Summary:

- Capital One is a financial services company with a market cap of over $50 billion, focusing on strong financial returns and acquiring Discover Financial Services.

- Q1 2024 highlights include $1.3 billion net income, strong credit card focus, and maintaining strong allowances for credit losses.

- Capital One is acquiring Discover at a 26% premium, expecting $2.7 billion in pre-tax synergies and a >15% increase in 2027 EPS.

John M. Chase

Capital One (NYSE:COF) is a financial services company with a market capitalization of more than $50 billion. The company is continuing to generate strong and growing financial returns, and working to close a more than $30 billion acquisition of Discover Financial Services. That will give the company a payment network that, combined with the rest of its assets, will generate strong shareholder returns.

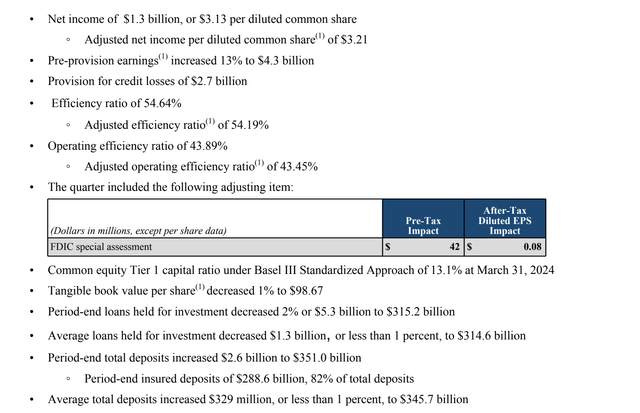

Capital One Q1 2024 Highlights

The company had a strong quarter, earning $1.3 billion of net income, putting the company at a P/E ratio of ~10.

Capital One Investor Presentation

The company’s pre-provision earnings increased 13%, but the company’s credit card focus means it has had to maintain strong allocations for credit losses, which were $2.7 billion. The company has maintained a strong efficiency ratio of 54.64% and a strong operating efficiency ratio. The banking failures resulted in an FDIC special assessment of $42 million, relatively negligible.

The company remains an earnings powerhouse, trading at a relatively low valuation.

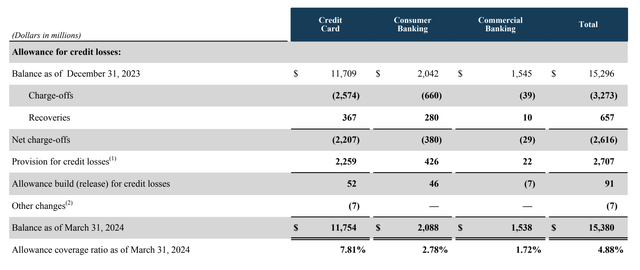

Capital One Loss Allowances

The company has continued to maintain strong allowances for credit losses.

Capital One Investor Presentation

The company’s allowance for losses remains primarily in its credit card business, not surprising, with $2.6 billion in charge-offs in the quarter and $11.7 billion in balances. The company has built its net credit losses by $52 million. The company’s total provision for credit losses was $2.71 billion, up $91 million.

The company’s allowance coverage ratio is ~4.88% given the risks of various types of loans.

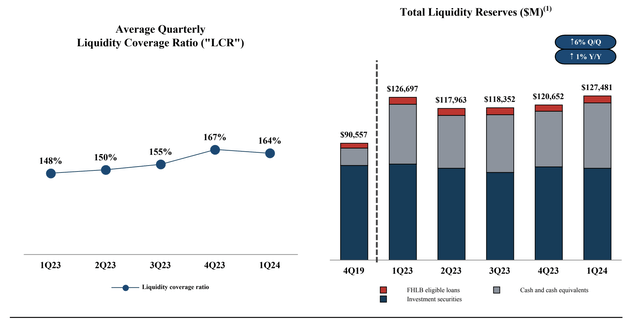

Capital One Liquidity

The company has managed to maintain a strong liquidity coverage ratio with almost $128 billion in cash driven by more than $50 billion in cash and cash equivalents.

