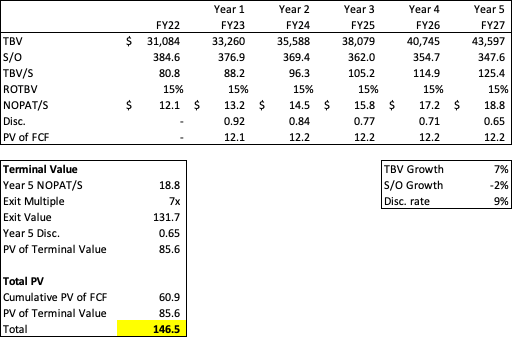

Alternatively, we could use a DCF to factor in earnings growth. For the past 5 years, Capital One’s yearly share buybacks have been 2%, TBV has been growing at a 7% clip, and the return on TBV has been 15%. Extrapolating these trends into the future, our DCF provides us an intrinsic value of $146.5, on a 9% discount rate and 7x exit multiple (see DCF below). At current market prices, Capital One’s price/value is 63%. A 3-year convergence of price to value will yield investors a CAGR of 16%. A 5-year convergence would equate to a 9.5% CAGR.

COF DCF analysis (Author’s calculations)

Peer Comparison

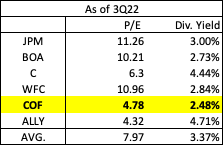

Capital One is among the largest banks in the US, making it eligible for comparison with the “Big 4” domestic banks. Ally Financial is also a near comp because of its specialization in auto loans, despite being a lot smaller than Capital One. Measured by net income, Capital One’s ROTBV is among the highest when compared to peer banks, while its PE ratio is among the lowest. I believe this is yet another indication of Capital One stock’s cheapness.

COF ROTBV comps. (Author’s calculations)

PE comps (Author’s Calculations)

Alignment of Management’s Interest

Capital One’s first CEO and Chairman, Richard Fairbank, is heading into his 29th year at the helm. Mr. Fairbank owns ~1.1% of the company, which is about $400 million in current valuations. According to Forbes, Mr. Fairbank’s net worth was $1.1 billion as of 4/4/2022, which is probably lower now that Capital One’s stock has tumbled by nearly 30%. With the majority of his net worth tied up in Capital One, Mr. Fairbank has put all his eggs into one basket. I bet he’s watching this basket very closely.

According to the 2022 proxy statement, Mr. Fairbank neither gets paid a base salary nor a cash salary. Instead, the CEO receives equity-based incentive payments and deferred cash bonuses. Mr. Fairbank was paid $27.5 million in FY21, lower than that of Jamie Dimon’s (JP Morgan) $84.4 million, but higher than that of Brian Moynihan’s $23.7 million (Bank of America). Other Capital One executives receive between $5-7 million in compensation, typically in half cash and half equity. The executives are required to hold Capital One stock worth 3x their annual cash salary.

Mr. Fairbank is the only company executive on a board of 13 people. Besides him, other board members do not own a lot of Capital One stock – only 0.16% of shares collectively. Excluding Mr. Fairbank, who does not get paid for sitting on the board, each board member gets paid $300k+ in compensation. The board’s high compensation and lack of skin in the game could demotivate members from speaking up against the CEO. The board is fairly diverse, including 4 women and 3 people of color.

Curiously, Harris Associates and Davis Advisors are among the largest holders of Capital One stock. Harris Associates houses the Oakmark Fund, headed by famous value investor Bill Nygren. Oakmark’s Capital One position was among its top 10 holdings in 3Q22. Davis Advisors is also a value-oriented shop with Capital One as its second-largest holding behind Wells Fargo. In 3Q22, Ruane, Cuniff’s Sequoia Fund plowed $260 million into Capital One stock at an estimated cost of $92 per share. Purchasing Capital One stock now would mean getting in at similar prices as the aforementioned value investors.

Capital Allocation

The figure below shows management’s capital allocation record. Over the past 10 years, Capital One has had a fairly articulate distribution policy – paying out around 35% of earnings and retaining 65%.

COF capital allocation record from FY11-21 (Author’s calculations)

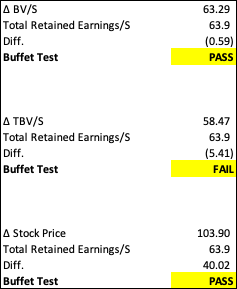

Management has reinvested retained earnings wisely. Over the past 10 years, retained earnings totaled ~$32 billion. Concurrently, Capital One’s market cap rose by around $40 billion, BV rose by $27 billion, and TBV rose by $26 billion. Using the “Buffett Test” of creating $1 of stock price/BV per $1 of retained earnings, Capital One has roughly passed the examination. The chart below shows the Buffett Test on a per-share basis. Although the Company fails the TBV test, the mismatch is not egregious.

COF’s Buffett test scorecard (Author’s calculations)

ESG

Capital One has a respectable ESG program. The Company has produced a large amount of ESG-related documentation, including an ESG fact sheet authored under the framework of the Task Force on Climate-Related Financial Disclosures (TCFD). Capital One is also tracking its own GHG emissions and has committed to a 5 year $200 million grant program to help facilitate social mobility among key stakeholder communities. However, the Company does originate many auto loans, which could indirectly affect climate change negatively.

Risks

Rise in loan delinquencies

There is always a certain level of uncertainty when investing in banks. It is impossible to do due diligence on the millions of individual loans the bank has originated, so who knows what is in those books? But by looking at net charge-offs, we can get a hint of Capital One’s underwriting discipline.

Net charge-offs in 3Q22 remain at 1.24%. During the GFC of 2008, charge-offs rose to around 4%. The normal rate of charge-offs is around 2% give or take. If the US is indeed headed for a recession in 2023, then charge-offs are likely to be higher than current levels. Although it is too early to tell, I think there is a slim chance that charge-offs will rise to apocalyptic GFC levels. With a loan book worth approximately $300 billion, and with pre-tax earnings on track to be $9-10 billion in FY22, charge-offs of up to 3.5% can be covered by earnings alone. Management can also cut back on marketing to further control costs. Overall, I think Capital One is well-positioned to ride out the bumpy roads ahead.

Personnel risk

CEO and Chairman Richard Fairbank is in his 29th year at the helm of the bank. Fairbank is 72 years old and owns 1.1% of Capital One shares. It is unlikely that Capital One’s board can find somebody with Fairbank’s track record in the event of his retirement. Needless to say, it will be even more difficult to replace the incumbent CEO with somebody with as much “skin in the game” as him. Many companies have moved to create the office of the executive chairman to facilitate succession planning. I believe it would be the best-case scenario for Capital One if Fairbank stayed on as executive chairman upon retirement, allowing him to mentor the next generation of executive talent at the bank.

Conclusion

Capital One is an above-average business with experienced managers at the helm. The Company allocates capital well, and its ESG track record is more than adequate. Value-oriented asset managers are among Capital One’s largest shareholders, including the Oakmark fund and Davis Select Advisors. In my view, Capital One is a value investment for the long run, with a 30-40% upside in the next 3-5 years.

Disclosure: I/we have a beneficial long position in the shares of COF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.