Summary:

- Capital One’s shares have gained 63% in the past year, but it is no longer a “strong buy” given a slightly lowered earnings outlook and concern about the Discover purchase.

- The bank’s deposit franchise remains strong, with average deposits slightly increasing in Q1, and 82% of deposits insured.

- Credit card loans are a major driver of COF’s profits, but credit quality has been deteriorating, although signs of a peak are emerging.

- The Discover deal will face significant regulatory scrutiny, but I am concerned it could prove dilutive.

Sundry Photography

Shares of Capital One (NYSE:COF) have been a strong performer over the past year, gaining 63% as the company has handled the regional banking crisis well. Its deposit franchise is strong, and consumer credit trends have been better than many feared. I reiterated shares of Capital One as a “strong buy” in December, and since then, shares have returned nearly 20% vs the market’s 11% rally. Given its ongoing outperformance and with new financials available, now is an opportune time to revisit the stock. While I remain positive on COF, I no longer see it as a “strong buy.”

Seeking Alpha

In the company’s first quarter reported on April 25th, Capital One earned $3.21 in adjusted EPS, which was $0.17 below estimates, though delinquencies in March fell by 0.24% from February to 4.48%, adding to hopes we are through the worst of the credit deterioration cycle. Earnings were adjusted for a $42 million special assessment to the FDIC to cover its bank bailout losses. Q1 can be significantly impacted by tax refund season as consumers use tax refunds to catch up on overdue bills, and a slower refund cycle has modestly weighed on results. This should average out over time.

When looking at any bank, I believe it prudent to begin looking at deposits, which are the lifeblood of their funding structure. Here, COF has acquitted itself well during the volatility of the past year. Average deposits of $345.7 billion were up marginally from $345.3 billion in Q4 and up 2% from last year. I view sequential growth in Q1 positively because deposit balances tend to build into the end of the year and then draw down in Q1. Being able to still add deposits during Q1 speaks to a strong franchise. COF’s deposit trends have held in well because it is primarily a consumer bank with a large online presence. As a result, 82% of its deposits are insured, reducing flight risk.

Because COF has a largely retail deposit base, it has limited noninterest bearing (NIB), which have shown the most flight as those customers seek to take advantage of the elevated rate environment. Only about 8% of deposits are NIB, though those balance fell about $2 billion sequentially. NIBs are generally transactional accounts, like a payroll account, and are generally held by businesses. As a result, commercial deposits fell 8% to $31.8 billion. The average rate on its commercial deposits fell to 2.65% from 2.79% last quarter. Consumer deposits continues to rise with an average rate of 3.15%, up 9bp sequentially. COF has begun cutting rates on some CD maturities given the resilience of its deposit base, which should support net interest margins (NIM) going forward.

In Q1, Capital One had a 6.69% NIM, which was down 4bp sequentially, as consumer deposit costs rose. Still, NIM was up 9bp from last year, aided by credit card loan growth as that productive has particularly high yields. COF had $7.5 billion in net interest income (NII), which was flat sequentially. This was up 4% from $7.2 billion last year, given growth in its credit card portfolio. NIM was also negatively impacted by 1 fewer day in the quarter. With deposit rates likely having peaked and loan yields unlikely to fall before the Fed begins cutting rates, I do expect some NIM expansion in coming quarters.

During Q1, COF had $314.6 billion in average loans, down about $1.25 billion sequentially but up 2% from a year ago. While its credit card portfolio continues to grow, it has trimmed lending elsewhere as it manages risk-weighted assets can capital ahead of its Discover Financial (DFS), which I will discuss further below.

Now, credit cards are the focus of the company, delivering three quarters of COF’s profits. Credit card loans were up 10% YoY to $150 billion. One driver of loan growth is increased purchase activity, as volumes are up 6% from last year. However, consumers are also carrying greater balances for longer as excess savings from the pandemic stimulus measures have been eaten away by spending and inflation. Because of this, consumer credit quality has been deteriorating for over one year, but we are seeing a deceleration in this trend.

Across Capital One’s loan book, 3.67% are 30+ days delinquent, down from 3.99% last quarter but up 58bp from a year ago. With greater delinquencies, COF is also having to charge-off more loans. Credit cards had a 5.9% charge-off rate from 5.3% in Q4. Charge-offs are 18% above 2019 levels. Now, delinquencies usually fall in Q1 as consumers use refunds to pay off debt. However, this seasonal benefit was “modestly worse” than expected, with management blaming the fact tax refunds have been smaller and paid out more slowly. However, other companies like Ally (ALLY) saw strong seasonal improvement.

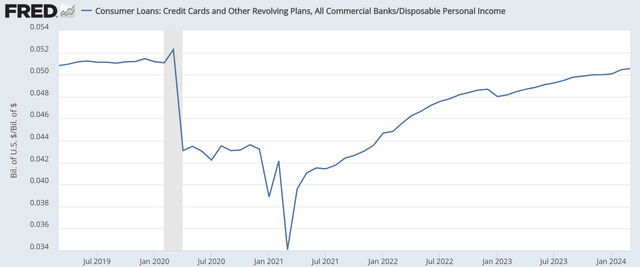

Still, the pace of YoY deterioration is improving, a necessary step before peaking and hopefully eventually falling. Management also reiterated its belief that consumers are “in reasonably good shape.” I would also note that while credit card debt is rising; as a share of disposable personal income, it is back to pre-COVID levels. So long as employment remains in firms (which appears likely), this would be consistent with delinquencies and losses nearing their peak.