Capital One Investor Presentation

The company’s liquidity coverage ratio of 164% is well above the requirement of 100%, and in-line with other major banks such as JPMorgan Chase. The company’s ratio has drifted up as the company’s short-term liquidity obligations have drifted down, as the cash number has remained fairly constant for the company.

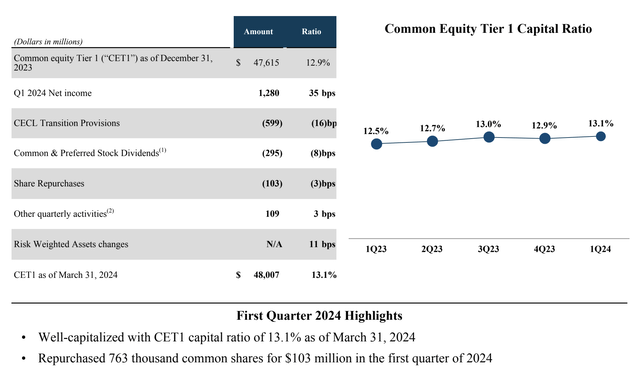

Capital One Capital

Capital One maintains one of the strongest capital ratios while continuing to drive shareholder returns.

Capital One Investor Presentation

The company continues to slowly repurchase shares, with 763 thousand common shares repurchased for $103 million in the quarter. That’s ~0.1% of the company’s shares annualized, a weak buyback program, but the company’s capital ratio enables additional buybacks by the company. We’d like to see it ramp up buybacks post acquisition.

The company does have a $5 billion buyback program that we’d like to see it fully utilize.

Capital One Discover

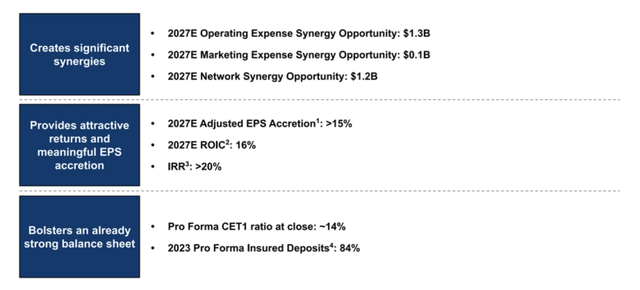

Capital One is acquiring Discover at a 26% premium, in an all-stock transaction, that will result in Discover shareholders owning 40% of the combined company. The global payments platform will have 70 million merchant acceptance points, and it’s expected to generate >$2.7 billion in pre-tax synergies, resulting in a >15% increase in 2027 EPS.

Capital One Investor Presentation

Discover is the smallest of the payment networks with $550 billion in annual volume versus $1.35 trillion for American Express (a company more than double the size of Capital One by market cap). The company expects to add more than $175 billion of Capital One purchase volume, which could expand in subsequent years.

Total synergy opportunities are expected to be $2.6 billion with double-digit 2027E adjusted EPS acquisition and a >20% IRR. The pro forma CET1 ratio at close is expected to be ~14% with 84% insured deposits.

Thesis Risk

The largest risk to our thesis is that the company is about to go through a large and expensive acquisition with Discover Financial that might not pan out and will be an expensive integration. There’s plenty that could go wrong with an expensive integration, which could hurt the company’s ability to generate strong shareholder returns over the long term.

Conclusion

Capital One has an impressive portfolio of assets, with a strong credit card portfolio. The Venture X is considered one of the best high-end credit cards, a recent entry to the scene. At the same time, the company is expanding to vertical strength, a strategy that worked well with American Express, by purchasing Discover Financial, giving it a strong payment network.

The company will be able to grow Discover Financial, increasing overall strength and increasing its margins. At the same time, the company continues to have an incredibly strong financial portfolio, trading at a low valuation, with strong synergies from the acquisition. This will enable strong future shareholder returns, making Capital One a valuable investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DFS, COF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.