St. Louis Federal Reserve

Elsewhere, non-credit card consumer loans were down 2% sequentially and 5% from last year at $75.1 billion. Commercial loans fell 1% sequentially and 4% from last year to $89.9 billion. Credit quality is pristine, with business charge-offs just 0.12%. Unlike most banks, COF has little commercial real estate exposure with just $2.2 billion of office loans, about 0.6% of its portfolio. It already has reserved for 12.4% losses here.

Overall, during Q1, the company took $2.7 billion in provisions for credit losses. Against this, there were $2.6 billion in net charge-offs in Q1 for $91 million of reserve builds. Charge-offs were up from $2.5 billion in Q4. With higher reserves and lower loans, it now has 4.88% loan coverage, up 11bp sequentially, with the build focused in autos and credit cards. Overall, COF has about $15.4 billion in reserves. This provides 18 months of charge-off coverage, consistent with healthy levels.

Absent a recession, I expect credit costs to be broadly similar to Q1 levels this year, though they may tick up modestly. EPS should be aided by NIM expansion as lower deposit rates feed through, and COF is managing costs well with operating expenses up just 2% annually to $4.1 billion. COF is also well capitalized with a common equity tier 1 (CET1) ratio of 13.1% from 12.9% in Q4. It may continue to build capital toward 14% into DFS acquisition. The announcement of the Discover (DFS) purchase limited buybacks in Q1, and there are restrictions around the proxy as well. COF can otherwise buy back stock. As such, I expect the pace to be muted but somewhat higher than Q1’s $103 million in buybacks.

On a stand-alone base, I see COF earning $13.50-$15 this year, depending on the exact trajectory of credit card losses. Losses were a bit higher than hoped for Q1 and buybacks will be slower, which is why I see earnings coming towards the lower end of my initial 2024 estimates, and shares are trading about 10x earnings. Overall, I view this attractive on a standalone basis, as it is toward the lower-end of quality regional banks. Given my view a recession is unlikely and COF’s elevated capital position, I believe shares could move another 15% higher, given modest multiple expansion as credit fears ease and share count reduction via repurchases.

However, COF is also trying to buy Discover. I say “trying” here because there is likely to be significant antitrust scrutiny. COF believes the Discover deal will pass regulatory muster, with the deal closing later in 2024 or early in 2025. COF will argue it will add scale to Discover’s network, making it a more viable competitor to Mastercard (MA) and Visa (V); however, antitrust regulators may be concerned about credit card concentration. There is definitely deal risk here, and I believe it is hard to know the outcome. This is especially the case because a decision will likely be made after the election, so it is also hard to know who the decision makers will be.

Frankly, I am not a fan of the deal. Discover continues to face elevated charge-offs, which has led to earnings misses, including its most recent quarter. Expenses related to past accounting and card classification issues also reduced earnings. I have not been a bull on the company on a standalone basis, given my concerns about its underwriting and its history of regulatory and accounting challenges. I view DFS as inferior to COF.

However, COF is paying out 1.0192 shares for each share of DFS. As noted above, COF will earn $13.50-15 a share, whereas DFS will likely earn under $12. DFS will earn 10-20% less than COF per share but is receiving slightly more than 1 share per share. That is a material premium, and so I expect the deal could be somewhat dilutive unless COF can generate substantial savings and additional traffic over the DFS network, which would likely to take years to realize. At the same time, it is taking on increased credit risk, given DFS’s inferior underwriting, which could increase losses if a recession occurs.

I believe the DFS purchase will make it harder for COF to grow earnings in 2025 with longer-term benefits unclear to me. I would actually prefer to see the deal get blocked, leaving COF a stronger entity with significant excess capital that could be used for aggressive share repurchases, likely reducing its share count by ~10% in the 12 months after a deal is blocked. With 15% standalone upside, I do not view COF as “strong buy” given its large run but still a solid “buy.” Combined though, its blended multiple is over 10x already, and there is execution risk to this deal ever being accretive with buybacks likely to be slower. That leaves the stock fully valued in my view.

DFS shares are trading about 16% below the deal price but 20% above pre-acquisition announcement levels. Given a 5.3% Fed funds rate and likely ~12 months to closing, a deal with minimal closing risk should have just a 5-8% discount. A discount of this magnitude suggests a deal is greater than 50% likely but less than 75% likely, which feels broadly right to me, given the uncertainties here but DFS’s small network and the fractured credit card environment. With 15% stand-alone upside and 0% upside if combined with DFS, COF has a blended probabilistic upside of 7.5-11%.

This puts COF on the cusp between a hold and a buy, given my return hurdle of 10% for buys, as I view a “hold” as delivering market-like returns (8% over the long-term). Given the DFS deal, while not certain, is likelier than not, I am moving COF to a hold, in part because there are other banks like Ally or Bank OZK (OZK) that now have cleaner stories and clearer upside. COF has delivered excellent returns in recent months, but this trade is likely running out of a steam. While there is no rush to sell, as I do not see shares as overvalued absent a recession, there is no longer a compelling argument to buy, and there are better opportunities elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.